- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

The global growth momentum has improved slightly since the beginning of this year thanks to China’s increased fiscal stimulus and declining inflation numbers in many western economies. Regarding the near-term outlook, we see significant differences on a country level in growth and inflation forecasts, implying that central banks’ rate paths will also diverge.

Global confidence indicators have slightly improved since our winter forecast. The main reasons for such an improvement are increased fiscal stimulus and the resulting stabilised growth outlook in China and the continued downward trend in inflation in many western economies, which allows the majority of central banks to proceed with rate cuts.

Although the outlook has improved broadly in the global economy, we see interesting differences between countries, implying that central banks’ rate paths will also diverge. In the Euro area, GDP growth has been practically non-existent for nearly two years, and we expect price pressures to continue to weaken, even if growth will likely gain pace towards the end of 2024. This leaves room for the ECB to start cutting rates in June. On the other hand, growth has continued to surprise positively in the US, where some indicators signal that price pressures may have strengthened again in the first months of 2024. As a result, one of the risks to the global outlook is that inflation continues to be more stubborn than expected and that the rate cuts that are priced in in financial markets fail to materialise.

Geopolitical topics will continue to be high on the agenda, given the approaching US elections, the continuous Russian assault on Ukraine and the increased tensions in the Middle East. Geopolitical risks are also one of the main risks to the global outlook, given their potential to disrupt global supply chains and weaken both business and consumer sentiment. Even if we expect the US-China relationship to remain rather calm (at least until the US elections), one of the underlying trends continues to be the great power struggle.

Inflation has continued to slow down in most western countries, and we expect that trend to continue, but more gradually, in the coming quarters. The downward trend is partly owing to energy and food prices where global price changes are in the base case scenario expected to be modest. For example, we expect the oil price to keep hovering at around 90 dollars.

