- Name:

- Lea Gamsjäger

- Title:

- Nordea Sustainable Finance Advisory

Den här sidan finns tyvärr inte på svenska.

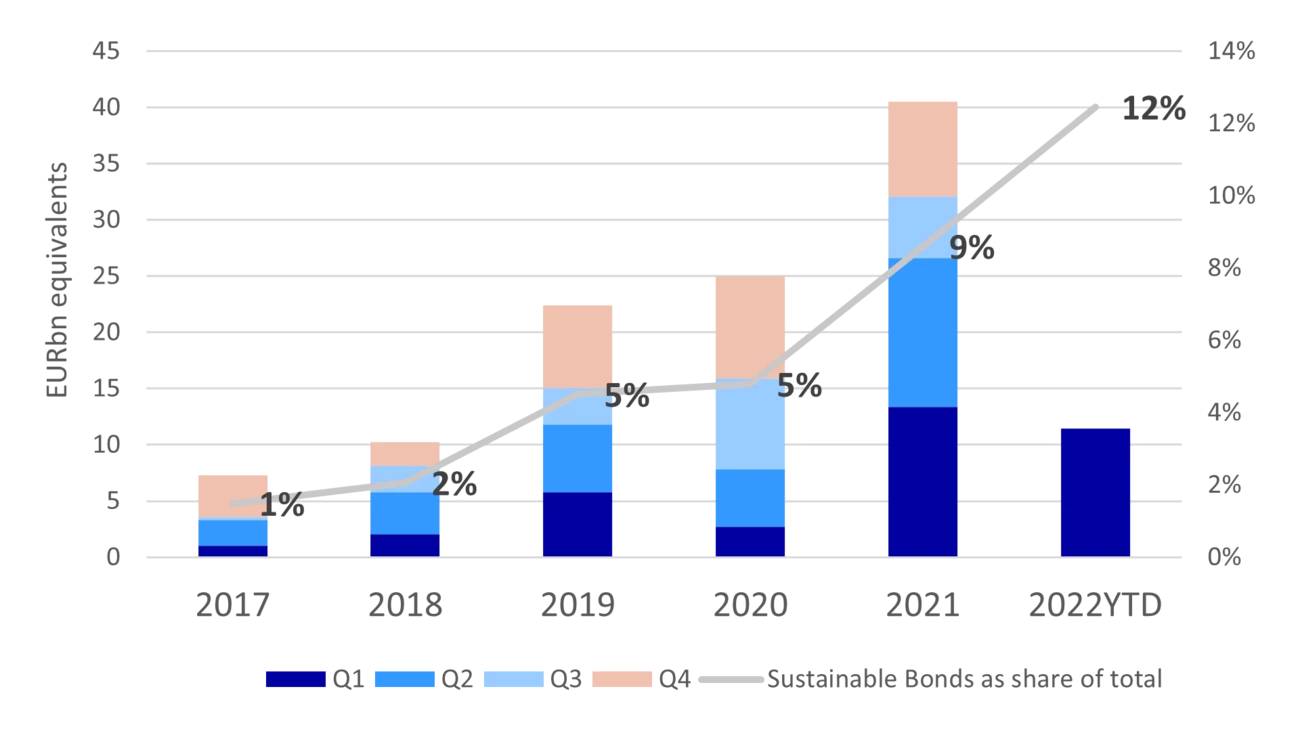

Stanna kvar på sidan | Gå till en relaterad sida på svenskaThe majority of market focus during Q1 was dedicated to the war in Ukraine and efforts to limit its repercussions in the world and the markets. Nevertheless, sustainable debt continues to grow, and the first quarter showed that it can be a source of stability in a turbulent market environment.

2021 was marked by exceptional growth of the sustainable bond market, highly exceeding expectations. Expectations were adjusted during the first quarter of 2022 when markets were slow to get up to speed due to reduced pandemic bond issuances, continued worries about Covid-19 and subsequent geopolitical instability caused by Russia’s invasion of Ukraine.

