- Name:

- Torbjörn Isaksson

- Title:

- Nordea Chief Analyst

Sivua ei ole saatavilla suomeksi

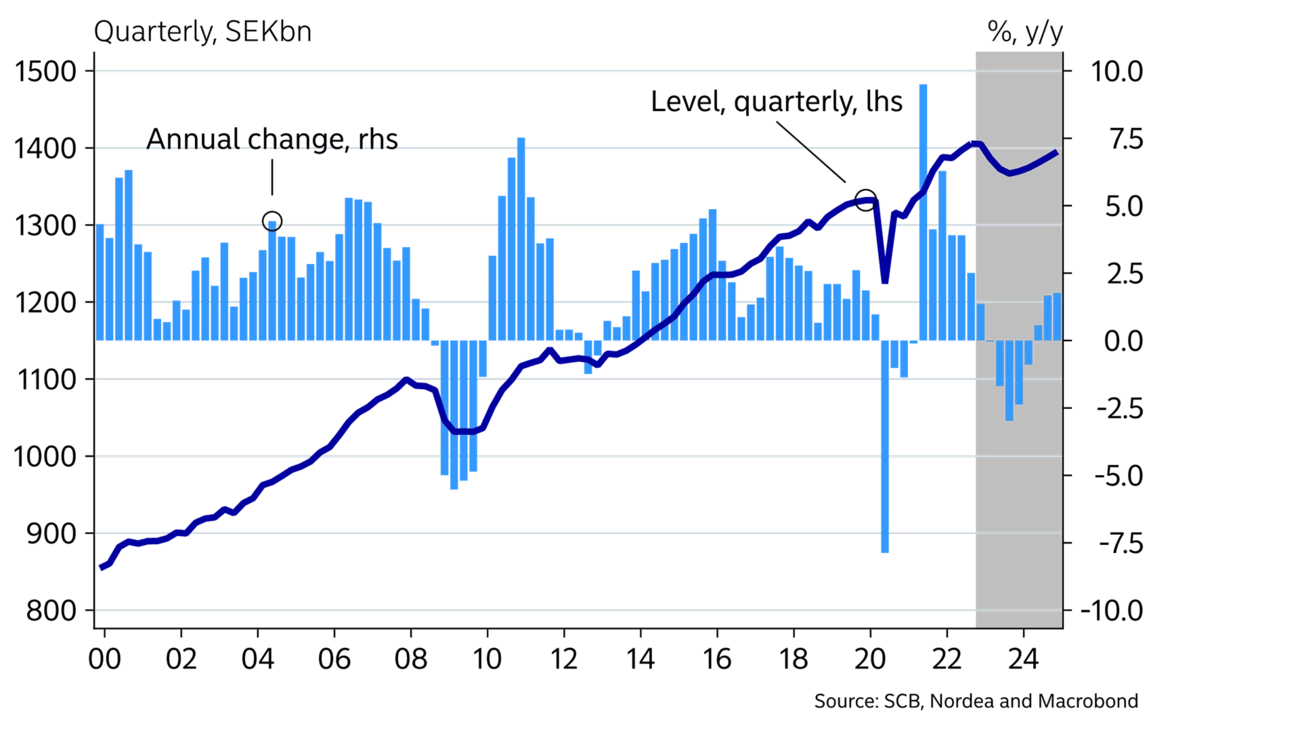

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleThe outlook for the Swedish economy is worrying. After many years of debt build-up, the resultant vulnerability is now being tested and will contribute to a decline in the economy in 2023. Many forces are at play, with the dramatic change in financial conditions impacting the economy the hardest. It is uncertain when the effects will become more noticeable and how deep the decline will be. But much suggests that 2023 will be a lost year. In addition, the recovery will be weak during 2024.

