- Name:

- Mikko Hirvonen

- Title:

- Senior ESG Analyst

6 min to read

Discover how Nordic countries are leading the charge in electric vehicle adoption, from passenger cars to heavy-duty vehicles. Explore the current state of electrification, infrastructure development and future outlook for sustainable transportation in the region.

Electrification of road transport plays a key role in reducing global CO₂ emissions, a fact that also holds true in the Nordic region. Among various sustainability initiatives, electrification stands out as one of the most impactful and rapidly expanding trends. The Nordic countries, in particular, are frequently recognised for their pioneering efforts in this transition. But what is the current state of road transportation electrification across the Nordics?

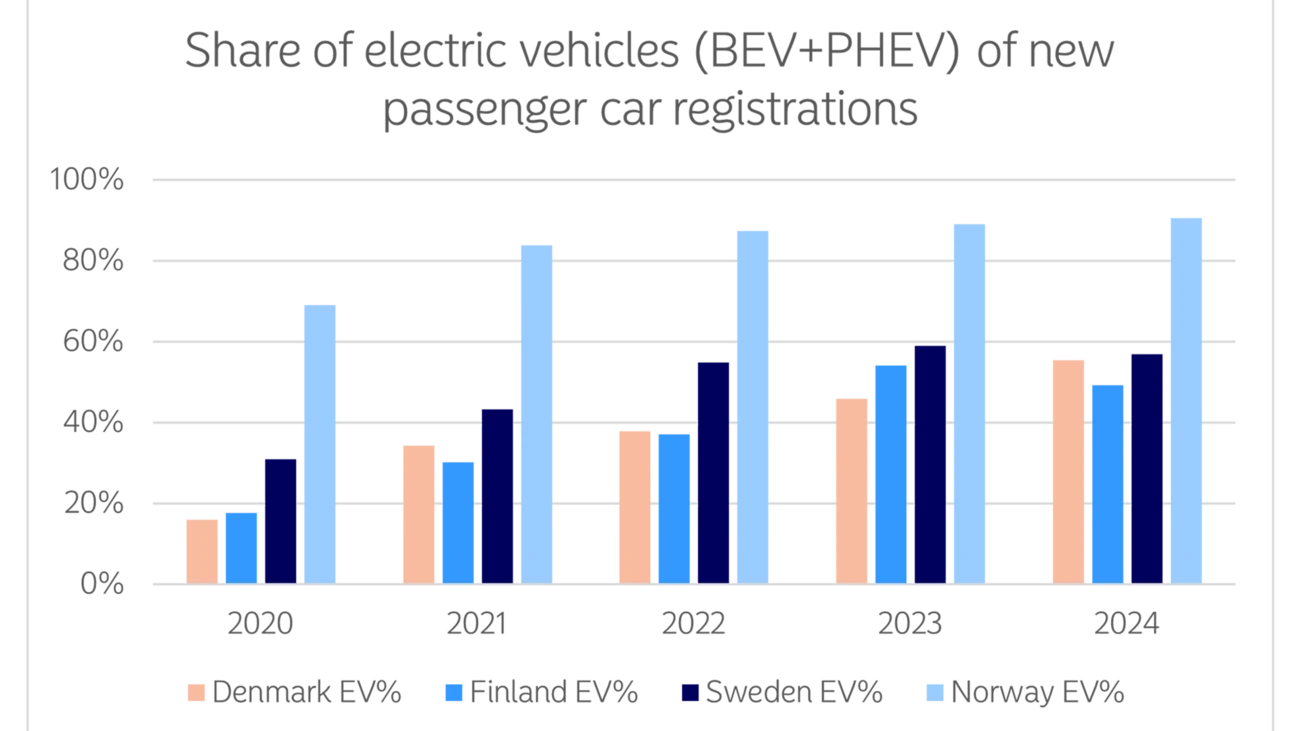

When examining the adoption of rechargeable electric passenger vehicles—including both battery electric vehicles (BEVs) and plug-in hybrids (PHEVs)—it is clear that the Nordic countries have made significant progress over the past five years. A key factor driving this change has been incentives provided by each government to support the transformation. The share of electric vehicles in new car registrations has shown consistent year-on-year growth, highlighting the region’s rapid advancement in sustainable transport.

Norway leads the Nordic nations in both new EV registrations and total EV fleet. From January to June 2025, 93.7% of new car sales in Norway were BEVs, with an additional 2.4% being PHEVs. The country boasts more than 5,000 charging stations and 37,000 public charging points.

