- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

Kjetil Olsen

The Norwegian “frontfag” pay talk model means that the negotiations start in the industries particularly exposed to international competition. One of the most important indicators used during these negotiations is the wage share in the manufacturing sector. The historically low wage share presents a clear upside risk to wage growth and to Norges Bank’s forecasts in the coming years. Consequently, it may take even longer before inflation returns to the inflation target.

Wage formation in Norway is governed by the “frontfag” pay talk model. The model was formalised following the Aukrust Committee’s report in 1966 and builds on a historical practice where industries most exposed to competition negotiate first, establishing the norm for collective bargaining in other sectors. The purpose is to ensure that the Norwegian manufacturing sector remains competitive with a wage standard that does not exceed industrial profitability – while also ensuring that wage-earners receive their fair share of value creation. This Norwegian model for wage formation has been an important component in the interplay between fiscal policy, monetary policy and labour market partners. It has been the subject of discussion and evaluation by many government-appointed committees, but has remained strong despite all the debate.

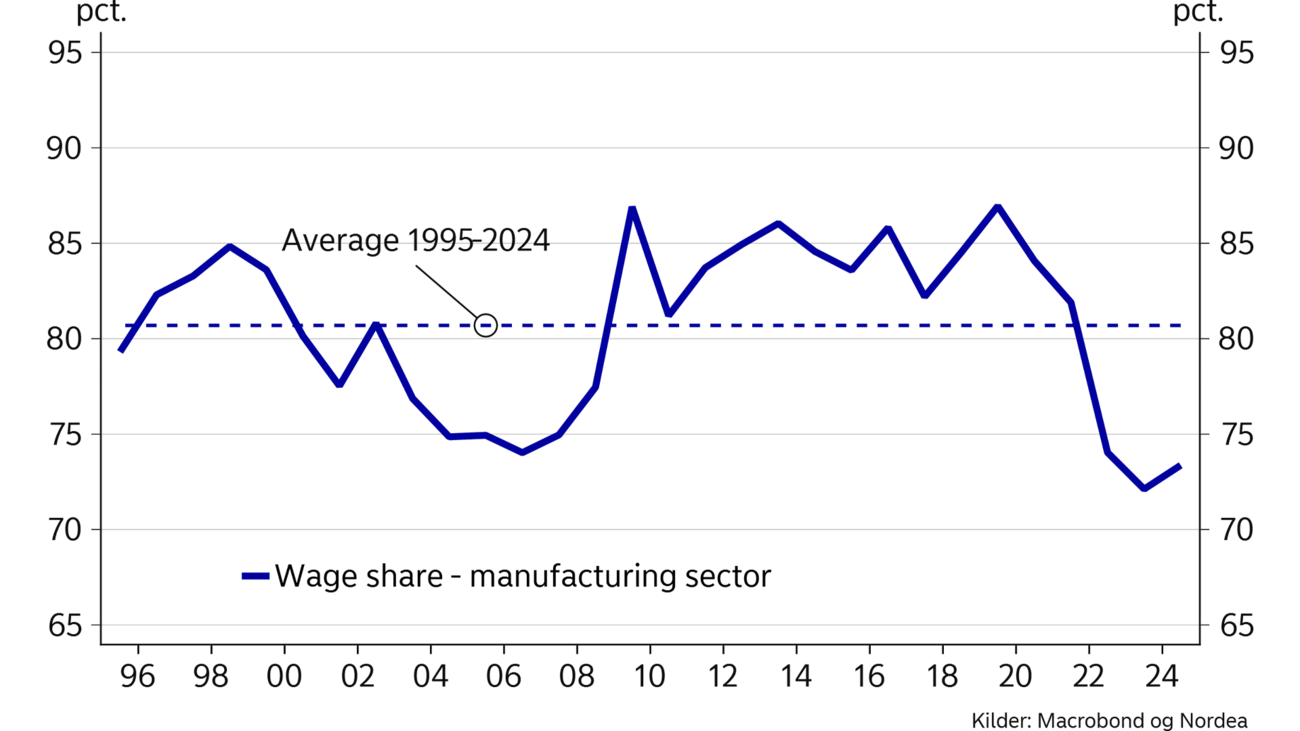

Several indicators are used to assess what the negotiation framework should be. One of these indicators is the wage share in the manufacturing sector – the share of the sector’s factor income that goes to wages. The goal of the “frontfag” model is for this share to remain relatively stable over time. When the wage share falls, it means wage-earners’ slice of the pie is shrinking. This could create persistent pressure to recover lost ground in later negotiations.

Historically low wage share in the manufacturing sector could maintain inflationary pressures in Norway.

