- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

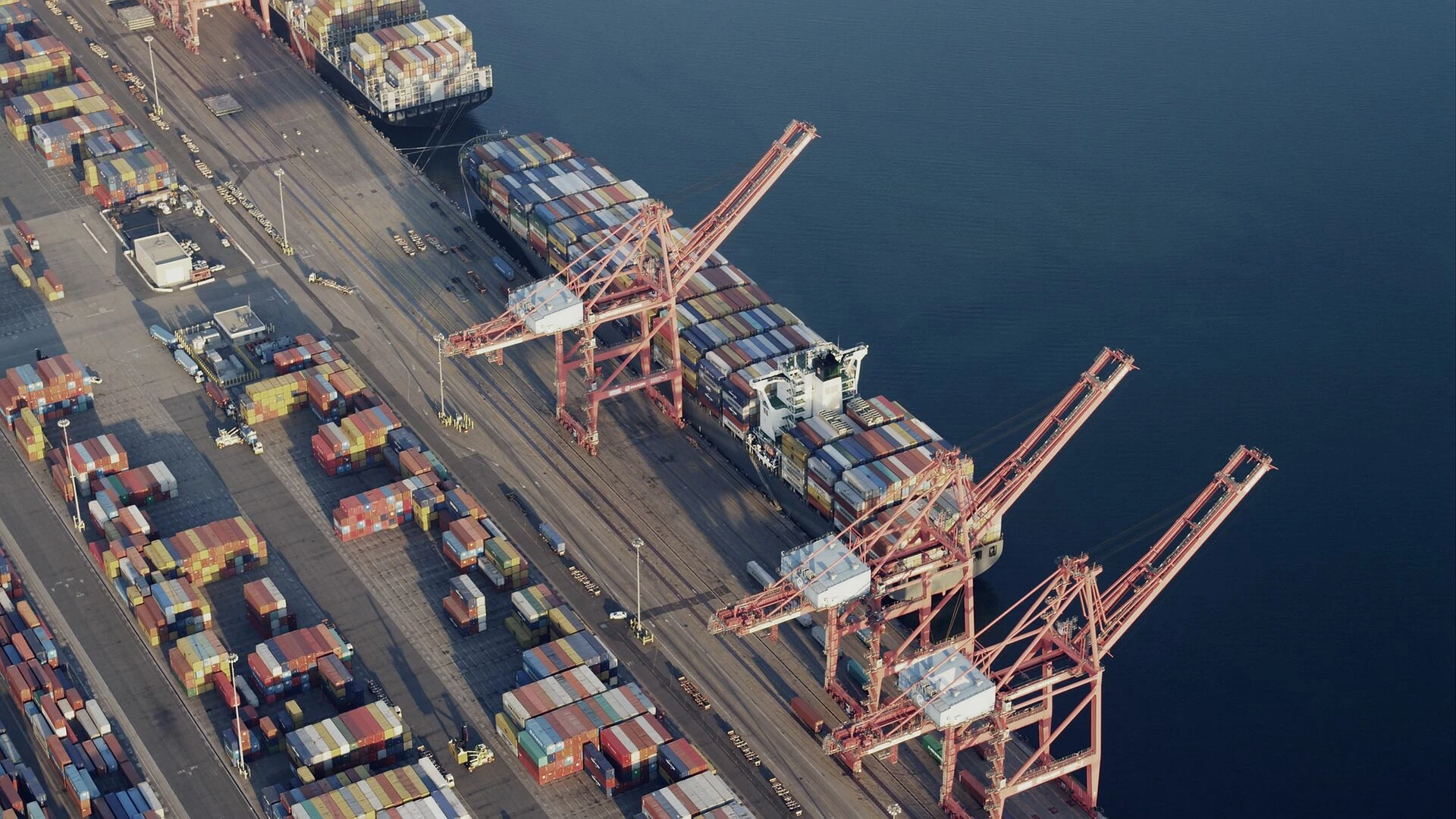

Although industrial production has been running at full capacity this year, manufacturing output and goods exports volumes are still below the levels seen in 2008. This is due to the fact that production capacity has fallen and the share of value added to the economy by manufacturing has decreased permanently.

Finnish manufacturing has been doing well in recent years despite the pandemic and the war in Ukraine. In June, manufacturing output volume grew by 9% year-on-year. The value of goods exports has seen an increase of 26% from a year ago and nearly 60% from two years ago.

The value of exports has been on a growing trend thanks to soaring global market prices of commodities and raw materials important to Finland – namely metals, timber, paper and pulp. However, it has been quite the opposite story for goods exports volume which shrunk by as much as 8% year-on-year in June. The paper workers’ strike and large drop in exports to Russia have partly contributed to the decline in exports volume.

Over the summer, global market prices of metals and other raw materials began to fall. This heralds a decrease in the Finnish export prices, which would also negatively affect Finland’s terms of trade. At the same time, Finland’s second biggest goods exports partner, Germany, is struggling with energy supply. Manufacturing output has been in decline in Germany for two consecutive years now, which does not bode well for Finnish exports. In fact, the number of new orders has already started to dwindle this year. It therefore looks like manufacturing output and goods exports are past their peak.

The key advantages for Finland are know-how and the ability to innovate.

Industrial production has been running at almost full capacity this year, which means that manufacturing output and goods exports are currently demonstrating close to maximum performance. Despite this, neither goods exports nor manufacturing output volumes reached – and may never again reach – the levels seen in 2008. When paper mills and electronics manufacturers closed, no other investments of similar size emerged to fill the void, resulting in lower production capacity. New capacity to bridge the gap will either be built in emerging countries or not be built at all.

A similar trend has been prevalent in other developed countries, too, where manufacturing output growth has been lacklustre in recent decades; albeit not as lacklustre as in Finland. The share of value added to the Finnish economy by manufacturing has decreased by 10 percentage points over the past 20 years, down to 17% in 2021. The share of value added generated by services and service exports, on the other hand, has increased, as service exports now account for one-third of the value of total exports.

Manufacturing and goods exports will continue to play a role in the Finnish business community. However, it may be less significant than before, even if globalisation takes a few steps back. Finland naturally has some strengths, for example, in the availability of commodities such as metals and timber. Relatively cheap and low-emission power generation also gives Finland a competitive edge over many other countries and will help maintain local production in the future.

But the key advantages for Finland are know-how and the ability to innovate. Instead of investing in manufacturing capacity, Finland should shift its focus towards R&D investments. When manufacturing products, the greatest value added is created on the drawing board where technology is developed and brands are built. The Finnish export industry would benefit from focusing more on technology and services with high value add and less on mass production.

If industrial mass production decreases, this will free up labour for health care and other service sectors where demand for workers is constantly growing. As long as adequate training, wages and labour market flexibility are ensured, there is no need to worry about this structural change resulting in growing unemployment.

This article originally appeared in the Nordea Economic Outlook: Feeling the Squeeze, published on 7 September 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more