Sweden follows, with plug-in vehicles comprising around 26% of new registrations in 2025 and a combined BEV and PHEV market share of 61%. As of September 2025, Sweden had 8,700 public charging stations offering 62,000 connections.

Denmark has rapidly scaled its infrastructure, recording Europe’s fastest growth in direct current (DC) fast chargers in Europe during Q1 2025, with year-over-year growth exceeding 100%. By September 2025, Denmark had over 46,000 charging stations nationwide.

Finland, despite its smaller market size, has shown strong performance in vehicle electrification. Over 54% of new car registrations in 2025 were either BEVs or PHEVs, with an additional 27.6% of registrations being hybrid electric vehicles (HEVs), which are self-charging hybrids. By the end of August 2025, Finland had around 3,500 charging stations and more than 18,000 public chargers.

It is important to note that Nordic countries rely heavily on private charging infrastructure—such as those at homes, housing associations and workplaces—which are not included in the public statistics.

| Country | Total Amount of Electric Passenger Cars | Electric Car Share of the Entire Car Fleet | % of Electric cars of 2025 registrations | Charging Stations | Chargers / Charging Points |

|---|---|---|---|---|---|

| Norway | 997,000 | ~35% | ~96% | 5,134 | 37,058 |

| Sweden | 774,000 | ~15% | ~61% | 8,708 | 62,012 |

| Denmark | 472,000 | ~16% | ~66% | 11,026 | 46,042 |

| Finland | 342,000 | ~12% | ~56% | 3,514 | 18,152 |

While electrification has advanced rapidly among passenger vehicles, progress within the heavy vehicle segment has been more gradual, mainly due to the unique challenges these vehicles present. Larger trucks, buses and vans require robust solutions—both in battery technology and charging infrastructure—to meet their operational demands. As a result, the full transformation of Nordic commercial fleets remains ongoing, with less than 10% of heavy vehicles currently electrified across the region.

Norway leads the way in electrifying light and heavy commercial vehicles, recording a remarkable surge in 2025: 41% of new registrations in this category were electric. Oslo, in particular, stands out, as 85% of bus kilometres logged in 2024 were covered by electric buses, marking a substantial reduction in urban emissions. Sweden continues to make significant headway, especially in public transport, registering 235 electric buses in 2024 and attaining a 23% electric share across new registrations of light and heavy trucks and buses. Denmark is accelerating its efforts, with over 30% of its new commercial vehicle registrations being electric, reflecting robust policy support and expanding infrastructure.

Finland, while making commendable progress in electrifying passenger cars, faces more pronounced obstacles in the heavy vehicle segment. In 2025, just 17% of new registrations for heavier vehicles were electric, largely due to limited charging infrastructure tailored to the needs of trucks and buses. Despite this slower pace, ongoing investment and regional collaboration hint at an accelerating transition in the years ahead.

| Country | Total Amount of Light Trucks, Trucks and Buses | % of vehicles are electric | % of Electric vehicles of 2025 registrations |

|---|---|---|---|

| Norway | 596,000 | 7% | 41% |

| Sweden | 734,000 | 5% | 23% |

| Denmark | 388,000 | 6% | 31% |

| Finland | 341,000 | 2% | 17% |

While electrification has advanced rapidly among passenger vehicles, progress within the heavy vehicle segment has been more gradual, mainly due to the unique challenges these vehicles present.

BEVs dominate new light-duty registrations, with plug-in hybrids providing a transition, especially in Sweden and Finland. Public charging infrastructure is rapidly expanding, led by Sweden and Denmark. Urban bus electrification accelerates, sharply reducing diesel use. Early adoption of electric vans and medium trucks proceeds on fixed routes, while public heavy-duty vehicle charging emerges. LNG/CNG remains niche, mainly for specialized logistics. Key drivers include stable electricity prices, charging infrastructure development, Trans-European Transport Network (TEN-T) expansion, municipal zero-emission tenders, and increased Original Equipment Manufacturer (OEM) model availability as well as national incentives, especially for heavier vehicles.

Longer term forecasting is more unstable, with many potential scenarios:

For more, read our previous article on the land transportation sector, where we explored several key trends driving sustainability within the industry. And don’t miss our Sector Insights page, where you can learn how ESG factors are driving innovation and reshaping business models across diverse industries.

Nordea as a bank helps climate transition in land transportation sector by offering a broad range of solutions and products to our large as well as small and medium-sized corporate customers. Nordea also has a sector target of decreasing our financed emissions from cars and vans by 40% (2022 levels to 2030).

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more