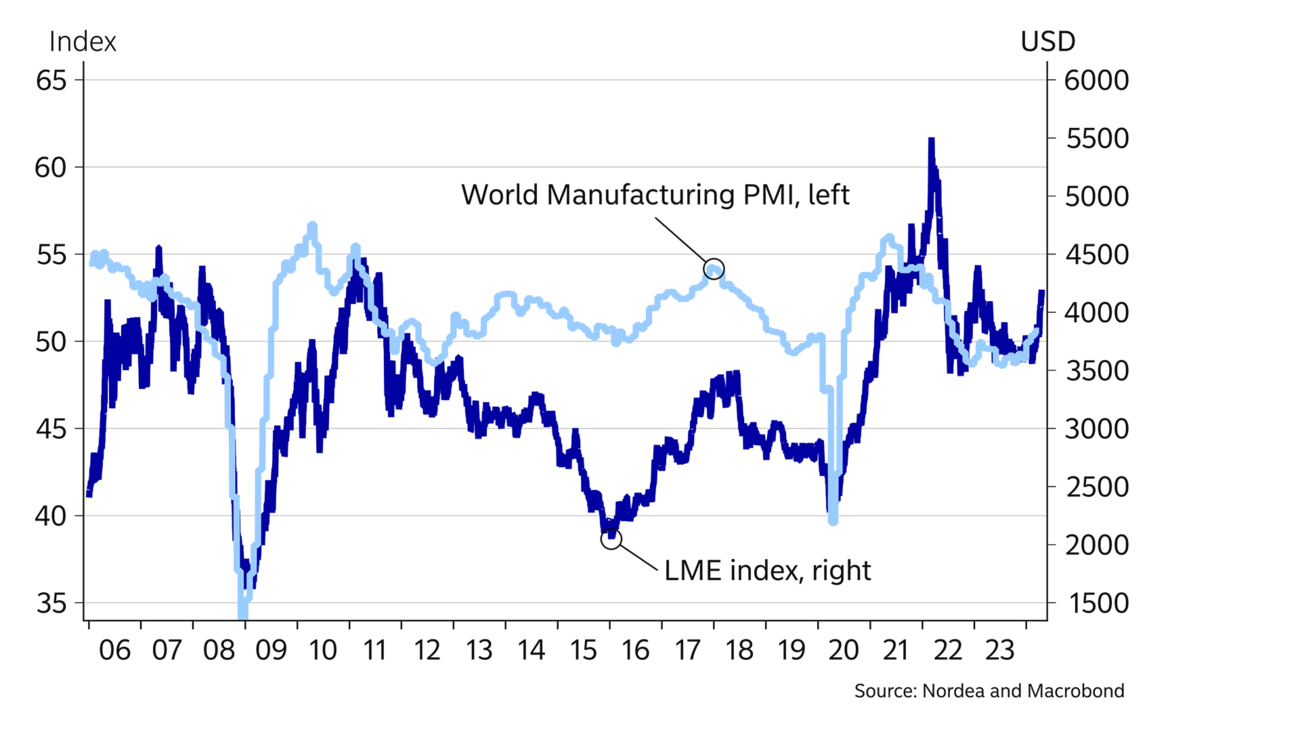

Many factors will also limit global goods price inflation. China’s investment boom in manufacturing, combined with limited domestic demand, has caused overcapacity in a number of sectors and continued to push prices down on many consumer goods. Also, the rise in shipping costs as a consequence of the weakened security level in the Red Sea turned out to be a temporary phenomenon, and prices have almost normalised. In addition, the weak demand for goods, especially in the Euro area, has limited corporates’ pricing power. As a result, consumer goods prices in the Euro area and in the US have been practically unchanged since last summer and even if the improvement in the global outlook has now slightly boosted certain raw material prices, we expect the low goods price pressures to continue in the near-term.

The most sticky part of inflation has been services, where increasing labour costs and the robust post-pandemic demand play a role. We expect that the so far strong labour markets will cool down and wage increases will gradually become smaller in both the US and the Euro area. There are already early signs that this is happening on both sides of the Atlantic. However, especially in the US, there are certainly risks that if economic growth continues to surprise to the upside, the stubbornly high inflation will continue as well.

The US economy continues to steam ahead despite many traditional leading indicators warning of weaker times ahead. Consumers are spending, and companies continue to invest and hire. A strong flow of immigrants has enabled some wage growth moderation despite robust employment growth. While the inflation picture remains mixed, solid demand and tight labour markets continue to pose upside price risks, which we think will postpone the first Fed rate cut to the autumn, maybe even into 2025. There are naturally downside risks as well, including important elections in the autumn, which could lead to abrupt changes in some policy areas. Fiscal policy has remained exceptionally loose after the pandemic, and the fiscal situation is unlikely to improve materially no matter the outcome of the elections.

The main risks stemming from China’s housing sector are now related to the declining prices.

Chinese leaders nailed the 2024 growth target at “around 5%” in March and promised to support the economy through, for example, loose monetary policy. Growth will continue to rely on fiscal stimulus and investments in manufacturing and infrastructure, as consumer confidence is weak and data indicate that households continue to be cautious. One reason for the weak confidence is the ongoing downward correction in the housing sector. While the construction volumes could stabilise by the end of 2024, the main risks stemming from the housing sector are now related to declining prices and resulting negative wealth effects on consumption. It is not likely that the scale of announced stimulus policies would be enough to turn that development more positive.

The most recent PMIs indicate that the Euro-area growth outlook has turned marginally more positive. Out of the large Euro-area countries, the growth outlook is still weak in Germany and France, while indicators are stronger in Southern Europe. We expect that slower inflation and robust wage increases will imply significant gains in household real income, which should boost consumption towards the end of this year. There is more uncertainty about the future trends of fixed asset investments where growth recently has been weak. The expected ECB rate cuts should ease the situation to some extent, but companies may continue to be worried about the EU’s complex regulatory environment and geopolitical uncertainty.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

| 2022 | 3.6 | 3.6 | 1.9 | 2.1 | 3.4 | 3.4 | 3.0 | 3.0 |

| 2023 | 3.1 | 2.9 | 2.5 | 2.1 | 0.5 | 0.5 | 5.2 | 5.0 |

| 2024E | 3.1 | 2.9 | 2.7 | 1.5 | 0.0 | 0.0 | 5.0 | 5.0 |

| 2025E | 3.2 | 3.0 | 1.9 | 1.8 | 1.5 | 1.0 | 4.0 | 4.0 |

| Year | EUR/USD | EUR/GBP | USD/JPY | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

