- Name:

- Torbjörn Isaksson

- Title:

- Nordea Chief Analyst

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskThe Swedish economy is currently stronger than it has been for many years. However, the economy is entering a phase of subdued growth as high inflation and rapid rate hikes are slowing activity. The labour market will improve further in the near term, but employment will stagnate longer out. Inflation is elevated, and the Riksbank will hike rates swiftly during 2022, while the hiking cycle should end in early 2023.

After robust growth in recent years, the state of the Swedish economy is strong. However, growth conditions will change during the forecast period. Over the past ten years inflation and interest rates have been low and stable. This year interest rates will rise quickly, leading to tighter monetary conditions.

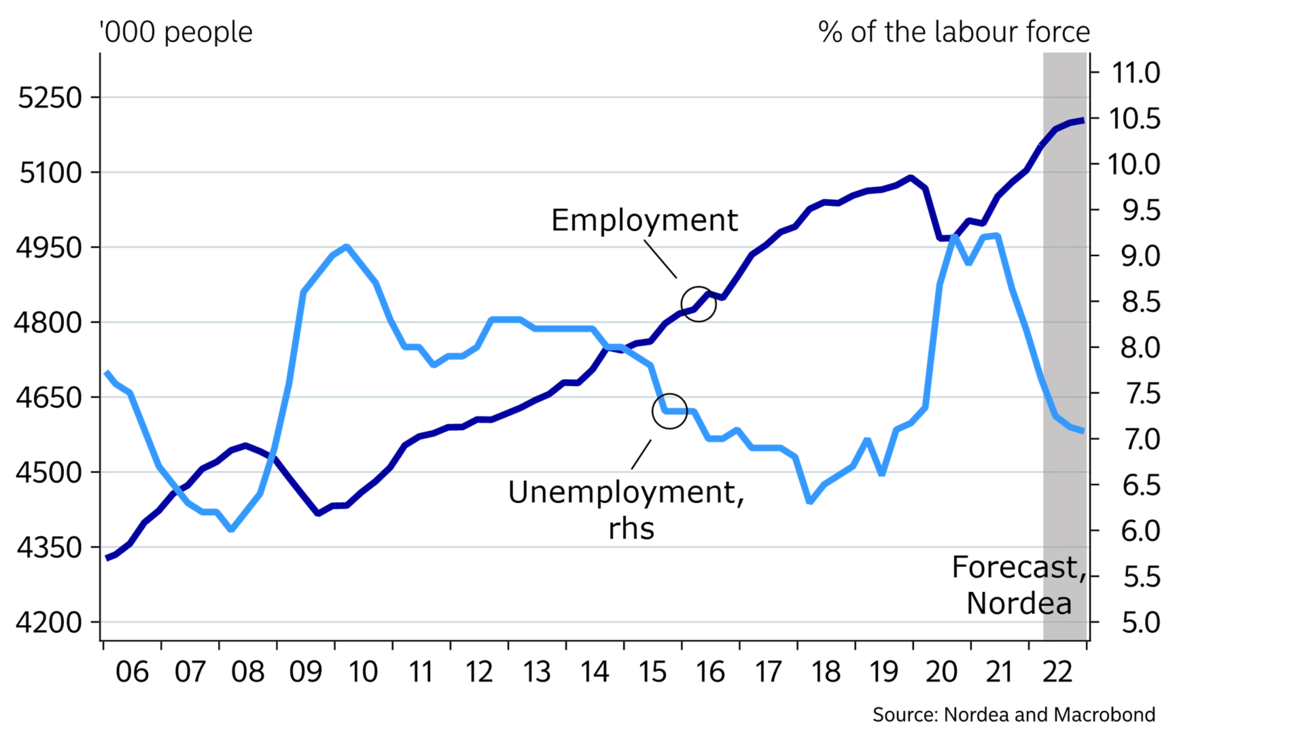

Although many businesses are struggling with bottlenecks, growth in H1 2022 is generally good. Further ahead, growth in domestic demand will slow significantly. Also, the global economy looks set to enter a phase of lower growth. Consequently, Swedish export growth will slow. GDP growth is thus likely to be low, especially in 2023. Employment, which has developed really well over the past quarters, will level off next year, and unemployment will stop falling.

