- Name:

- Kjetil Olsen

- Title:

- Chief Economist

Kjetil Olsen

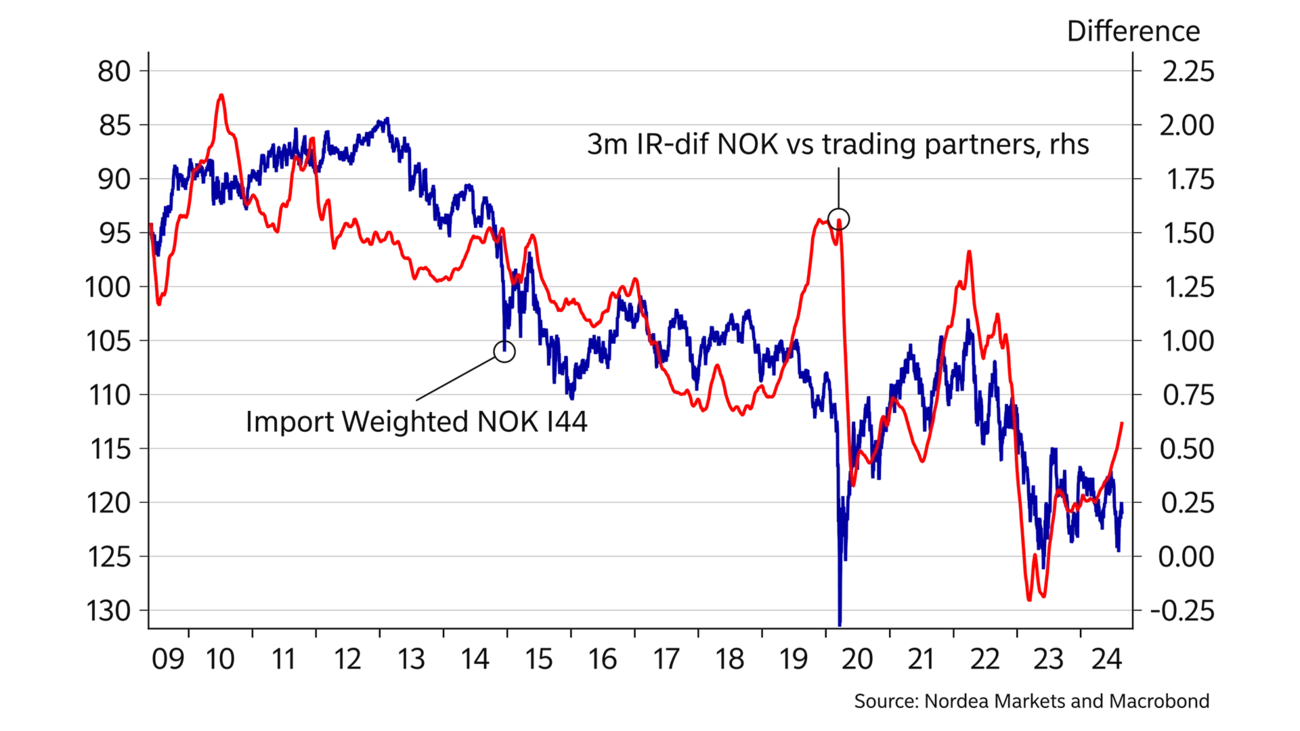

In the past decade, Norway’s relative global excellence has weakened. As a result of the drop in oil prices in 2014, Norwegian interest rates approximated the levels of our trading partners, and the NOK weakened from very strong levels. After the pandemic the fact that other central banks hiked rates more than Norway in order to curb inflation added fuel to the fire. Maybe it is boring that interest rate differentials and the NOK exchange rate are related, but maybe it is not that strange.

Recently, we have seen more than one explanation for the very weak NOK. Politicians have suggested to establish a NOK commission to further investigate the phenomenon. While most people agree that a weaker NOK leads to higher inflation, some seem to believe that the NOK exchange rate is not particularly affected by Norges Bank’s interest rate initiatives and that the interest rate is thus not the right remedy. We, however, believe the interest rate differential can explain much of the NOK exchange rate developments in the past decade.

Chart A goes back to 2008, and although the correlation is far from perfect, it is difficult to dismiss the interest rate differential as a factor behind the NOK exchange rate. We have had two major shifts in the NOK exchange rate and interest rate differential over the past decade.

In 2010-12, the NOK was considered a safe haven. Back then there were concerns the euro would disappear, and Norway could offer high and very profitable oil investments, a relatively strong growth outlook and significantly higher interest rates as an alternative. It was perhaps not so strange the NOK was strong. The euro crisis eventually passed, and in 2014 oil prices took a nosedive. The impression of Norway was turned upside down. Oil investments fell sharply, and profitability in the oil sector was hit hard. Suddenly we were not so special any more, and Norges Bank cut rates while other central banks kept theirs on hold. The safe haven was suddenly the eye of the storm. The NOK weakened significantly and stayed at a significantly weaker level up to the pandemic.

