Three takeaways:

1. Good ESG progress despite the pandemic

2. Rebound in absolute emissions, but intensity still down

3. Look out for a reversal in top-rated companies’ ESG underperformance

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskIn September, the Nordea ESG Research expert team released the yearly update of its ESG ratings. The update covers insights into disclosure trends and the material ESG risk and opportunity exposures of around 330 Nordic companies. With information collection based on FY2021 disclosures, the updated report offers new insight into the first full “back to business” year.

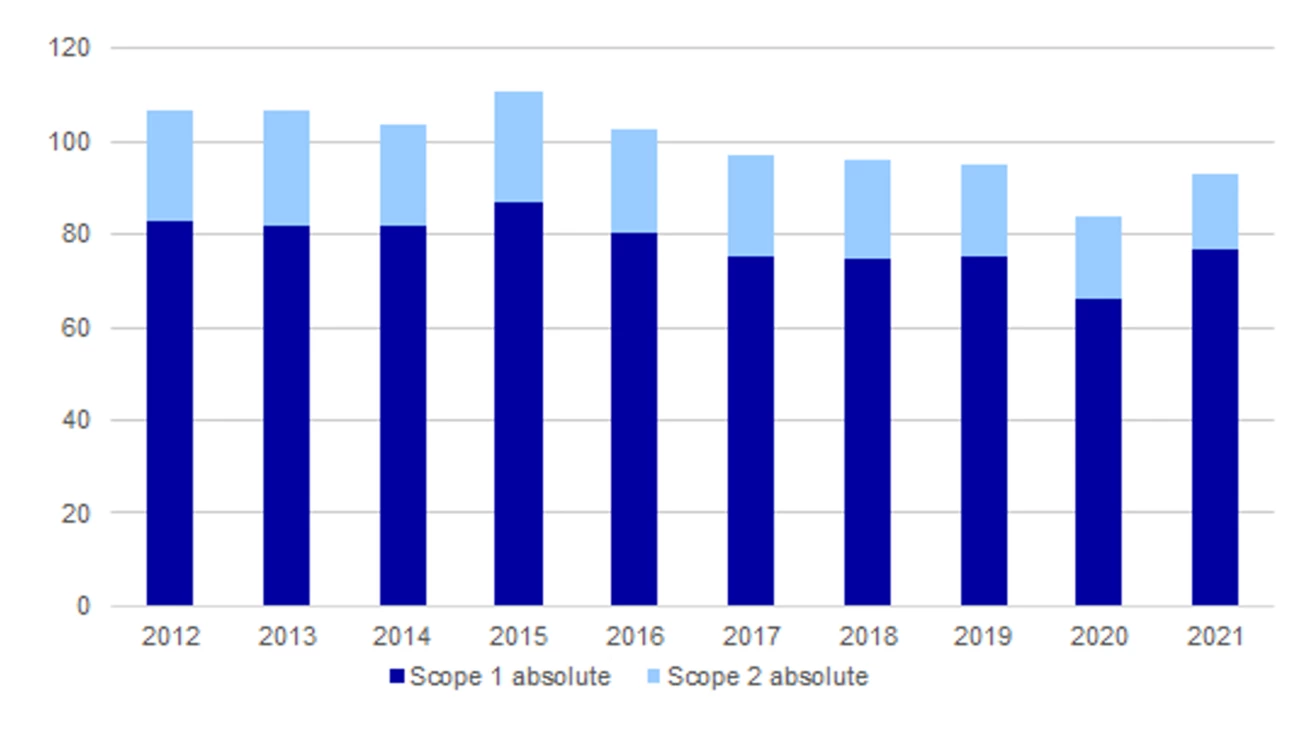

