- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

Tuuli Koivu, Jan von Gerich

Economic data has been weaker in all the major economies during the summer and labour markets are weakening. This could encourage China to ease fiscal policy further, and the western central banks are expected to cut rates. With a delay, both actions should bring more stability to the growth numbers. However, there are substantial risks to our baseline forecast. Many of these risks stem from politics.

Global economic development during the summer was bumpier than many expected and data surprised the market repeatedly to the downside. As a result, expectations about central banks’ rate cuts have increased even if inflation data has continued to be volatile and complicates monetary authorities’ task to find a balanced monetary policy stance.

We expect both the Fed and the ECB to remain cautious and cut rates gradually in the coming quarters as we see a risk of recession to be limited. The main reason for this view is that labour markets in both areas continue to be robust despite their recent cooling. Rate cuts will support the economies with a lag, which implies that we expect global economic growth to remain rather weak for a while before the looser monetary policy kicks in.

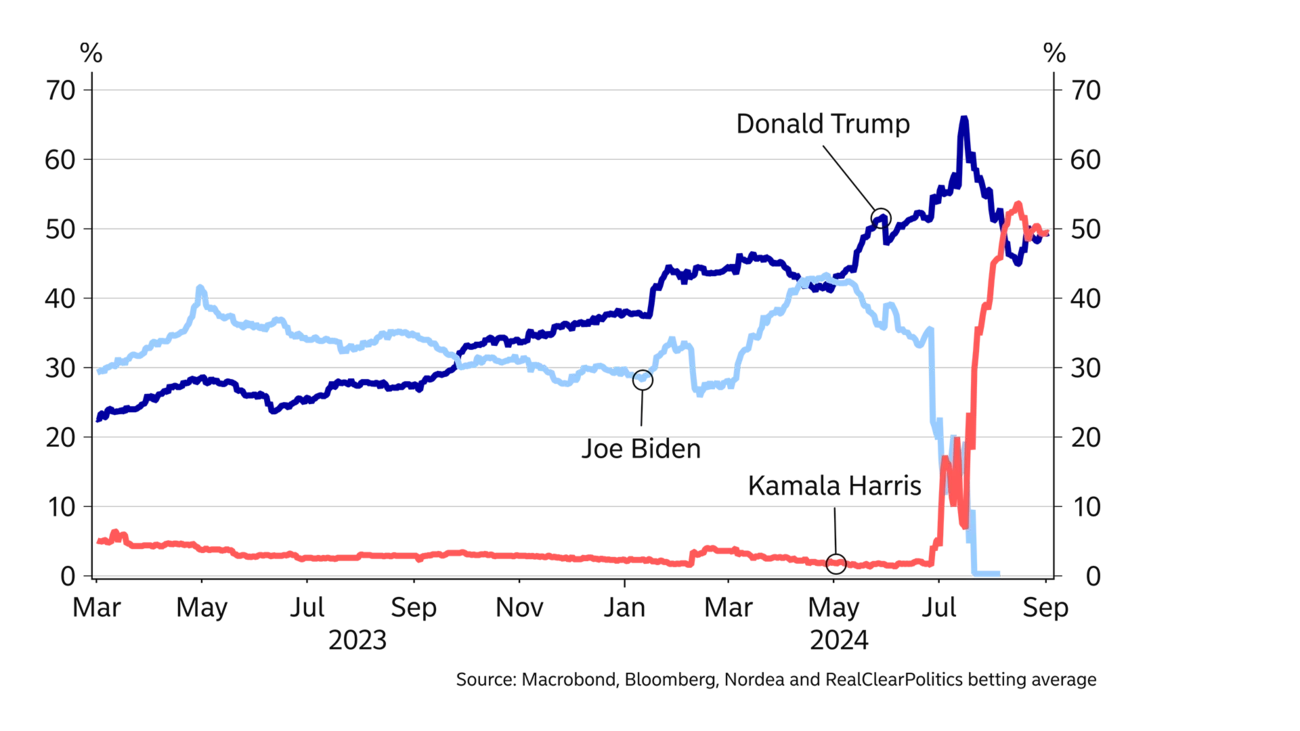

There are certainly risks to both ways in our baseline forecast. Many of these risks stem from politics. Geopolitical tensions continue to attract a lot of attention, but the elections can also bring surprises and have a significant impact on economic policies, as we have already seen in for example France and the EU earlier this year. The US elections will of course be one of the main events in the autumn and can cause volatility in the financial markets. In the EU, Ursula von der Leyen has made ambitious plans for the new Commission, but the implementation part is highly uncertain. We cannot completely rule out a positive risk stemming from possible peace negotiations in Ukraine, even if the current situation remains very challenging.

