- Name:

- Carolina Mariotto

- Title:

- Nordea Sustainable Finance Advisory

While sovereigns were latecomers to the sustainable bond market, the share of sovereign issuance is growing. Will the sustainability-linked bond format be able to gain a foothold in the growing sovereign sustainable debt market? Nordea’s Sustainable Finance Advisory team takes a closer look.

Bond issuers categorized together as “Sovereign, Supranational and Agency,” or SSA, issuers have played a central role in the development of sustainable finance and the proliferation of sustainable bonds. Within the SSA category, it is supranational issuers, entities formed by two or more central governments, that have led the way since the development of the sustainable debt market. For example, the World Bank in November 2008 issued the world’s first green bond – an issuance dedicated solely towards financing climate-focused projects.

While supranational agencies were able to find new ways of tapping into debt markets during the early days of sustainable finance, thanks in part to often clearly defined aims and timelines, it took sovereign issuers almost another nine years to utilize the green bond format.

Sovereign issuers were latecomers to the sustainable debt market largely due to challenges related to:

(1) the fungibility requirements of public debt frameworks conflicting with the use-of-proceeds requirements of green, social and sustainability bonds and

(2) the lack of a possible guarantee that new green investments will be made using the bond proceeds (previous vs future allocation).

Few countries were able to explain how their green bonds could align with wider national debt management strategies, particularly at a time when there was less standardisation around what constituted “green.” Countries eventually overcame this barrier when sovereigns and investors were able to align expectations and outcomes by supplementing or refinancing past government expenditures rather than attempting to finance future green projects.