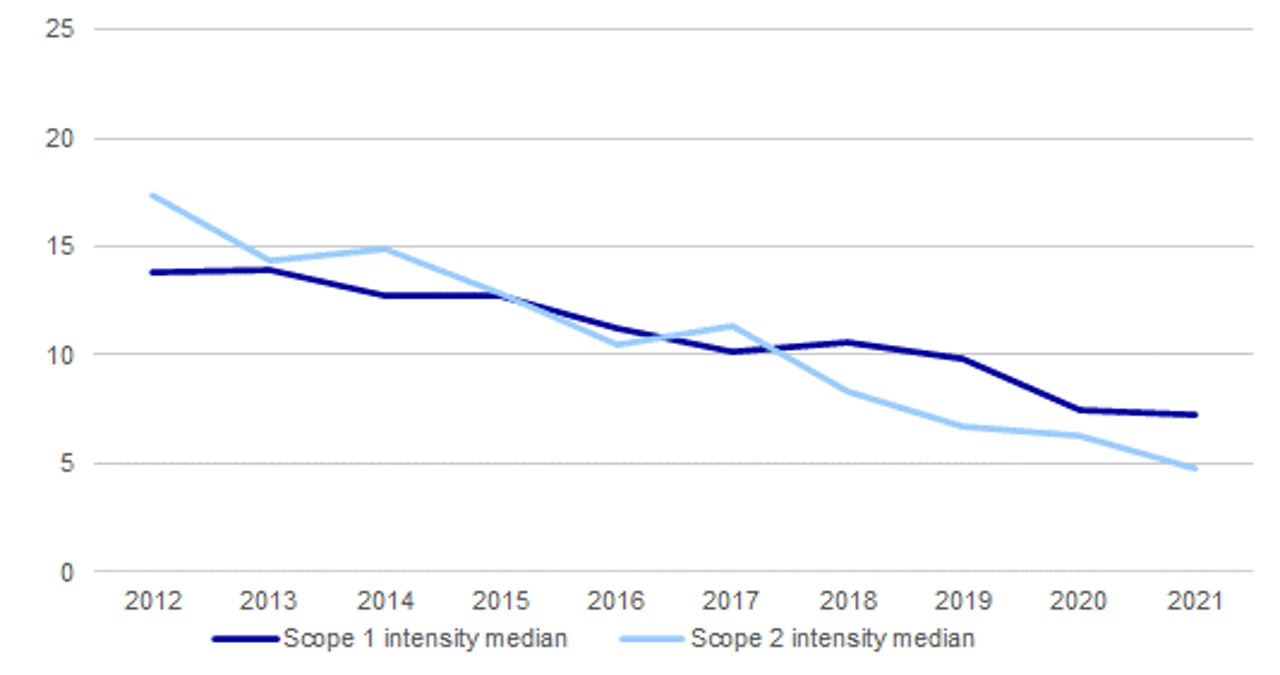

In what can in many ways be classed as a rebound year following the pandemic, some sustainability-related measures experienced a change in momentum in 2021. Absolute scope 1 and 2 emissions in the coverage universe rose 11% year-on-year to 93 million tonnes, and workplace health and safety metrics appeared to worsen as employees returned to work. The longer-term outlook is brighter, however, with emissions intensity down year-on-year, more companies than ever setting ESG targets, and the linking of CEO remuneration to ESG metrics becoming more commonplace across the Nordics.