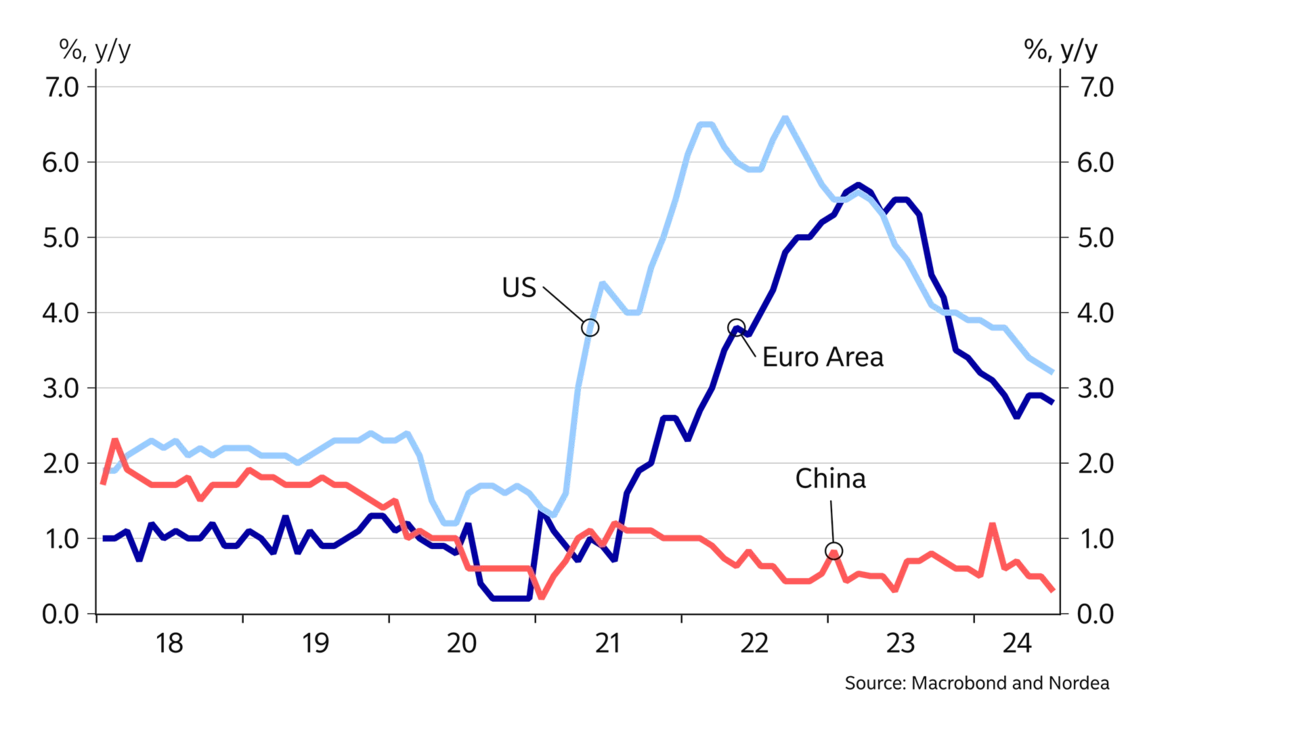

There is still a lot of focus on inflation developments in the financial markets and they have continued to be interesting. Once again, inflation numbers both in the US and the Euro area have continued to surprise us and in the opposite directions!

In the US, inflation numbers have slowed down considerably during the summer months and, by many measures, inflation is already close to the Fed’s target, and momentum has clearly slowed down. The US labour market is gradually cooling down by most indicators and wage pressure is clearly moderating.

At the same time, service price inflation has continued to be robust in many Euro-area countries and wage pressure continues to be elevated. In some European countries, momentum in wage increases has actually become even stronger recently as the wage level continues to catch up with the increased price levels. In the June projections, the ECB raised its expectation for the increase of labour compensation to almost 5% in 2024 but then to slow down. The downward trend is supported by the evidence of already declining wage increases from those countries where wages reacted rapidly to the increase in inflation. Based on that experience, it seems that the current strong wage increases can be treated more like a delayed one-off catch-up effect than as a signal of a strong price-wage cycle. We thus expect inflation will continue to slow down towards the ECB target even though the process has been slower than we thought in our earlier forecast.

External price pressure is expected to be weak. China’s overcapacity and weak housing sector put downward pressure both on global goods and raw material prices. In addition, the oil price has continued to hover at around USD 80 per barrel due to a combination of moderate global GDP growth and robust supply. As no big changes are expected to take place in this big picture, oil futures are downward trending. Furthermore, the probability of another energy crisis in the EU is low given the high level of gas storage and the increased capacity to both import LNG and to use other types of energy.

