- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

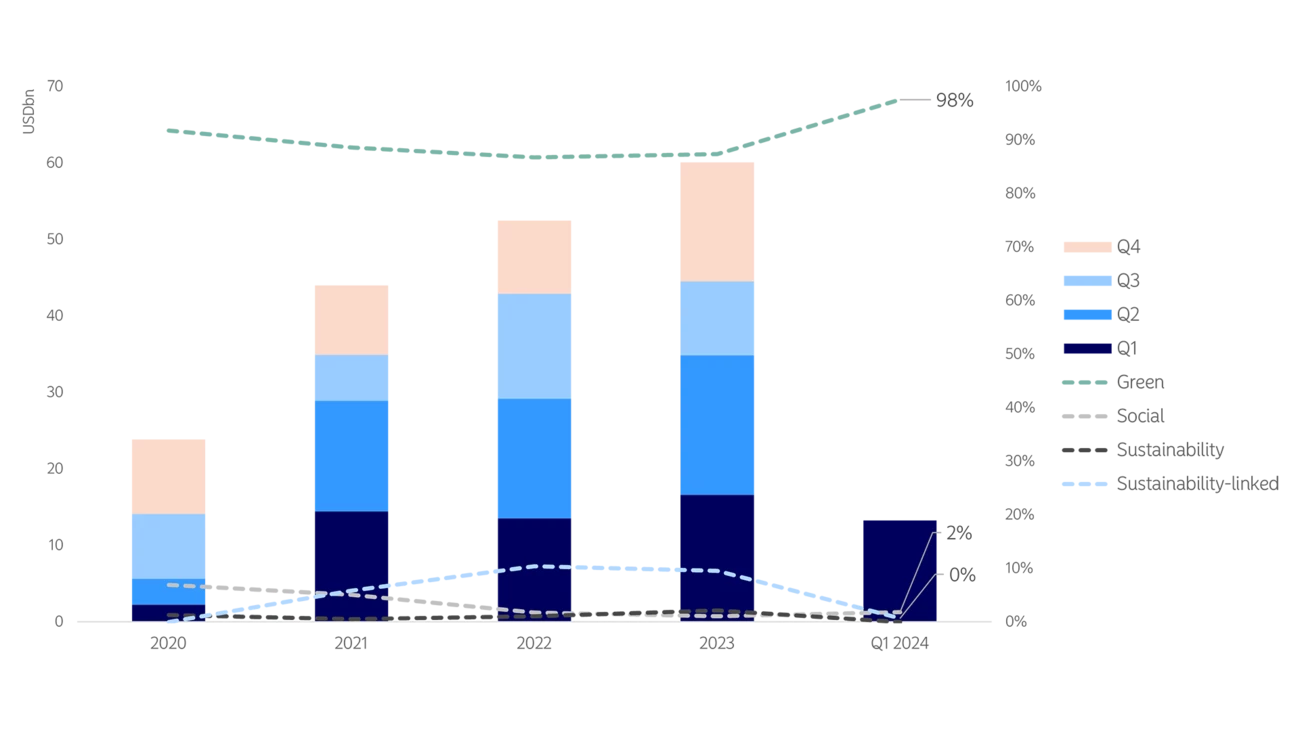

Despite record volumes in 2023, early indicators hint at a slowdown in the growth of the Nordic sustainable bond market. For the first time since 2020, 2024 Q1 volume shows contraction both year-on-year and relative to the previous quarter. While yearly volumes may still recover from this first quarter dip, it signals the end of the Nordic region’s extraordinary performance relative to other markets, as both global and European sustainable bond volumes hold steady over the same period.

The Nordic bond market saw just over USD 13 billion of sustainable issuance in the first quarter of 2024, down approximately 20% on last year’s record Q1 volume and approximately equal to that seen in 2022. Notably, Q1 2024 marks the first time since the onset of the global pandemic in 2020 that first quarter volume has failed to exceed that of the closing quarter from the previous year. Although we expect some natural quarterly variation, and Q4 2023 was indeed an outstanding quarter, the 15% drop in volume from Q4 2023 to Q1 2024 is not the only indicator of a potential end to the Nordics’ consistent growth and outstanding performance relative to other sustainable debt markets.

While for the past three years Q1 supply has exceeded the average quarterly figures the previous year, 2024 Q1 volume fell 12% short of the quarterly average of 2023. It has also been the case that since 2020, Q1 supply has exceeded the quarterly average for the rest of the year. While there are not sufficient datapoints to make accurate predictions about the still evolving sustainable debt market in the Nordics, early indications suggest full-year volume for 2024 that is likely flat on 2023 figures, should past relationships hold.

Early indications suggest full-year volume for 2024 that is likely flat on 2023 figures.

