- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskThe sustainability reporting landscape is rapidly changing. Cutting through the noise, Nordea’s Sustainable Finance Advisory team has conducted a deep dive to highlight what’s essential. Find the key takeaways and market developments summarised below.

Since our October 2021 publication aimed at demystifying sustainability disclosures, there has been significant movement in the field. One development that has become increasingly clear is the emergence of a two-pillar structure focusing on financial and external impacts.

The Global Reporting Initiative (GRI) has long been a proponent of a two-pillar structure in sustainability disclosure, for financial and sustainability reporting, which is now beginning to crystalise. One pillar, targeted more at financial stakeholders, emphasises the financial materiality aspects of sustainability reporting. Represented by organisations such as the Sustainability Accounting Standards Board (SASB) and the International Sustainability Standards Board (ISSB), this approach focuses on defining the impact of sustainability-related issues on the enterprise value of the reporting organisation.

The other pillar lays out sustainability disclosure aimed at communicating both sustainability-related risks and the company’s impact on the environment to a broad stakeholder base. This approach is represented by organisations such as the GRI and the EU’s Non-financial Reporting Directive (NFDR)/Corporate Sustainability Reporting Directive (CSRD) and often goes hand in hand with the concept of double-materiality.

Increasingly, the market moved to distinguish between sustainability reporting in financial reports and broader reporting on the company’s impact, which has contributed to the increased harmonisation across pillars, such as through the foundation of the ISSB.

| Pillar 1 | Pillar 2 |

| Addressing financial considerations through a strengthened financial report, which includes sustainability disclosures in the context of enterprise value. | Concentrating on sustainability reporting focusing on all external impacts a company is having on society and the environment and thus their contributions towards the goal of sustainable development. |

| Financial materiality | Double materiality |

| 1) Sustainability issues affecting enterprise value | 1) Sustainability issues affecting enterprise value

2) Company’s impact on the environment |

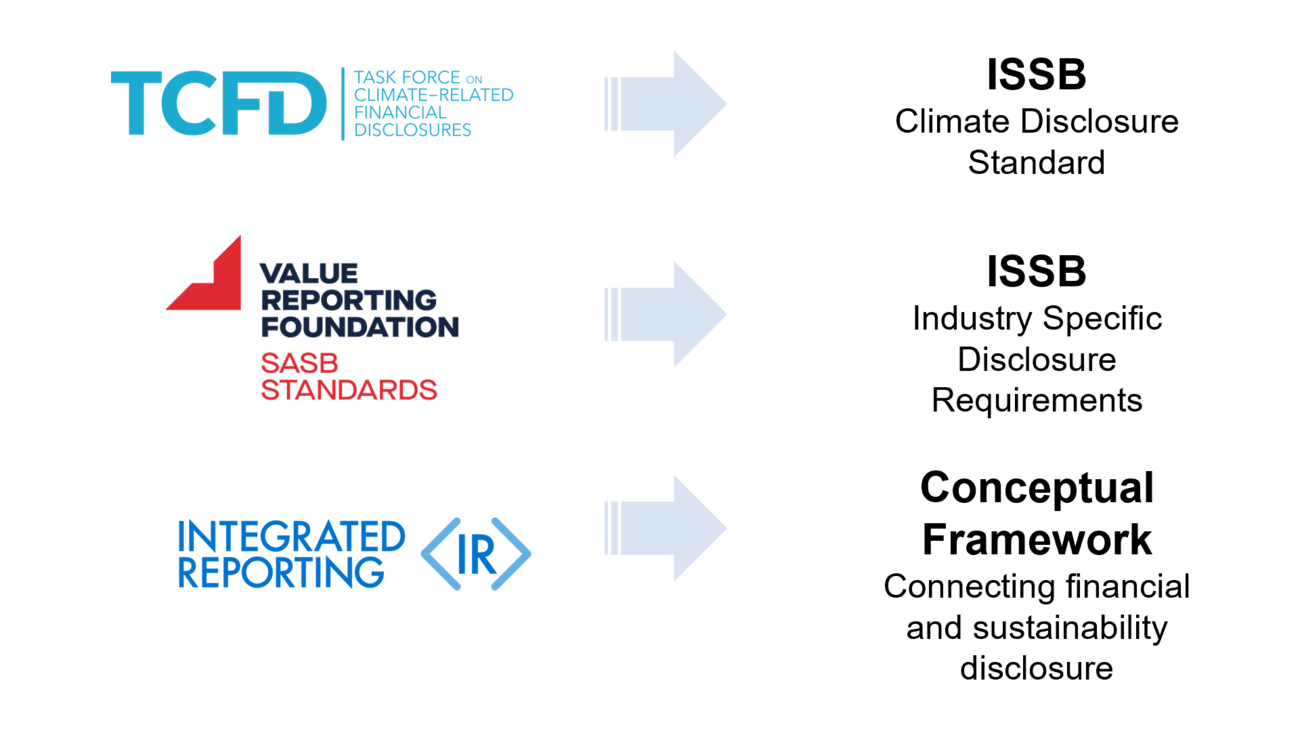

Since our last article, the International Financial Reporting Standards (IFRS) Foundation has announced the launch of the ISSB. Through input from several key players, the standard is set to significantly harmonise sustainability reporting for financial materiality. Later this month, the ISSB is expected to publish its first set of draft standards.

The European Union continues to lead regulatory developments around sustainability disclosures. At the core of the European Union’s disclosure strategy, the European Commission’s CSRD is in the completion phase, with planned application from 1 January 2024 for the financial year 2023. The European Financial Reporting Advisory Group (EFRAG) will be tasked with developing the standards, with the first set of draft standards expected to be published in October 2022.

The application of double materiality features in an increasing number of reporting standards. Frameworks, such as the GRI, can help to prepare for this type of reporting and make the CSRD more accessible even prior to its application.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more