76%

Labour force participation rate in H1 2025

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskTorbjörn Isaksson

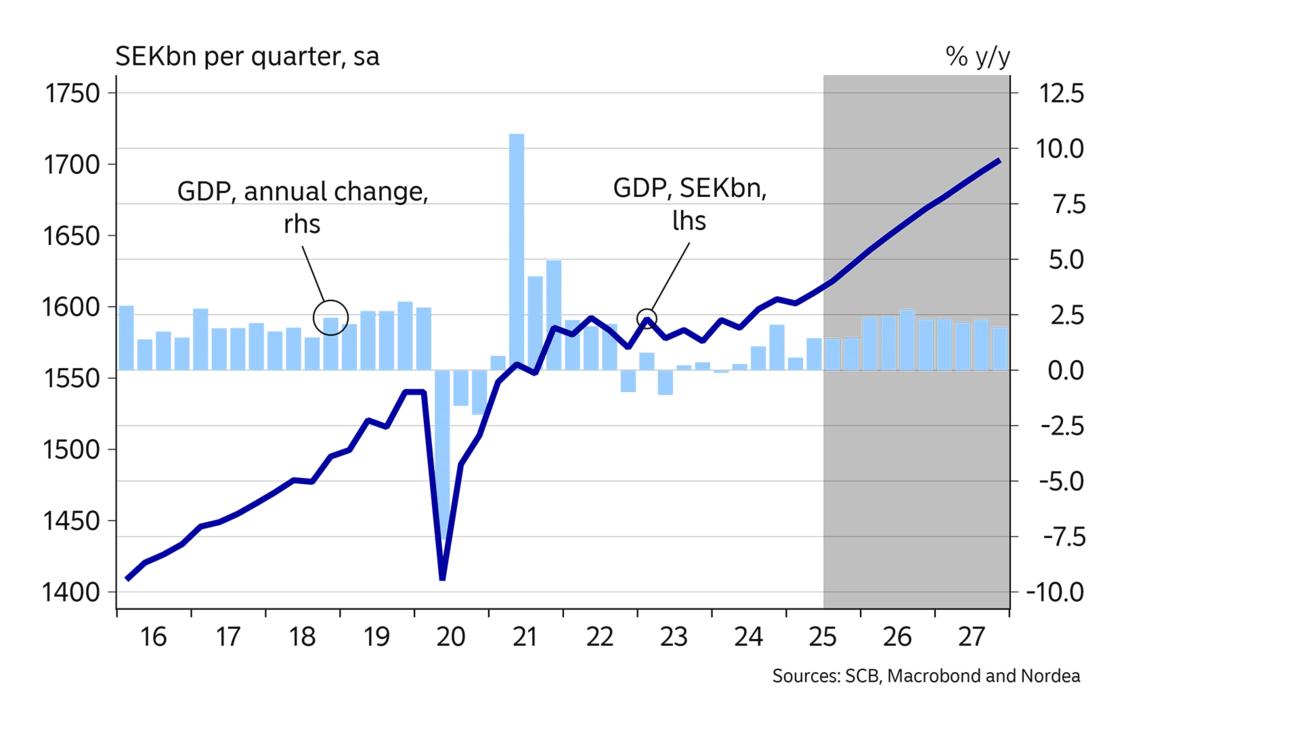

The turbulent global environment has impacted the Swedish economy, leading to slower growth and a subdued start to the year. However, households are becoming more confident, and we expect spending to pick up going forward. The export industry has been resilient and is benefitting from global trade frameworks falling into place. Inflation should decline next year and align with the inflation target. Stronger economic conditions reduce the need for monetary policy stimulus.

The Swedish economic recovery faltered in early 2025. GDP growth slowed and labour market conditions became more uncertain.

According to our forecast, the recovery should regain momentum soon. Household income is increasing rapidly, fiscal policy is expansionary and uncertainty is easing, at least the uncertainty linked to the ongoing trade conflict. Albeit with some delay, this should also benefit the labour market, which we expect to improve next year. The recovery will likely be gradual, but sufficient to limit the need for further monetary policy stimulus from the Riksbank.

Stagnant population growth lowers the long-term growth rate of the Swedish economy and will affect GDP growth in the coming years.