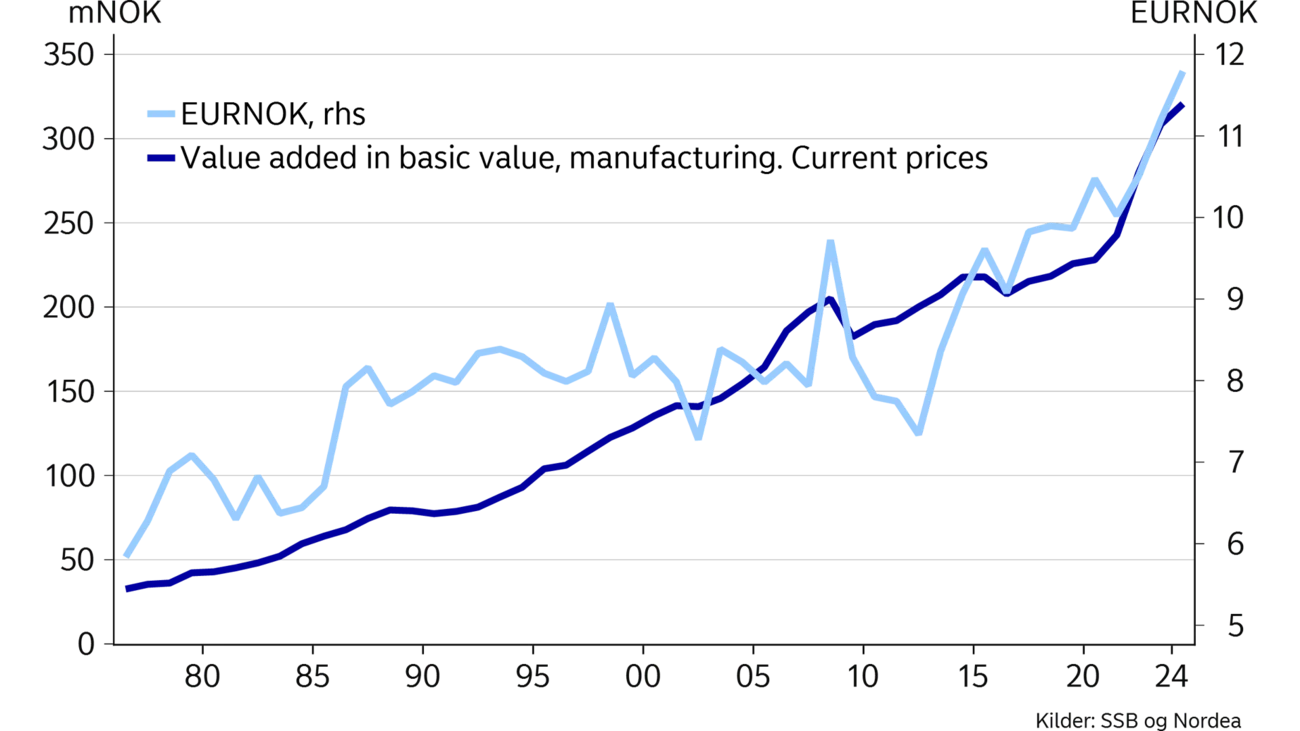

And this is precisely the challenge: the wage share in the manufacturing sector has fallen from 87% in 2019 to around 73% in 2024 – well below the average of the past 20 years and the lowest level ever measured, see chart A. High inflation has led to substantial wage increases in recent years. Nevertheless, wage-earners’ share of value creation has fallen. The explanation lies in the unusually good earnings in industry. The sharp NOK depreciation has significantly boosted exporters’ profitability in recent years, see chart B.

If the wage share is to return to the average of the past 20 years within a reasonable period of time, either the NOK must strengthen significantly and reduce profits that way, or coming years’ wage growth must be clearly higher than what Norges Bank assumes in its forecasts. Norges Bank expects wage growth to decrease to 4.1% in 2026 and 3.6% in 2027. If industry earnings stay in line with pre-pandemic levels, the wage share will remain at today's historically low level if the NOK continues to be weak as we believe it will. This opens the possibility that wage-earners may demand higher wage increases than Norges Bank anticipates.

Higher-than-expected wage growth will keep cost pressures up in other sectors as well, since wage increases agreed in the manufacturing sector set the tone for other pay talks. For sheltered sectors, higher wages will largely need to be passed on to prices to maintain margins. When wage growth is strong, it also becomes easier to pass costs on to consumers because they can “afford” to pay the higher prices. The low wage share in the manufacturing sector thus presents an upside risk not only to wage growth but also to price growth. It may thus take longer than Norges Bank currently assumes before inflation reaches 2%. If so, this will also contribute to higher interest rates in the coming years than widely expected.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more