The global and European sustainable bond markets provide further context to the rather gentle start to 2024 seen in the Nordics. In contrast to the year-on-year contraction seen in the Nordic region, Q1 2024 sustainable bond volume was approximately flat year-on-year both globally and across Europe as a whole. Further, Q1 2024 supply was up on that of the previous quarter in the larger markets, by approximately 33% globally and 50% in Europe. With growth rates of the Nordic sustainable debt market having exceeded global figures with some consistency during recent years, this may represent a turning point in past trends.

Almost all of the first quarter sustainable issuance was in a green format, with only two sustainability-linked bonds and no social or sustainability bonds issued in the Nordic region in the first quarter of 2024. While this is somewhat expected, it is worth noting that both sustainability-linked bonds issued during Q1 contained green themes with the KPI structures. With three quarters still remaining in the year, we anticipate that the proportion of SLB issuance will increase through 2024.

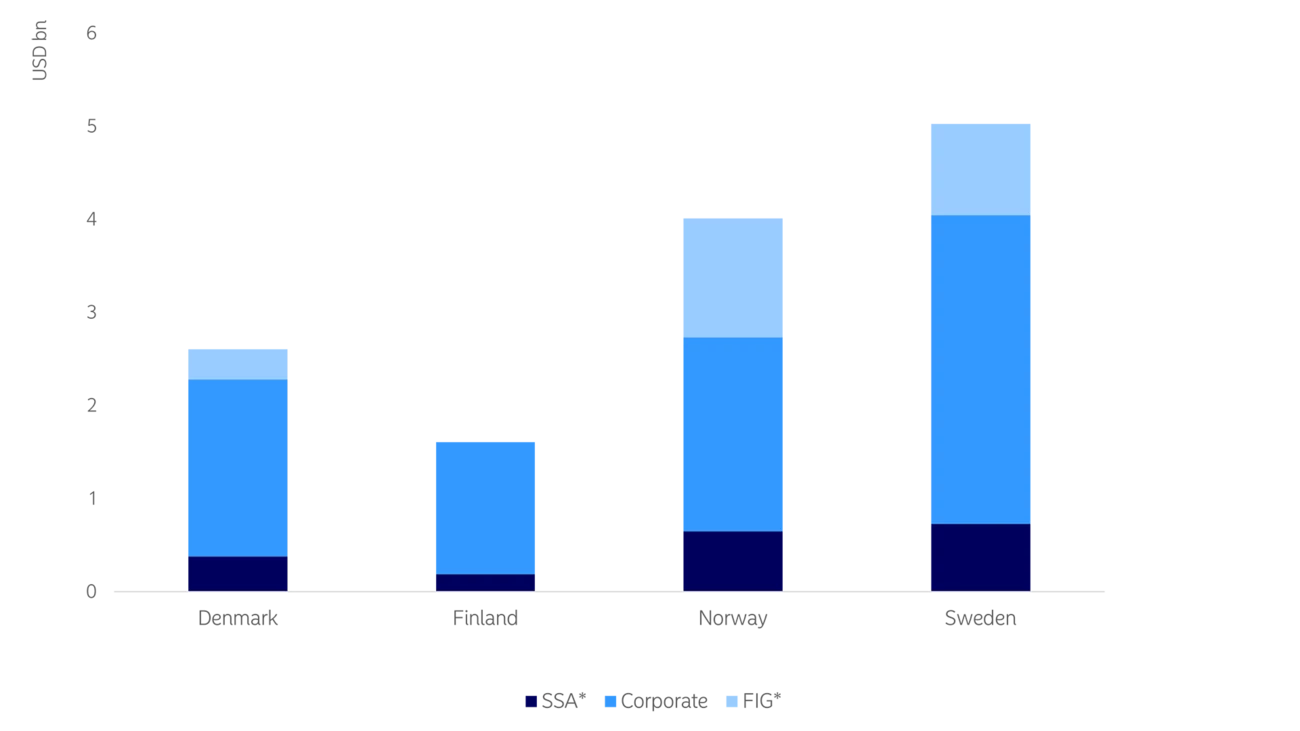

Of approximately USD 13 billion in sustainable bond volume issued across the Nordics during Q1 2024, almost USD 9 billion was in the form of sustainable corporate bonds. This 66% share represents a significant increase of the previous full-year shares of 41% in both 2023 and 2022. This level of supply represents an increase in the average quarterly issuance of sustainable bonds from corporate issuers over the past few years, despite lower total sustainable supply levels in Q1. Sustainable corporate bonds made up a majority of labelled issuance in each country individually, with the greatest proportion of sustainable bonds from corporates seen in Finland (88%) followed by Denmark (73%), Sweden (66%) and Norway (52%).