76%

Labour force participation rate in H1 2025

18%

Services exports as a share of GDP in 2024

kr 10bn

Increase in household debt per month so far in 2025

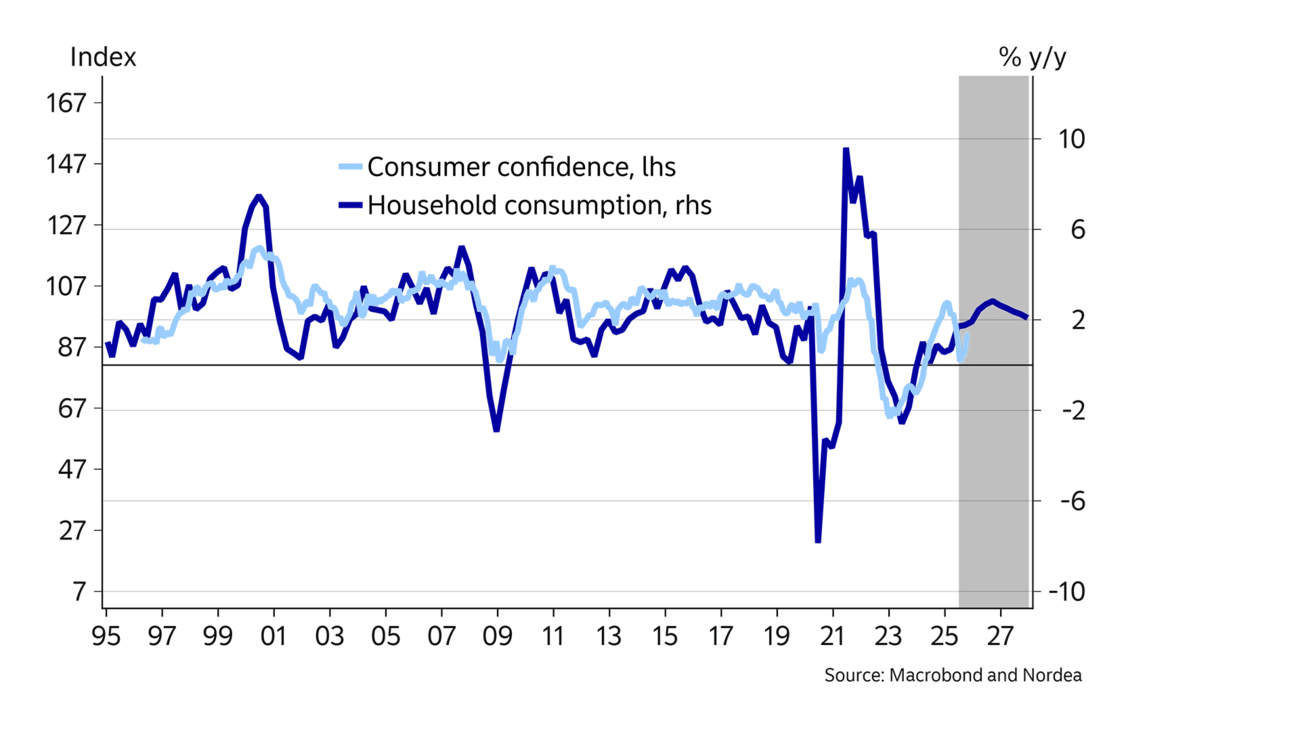

Earlier, the outlook had seemed so promising. During 2024, household sentiment normalised and GDP growth accelerated. Then, things came to a halt. Early in the year, confidence fell, anxious households tightened their purse strings and consumption growth slowed.

Households grew increasingly concerned for a variety of reasons. Above all, international turbulence heightened anxiety, particularly the drastic shifts in global trade policy. Meanwhile, the security situation in Ukraine and the Middle East continued to be a source of concern. Many households have also likely been worried that a longtime close ally, the US, no longer seems as close to Europe as before.