While the inflation situation allows the Fed to start cutting rates, we think the activity outlook does not call for more than gradual and limited rate reductions with the aim of securing a soft landing for the economy. We still believe the underlying momentum in the economy is strong, and although slower growth lies ahead, we do not see a recession. The autumn election is obviously a wild card. We think that due to Trump’s unpredictability and his protectionist initiatives, downside short-term risks to the economy would increase more under a Trump than a Harris victory, as would inflation pressure. However, Trump’s agenda leaves room for many kinds of interpretations, increasing risks both ways, while the Harris agenda is certainly not without downside growth risks either. In any case, in the medium term, other factors are likely to matter more for the broad economy than the election result.

China’s Party Plenum listed more than 300 measures to improve economic development but the implementation of the much-needed structural reforms remains uncertain.

China’s Communist Party held an important Party Plenum in July. The documents from the meeting paint a picture where Xi Jinping’s ideas about increasing control of the Party and a strong role of national security as well as the importance of self-sufficiency and high-tech industries were emphasised. Even though the meeting listed more than 300 measures to improve economic development, the implementation of the much-needed structural reforms remains uncertain. As a result, China is likely to achieve its about 5% growth target this year thanks to robust export and fixed asset developments, but the unchanged political stance continues to limit growth in a large part of the economy. It remains to be seen whether the weakness in consumption and labour market encourages the leaders to introduce more economic stimulus towards the end of the year.

The GDP numbers surprised us slightly positively in the first half of 2024, but this is mainly due to favourable development in net exports and a continuous increase in public spending. High inflation and high rates have limited growth of both fixed asset investments and household consumption. Growth of domestic demand is expected to gain pace towards the end of the year given that inflation is set to decline further, allowing the ECB to continue to cut rates. In a longer horizon, the new EU Commission is expected to come up with plans to invest more in common defence and R&D, which should both be growth-positive and could finally push Euro-area productivity developments on a stronger trend.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

| 2023 | 3.2 | 3.1 | 2.5 | 2.5 | 0.5 | 0.5 | 5.2 | 5.2 |

| 2024E | 3.2 | 3.1 | 2.5 | 2.7 | 0.7 | 0.0 | 5.0 | 5.0 |

| 2025E | 3.4 | 3.2 | 1.8 | 1.9 | 1.5 | 1.5 | 4.5 | 4.0 |

| 2026E | 3.3 | 2.0 | 1.5 | 4.0 |

| Year | EUR/USD | EUR/GBP | USD/JPY | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

