Science-based targets play an increasingly important role in sustainable finance

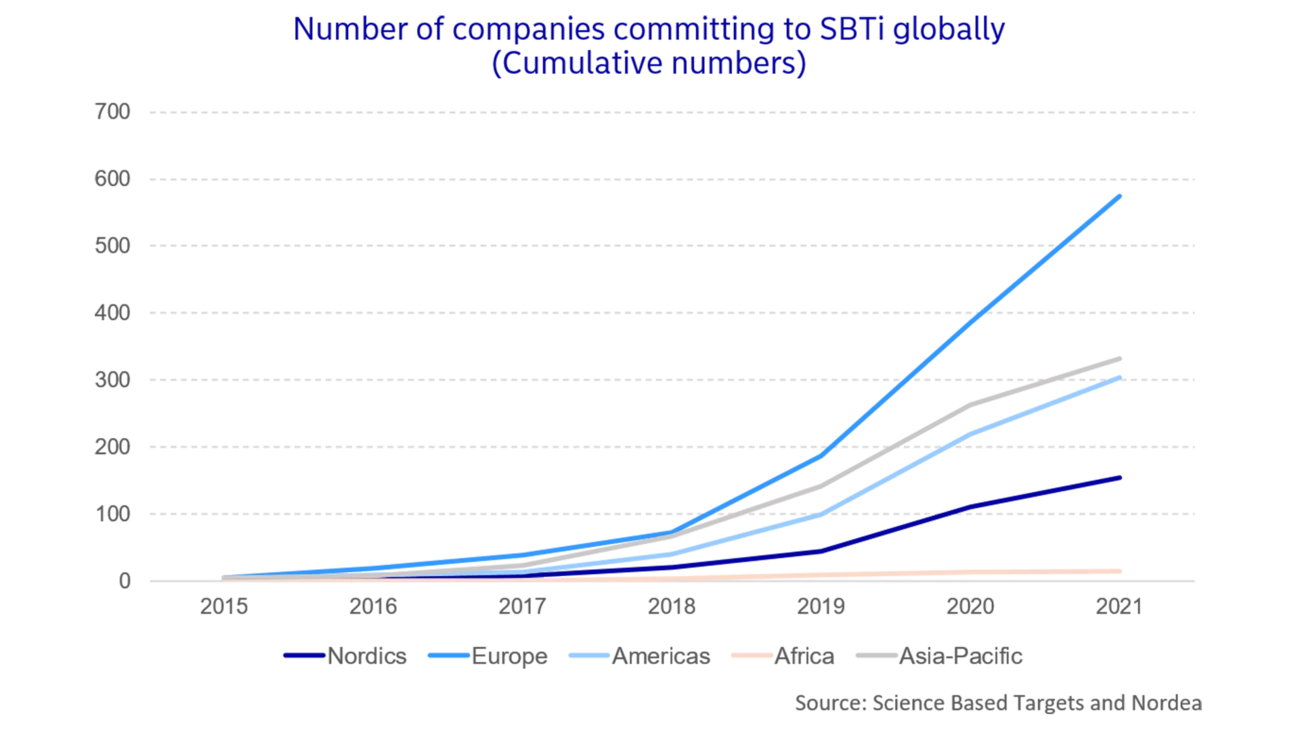

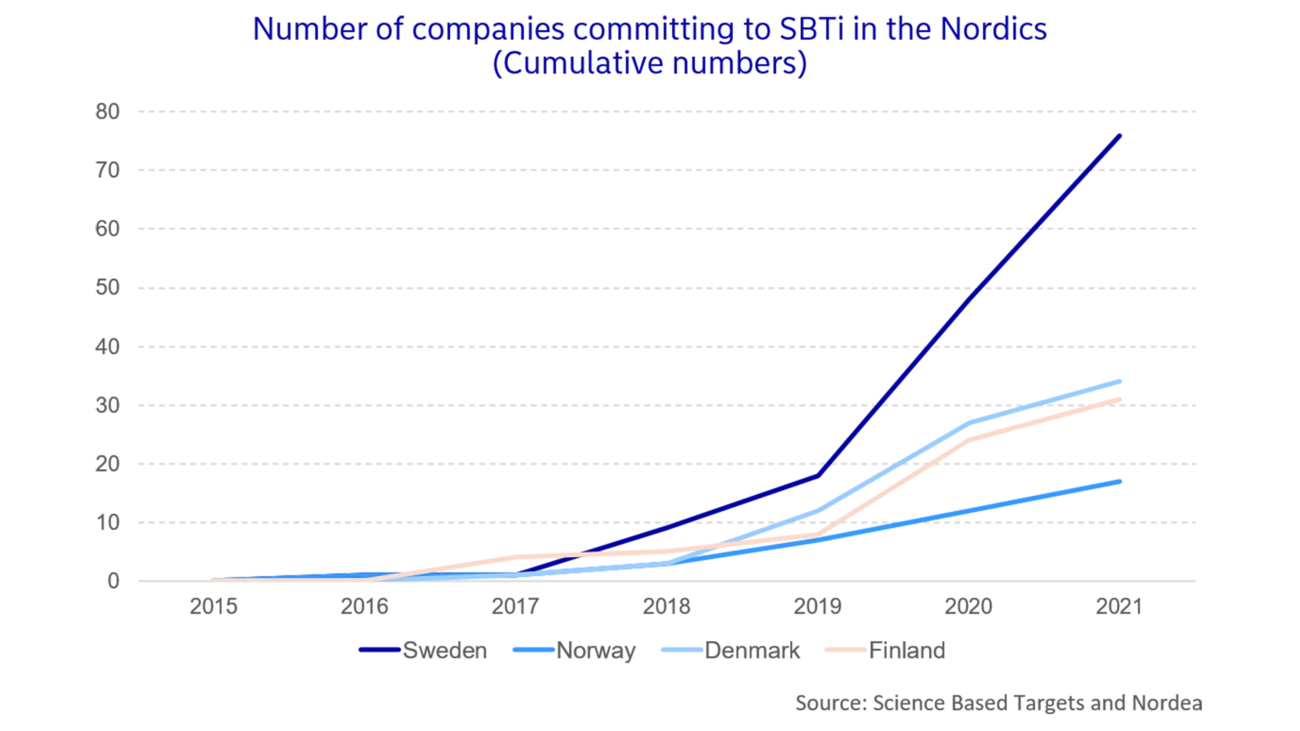

The growth in companies committing to SBTs bodes well for the sustainable finance space, in particular for sustainability-linked debt instruments, such as sustainability-linked loans (SLLs) and sustainability-linked bonds (SLBs), where companies commit to achieving certain sustainability-related targets during the lifespan of their loan or bond.

Key to these structures is that targets are ambitious, and that the overall indicator is considered material to the borrower. It is for this particular reason that the SBTs come in handy, as the process for defining what constitutes “ambitious” and “material” is not always straightforward. The SBTs allow for a smoother process as it is recognized that commitments to the SBTi meet this threshold. Indeed, the International Capital Market Association (ICMA) last year released a Climate Transition Finance Handbook with specific reference to climate transition strategies being science-based.