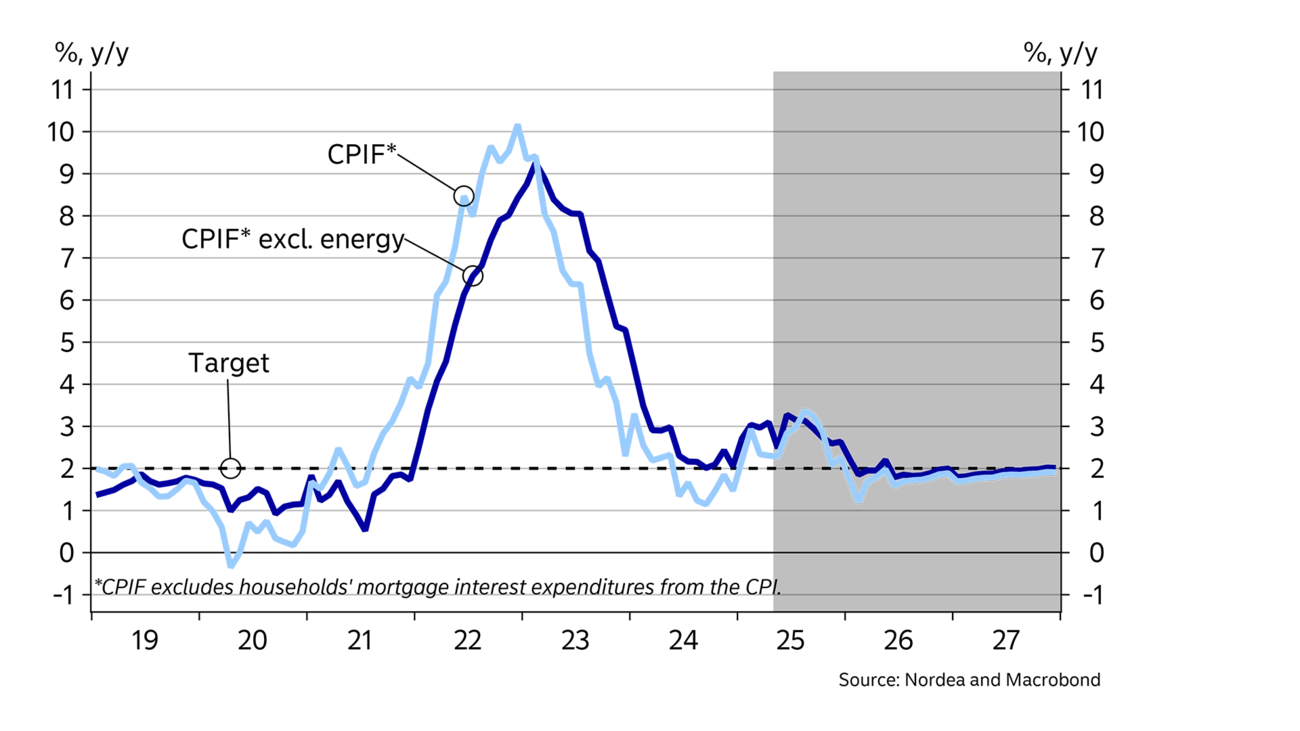

High inflation also likely took a toll on consumer confidence. Households dislike high inflation because it creates uncertainty and erodes purchasing power. CPIF inflation excluding energy averaged 3.0% during the first seven months of the year. In particular, food prices have risen rapidly, at an average annual rate of nearly 5%.

As described below, we expect food prices to stabilise and project that overall inflation will decline after the turn of the year, which should boost confidence. Uncertainties related to the trade wars have begun to ease, but the security situation remains a concern. Households are already becoming more confident, and consumer sentiment is likely to continue normalising.

Households’ improved financial situation should lead to increased consumption. Buffer savings have been high in recent years. Despite some dark clouds, we do not expect savings to increase significantly. At the same time, household income is increasing at an unusually rapid pace, by around 5% in nominal terms and by about 2.5% adjusted for inflation.

