E-commerce is distance selling 2.0

Harald Ström (HS), Managing Director in Corporate Finance at Nordea, has been advising retailers for 25 years and brings a unique perspective on e-commerce in this interview from Nordea On Your Mind.

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaHarald Ström (HS), Managing Director in Corporate Finance at Nordea, has been advising retailers for 25 years and brings a unique perspective on e-commerce in this interview from Nordea On Your Mind.

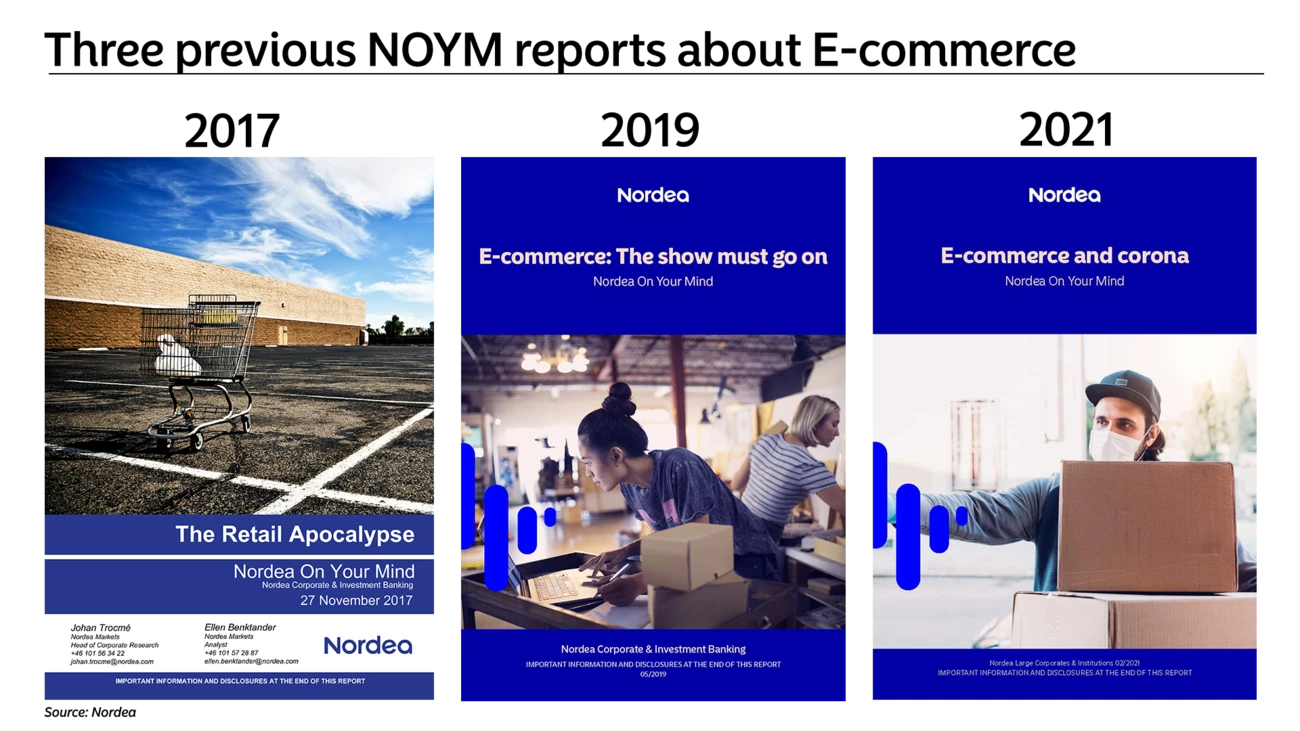

E-commerce has given the retail industry a wider but more shallow profit pool. Categories with the highest price-to-fulfilment cost ratio are driving up online penetration, while most Nordic retail categories favour an omnichannel approach. That's according to Harald Ström, Managing Director in Corporate Finance at Nordea, in this interview with Nordea Thematics's Viktor Sonebäck (VS) from the latest Nordea On Your Mind: E-commerce - The new normal.

VS: I would be tempted to call you a guru on the retail industry – could you briefly describe your role and give us a flavour of your professional background and experience?

HS: While I would definitely opt for a more modest description of my role, I have had the privilege to work as an investment banker and board member focusing on the Consumer & Retail sector since the mid-1990s. In that capacity I have worked with clients globally and had the opportunity to execute M&A transactions, Initial Public Offerings, and Equity as well as Debt fund-raising in the sector. This has given me the opportunity to work with many of the most talented and influential decision-makers in the industry and together with them navigate an ever-changing strategic landscape. I joined Nordea in 2010 to cover the sector across the Nordic region, but my first transactions in the e-commerce space date back to 1998/99.