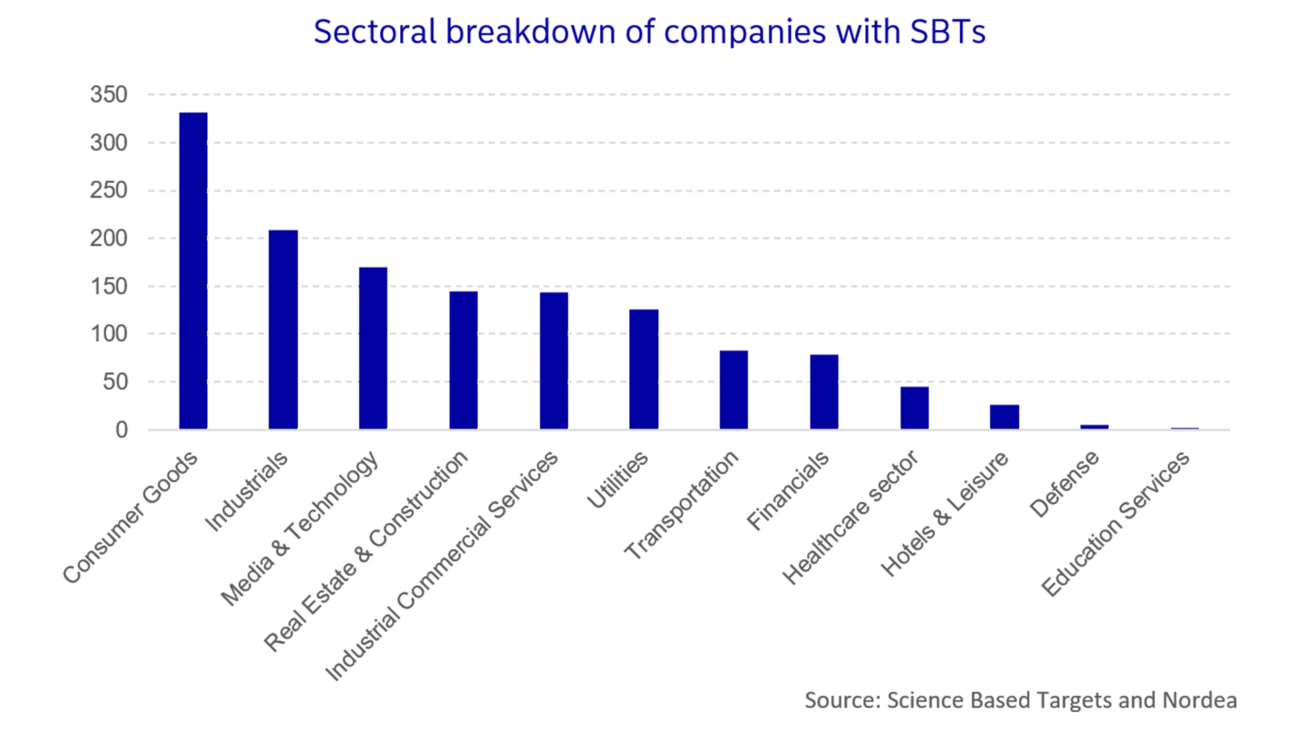

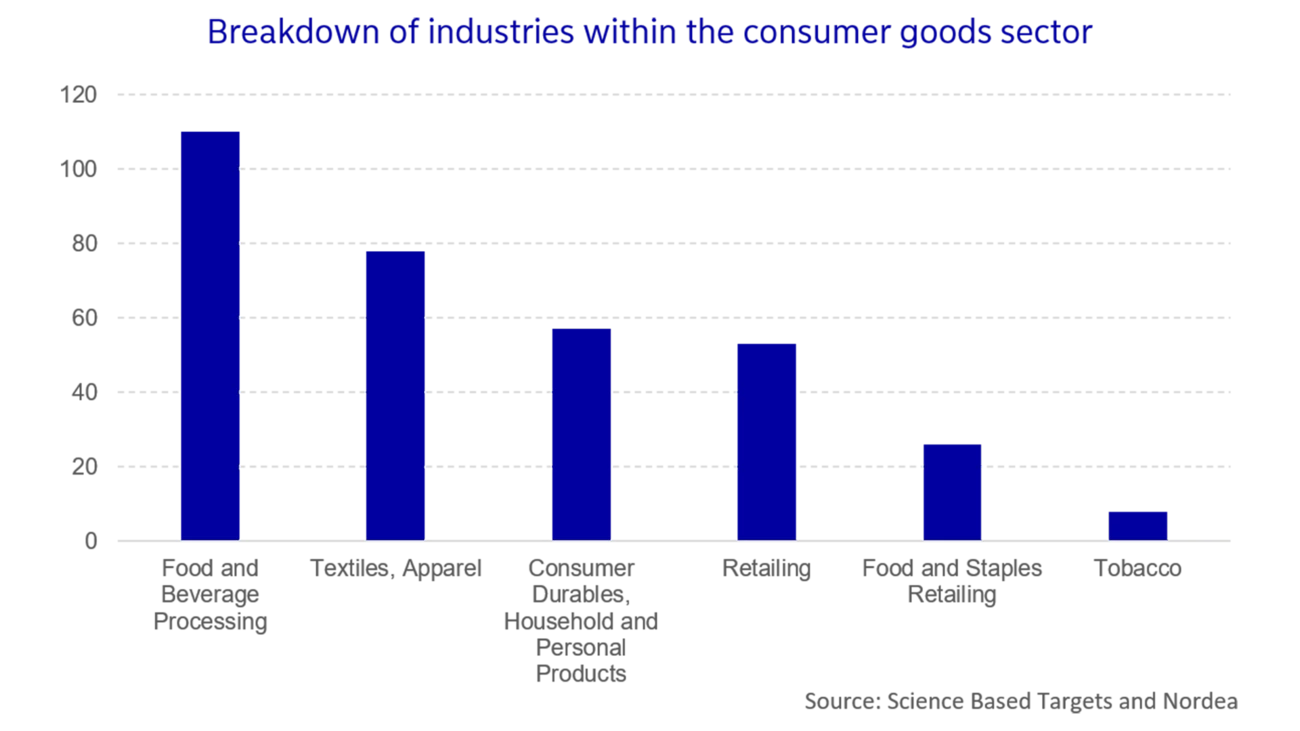

With the ever increasing focus on sustainability, not least represented by the new Biden administration in the US, it is fair to expect that the number of companies of committing to SBTs will increase. However, only a fraction of corporates in the world have climate impact mitigation targets based on science. According to SBTi’s own report, the initiative only covers a minority of private sector emissions, and the distribution of industries is uneven. There is still a large growth and scale-up ambition for the initiative in high-emitting sectors.

Authors:

Johanna Björk, Sustainable Finance Advisory, Nordea

Oskar Hagman, Sustainable Finance Advisory, Nordea

Jacob Michaelsen, Head of Sustainable Finance Advisory, Nordea