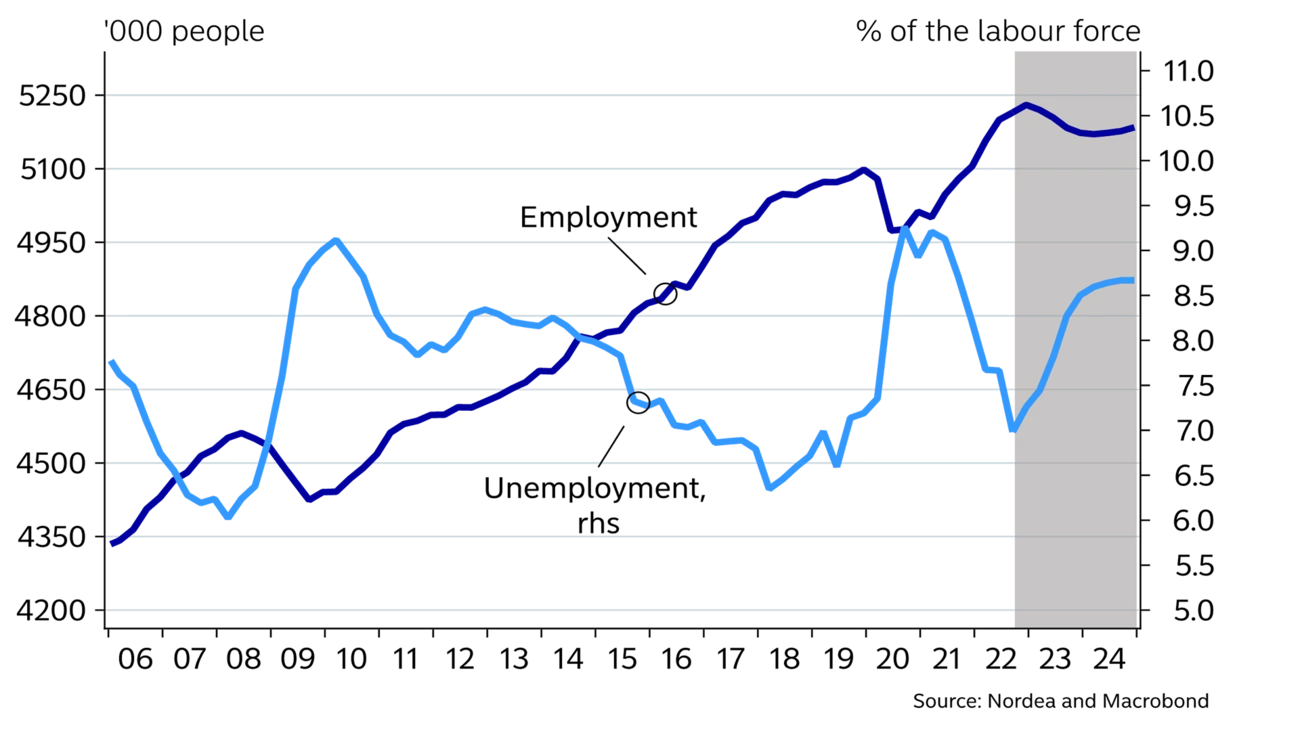

For most of 2022 the Swedish economy was very strong. The labour market in particular was over-heated with significant labour shortages in all regions and sectors.

Towards year-end, more signs of weakness became evident, and we estimate that the Swedish economy will deteriorate markedly going forward. GDP will fall by around 2% during 2023, and the demand for labour will go down.