"E-commerce has given the retail industry profit pool a bigger surface but less depth."

VS: From modest beginnings some 20 years ago, online retail has in recent years seen exponential growth. What do you think have been the key drivers of online migration of retail sales?

HS: Online retail is a form of distance selling, which has been around since Aldus Pius Manutius published the world's first mail order catalogue in Venice in 1498. The key drivers for distance selling and the online migration are no different and revolve around technology, price and consumer preferences. E-commerce was met with tremendous enthusiasm in financial markets already in the late 1990s, but at the time neither tech nor consumer preferences were ready for the new channel and many early-stage companies failed. The Internet has come a long way since then in terms of, for instance, convenience, stability, speed and secure payment solutions, and in the meantime a new generation of consumers has grown up who are digital native to a much larger degree and who are also endowed with significant purchasing power.

VS: The online migration has affected different types of retailers in very different ways. Do you see any clear patterns for who have benefitted, and who have faced big headwinds?

HS: Retailers are affected to differing degrees depending on how far and how quickly the e-commerce penetration progresses in different product categories. The categories with early migration and where penetration is expected to reach high levels over time are those where the price/fulfilment cost ratio are the highest. It is also noticeable that legacy systems haven't been a significant competitive advantage. The big mail order firms who used to dominate the distance selling segment have not been able to translate their logistics setups to a digital context; instead we have witnessed Schumpeter's creative destruction at work and the emergence of new corporate champions.

The price/fulfilment cost ratio is a useful tool when thinking about e-commerce penetration. A very interesting example of this is product categories which are consumed on a very large scale and where the product itself can be entirely digitised. Categories which spring to mind include audio and video where companies like Spotify and Netflix are able to retail music and films respectively on a global scale and where the fulfilment cost falls dramatically as these retailers build scale.

For most Nordic retail categories, the consensus favours an omnichannel approach.

VS: The COVID pandemic turbocharged the online migration in retail. Do you think it was a temporary boost, or has it changed consumer behaviour on a permanent basis?

HS: There is a pretty strong case, both from the South Korean experience during SARS as well as early post-COVID evidence, which suggests that we can expect a short-term bounce-back favouring physical retail, followed by continued medium- and long-term online migration to a new saturation level.

VS: What do you think are key success factors for a retailer to do well online? Is there a universal strategy that seems to work well, or does each retailer have to find its own recipe for success?

HS: E-commerce has changed the shape of the retail profit pool. Compared to pre-online migration the pool now has a very large surface but has become very shallow. Online retailers are able to reach a global audience, but price transparency is causing significant margin compression. The strategies which seem to work best to date have been to either go for less differentiated market share on a global scale very rapidly, or build a highly curated environment or brand monopoly. In essence, both of these strategies are all about maximising the price/fulfilment cost ratio.

VS: How do you see in-house development and execution of e-commerce fulfilment versus outsourcing or partnering with external suppliers?

HS: In my experience that depends on the scale and skill set of the individual company. At one extreme you find Amazon acquiring significant stakes in cargo airlines, and ICA opting for Ocado's warehouse automation systems, and at the other extreme you find entrepreneurs developing manual picking routines in the warehouse which outperform automated picking in terms of both speed and accuracy. It is a very heterogenous picture which is difficult to generalise.

VS: How should Nordic retailers think about online sales today? What are the critical do's and don'ts?

HS: Nordic retailers are embracing the online channel and in most cases doing very well. Grave concerns surrounding Amazon's entry in Sweden have given way to seeing the e-commerce firm as an opportunity to reach new consumers on a vast scale. In sectors with a very low price/fulfilment cost ratio, such as hard discount food retail, physical retail tends to dominate. In sectors where the ratio is very high, such as digitised consumer goods, pureplay e-commerce dominates. Most sectors are in between these extremes and here consensus favours an omnichannel model and there are examples of physical retailers building a successful online channel, as well as pureplay online retailers opening profitable physical stores to serve consumers and build brand equity. Key success factors include a curious mindset, relentless focus on consumer preferences, and avoiding complacency at all cost.

Human connectivity has soared over the past decade, offering new online solutions for our private and work lives. In the report E-commerce and Corona from Nordea On Your Mind, we explore the COVID-19 pandemic's disruption of business models and turbocharging effect on e-commerce.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more