Pressure to integrate ESG into corporate financing

All of the panellists emphasised the increased internal and external expectations for companies to advance the ESG agenda, including through their financing decisions.

In the case of LEO Pharma, the impetus for the sustainability-linked loan came from the finance side of the company, according to Director of Global Sustainability France Bourgouin.

“Having that financial incentive, and how investors perceive it, creates a strong platform internally,” she said. However, she said, the pressure is coming from all angles and in different ways, including from the owners, employees and clients.

Ida Krabek, Head of Global Sustainability at Ørsted, said she does not expect companies’ commitment to ESG to decline, despite current global challenges from the energy crisis, inflation and geopolitical tensions. While businesses are under significant pressure in the current economic environment, awareness of the urgency of the climate crisis will not go away, she said.

Eske Hansen, Head of Treasury at DSB, added that while companies will likely be hit in the short term, for example by shortages in the supply of materials or equipment, and may need to readjust their plans, “in the longer run, the ESG movement is here to stay,” particularly given the evolving regulatory landscape.

What about the “S” and the “G”?

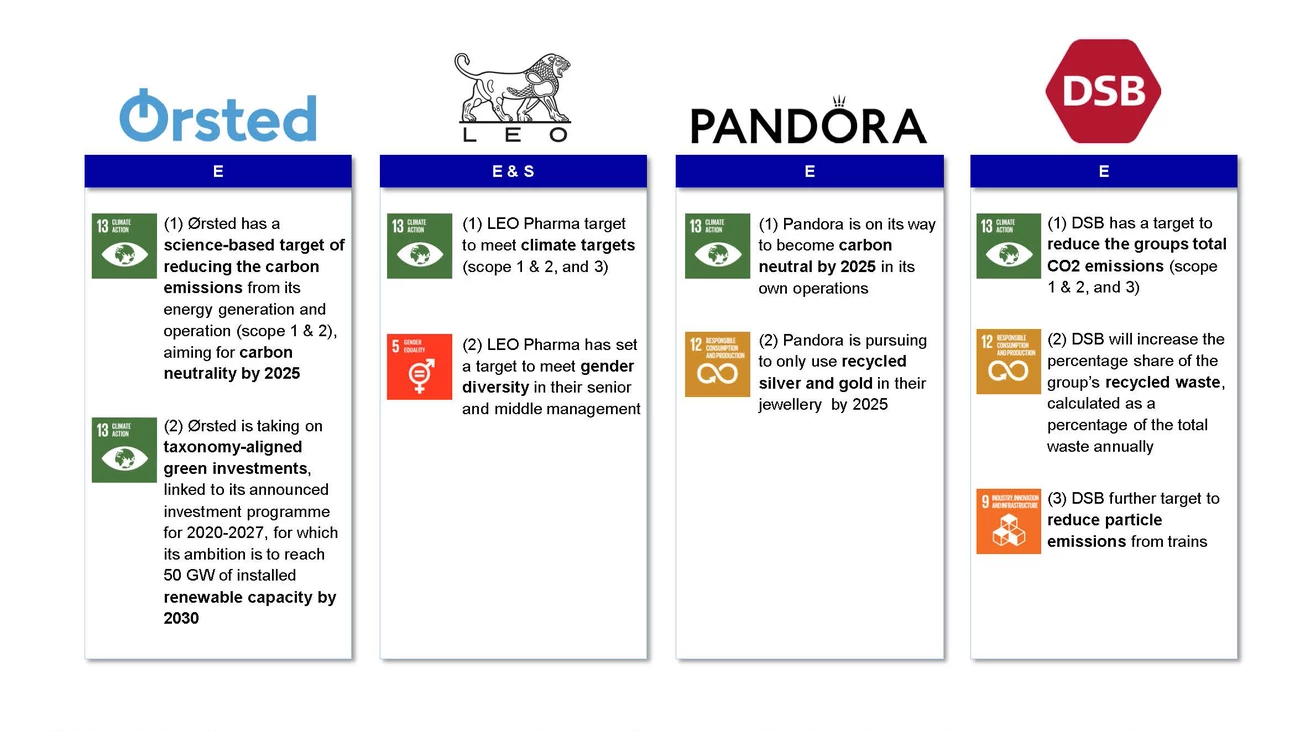

Targets in sustainable finance have historically focused on the E in ESG. Climate change is a global issue, and with the Greenhouse Gas Protocol and environmental reporting standards, the E sphere is more mature than its S and G counterparts.

“There’s increased discussion of the S versus the E. But we need to careful about not pitting the S against the E,” said LEO Pharma’s Bourgouin. “Discussions about climate change clearly highlight the societal impacts of climate change, such as displacement caused by flooding. We’re very aware of the human impact. The E and S are interlinked.”

The question is how to find the right metrics for social impact. In 2021, when refinancing its loan facility, LEO Pharma set not only E targets on carbon reduction but also an S target for increased gender diversity in management.

Kristian Skovfoged, Head of Treasury at ISS and previously Head of Group Treasury at Pandora, noted that while such gender diversity targets may be easier to quantify, broader social initiatives are more difficult. Facility management services company ISS, for example, often employs immigrants, helping them get a foothold in a new society with a job so they can learn the language, advance their qualifications and build a better life. The challenge is finding a social impact target that’s easy to measure and understand, he said.

Immelborn reported that around two-thirds of the targets in the loans Nordea facilitates are focused on the E. The rest tend to focus on the S, with only a small portion on G. He noted that G-related targets are tricky, as borrowers are generally expected to have good governance in place.

“It’s hard to subsidise interest rates just because companies have zero tolerance for bribery or child labour,” he said. “That falls under the license to operate. You need to have the basics in place.”