Norges Bank. Highly indebted Norwegian households with floating interest rates may explain part of this difference. Nonetheless, the interest rate differential fell further as a result and at the most extreme point our trading partners had nearly 0.25% point higher interest rates than us. In comparison, there was a positive difference in our favour of around 1.5% points or more in the period before the oil crisis.

Interest rate differentials may affect investors via direct returns on financial positions and thus affect exchange rates. They also reflect the relative relationship between two countries, not entirely unlike exchange rates. Then it is perhaps not so strange there is a correlation.

Maybe it is boring that interest rate differentials and the NOK exchange rate are related, but maybe it is not that strange.

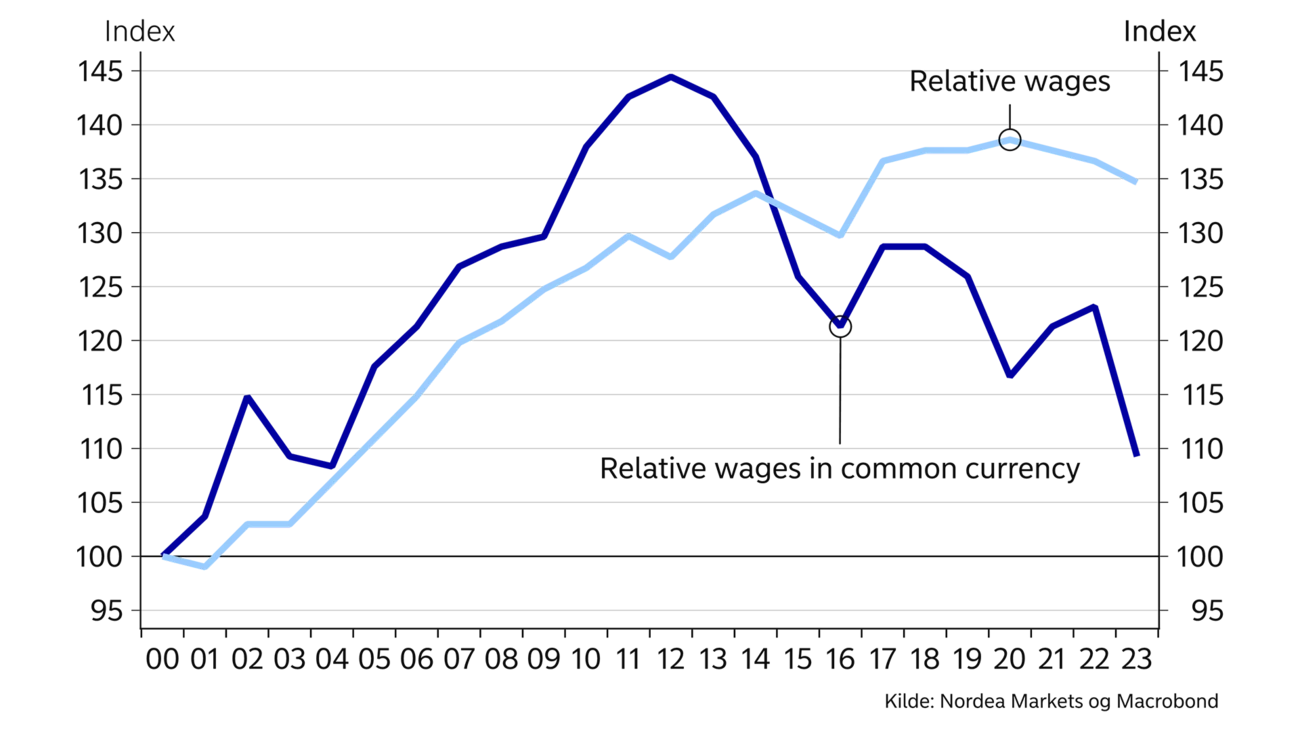

A bigger question is if Norway can expect to return to a position where our outlook is much better than others with a resultant increase in the NOK exchange rate and interest rate differential. If not, it is worth keeping in mind that a weak NOK is favourable when we over time need to transition away from oil and gas and attract investments to Norway. Our competitiveness deteriorated significantly up to the oil crisis in 2014, in line with economic theory when a country creates more value per employee than others, see chart B. The NOK weakening over the past decade has improved competitiveness significantly in tandem with the weakening of our relative excellence.

This article first appeared in the Nordea Economic Outlook: Precision Play, published on 4 September 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more