2.9%

Goods exports to the US as a share of GDP

Torbjörn Isaksson

The global landscape has been jolted, partly due to the global trade war. This also affects Sweden, causing households and businesses to hesitate. However, the impact on growth is expected to be limited. There are conditions in place that will help to continue last year’s gradual recovery of the Swedish economy. Inflation will likely decline next year, but a stronger economic climate should reduce the Riksbank’s need to ease monetary policy.

More clouds have gathered on the horizon, but most of them over other countries and regions, while milder winds blow in Sweden. Several favourable factors stabilise the Swedish economy. Interest rates have fallen over the past year, fiscal policy is expansionary and the business sector is competitive. The recovery that began in the Swedish economy during H2 2024 can thus continue after a temporary slowdown in H1 2025.

Significant uncertainty surrounds the trade war and the new US administration. Tariff disputes remain unresolved at the time of writing. The fragile geopolitical situation also clouds the outlook. This uncertainty dampens households’ propensity to spend and could make businesses reluctant to invest and hire also in Sweden.

Our baseline scenario is that tariffs will not become overly burdensome and that the EU refrains from significant countermeasures against the US. We also assume that the most extreme ideas floated by the new US administration, including non-economic areas, will not be implemented. This will mitigate uncertainty and the recovery should gain momentum again. Several fundamental factors support stronger growth in the Swedish economy compared to many other European countries.

Several fundamental factors support relatively good growth in the Swedish economy.

Last year, households felt a budding optimism, which this year once again turned to unease. Households are concerned about Sweden’s economy and their own financial situation. This bodes ill for consumption.

However, households’ financial positions look set to improve this year, creating a basis for growing consumption despite a shaky global environment. Not least have interest rates fallen over the past year. About 70% of all outstanding mortgages have a variable interest rate. For a household with a variable-rate mortgage, interest expenses have decreased 40% compared to the peak in early 2024.