Nevertheless, the circumstances showed that sustainable bonds have generally fared better in the very volatile market environment. Investors showed a preference for sustainable debt over its traditional counterparts, translating into a growth of the share of sustainable bonds issued from 9% to 12% compared to the previous year.

Source: Bloomberg and Nordea

Source: Bloomberg and Nordea

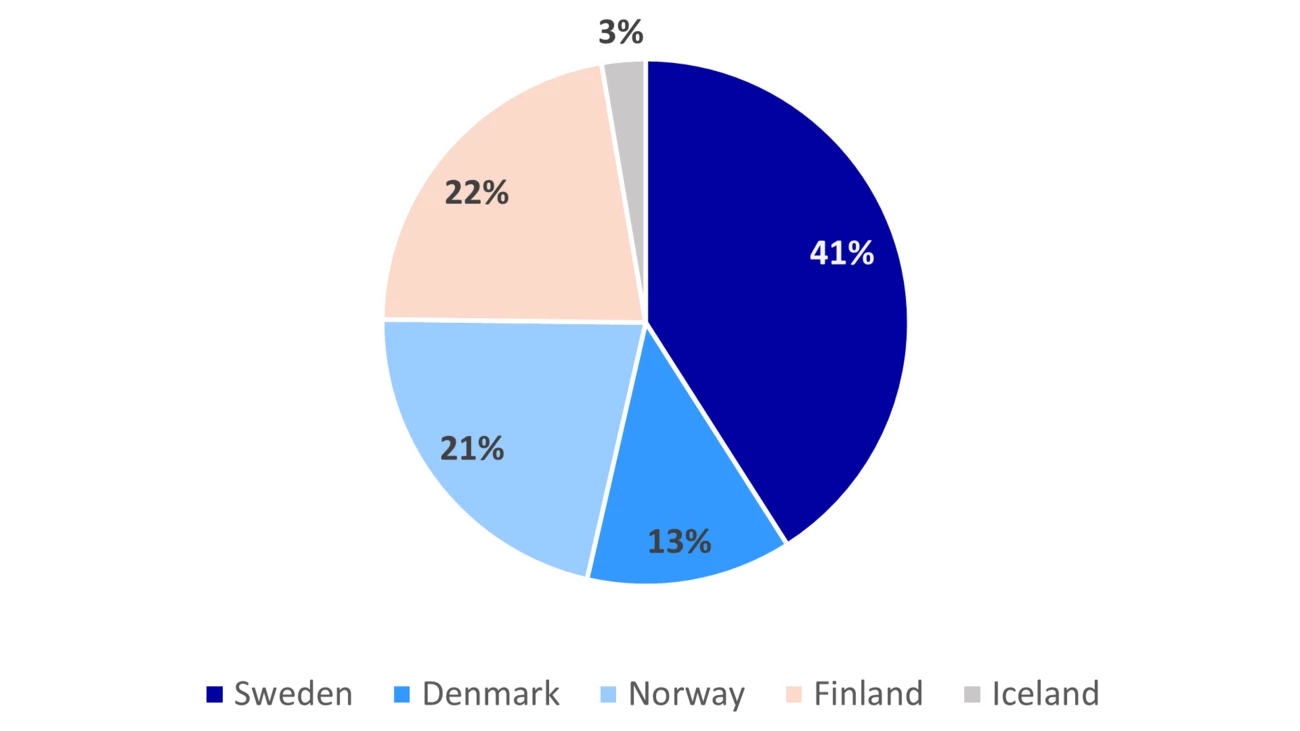

From a geographical perspective, European issuers still constitute the largest share globally with around half of the total market share. In the Nordics, Sweden continued to be the most active market, followed by Denmark and Finland with around a fifth of the market share in 2022.