| 2022 | 1.07 | 0.89 | 131.94 | 11.12 | 2.00 | 4.50 | 3.88 | 2.56 |

| 2023 | 1.10 | 0.86 | 141.02 | 11.10 | 4.00 | 5.50 | 3.88 | 2.02 |

| 2024E | 1.08 | 0.84 | 147.50 | 11.30 | 3.25 | 5.00 | 4.60 | 2.30 |

| 2025E | 1.10 | 0.82 | 142.50 | 10.70 | 2.25 | 4.75 | 4.50 | 2.15 |

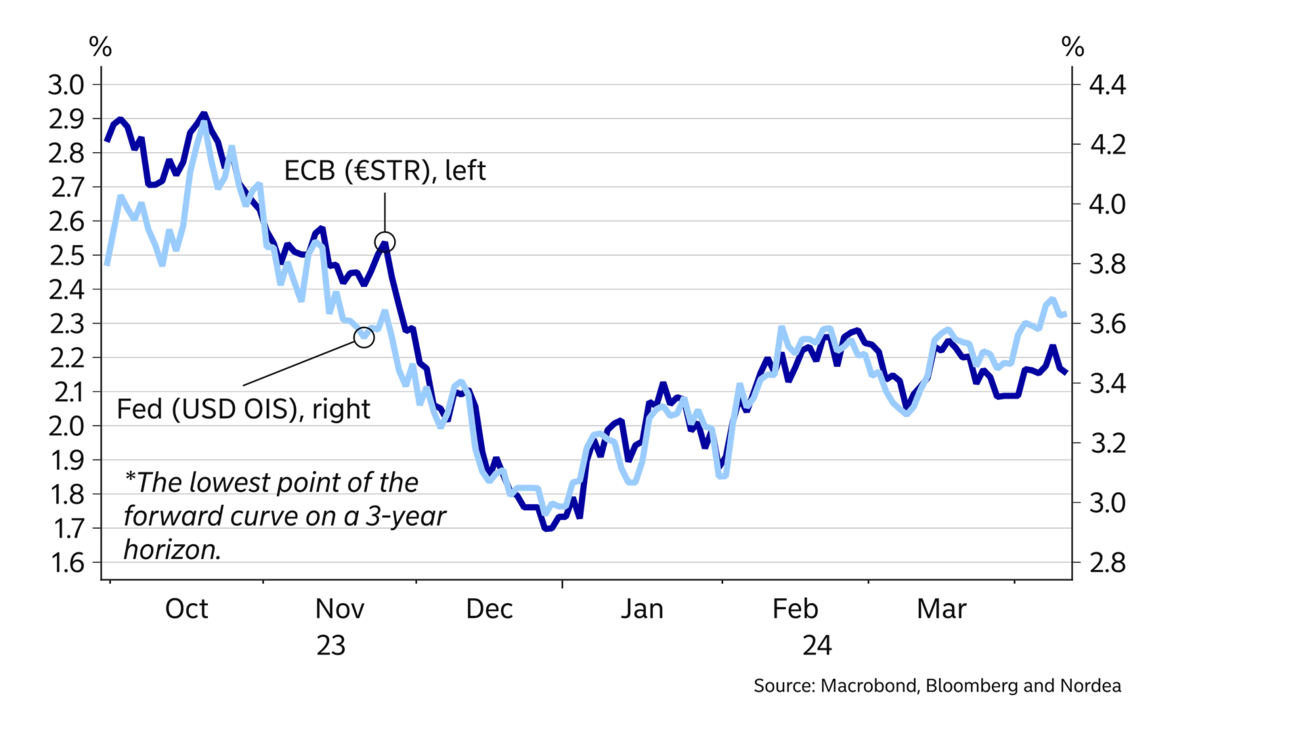

While the financial market’s rate cut pricing for the Fed and the ECB has been moving almost in tandem in the past months, we find that the ECB has much stronger reasons to cut rates than the Fed.

While upside inflation risks prevail in the Euro area, especially in terms of service sector prices, the economy has been largely stagnant for more than a year, which should gradually lead to lower price pressures. The ECB is almost certain to start cutting rates at its June meeting, and while the central bank has been reluctant to commit to any predetermined pace of rate cuts after the first move, we think that quarterly 25bp rate cuts throughout the remainder of this year and next remain a good baseline. We see risks tilted towards a faster reduction in rates than this. The biggest downside movements in longer yields are likely already behind us.

The pace of US growth, in turn, has surpassed trend growth, which should contribute to inflation pressures again and thus make the Fed more reluctant to cut rates. Several FOMC participants have already noted this, and finally even Powell admitted that it might take longer to gain sufficient confidence to cut rates. We see the first cut in September and only a total of three 25bp reductions until the end of 2025. There are also risks of faster cuts if tighter liquidity conditions on the back of quantitative tightening (QT) cause volatility in financial markets in the coming months, but we would not rule out the chance of rate cuts being postponed into 2025 either. We see longer Treasury yields remaining above 4% throughout our forecast horizon.

