- Name:

- Ebba Ramel

- Title:

- Lead ESG Analyst, Sweden

In the transition to a sustainable future, the real estate sector is a crucial player. ESG Sector Analyst Mons Lunde explores how energy efficiency is reshaping the industry and creating new opportunities for developers and owners of real estate.

The real estate sector is central to the energy transition, with buildings in the EU accounting for 40% of total energy consumption. This presents significant potential for property owners to implement energy efficiency measures, simultaneously reducing emissions, easing strain on energy infrastructure, lowering operational costs and mitigating the risk of stranded assets.

As regulatory pressures mount to “green” the building stock, failure to adapt could result in lower demand for brown buildings, potential asset devaluation and prolonged vacancies for commercial real estate.

The Energy Performance of Buildings Directive (EPBD) is set to transform the sector, aiming for a fully decarbonised building stock in the EU by 2050. With its implementation into national laws by mid-2026, the directive will trigger a “Renovation Wave,” potentially doubling the annual rate of energy renovations and targeting the upgrade of 35 million buildings in the EU by 2030. For more information, see EU Renovation Wave: Impact on Nordic real estate companies | Nordea.

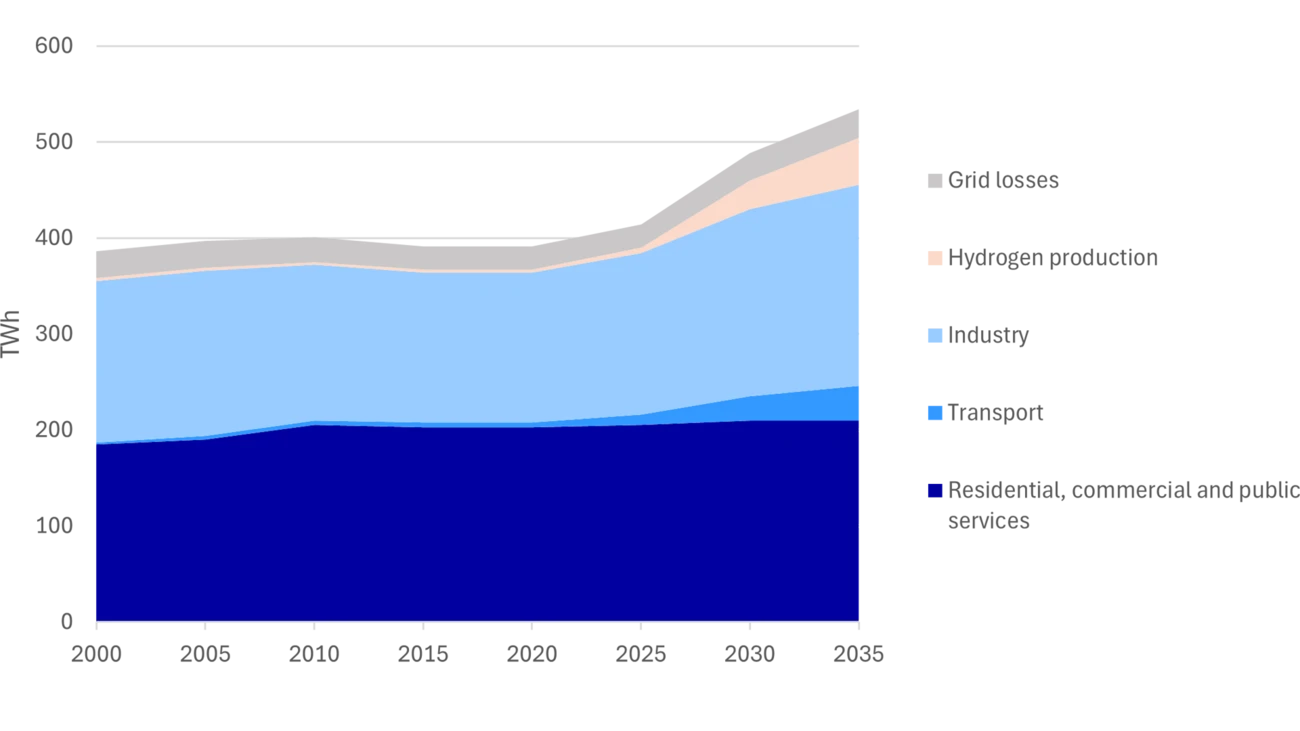

Electricity makes up substantial share of the Nordic energy system, complemented by fuels and heat. As sectors like transport, industry and heating are transitioning to replace fossil fuel consumption with electricity, the demand for electricity continues to grow. While the Nordic electricity mix is among the cleanest in the world, predominantly powered by hydropower, wind and nuclear sources, we must prioritise the efficient use of renewable electricity to support broader decarbonisation efforts. By using electricity in a smarter way, we can make clean electricity available for other sectors and reduce the burden on the environment.

By using electricity in a smarter way, we can make clean electricity available for other sectors and reduce the burden on the environment.

| Denmark | Finland | Norway | Sweden | |

| Final energy consumption, largest sectors | 31% Transport 29% Residential 18% Industry | 41% Industry 21% Residential 16% Transport | 30% Industry 24% Transport 18% Residential | 36% Industry 23% Residential 21% Transport |

| Residential energy use, largest sources | 43% Heat 22% Electricity 18% Biofuel/waste | 39% Electricity 32% Heat 24% Biofuel/waste | 81% Electricity* 15% Biofuel/waste | 49% Electricity 36% Heat |

| Commercial and services energy use, largest sources | 44% Electricity 39% Heat | 51% Electricity 36% Heat | 77% Electricity 11% Heat | 63% Electricity 29% Heat |

| Renewable share in final energy consumption | 40% | 50% | 61% | 58% |

*Electricity includes heat in Norway

Source: Energy efficiency in the Nordics, Nordea

Balancing clean electricity demand