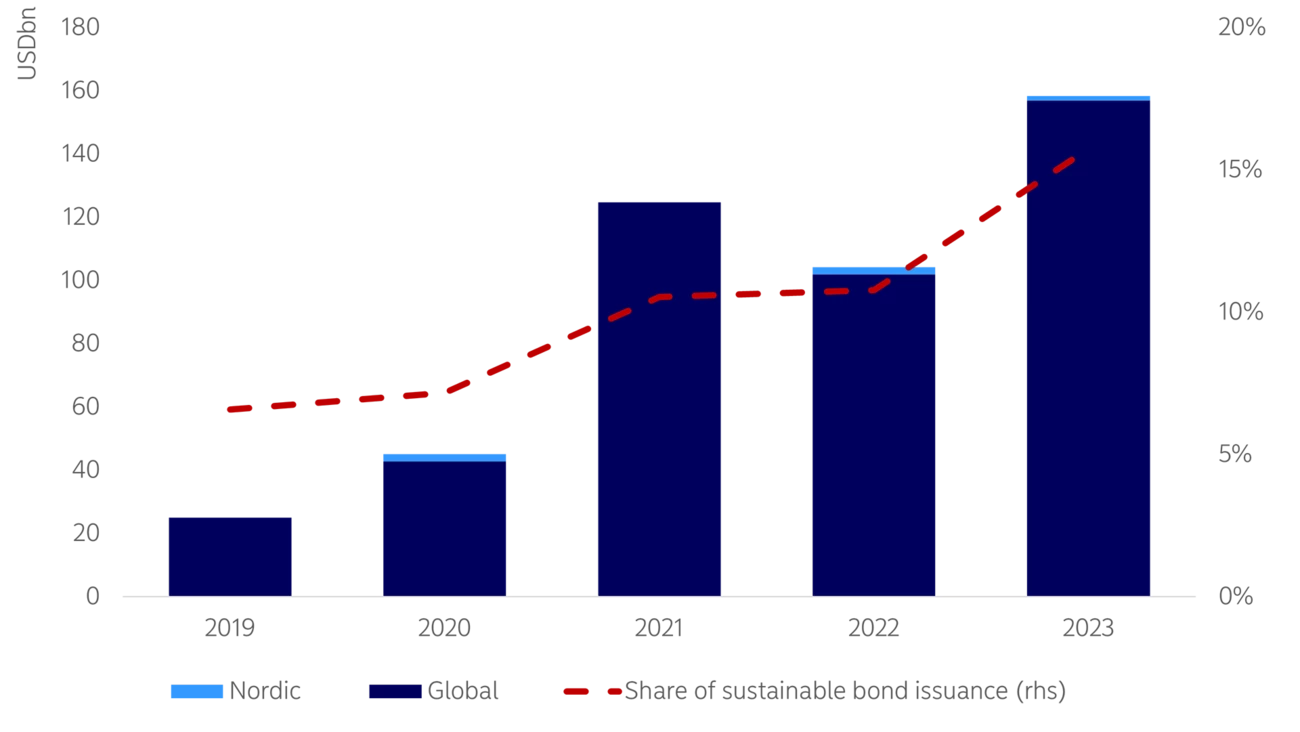

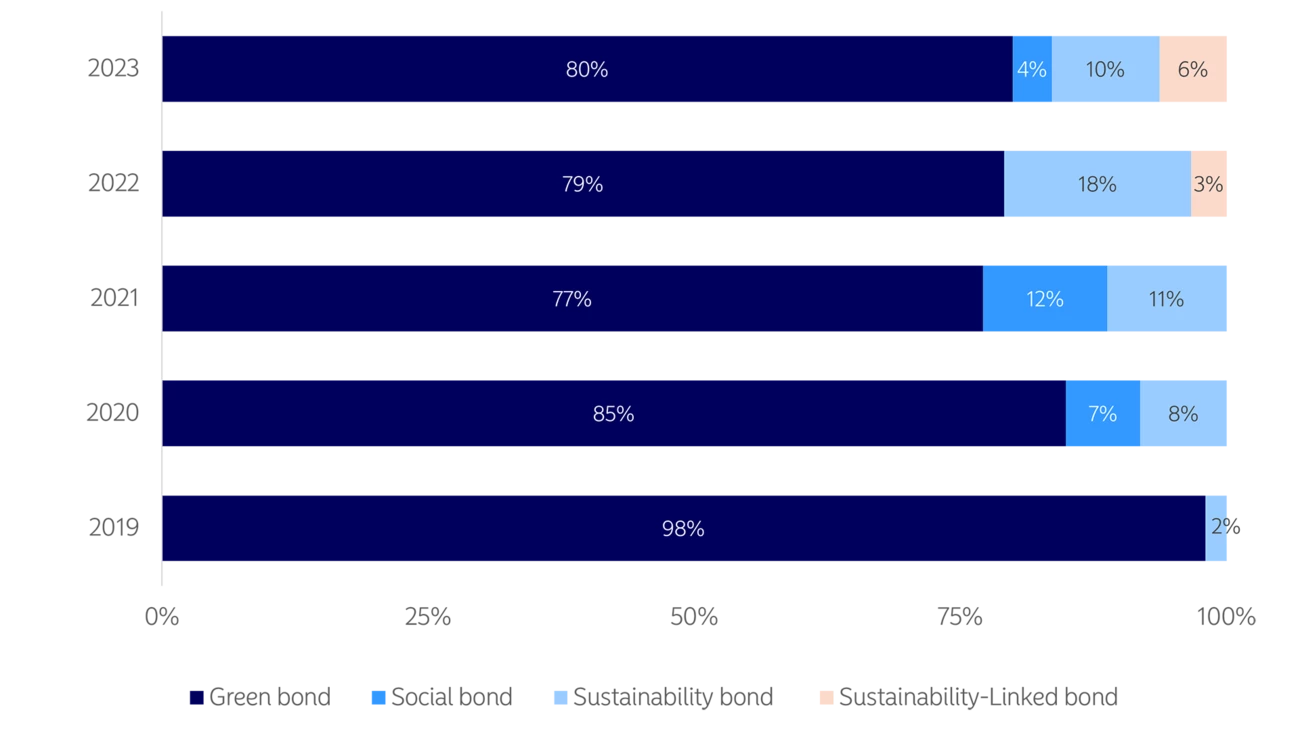

Since the first sovereign green bonds issued by Poland and France in 2017, sustainable sovereign bond issuance has been on the rise in both absolute and relative terms. Sustainable sovereign debt experienced its first large uptick in volume from 2020 into 2021, largely as a result of increased social- and sustainability-labelled issuance in the wake of the global pandemic. While social issuance has since gone down, sovereigns have remained active issuers, with the total issued volumes of green, sustainability and sustainability-linked debt increasing year-on-year. Sovereign issuance made up 16% of global sustainable bond volume issued in 2023, up from an 11% share in 2021 and 2022.

In recent years, sustainability-linked bonds (SLBs) have emerged as a promising option for sovereigns seeking to issue sustainable debt while avoiding some of the challenges that relate to the use-of-proceeds format of green, social or sustainable bond issuance. The attraction of SLBs for sovereign issuers lies in the ability of the format to support a broad expenditure programme, even if projects that are strictly green are not available in sufficient quality, size or predictability. As SLBs utilise pre-defined performance targets that are backed by penalty mechanisms that kick in if targets are not met, they provide flexibility in the use-of-proceeds (unlike green, social or sustainability labelled bonds) and can more closely align with the fungibility requirements of public debt.

While 2022 was the first year that sustainability-linked bonds took a notable share of sovereign issuance, representing 3% of issued sustainable sovereign volume for that year, we see room for the format to take an increasing share now that the first steps have been taken. Investor understanding and appetite from a range of issuer types appears to be growing. Ambitious sovereigns now have working case studies for inspiration, and there is even more formal guidance on sovereign SLB issuance thanks to updates to the International Capital Market Association’s (ICMA) Sustainability-Linked Bond Principles in June 2023.

Although there are only two sovereign issuers of SLBs, Chile and Uruguay, the share of sovereign SLB issuance doubled to 6% of sustainable sovereign bond supply issued in 2023.