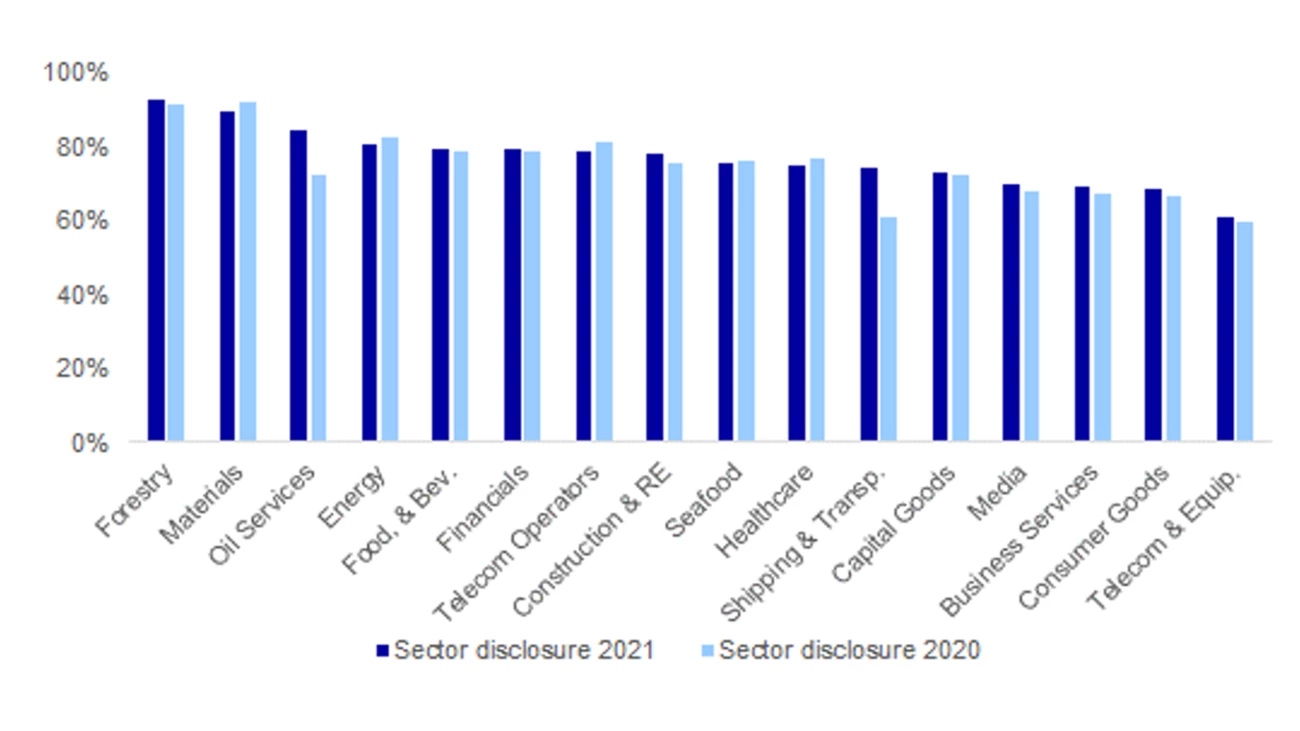

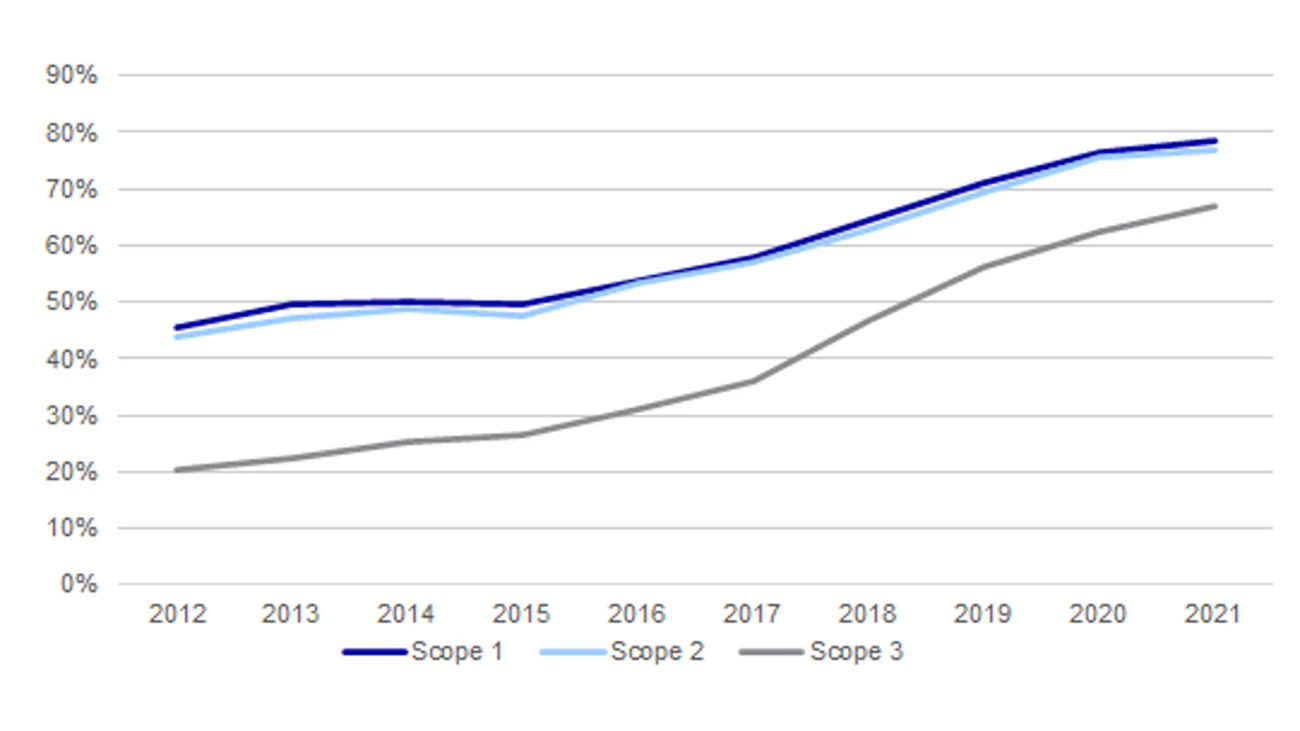

The average ESG disclosure rate has continually improved since 2012, with around 90% of companies in the sample reporting governance metrics, 60% environmental metrics and 50% social metrics. The disclosure of scope 1 and 2 emissions has increased to roughly 77% in FY2021 from 70% in FY2020. From a sector perspective, the forestry and materials sectors showed the highest degree of disclosure, with the telco operators trailing behind. Within the sample universe, the increased disclosure of ESG metrics appeared to be in line with an increasing number of companies setting climate targets, now 81% as compared to 73% in the previous year’s evaluation.

1. Good ESG progress despite the pandemic

2. Rebound in absolute emissions, but intensity still down

3. Look out for a reversal in top-rated companies’ ESG underperformance

We expect the trend of increasing disclosure to continue, not least due to regulatory tightening of corporate sustainability disclosure with the upcoming CSRD (Corporate Sustainability Reporting Directive) and SFDR (Sustainable Finance Disclosure Regulation) in the EU. Corporates are likely to see increased ESG data demands from investors over the coming year, even before CSRD requirements fall into place, as investors position for their own disclosures under the more imminent requirements of the SFDR.

With regards to environmental metrics, Nordea’s ESG Research team reports an increase of absolute emissions and a decline in overall carbon intensity. Reported carbon intensity, however, showed large variation across sectors, with the increases in the construction and real estate sectors, telco operators and capital goods. As companies are becoming more adept at collecting and publishing emissions data, we expect to see the share and quality of scope 3 emissions disclosure increase.