While FIG issuers still represented a healthy 32% of issued volume in Norway during Q1 2024, the representation of the sector dropped off across the Nordic region throughout the start of 2024. At the end of Q1 FIG issuers represented 20% of Nordic sustainable bond volume, down from 44% in 2023 and 46% in 2022. We expect this share to pick up again throughout the year.

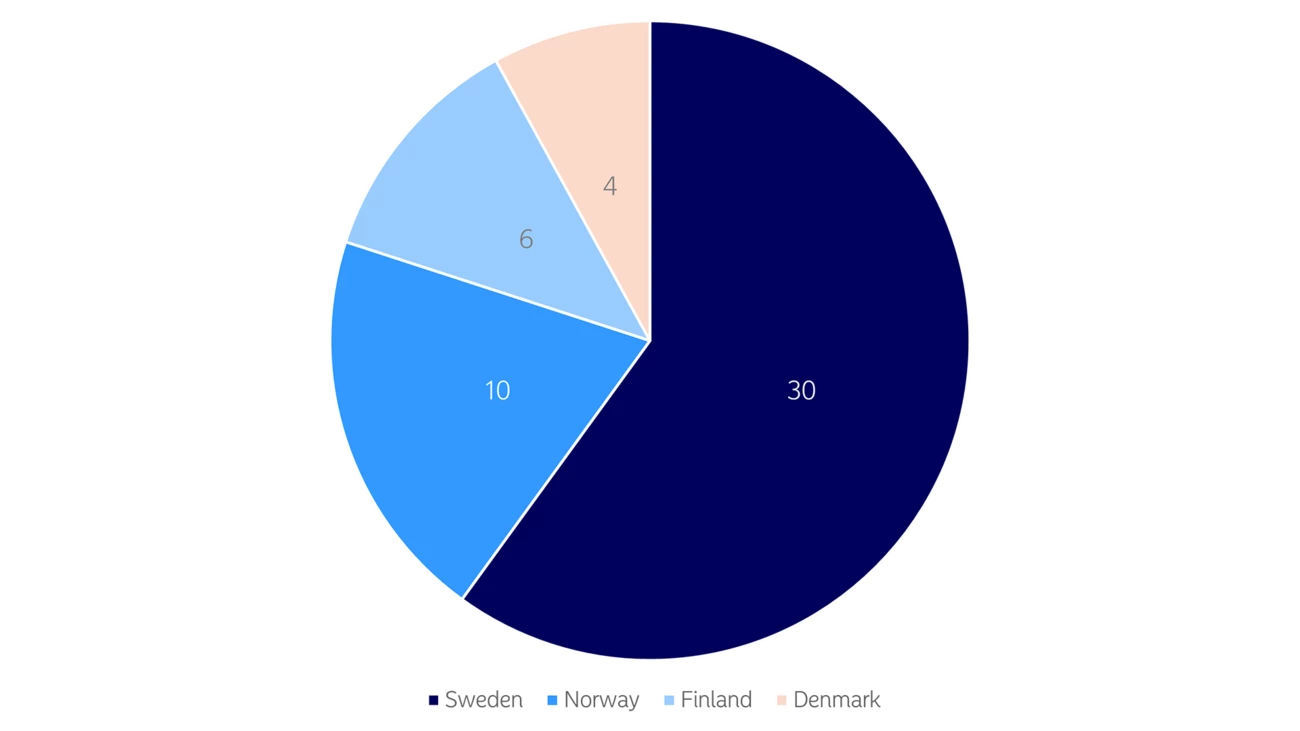

The Nordic region saw 50 unique issuers of sustainable bonds in Q1 2024, with 30 originating from Sweden. Swedish dominance of the Nordic sustainable bond market has primarily been driven by relatively high activity from the real estate sector. With 50% of the list of Swedish issuers from Q1 2023 coming from the real estate sector, it is no surprise that the country tops the region in terms of number of issuers, sustainable bonds issued and total sustainable bond volume issued during the quarter.

Although 60% of Nordic issuers of sustainable bonds were Swedish during Q1 2024, it is worth noting that the country only represented 38% of issued sustainable volume during the quarter, a 4% drop in share vs full year 2023 figures. Norway saw the greatest increase in volume share vs full-year 2023 figures, with 30% of Nordic sustainable bond volume issued in the country. While Denmark lost 3% of Nordic volume share, down to 20% from 23% in full-year 2023, the country had the largest average deal size in Q1 at just over USD equivalent 500 million. Finland had an average deal size of just over USD equivalent 250 million, while Norway’s was just under that same amount. Despite its largest total volume share, the average deal size in Sweden throughout Q1 was just under USD equivalent 100 million.

Stay on top of the latest developments in the fast-moving world of sustainable finance. Receive a curated monthly digest and occasional flash updates with the latest news, insights and data from our Sustainable Finance Advisory team.

Register here

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more