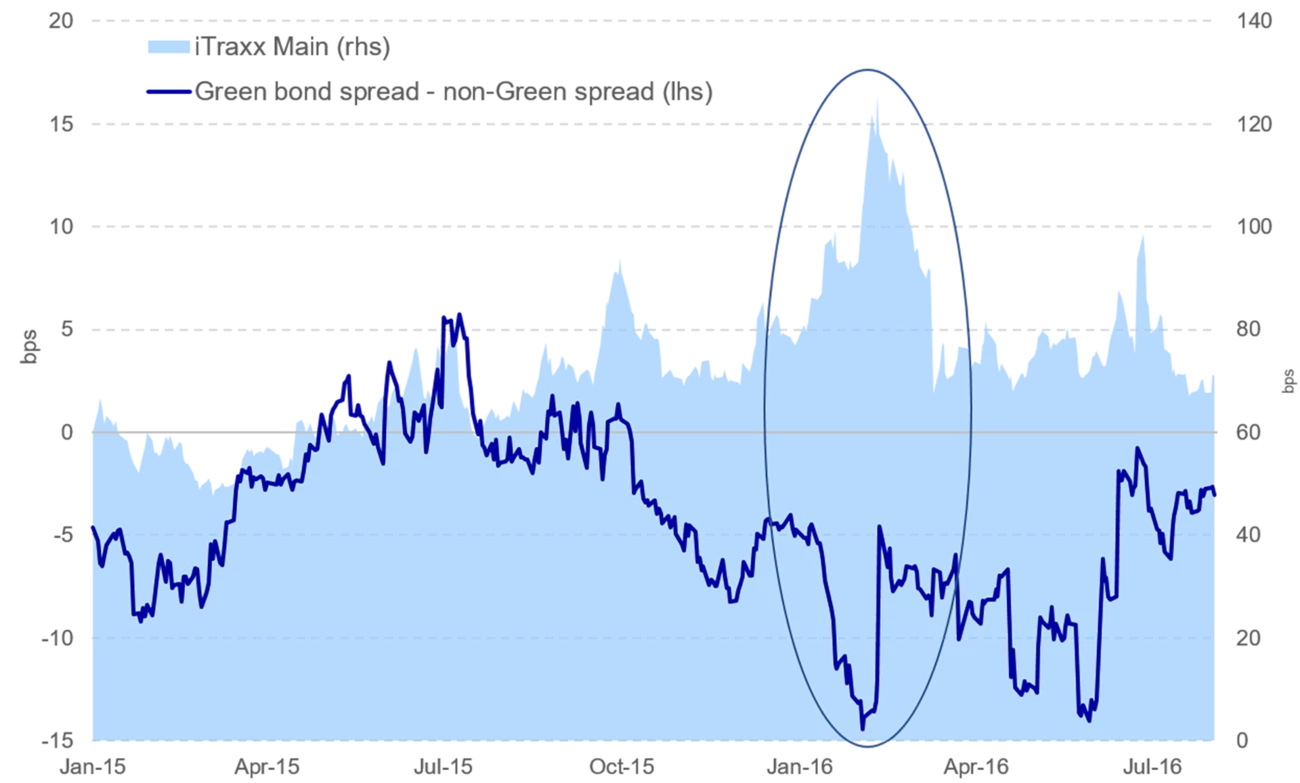

Figure 3. Green spread – Non Green spread (lhs) compares spreads of EUR benchmark green bonds and vanilla bonds from the same entities with similar tenor, sector and rating. iTraxx main (rhs).