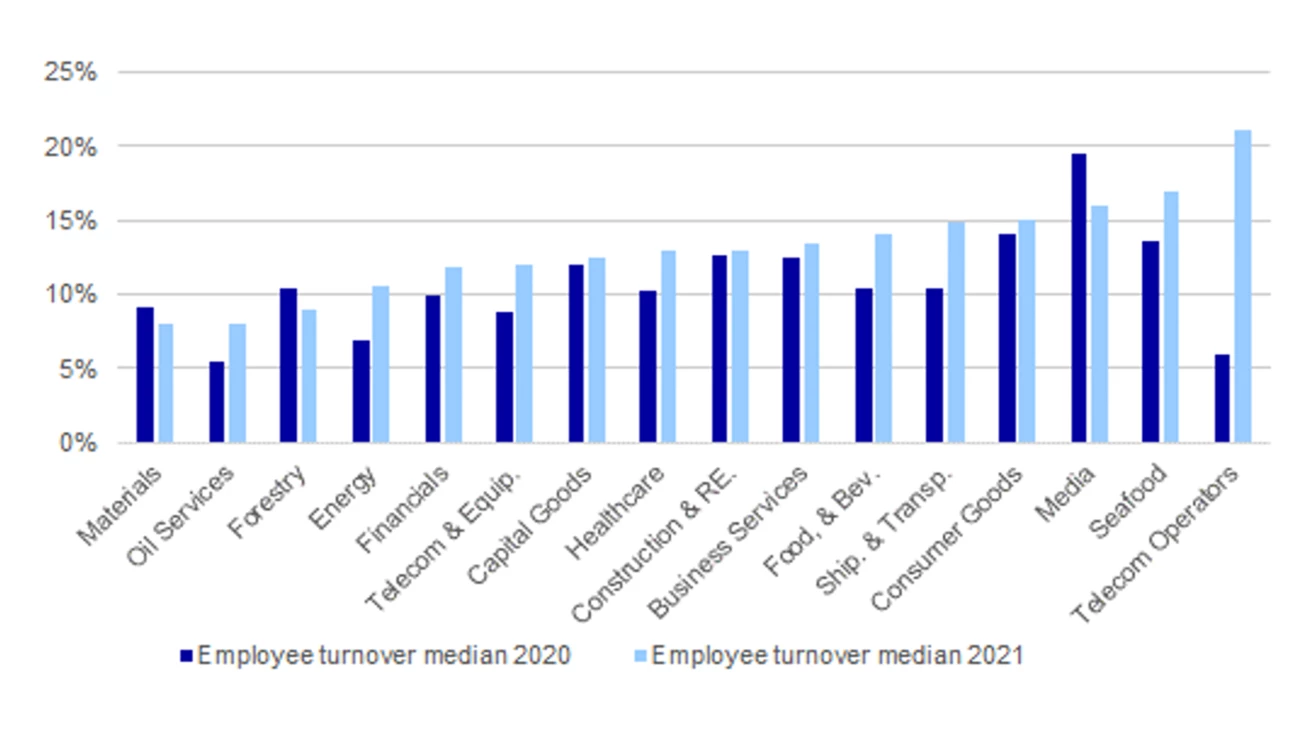

The ESG Research team reports that employee turnover and fatality increased over the past year, most likely due to the return to the workplace after the first pandemic year. Gender diversity, including the dimensions of workforce, board and management, remained largely flat. Concerningly, the sharpest increase between FY2020 and FY2021 was observed in incidents of harassment and discrimination.

The causes of the previous year’s trends are yet to be determined. The coming years are likely to reveal whether sliding performance is a result of return to the workplace, the onset of new working habits and cultures following the pandemic, or is caused by increased awareness of diversity and discrimination issues in the workforce.