Energy-intensive buildings consume a significant share of available clean electricity for lighting and heating. This power could instead be used to decarbonise high-emission sectors such as heavy industry and transport, which are transitioning from fossil fuels to electricity and rely on access to limited clean power supplies.

Managing grid strain

Power systems must be designed to handle peak demand, not just average use. In the Nordics, electricity consumption tends to spike on cold winter mornings when buildings are heated and the workday begins. These demand peaks stress the grid and necessitate investments by grid operators to mitigate blackout risks during extreme events.

Optimising local energy production

A system-wide approach is required to coordinate the use and development of local energy sources such as rooftop solar power or waste heat. While local production can reduce demand for extensive transmission and distribution capacity, challenges remain in establishing ownership models and pricing mechanisms that consider taxes, fees and grid tariff costs while fairly distributing the benefits among producers, consumers and grid operators. In Norway for example, a model for sharing local energy production has incentivised investments in rooftop solar for multi-owner buildings by eliminating grid tariffs and fees for locally produced electricity. Similar models are being explored in other Nordic countries.

For society, reducing energy consumption in buildings is one of the most cost-effective ways to ease these pressures while benefiting owners through lower energy costs and potentially higher valuations. For new buildings, constructing energy-efficient buildings with low heating demand and modern energy management systems can dramatically reduce long-term energy needs. Nordic countries ensure this through energy requirements in the national building codes.

The true challenge – and opportunity – lies in renovating the large stock of existing buildings. Renovation is often the most climate friendly option, extending building lifespans and avoiding the embodied carbon associated with new construction. Going forward, owners are expected to monitor the Energy Performance Certificates of their portfolio and make plans to upgrade the lowest performing buildings to reduce the risk of stranded assets.

Best practices for Nordic house renovations include:

For commercial buildings, cost-effective measures often include:

Improving energy efficiency in buildings not only reduces emissions but also helps balance energy demand, supports the broader green transition and contributes to the resilience of Nordic power systems for the future.

Nordea has a long-term goal of becoming a net-zero bank. This is supported by mid-term decarbonisation objectives to reduce financed emissions by 40-50% for both the residential real estate portfolio as well as the group’s lending portfolio.

Nordea supports the climate transition of the real estate sector by offering a range of solutions and products with a sustainable focus to our private and corporate customers. We are available for further discussions with our clients on how to finance and implement sustainability initiatives.

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more