Source: Bloomberg and Nordea

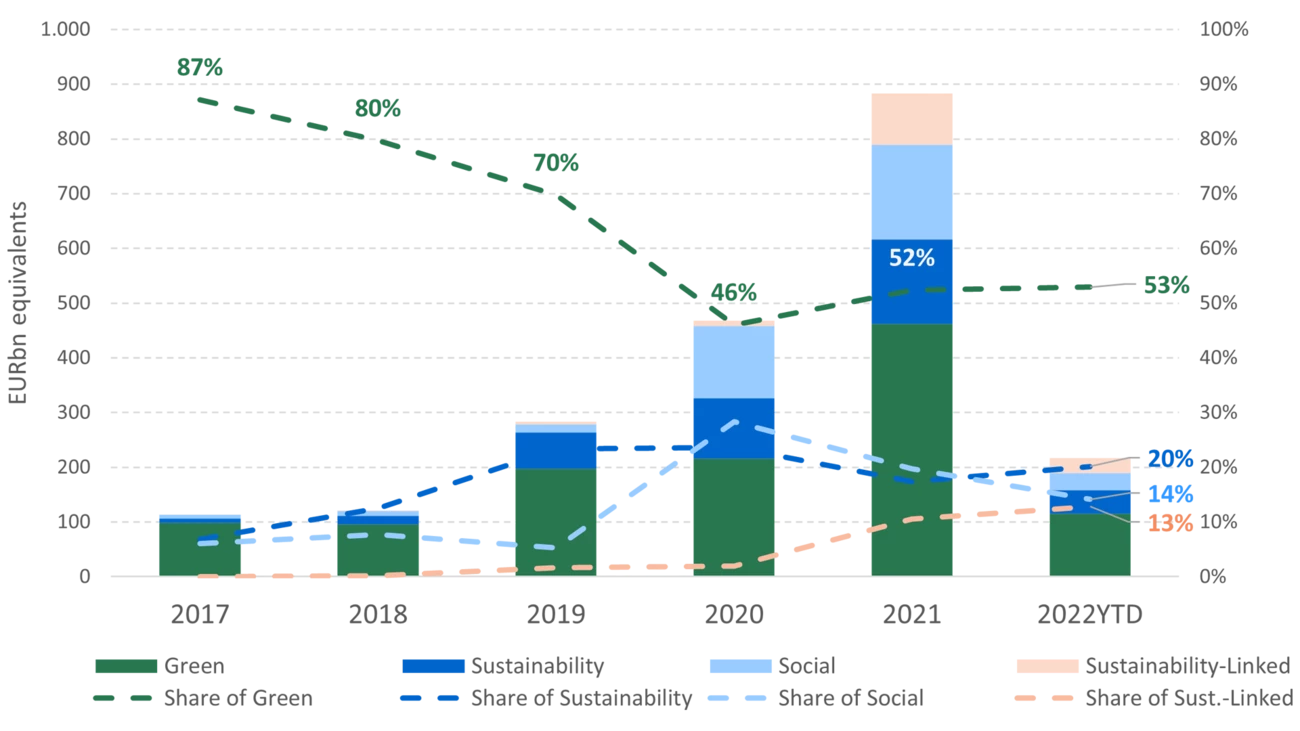

Since 2020 we have seen an increasing diversification of formats in the market. While the pandemic has led to an enormous growth in social bonds issued, primarily by sovereign issuers, 2021 has overall shown a decline in social and sustainability formats as compared to the previous years.

So far in 2022, we have seen renewed interest in sustainability bonds combining green and social assets, this time by corporate issuers, although supply remains considerably dampened when compared to Q1 2021.

In January 2022, we also saw the landmark issuance of the first ever sovereign green bond by the Kingdom of Denmark. The inaugural DKK 5 billion issuance with a 10-year maturity, focused on renewable energy and the transition to green transportation. It also proved to be a case study for the alignment of a sovereign green bond framework with the EU Taxonomy.