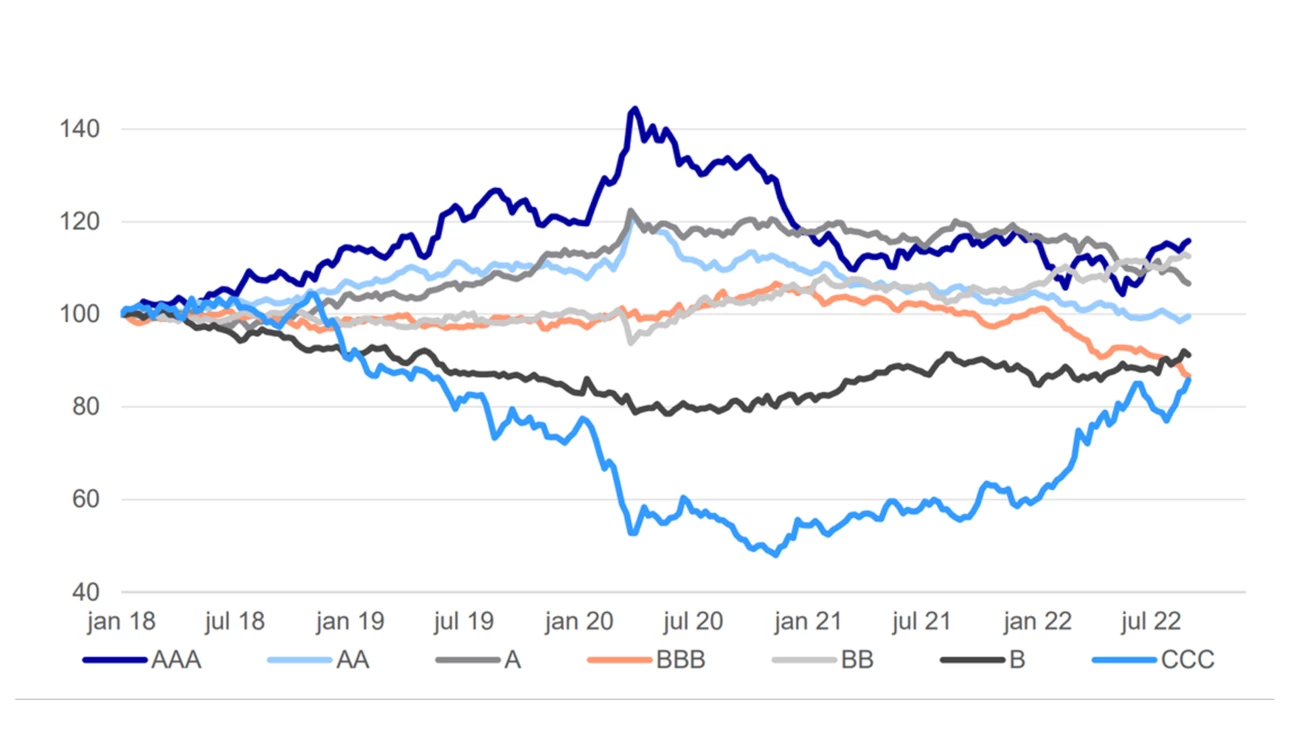

From 2018 to the end of 2020, AAA-rated companies strongly outperformed lower-rated companies in the coverage universe, beating average (BBB) companies by 13% and bottom-rated (CCC) companies by 63%. Much of this outperformance reversed in 2021 due to changes in the interest rate environment and the rally in energy commodities, given the high representation of oil and gas and shipping names among CCC companies (~40%).

So far in 2022, AAA companies have started to outperform the average company in the Nordic-focused coverage universe (14% versus BBB), but not against the bottom-rated names (-40% versus CCC), with the CCC rally continuing into 2022.

Although the sector-neutral nature of the research team’s ESG ratings likely exaggerated the effects, bottom-rated companies have lately benefited from exceptional conditions that helped to drive earnings to peak levels.

Evident in the COVID slump, the industrial recession of 2015-16 and the global financial crisis in 2008, however, earnings of the bottom-rated companies have tended to be more volatile than that of their higher-rated counterparts. Therefore, the ESG Research team argues that, moving towards a recessionary scenario – as expected by our strategists – a reversal of the bottom-rated companies' outperformance could be near, and today could represent a good entry point into top-rated companies. This, in combination with the policy headwinds that several bottom-rated companies will experience, supports a strategy which is long top- and short bottom-rated companies.

For the full report and Nordea’s updated ESG ratings, please contact the ESG Research team here.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more