Strong public finances

According to the preliminary statement, last year’s public budget surplus was DKK 87bn, or more than 3% of GDP. This marked the sixth year running with a surplus, and Denmark has for several years been among the countries in the EU with the most solid public finances.

The surplus in the past two years is extraordinarily remarkable, as pension tax receipts in both 2022 and 2023 have been much lower than previously. However, in recent years, government revenues have been strengthened by a large increase in income tax receipts thanks to the strong employment growth.

The large public budget surplus has also affected gross debt, which has fallen steadily in the past ten years. Debt has fallen even though the balance on the government's account with the central bank exceeded DKK 230bn as of the end of March. Net debt has thus fallen even faster, and overall, the public sector has financial net wealth of around DKK 700bn, corresponding to around 20% of GDP.

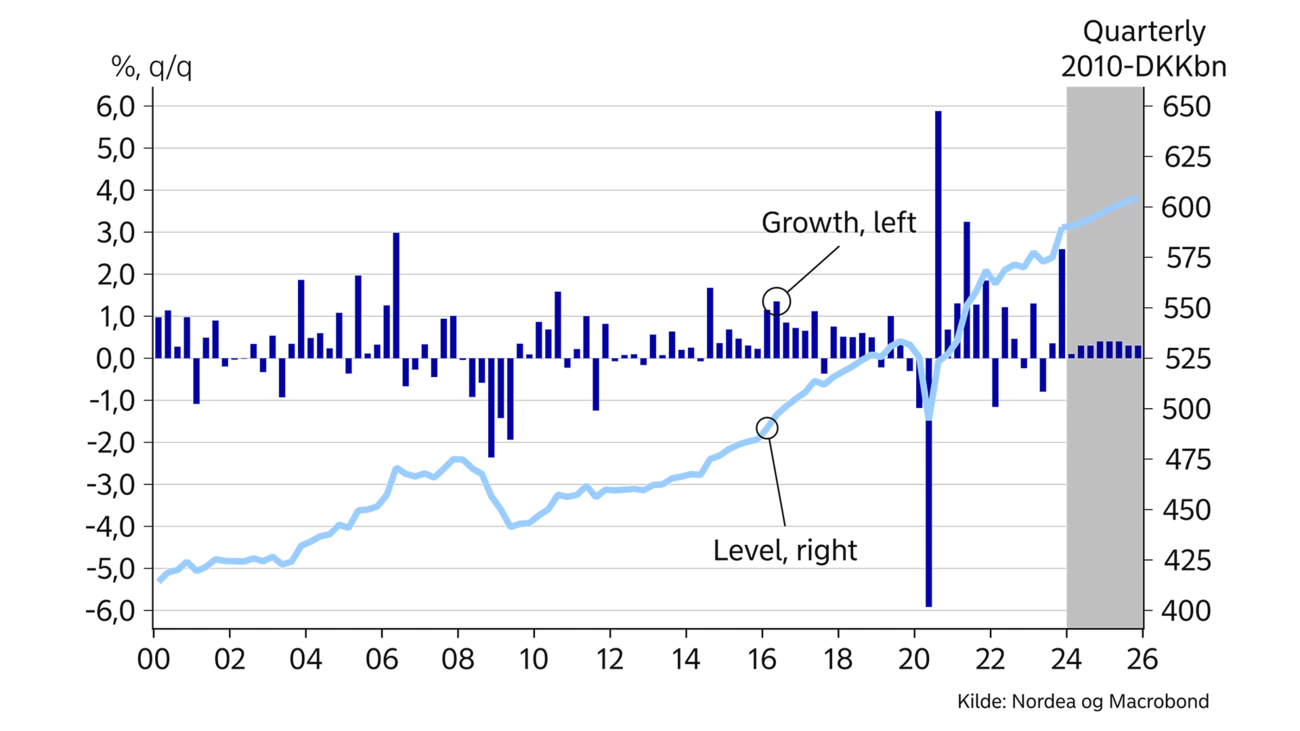

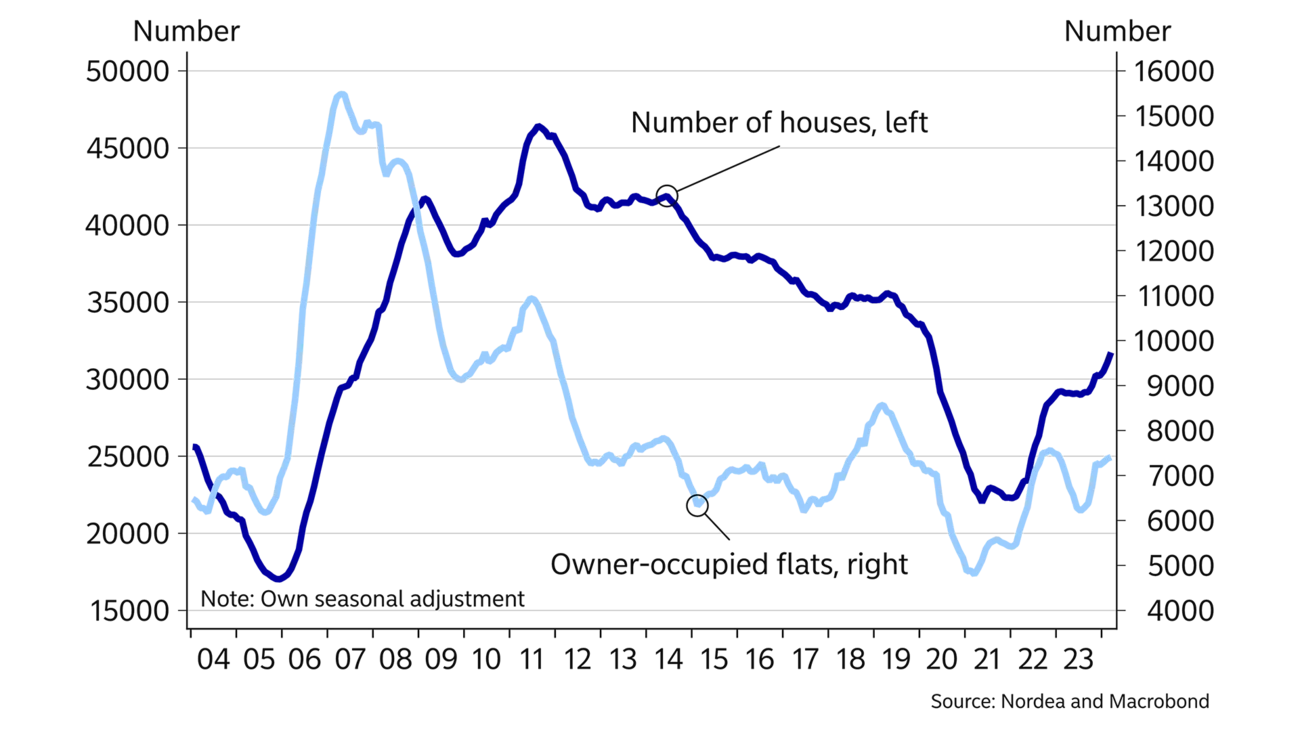

Contrasting housing market trends

Sale prices of single-family and terraced houses rose sharply from mid-2020 and over the next couple of years. Prices were driven by a combination of rising employment, low financing costs and fewer homes on the market. By mid-2022, prices started to fall, due to large rate hikes and higher inflation. Consequently, in 2023, average home prices fell by 2.7%, which was the first year with falling prices in more than a decade.