| 2024 | 2025E | 2026E | 2027E | |

|---|---|---|---|---|

| Real GDP (calendar adjusted), % y/y | 0.8 | 1.2 | 2.5 | 2.2 |

| Underlying prices (CPIF), % y/y | 1.9 | 2.6 | 1.7 | 1.8 |

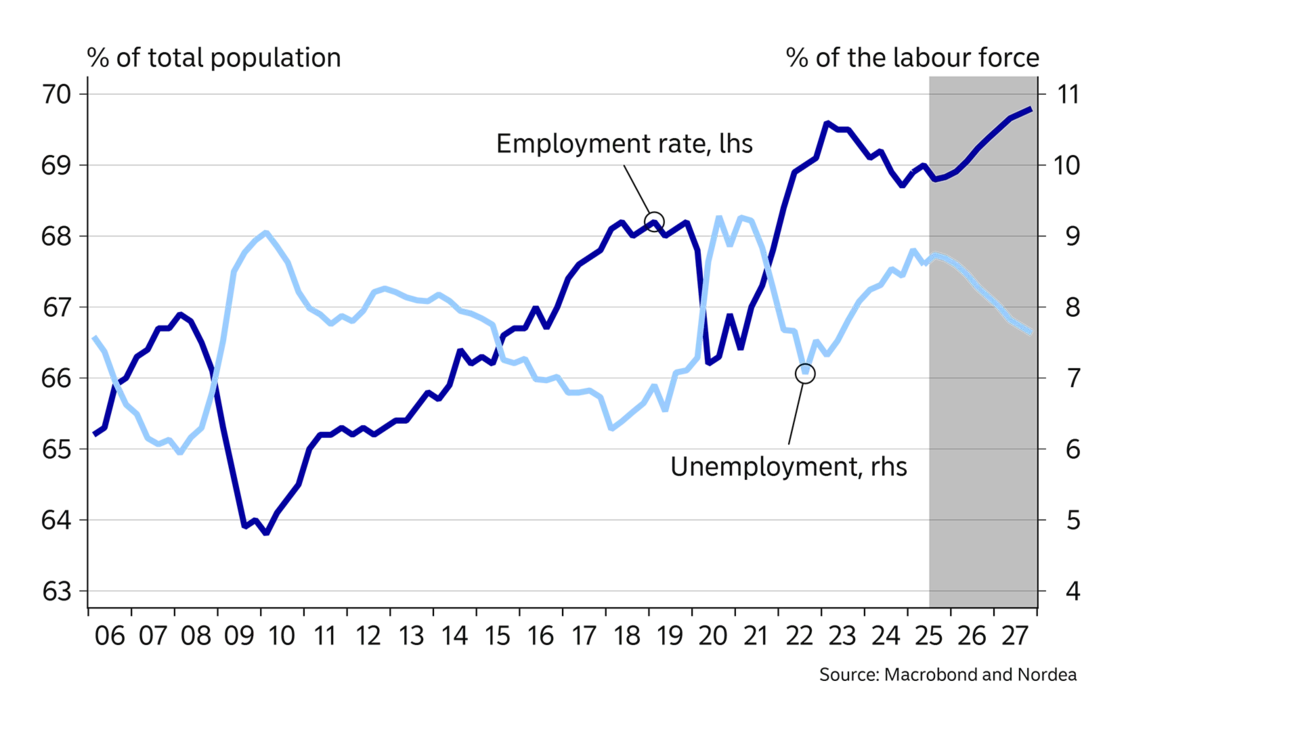

| Unemployment rate (LFS), % | 8.4 | 8.7 | 8.4 | 7.8 |

| Current account balance, % of GDP | 5.4 | 5.1 | 5.4 | 5.7 |

| General gov. budget balance, % of GDP | -1.6 | -1.0 | -1.5 | -1.0 |

| General gov. gross debt, % of GDP | 34.0 | 34.1 | 34.4 | 34.8 |

| Monetary policy rate (end of period) | 2.50 | 2.00 | 2.00 | 2.50 |

| EUR/SEK (end of period) | 11.48 | 10.90 | 10.60 | 10.50 |

There may also be pent-up demand for consumption after several years of stagnation. We do not expect a spending spree, but rather a gradual recovery in household consumption. For the same reasons, we expect a gradual recovery in housing prices after the dip earlier this year. From today’s level, housing prices will likely rise by about 5% throughout 2026.

Lower taxes are one of the reasons why household income is set to improve this year. More government resources will also be allocated to defence, regions and infrastructure. In total, discretionary fiscal policy corresponds to about 1% of GDP for 2025. We expect this to remain at least at the same level in the election year of 2026. The budget deficit amounts to about 1.0% this year relative to GDP for 2025 and to around 1.5% for 2026.

Public debt (Maastricht) is rising, but still close to the debt anchor of 35% of GDP during the forecast period. This is low in a historical perspective and significantly lower than in many other countries. Confidence in public finances thus remains intact.

It’s a paradox that households seem to have reacted the most to the global uncertainty, while the export industry has been resilient.