In addition to providing more flexibility than use-of-proceeds bond formats, SLBs offer a unique advantage for sovereigns by signalling commitment to high-level climate policy objectives, including the Paris Agreement. Outcome-based instruments such as SLBs could potentially lower hurdles for sovereign issuers as investors increasingly seek exposure to net-zero or Paris-aligned investments. Unlike in a portfolio construction based on backward-looking national emissions, pricing of SLBs could be based on existing policy commitments and climate transition paths, benefiting proactive sovereign issuers and penalising those that ultimately fail to live up to commitments. By mitigating the climate transition risk embodied in sovereign bond exposures in this way, SLBs can both reinforce the needed long-term policy commitment to sustainability and enhance debt-management strategies.

While there is opportunity for SLBs to take a greater share of the growing sovereign sustainable bond market, challenges remain. SLBs had a strong start in the global sustainable bond market more broadly, but their volume share has stagnated between 7%-9% since 2021. In addition to challenges faced by corporate SLB issuers, sovereign SLB issuance has its own unique set of challenges:

Despite the challenges reminiscent of those faced during the early stages of developing the global sustainable debt market, we see opportunity for sovereigns and investors to embrace the sustainability-linked bond format in order to promote and deliver sustainable future economies.

Concretely, the recent issuance of SLBs by Uruguay was broadly seen as a positive step for emerging market debt, indicating promising developments in this realm. Looking ahead, sustainability factors increasingly shape investment portfolios, and more countries are expected to embrace similar instruments in order to demonstrate positive sustainability actions. Investors and sovereigns seeking greater differentiation, measurable impact, and opportunities for engagement or financing – can jointly look towards sovereign SLBs as an additional solution.

Stay on top of the latest developments in the fast-moving world of sustainable finance. Receive a curated monthly digest and occasional flash updates with the latest news, insights and data from our Sustainable Finance Advisory team.

Register here

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more