The high inflation erodes households’ purchasing power and thus consumption. The sharp price increases are very likely contributing to the gloomy sentiment among households. Moreover, the war in Ukraine is lowering consumer confidence even more.

In the near term we see some resilience, though. Households are financially strong after the past few years’ high savings levels and massive wealth effects. The very strong labour market boosts confidence and stabilises incomes.

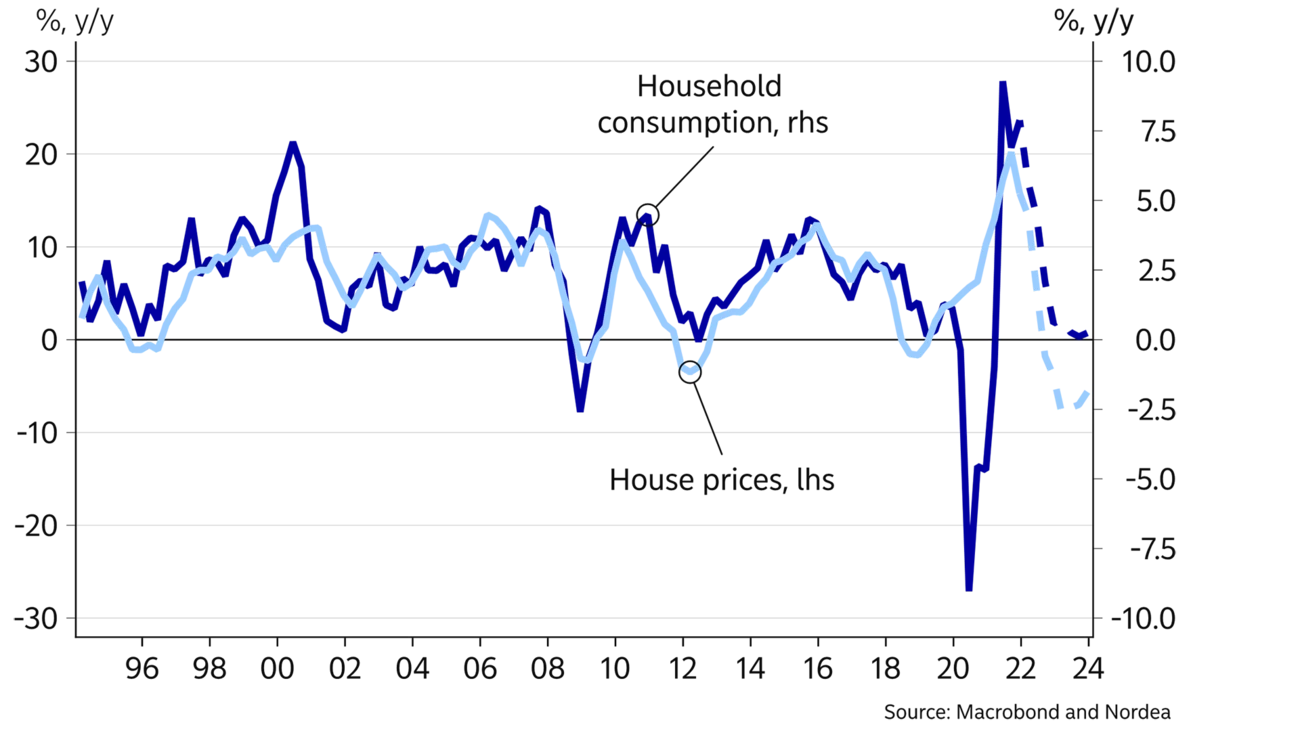

But the challenges for households will increase going forward. The share of interest expenses to disposable income will rise from a record low of 3.5% last year to around 6% next year. Moreover developments in the housing market will weigh on consumption. The trend in the housing market has historically had a big effect on households’ spending and savings behaviour. Rising housing prices generate positive wealth effects and may reduce the need for other savings. Rising housing prices increase households’ possibility of mortgaging their homes to purchase durable goods and strengthen the incentive to renovate their homes.

These positive effects will turn around during the forecast period. As a result of rapidly rising interest rates, housing prices will start to fall during H2, according to our forecast. Moreover, the supply of homes is high. During 2021, the construction of 64,000 new homes began, and most of them will be completed this year. That significantly exceeds the population growth rate, assuming two persons per home on average. Hence, housing prices will decline by up to 10% from the peak earlier this year. The weak stock market performance is not crucial, but still weighs on both housing prices and consumption. The key driver of the domestic economy, that is, household demand, will thus slow significantly at the same time as housing construction activity is expected to plunge. In 2021 new housing construction lifted GDP growth by around 0.5% point, but is expected to be an equally large drag on growth next year.