We expect home prices to rise slightly more than inflation over the coming year, as the effects of higher financing costs will continue to impact the housing market. The market will also need to absorb a larger supply of homes for sale, which is normalising after a few years with exceptionally low activity. On the other hand, the housing market will be supported by the property tax reform, which implies that about eight out of ten homeowners will pay lower housing taxes overall. Moreover, record-high employment and high wage increases will strongly underpin price formation. Accordingly, arrears and forced sales are still at very low levels.

Sales of owner-occupied flats rose sharply during 2023, as new homeowners could in many cases obtain a tax discount before the introduction of the new tax system by year-end 2024. However, this has left a “hole” in the market, and preliminary data indeed suggest that prices of owner-occupied flats have declined slightly since the beginning of the year. For 2024, on average, we expect prices of owner-occupied flats to be largely unchanged compared with last year.

Rate cuts moving closer

We expect the ECB will cut its policy rate for the first time in June followed by two additional cuts towards the end of the year.

The DKK has for some time traded at a very stable level against the EUR, and the Danish central bank has not needed to intervene in the FX market since early 2023. The central bank will most likely track the ECB, so that the Danish policy rate will continue to be 0.4 percentage points lower than in the Euro area. The need for a lower interest rate in Denmark to defend the fixed exchange rate regime is due, among other reasons, to the very large current account surplus.

In such case, the central bank deposit rate will decline to 2.85% by year-end – it is currently 3.60%. Quarterly rate cuts are expected until the end of 2025.

This article first appeared in the Nordea Economic Outlook: Falling into place, published on 24 April 2024. Read more from the latest Nordea Economic Outlook.