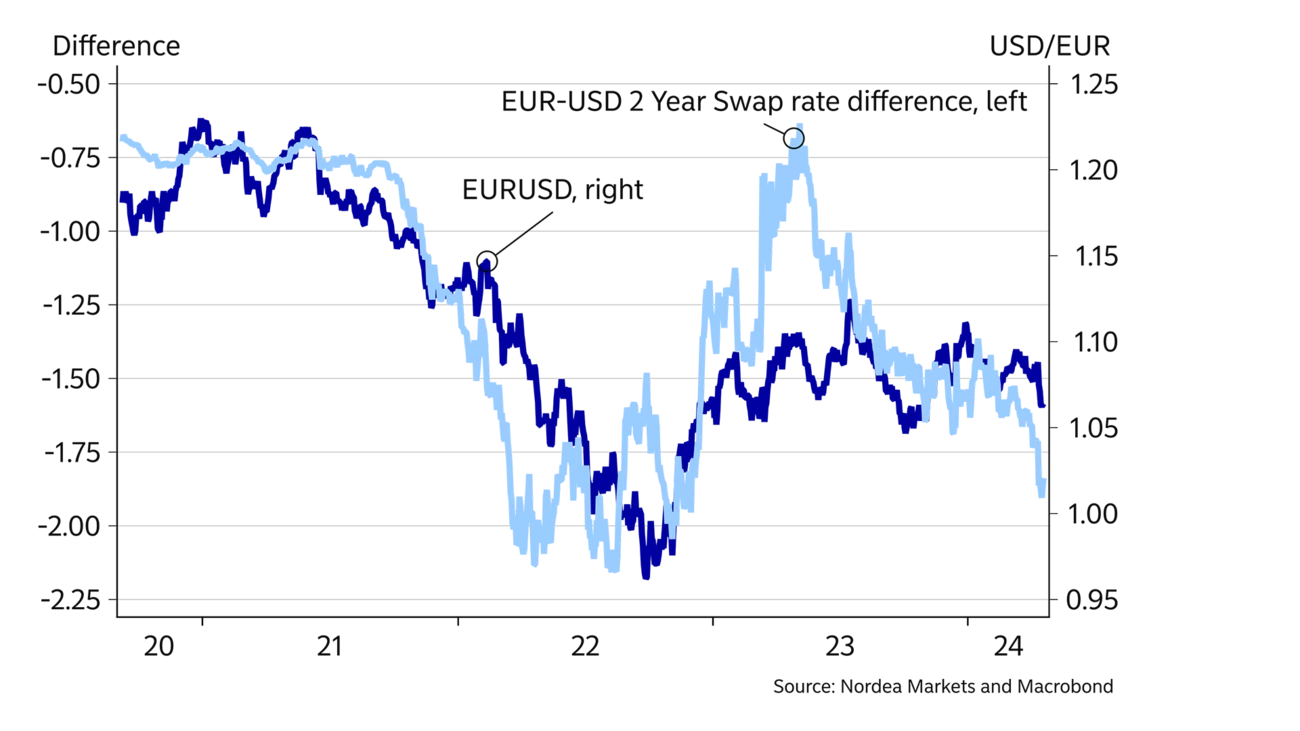

We believe that EURUSD will move largely sideways going forward. A still strong economic performance in the US, fewer rate cuts from the Fed than the ECB in the coming period, and a Trump comeback are factors that we expect will support the USD in the short to medium term.

Longer out, lower global rates should continue to support economic activity and risk sentiment, lowering the appeal of the USD from a safe-haven standpoint. With economic activity picking up in Europe and elsewhere around the world, the economic growth convergence between the US and other major economies should also dampen the appeal of the USD ahead. Broadly speaking, we still see the EURUSD range locked between 1.05-1.10 area ahead, but we believe that the risk to our EURUSD forecast is to the downside given the rising trade tensions that would resurface under a Trump presidency.

We believe the JPY will remain under pressure so long as the Fed and other central banks keep rates high while the BOJ continues to deliver lacklustre rate hikes. Eventually, somewhat lower rates in the US and elsewhere bundled by some additional rate hikes in Japan should give a stronger JPY. The CHF will also continue to be under pressure as inflation is much lower in Switzerland than elsewhere, allowing for faster rate cuts from the SNB and a weaker CHF ahead.

The GBP will continue to do well going forward as the Bank of England will need to keep rates higher for a longer period than the ECB due to more sticky inflation, we believe. Eventually, we still expect that cyclical currencies such as the AUD, NZD, CAD, NOK and SEK will find a firmer footing once global growth is allowed to pick up steam and inflation becomes less of a concern around the world; but this will take time and is highly dependent on global geopolitical and economic developments.

This article first appeared in the Nordea Economic Outlook: Falling into place , published on 24 April 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more