Source: Bloomberg and Nordea

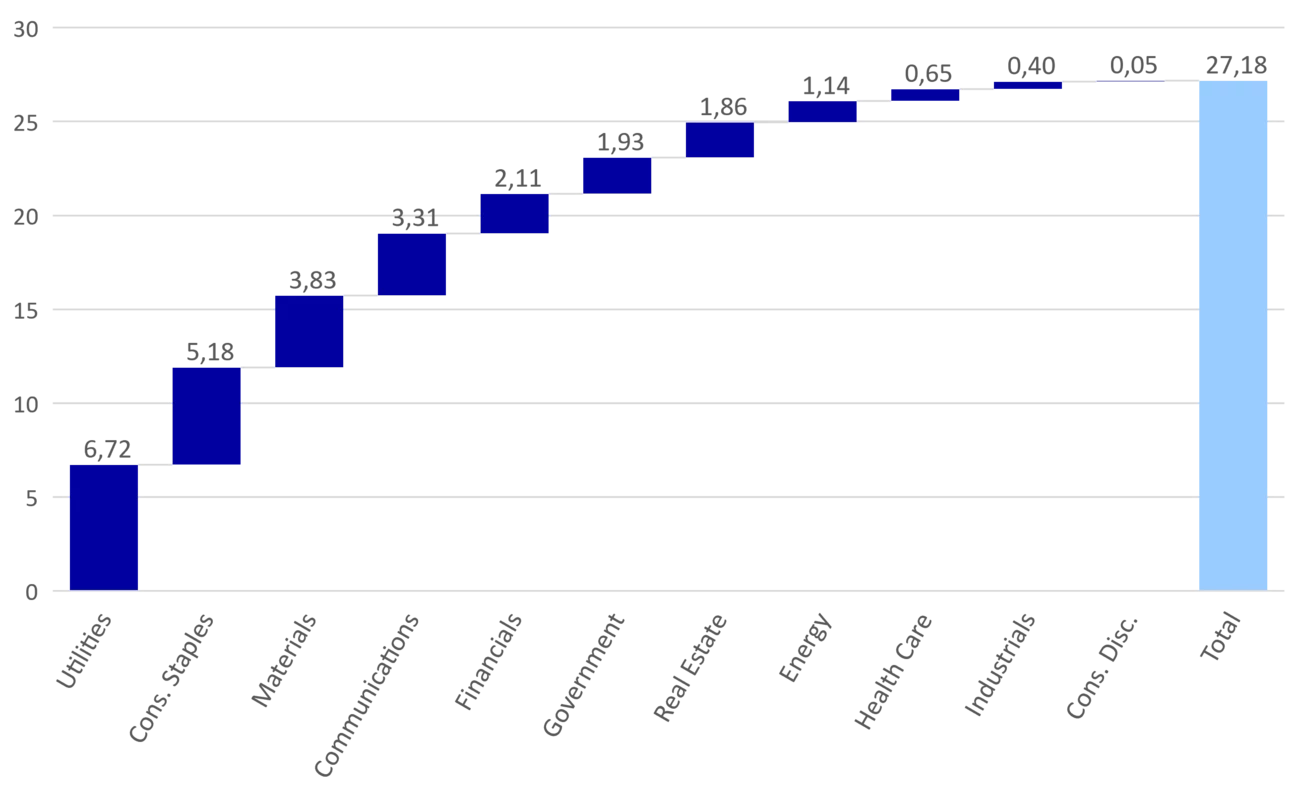

With a 136% increase compared to Q1 2021, global sustainability-linked bonds show by far the sharpest growth of all formats. This trend is, among other factors, driven by new sectors access to sustainable debt markets. While utilities remain the primary sector to issue debt linked to sustainability-targets, in the Nordics we have seen several debuts of the format for new sectors. With Atrium Ljungberg we saw the first sustainability-linked bond of a real estate issuer, with targets surrounding climate impact of construction, improvements in a social sustainability index and supplier reviews. With Helsingborg, we saw the first municipality in the Nordics to issue sustainability-linked debt with a focus on the reduction of greenhouse gas emissions.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more