- Name:

- Jan Størup Nielsen

- Title:

- Nordea Chief Analyst

Jan Størup Nielsen

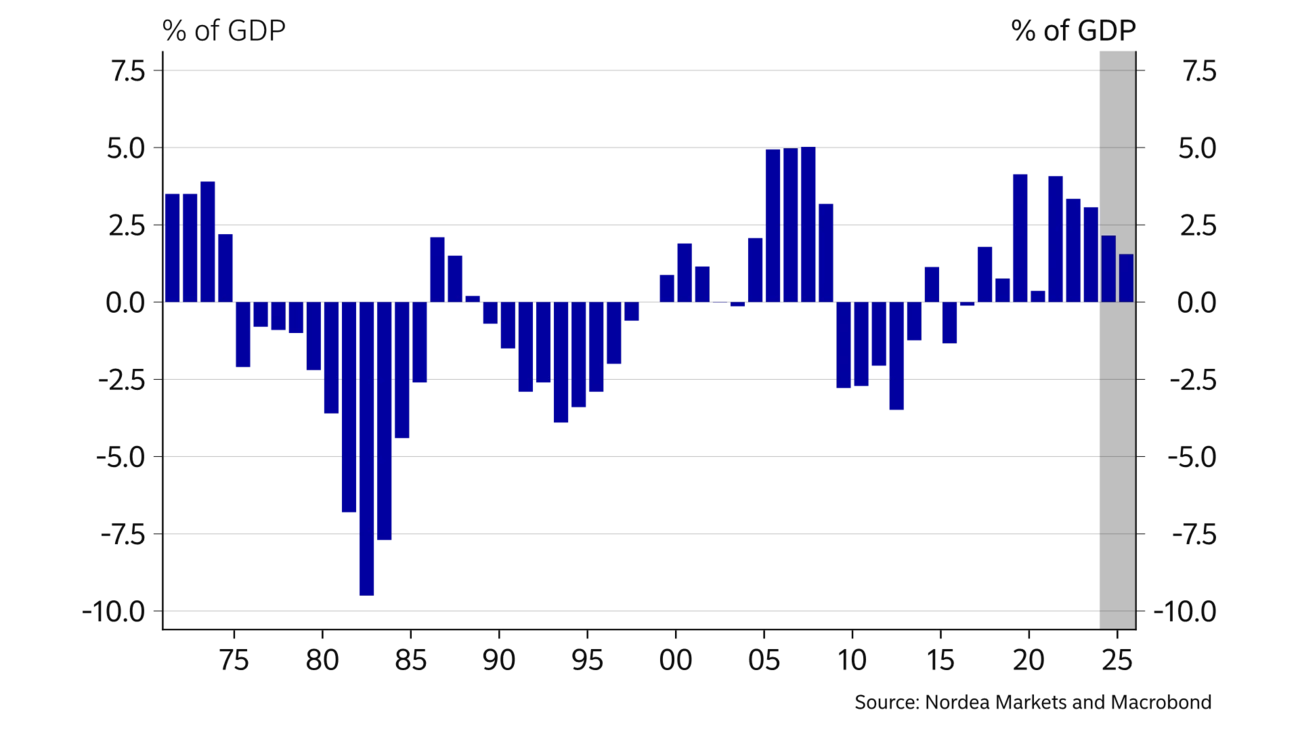

Danish public finances have seen a significant transformation over the past ten years. Budget surpluses have been recorded for seven consecutive years, and total government net assets have risen to a historically high level. Thus, the trend in Denmark is opposite to that of many other countries where large public deficits have taken hold. The solid finances help to ensure stable, low interest rates in Denmark. At the same time, investors have had the option to invest in the green transition.

In 2023 the surplus of public finances was around DKK 85bn, corresponding to just over 3% of GDP. It was the seventh consecutive year in which revenues were higher than expenses. At the same time, the surplus was once again among the highest in the EU. Owing to the long period of surpluses, the government’s net assets have risen to more than 15% of GDP. Lastly, this has also contributed to pushing gross government debt lower, to about 30% of GDP at present. This is a historically low level, with the exception of a short period leading up to the financial crisis in 2007-08.

The strong public finances have been supported by a major pick-up in employment. This helps to increase the government’s income tax receipts while also reducing expenses such as unemployment benefits. It is also reflected in a steady decline in recent years in the number of Danes under the pensionable age who are receiving public benefits – this is now approaching the pre-pandemic level.

In the coming years we expect continued public finance surpluses – but smaller than previously. This is due in particular to the expected economic slowdown, which will reduce revenues and increase expenses. In continuation of this, the government's pension return tax revenues are expected to nosedive, owing to the significant interest rate increases. Lastly, public expenses are also adversely affected by the repayment to homeowners of excess property taxes collected in the period from 2011 to 2020.

Public finances in Denmark are very strong – both historically and compared to many other countries.

Compared to the forecasts from the Danish Ministry of Finance, public finances have for some time tended to develop better than expected thanks to several years with very high pension return tax revenues, among other things. Coupled with a wish to maintain good liquidity in the Danish government bond market, the government accordingly has built up a substantial balance with the Danish central bank. At the start of the year, the balance was DKK 160bn, which is more than twice as much as the expected financing requirement for 2024.

The substantial balance allows the Danish central bank to be more selective in terms of how many Danish government bonds it wants to sell and at what price. This is one of the reasons why Danish yields are strongly linked to the trend in German government bond yields.

In 2022 Denmark joined the steadily growing number of countries that sell green government bonds. This allows investors to lend money to the Danish government that is earmarked for the green transition.

For the Danish central bank, the issuance of green government bonds has several advantages. First and foremost it may help open the door for a wider group of especially foreign investors with a mandate to invest in initiatives to promote the green transition. At the same time, green government bonds are typically sold at slightly higher prices than traditional bonds, and the government thereby can obtain an interest rate reduction when issuing green bonds.

In total, the Danish government has issued green government bonds of around DKK 26bn. Relative to the total size of the Danish government bond market, this is a relatively small share of around 4.5%. Going forward, however, we expect more green government bonds to come to the market – both because the government will have to channel further resources for that purpose and because players in the financial markets want to promote this process via active investments in the green transition.

This article first appeared in the Nordea Economic Outlook: Past the peak, published on 24 January 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more