| 2023 | 1.10 | 0.86 | 141.02 | 11.10 | 4.00 | 5.50 | 3.88 | 2.02 |

| 2024E | 1.08 | 0.86 | 147.50 | 11.50 | 3.25 | 5.00 | 4.30 | 2.30 |

| 2025E | 1.12 | 0.88 | 140.00 | 10.70 | 2.25 | 4.00 | 4.30 | 2.15 |

| 2026E | 1.13 | 0.88 | 137.50 | 10.60 | 2.25 | 4.00 | 4.30 | 2.25 |

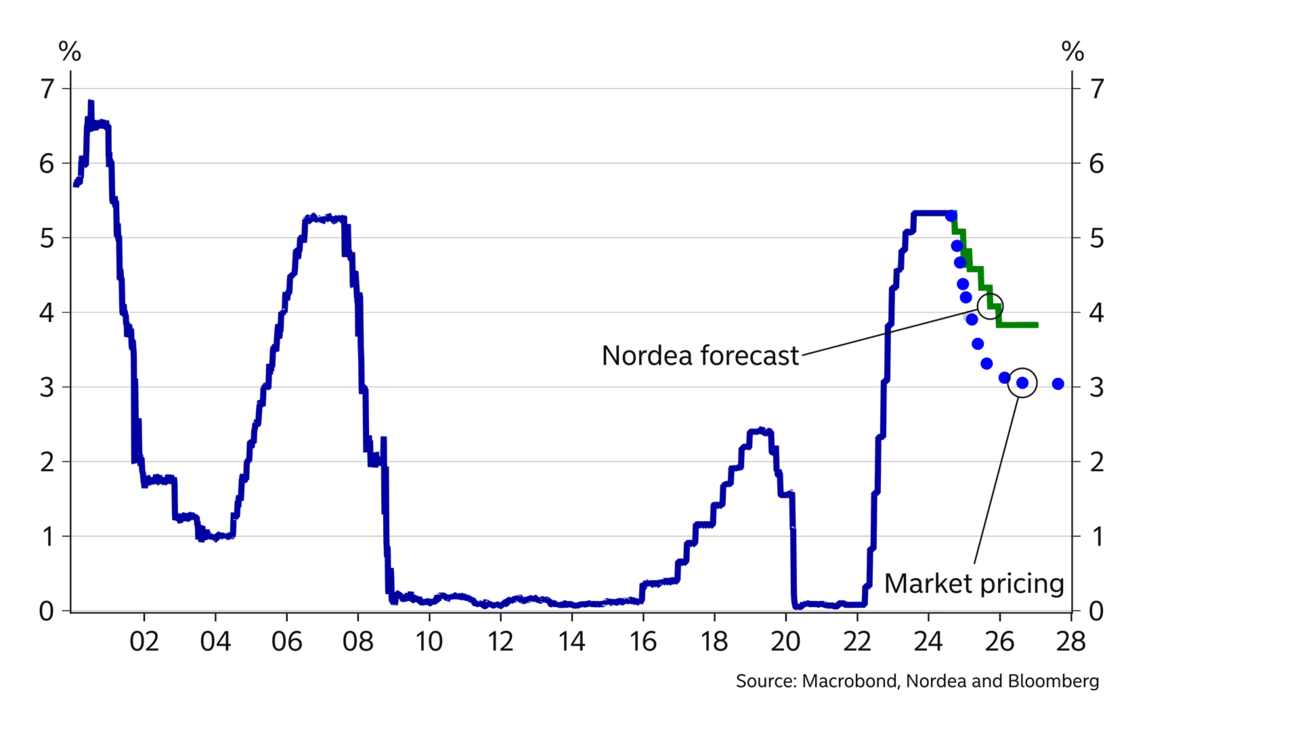

The ECB started its path of gradual rate cuts in June, and the Fed is set to start its cutting cycle in September. Looking past the financial market volatility, we think that a gradual path of quarterly 25bp rate cuts remains the best baseline forecast for now. With the US economy still enjoying considerable momentum and the ECB worried about sticky wage and service inflation, the case for more rapid rate cuts still looks rather weak to us.

A slow normalisation of rates is not how a central bank cutting cycle usually looks, and there are naturally considerable risks to this view this time as well. Usually, restrictive monetary policy is followed by accommodative monetary policy, and this could very well end up being the case this time as well. However, this economic and central bank cycle has so far been very special in many ways, so one should be cautious in expecting the cutting cycle to follow historical patterns.

We also think the level of the so-called neutral rates has risen especially in the US, and if we are right on that, financial markets may yet be surprised at what kind of levels the Fed stops its rate cuts. We see a quarterly pace of 25bp cuts until the end of 2025, which would leave the upper end of the Fed’s target rate at 4%, much higher than where even the Fed sees rates in the medium term. In the Euro area, we see rates falling to 2.25%, probably closer to where the ECB sees nominal rates as being neutral.

Whereas central bank rate cutting cycles are only starting, longer bond yields are already pricing in a significant number of cuts, and we do not expect longer bond yields to materially fall further from current levels.

We believe the USD will strengthen in the second half of this year. Investors have become overly optimistic about the prospect of interest rate cuts from the Fed. The bond market anticipates the Fed will cut its policy rate by about 100bp before year-end, but we expect a much more gradual approach of 50bp of interest rate cuts. The difference between our forecast and the bond market’s expectation is likely to bring EUR/USD back down to 1.08 before the end of the year.

Looking into next year, the USD is likely to maintain an interest rate advantage, but at some point, investors will shift their focus to how lower global interest rates will boost global economic activity. This will reduce the appeal of the safe-haven dollar and provide a big relief to the weak cyclical currencies. We expect this environment to strengthen the SEK over the coming year. The central bank will cut its policy rate from 3.50% today to 2.00% by the end of next year, but that and more is already priced into the rate market. The NOK is will experience an even larger appreciation. The central bank is unhappy about the weak currency and is unlikely to cut its policy rate this year and only cut the policy rate to 4% and not 3% like the market prices in by next year.

Our positive outlook on the global economy will be a tailwind for cyclical currencies like the AUD, NZD and CAD, and a headwind for defensive currencies like the CHF. The JPY is unlikely to benefit from its safe-haven appeal, but will likely strengthen on modest rate hikes in Japan versus lower rates elsewhere. Our forecast will likely take time to play out and is very dependent on the absence of escalating geopolitical tensions and that the global economy avoids a significant downturn.

This article first appeared in the Nordea Economic Outlook: Precision play, published on 4 September 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more