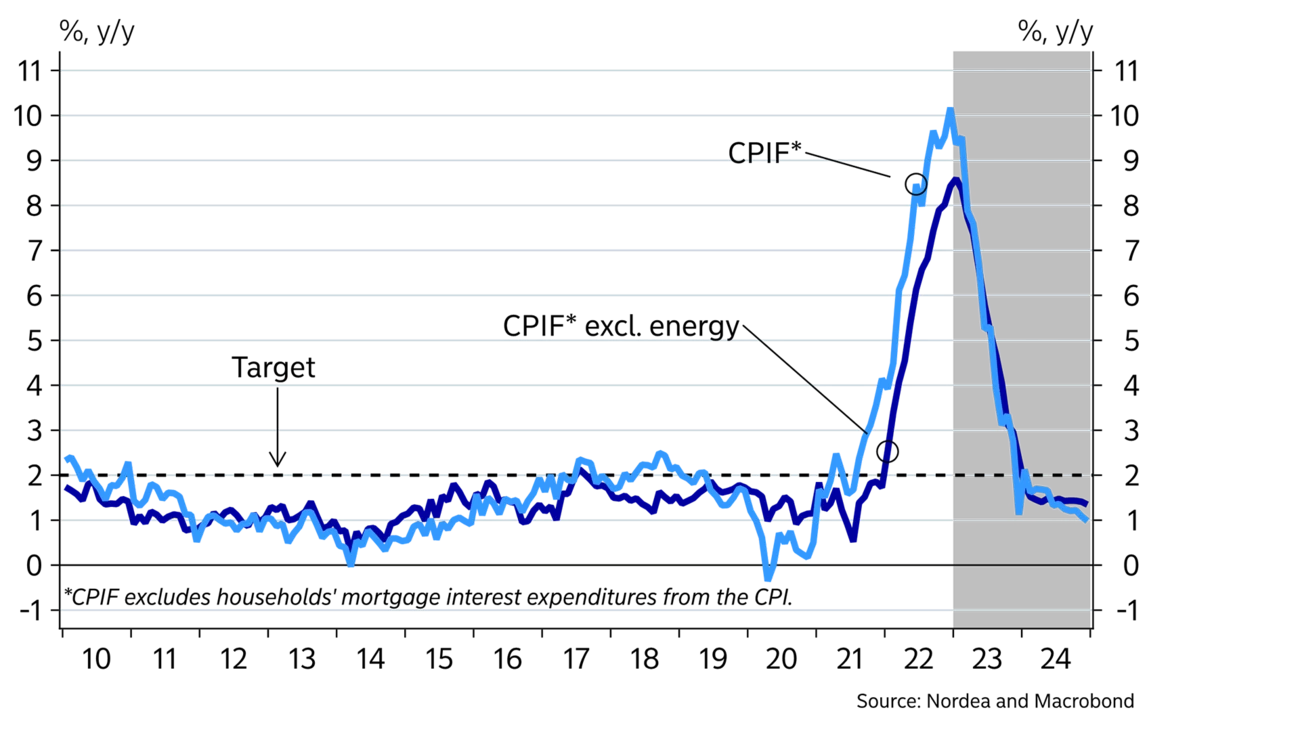

The main reason for the slowdown is the drastic change in monetary conditions. The increase in interest rates over the past year was both significant and unexpected. In addition, monetary policy will be tightened further in the near term. Also, high inflation is eroding growth.

After a shaky 2023, the economy is expected to stabilise during 2024. However, it will be a weak recovery. The Riksbank will lower its policy rate, but the interest rate level will remain higher than before the pandemic. It will be a difficult process for many households and companies to adjust to the higher interest rate level.

The unusually strong starting point for the Swedish economy makes it difficult to estimate when the downturn will become more pronounced. It is also uncertain how hard monetary policy tightening will hit household spending, for example. The negative effects could be larger and more protracted than forecast in this analysis. Several dark clouds are gathering on the global horizon, including the security policy situation and the energy crisis in Europe. On the other hand, an expansive fiscal policy abroad and longer out also in Sweden could soften the economic slowdown.

The housing market reacted immediately to the changed economic conditions caused by the rising interest rates. Home prices started to decline during Q1 2022 and by November they had fallen 13%. We expect home prices to continue to decline by a total of 20% from top to bottom.

The changed conditions already had affected the construction sector in the autumn. Construction companies’ production plans for the coming year are more pessimistic than since the crisis in the 1990s. Construction sector activity only accounts for 6% of GDP, but the effects of the weak construction cycle are still noticeable. For instance, we expect the number of housing starts to fall from the peak of 68,000 in 2021 to 25,000 in 2024. The lower housing construction activity alone will affect GDP by around 0.5% point in both 2023 and 2024.

SWEDEN: MACROECONOMIC INDICATORS

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP (calendar adjusted), % y/y |

-2.4 |

4.9 |

2.9 |

-1.8 |

0.8 |

|

Underlying prices (CPIF), % y/y |

0.5 |

2.4 |

7.7 |

5.4 |

1.4 |

|

Unemployment (SPES), % |

8.5 |

8.8 |

7.4 |

8.0 |

8.6 |

|

Current account balance, % of GDP |

6.1 |

6.4 |

4.6 |

5.3 |

5.7 |

|

General gov. budget balance, % of GDP |

-2.8 |

-0.1 |

0.8 |

0.1 |

-0.4 |

|

General gov. gross debt, % of GDP |

39.5 |

36.3 |

31.7 |

30.3 |

31.1 |

|

Monetary policy rate (end of period) |

0.00 |

0.00 |

2.50 |

3.25 |

2.00 |

|

EUR/SEK (end of period) |

10.04 |

10.30 |

11.12 |

10.90 |

10.50 |

With time, interest rate hikes will have a further impact on the economy. Households are the most exposed. Spending is already adversely affected, and we fear a more significant downturn. Households are affected in several ways. Interest rate expenses as a share of disposable incomes will rise from less than 4% in 2021 to more than 9% by mid-2023. Also, high inflation is eroding purchasing power. Real disposable income fell in 2022 by 1% and will fall in 2023 by around 2% despite compensation for high electricity prices.

These cash effects weigh on consumption. Other factors such as income expectations and wealth effects are even more important for households’ propensity to spend. This is underlined by fluctuations in the savings ratio, which is a measure of how much households save of disposable income. The savings ratio often varies from year to year, indicating that in the short term income has a limited effect on consumption. For example, households’ own financial savings were negative during 2022. In other words, financial wealth was used to maintain consumption.