It is quite a paradox that households have reacted the most to the global uncertainty. The export industry, by contrast, which is most vulnerable to the trade conflict, has proven surprisingly resilient, and goods exports are increasing this year.

The trade conflict has caused significant fluctuations in global trade in our part of the world. It rose sharply early in the year, but subsequently saw an almost equally steep decline. The industrial sector may have been supported by orders placed in advance of the introduction of tariffs. Consequently, global demand could decline further once this demand has been met. However, the latest indicators for the Swedish industry have improved, indicating ongoing resilience and a continued upturn in exports in the near term.

We expect exports to improve further in the long term. The US tariff of 15% on EU goods was higher than expected, but more importantly, companies now know what they need to adapt to. This makes investment and hiring decisions easier. In addition, fiscal policy is expansionary in Sweden and the rest of Europe, including increased defence spending. The defence industry accounts for just under 1% of Sweden’s GDP, but investments also spill over into other parts of the industry.

Overall, we expect the gradual increase in goods exports to continue in the coming year and to accelerate somewhat during the latter part of the forecast period as global demand picks up. The increasingly important export of services is also affected by the turbulent global environment, but continues to be supported by an underlying strong growth trend. As in recent years, services exports are set to outperform growth in goods exports.

Economic growth affects the labour market with some degree of a lag. The budding recovery of GDP growth last year contributed to the employment rate (the number of employed persons relative to the working-age population) rising to 69.0% in H1 2025. This is significantly higher than the pre-pandemic years, but lower than the record 69.6% in Q1 2023. The labour force also grew, and unemployment fell only slightly, to 8.6% in Q2, which is still a high level.

Owing to this year’s slowdown in GDP growth, the labour market recovery is hanging by a thread in the near term. Registered unemployment at the Public Employment Service is rising again after showing signs of declining earlier in the year. Economic uncertainty is affecting companies’ hiring plans. More companies now plan workforce reductions rather than expansions, which is also reflected in fewer newly-reported vacancies. Labour shortages are below normal levels, and many companies have the workforces they need.

Overall, there are currently available resources in the labour market and we expect conditions to remain subdued for the rest of 2025. As GDP growth gradually improves in the period ahead, we expect the demand for labour to rise again. Consequently, unemployment should fall next year and in 2027, from the current level of around 8.5% to about 7.8% by year-end 2027.

With the expected recovery in GDP growth, demand for labour will increase again.

We forecast that wage growth will decline from 4% last year to about 3.5% this year and next. Despite the slowdown, wage growth remains above pre-pandemic levels. This may contribute to higher inflation than before the pandemic, when price increases were generally lower than the inflation target. However, the link between wages and inflation is not straightforward, and history shows that inflation drives wages rather than the other way around. In any case, wage growth does not pose a threat to the inflation target, in our view.

Instead, we turn our attention to the global environment. Global inflation has lifted Swedish inflation this year – primarily through rising food prices, but prices of other goods also increased early this year. Food prices have risen primarily because specific items have been hit by supply disruptions. Meanwhile, price increases for non-food products likely stem from changing freight costs and pricing pressures caused by trade flow disruptions related to the ongoing trade conflict.

There are still supply shocks affecting some food items in the near term. But we expect food prices to stabilise early next year. Indicators for other goods show mixed signals, but with a more stable global trade environment and a steady SEK exchange rate, prices of other goods should also stabilise. In addition, inflation in the important services sector is modest. During the summer of 2025, so-called basket effects lifted inflation. These are also expected to subside towards year-end. Thus, there is much to suggest that inflation will fall from the current level of about 3% to close to the 2% target at the beginning of next year.

We emphasise that the inflation forecast implies favourable development for most goods and services, without any major disruptions. Over the past year, there have been several surprises, though, and some uncertainty about inflation remains.

One wild card is the exchange rate. We expect the European Central Bank to leave its policy rate unchanged this year and next. If the Riksbank unexpectedly cuts interest rates further, Swedish interest rates will become relatively low, which could reduce the demand for the SEK and weaken the exchange rate. This could, in turn, raise import prices and slow the expected decline in inflation.

To ensure that inflation falls, the Riksbank is keeping the policy rate unchanged in the near term, despite the fragile situation in the labour market. Further ahead, economic conditions should improve, reducing the need for stimulus. A stable monetary policy will help the SEK gradually strengthen against both the EUR and the USD over the next year.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more