SWEDEN: MACROECONOMIC INDICATORS

|

|

2019 |

2020 |

2021 |

2022E |

2023E |

|

Real GDP (calendar adjusted), % y/y |

2.0 |

-3.2 |

4.7 |

3.0 |

1.0 |

|

Underlying prices (CPIF), % y/y |

1.7 |

0.5 |

2.4 |

5.8 |

2.5 |

|

Unemployment (SPES), % |

7.0 |

8.5 |

7.9 |

6.8 |

6.5 |

|

Current account balance, % of GDP |

5.2 |

6.1 |

5.5 |

5.1 |

5.3 |

|

General gov. budget balance, % of GDP |

0.6 |

-2.7 |

-0.2 |

0.1 |

0.3 |

|

General gov. gross debt, % of GDP |

34.9 |

39.6 |

36.7 |

33.0 |

30.1 |

|

Monetary policy rate (end of period) |

0.00 |

0.00 |

0.00 |

1.00 |

1.25 |

|

EUR/SEK (end of period) |

10.51 |

10.04 |

10.29 |

10.40 |

10.20 |

Other parts of the domestic economy will partly offset the weak trends in consumption and housing construction. Election years often come with expansionary fiscal policies, which is also the case this time around. During the election year 2022, fiscal policy stimulus will amount to around SEK 140bn, which is less than the SEK 230bn spent last year, but still amounts to almost 3% of GDP. The inflow of refugees and increased military budgets contribute to increasing public spending, which will also feed through to 2023.

The expansionary fiscal policy line boosts government consumption as well as fixed investment. Moreover, the industries’ transition to greener production and the expansion of the energy sector will add to growth. Due to lower housing construction activity, total fixed investment will remain unchanged next year.

You need to go back to the 1990s to find equally positive views on the manufacturing industry’s order books, according to the NIER survey. Due to lack of input goods and labour, industrial companies have had difficulties meeting the high demand. The supply of input goods continues to be a problem this year especially for the automotive industry, but is expected to ease for other industries. The full order books can thus be handled this year, and exports of goods will increase. The influx of new orders will slow over the forecast period, and goods exports will grow at a more subdued pace next year. Meanwhile, exports of services will see stronger growth as tourism is expected to pick up again.

Further ahead, the challenges for households will increase.

Demand for labour is at an all-time high. In March alone nearly 200,000 new vacancies were registered with the Swedish Public Employment Service. In other words, there are only two unemployed persons per vacancy, which is the lowest figure since the early 1990s. Unemployment, as measured by Swedish Public Employment Service, will soon be at its lowest level in more than 10 years.

The changes made to Statistics Sweden’s Labour Force Survey at the beginning of 2021 seem to entail a permanent upward shift in unemployment. Thus, we do not expect unemployment according to the Labour Force Survey to decrease to previous lows. To improve comparability to previous years, we primarily follow the Swedish Public Employment Service's statistics for unemployment.

The tight labour market and high inflation result in higher wage growth (read more in the theme article on wages in Sweden). The acceleration in labour costs reflects that inflation leads wage growth rather than the other way around. Higher wage growth thus does not change the inflation outlook significantly.