We expect that the propensity to save and amortise will go up this year. An important reason for this is that falling home prices change the ratio between debt and income in a way households are not comfortable with. We also expect the labour market to deteriorate, which may create uncertainty about future income.

Therefore, we expect households’ own financial savings to rise during 2023. When the interest shock eases and inflation drops, households will recover somewhat and spending will pick up slightly in 2024, but the recovery will be weak and savings will remain at a relatively high level.

Households’ propensity to save is difficult to estimate, but given the sharp housing market decline, there is a risk that savings will rise even more than we indicate in this forecast. The decline in spending may thus be deeper and more prolonged. However, a positive factor is that savings grew significantly during the pandemic. Households could thus have larger financial buffers and be more resilient than assumed in this forecast.

It will be a difficult process for many households and companies to adjust to the higher interest level.

The weak SEK could contribute to a shift in households’ spending patterns. Less overseas travel and an increasing share of domestic consumption may benefit some domestic sectors. When households tighten the purse strings it nevertheless affects many service industries, which are therefore expected to reduce their investments and cut staff. Interest rate hikes also impact other sectors such as commercial properties. This contributes to a decline in total investments during the forecast period.

The public sector is an exception with ongoing infra-structure projects and increased defence spending, which will increase overall investments in the sector. However, the public sector is no big cyclical buffer. Local authorities’ financial positions are stretched by increased costs. Longer term, lower employment will hamper tax income. The public sector budget surplus from 2022 will diminish. Maastricht government debt is still at close to 30% of GDP.

Exports of goods stagnated during 2022 and performed worse than world trade. The reason why Swedish exports seem to have lagged behind is probably that the lack of input goods has been hampered, especially the production and export of cars and trucks. Swedish exporters generally still have full order books, indicating stable exports in the near term. However, the inflow of new orders is slowing and exports are expected to hit a soft spot later this year. Thus, the industry’s need to invest in new machinery and plants will also go down.

Demand for labour was still high around the turn of the year. However, it has already taken a turn for the worse. Companies’ hiring plans are less optimistic, short-term unemployment has risen and households see an increased risk of becoming unemployed themselves.

The weaker domestic demand results in lower employment. However, it will take some months into 2023 before the deterioration gets more pronounced. The labour market is affected by an economic slowdown at a certain lag. The lag may be longer than usual this time as labour demand and shortages were record high in 2022.

Eventually employment will also start to go down. During 2023 the decline will be 1% and unemployment will rise to 8.5%. In addition, an increasing population and thus rising labour supply will contribute to increased unemployment. Employment will flatten during 2024, and unemployment will be somewhat below 9% by the end of the forecast period.

The strong starting point on the labour market has some impact on the comprehensive pay talks which will take place during the spring of 2023. We expect wage growth to increase from around 3% to 4% this year. Read more about wages in this theme article.

Wages are not the reason why inflation skyrocketed in 2022. This was mainly due to the strong economy in Europe and the US. The pandemic created certain price-driven supply and transport disruptions. The war in Ukraine has also added fuel to the inflation fire. However, the main reason for the high inflation is the very high demand in our part of the world.

The falling demand will ease the price pressure. This has been evident for some time in falling commodity prices and lower global transportation costs, which suggest lower goods inflation also in Sweden. With lower domestic demand, it also becomes more difficult to pass on increased costs to the customers, which will result in lower inflation. CPIF inflation will fall to the 2% target H2 2023.

Indicators have turned to the worse, indicating that the labour market will deteriorate.

Wage increases of 4% are not a threat to the inflation target. However, the Riksbank will want to protect the credibility of the inflation target before future pay talks. To ensure that inflation does not take hold at an excessive level and to stay aligned with the ECB, the Riksbank will continue to hike its policy rate near term.

When inflation falls back and the economic downturn becomes more pronounced, the pressure to support the economy through monetary and fiscal policy measures will increase. The Riksbank will thus lower its policy rate during 2024.

The SEK weakened significantly during 2022. With an uncertain growth outlook and weak trends in asset prices on stock exchanges worldwide, risk appetite waned, which in turn lowered the appetite for the SEK. The interest rate-sensitive Swedish economy, and especially the housing market, pose a dilemma for the Riks-bank as fewer rate hikes compared to the rest of the world may weaken the exchange rate, while too sharp rate hikes may cast a shadow over the domestic growth outlook and in turn weaken the SEK. In other words, times are tough for the SEK, and the exchange rate will likely trade at relatively weak levels during the forecast period.

This article first appeared in the Nordea Economic Outlook: The Balancing Act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more