Reasons for green bond outperformance in risk-off periods

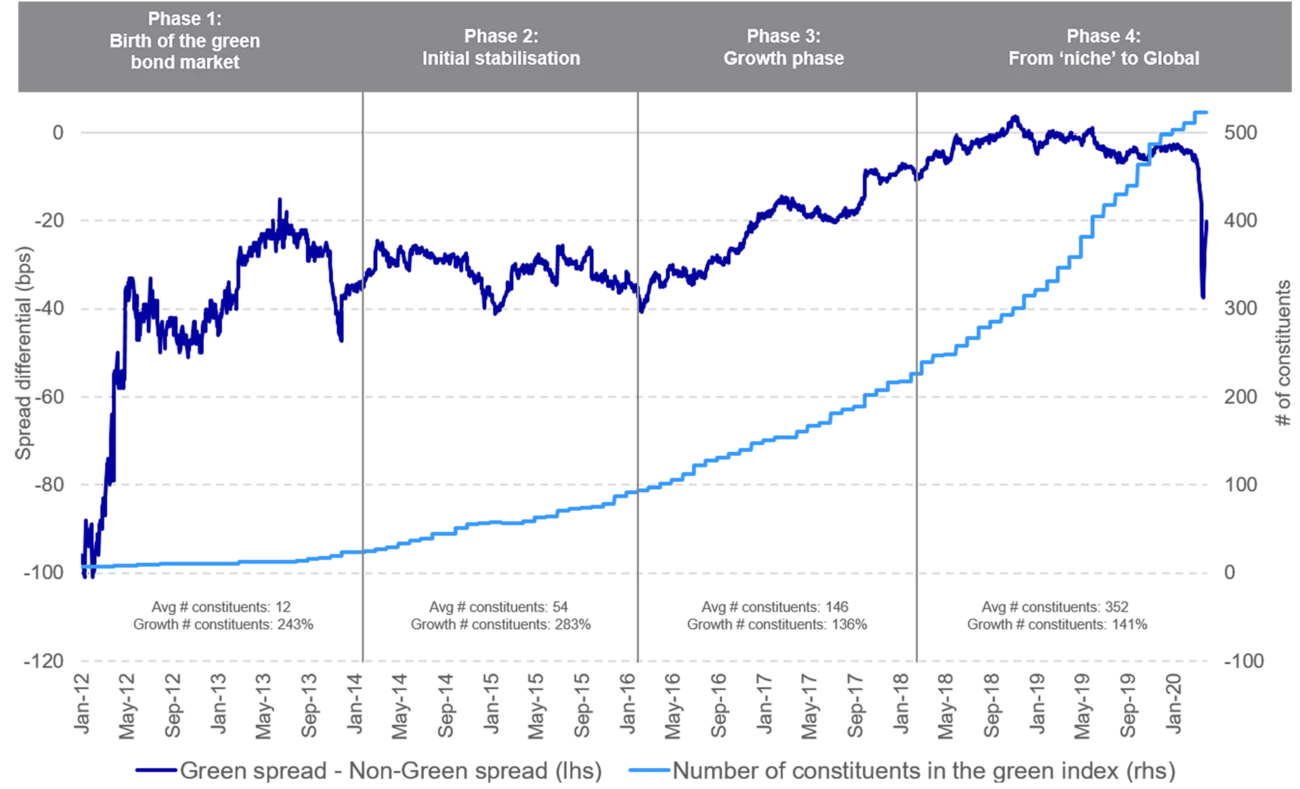

As indicated in the secondary spread analysis in Figure 1, green bonds do not currently seem to price tighter than non-green bonds (that is, the spread differential is negligibly close to zero) under ordinary market conditions. However, in periods of significant risk-off sentiment, a comparison of secondary spread developments indicates that green bonds offer greater resilience compared to non-green bonds. There are several potential reasons for this.

First, issuers of green bonds have historically been large, stable and forward-looking entities, with established governance structures. These entities are possibly better equipped to withstand a crisis, regardless of their “greenness.” Secondly, green bonds are rarely issued by oil companies, which were the ones hit hard in both of the last two crises. Thirdly, green bond investors have historically included a large share of long-term investors, such as pension funds and insurance companies, which are unlikely to move from green investments in a crisis (they are sometimes referred to as “hold-to-maturity” investors). In addition, dedicated green bond funds provide additional demand that, all-things-equal, should provide a better cushion for sell-offs.

The combination of long-term and stable issuers, the automatic exclusion of non-green companies hit hardest in past crises, as well the characteristics of green investors, could help explain why green bonds have fared better than traditional bonds during major risk-off periods.

About the authors:

Ebba Ramel is an analyst in Nordea’s Sustainable Bonds team.

Jacob Michaelsen is Head of Sustainable Finance Advisory at Nordea.