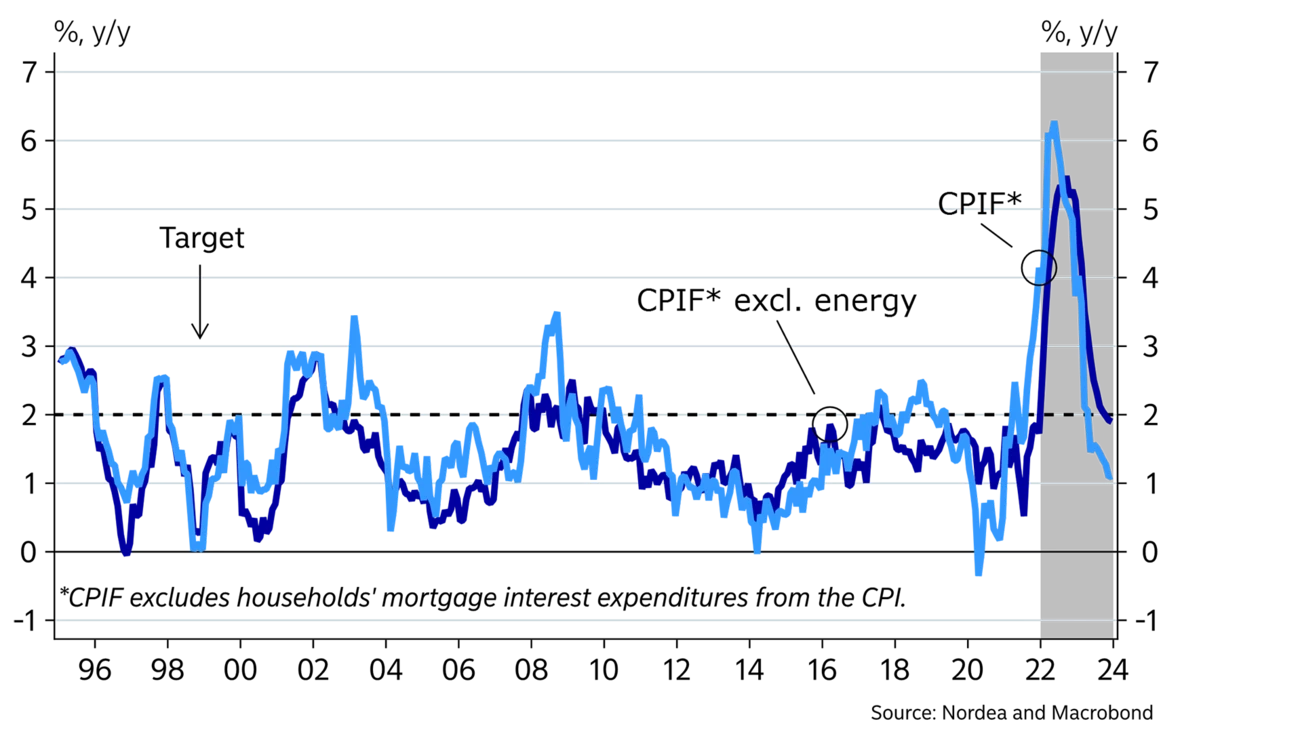

Prices of energy and food are the main inflationary drivers. However, the uptick in prices is broader than that. Price increases for other goods deviate the most from the historical pattern, but increasing services inflation also contributes considerably to inflation.

Although the increase is broadly based, it is to a large extent due to global events, such as soaring energy prices and high freight costs. These cost impulses will remain significant during most of 2022, and inflation will stay at a high level, also in Sweden. Lower growth in, for example, the US and the Euro area is expected to gradually dampen commodity prices and transportation costs longer out. Thus, the price environment will change also for Sweden, and inflation will fall back.

Price increases for goods other than food deviate the most from the historical pattern, but increasing services inflation also adds significantly to inflation.

In April the Riksbank raised the repo rate above zero for the first time in eight years. We believe that the Riksbank will continue to step harder on the brakes and hike rates several times this year. The Riksbank cannot do much about the high price increases near term but will ensure that inflation falls back to close to target in a couple of years. It is not least important for the Riksbank to safeguard the credibility of the inflation target before the wage negotiations start in the autumn.

The Riksbank will especially monitor whether Swedish inflation deviates from global trends; that is, to which extent there is a domestic and extra mark-up of prices. Swedish businesses, for example, report that profitability is good, according to the NIER survey. It may be a sign that high demand allows businesses to not only pass on increased costs to their customers but also increase their profit margins. If so, it would be a concern for the Riksbank and therefore underscores the likelihood of several rate hikes this year.

As we expect inflation to fall back next year and especially domestic demand to slow, the Riksbank’s hiking cycle should end in early 2023, according to our forecast.

The SEK had a rough start to the year. Uncertainty due to the war in Ukraine, among other things, caused turmoil in the financial markets, which did not benefit the SEK. The krona did recover somewhat during the spring but is still trading at relatively weak levels. The Riksbank’s quick shift to a tightening bias supports the SEK. However, concerns about weak growth in the interest-rate sensitive Swedish economy may pull in the opposite direction. We expect the EUR/SEK rate to trade around 10.40 in 2022.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more