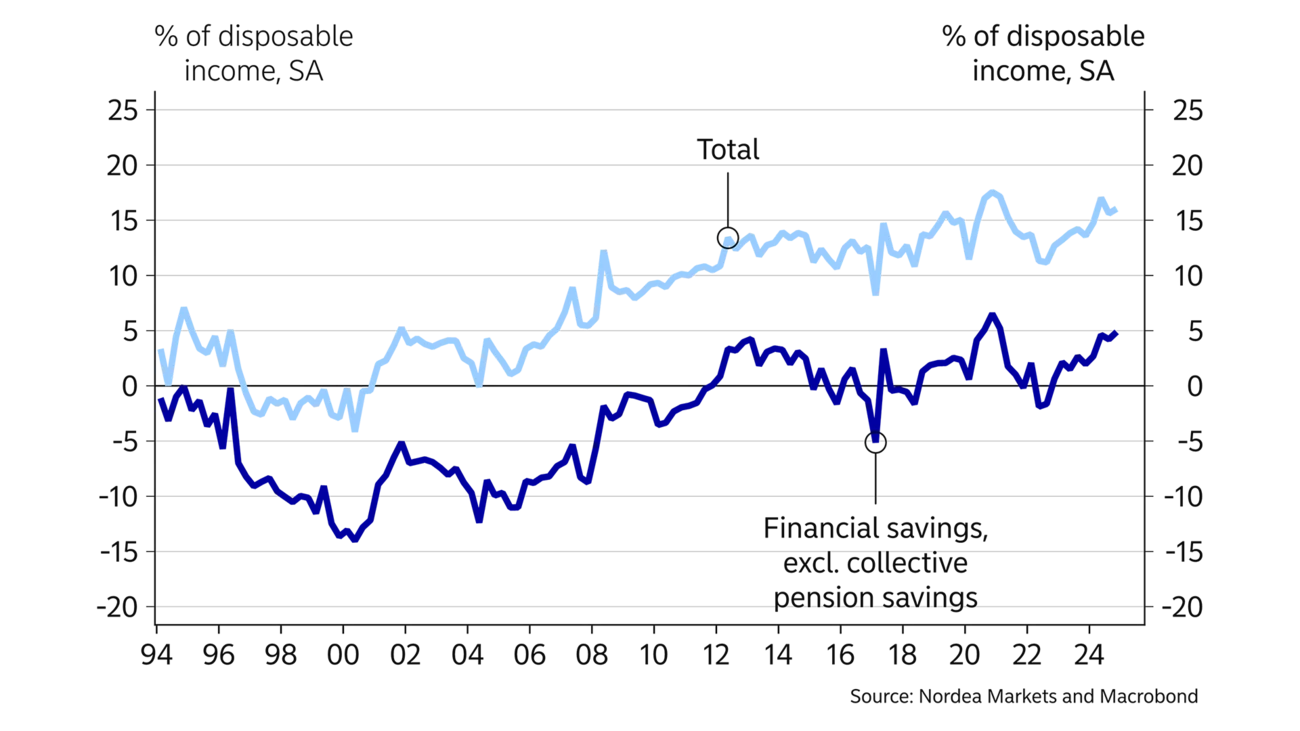

Household buffer savings have been high in recent years, and the need to save up more should be limited. For example, households’ own financial savings amounted to 5% of incomes at the end of last year. Consequently, a substantial share of income growth can be directed towards higher consumption. This year, incomes will likely grow by around 5.5% in current prices and by 3.5% adjusted for inflation. Households’ financial assets remained stable in the early part of this year, despite significant swings in global stock markets. Moreover, consumption has been subdued for several years, potentially creating pent-up consumer demand.

| 2023 | 2024 | 2025E | 2026E | |

|---|---|---|---|---|

| Real GDP (calendar adjusted), % y/y | 0.1 | 1.0 | 1.8 | 2.5 |

| Underlying prices (CPIF), % y/y | 6.0 | 1.9 | 2.5 | 1.5 |

| Unemployment rate (LFS), % | 7.7 | 8.4 | 8.7 | 8.3 |

| Current account balance, % of GDP | 6.7 | 7.0 | 7.1 | 6.8 |

| General gov. budget balance, % of GDP | -0.8 | -1.5 | -0.3 | -0.8 |

| General gov. gross debt, % of GDP | 31.6 | 33.5 | 33.5 | 33.6 |

| Monetary policy rate (end of period) | 4.00 | 2.75 | 2.25 | 2.25 |

| EUR/SEK (end of period) | 11.10 | 11.48 | 10.70 | 10.50 |

Overall, our forecast does not indicate a spending spree, but rather a gradual recovery in household demand. The baseline scenario for house prices also shows a gradual recovery during the forecast period, with a rise in tandem with income growth.

The trade war is the main risk to the forecast. One way this may impact households is via interest rates. If, contrary to expectations, interest rates were to skyrocket, households’ financial positions would deteriorate, consumption capacity would shrink and house prices would be dampened.

Thus far, the trade war has instead led to falling interest rates in Europe. If the Riksbank cuts interest rates more than expected, the recovery of the domestic economy may be stronger than forecast. In recent years, households have adapted to higher interest rates as debts have decreased relative to income. This means that monetary policy has become a more potent tool. For example, a policy rate of around 1% would imply that the interest-to-income ratio, that is interest expenses relative to disposable income, is close to the same level as before the pandemic when the policy rate was zero.

Lower taxes are one of the reasons why household incomes will improve this year. More resources will also be allocated to defence, local governments and infrastructure. In total, discretionary fiscal policy corresponds to more than 1% of GDP for 2025, which is expected to be largely the same in the election year of 2026. The budget deficit will likely be about 0.5% of GDP in 2025, and increasing slightly in 2026.

Public debt (Maastricht) is rising, but still close to the debt anchor of 35% of GDP during the forecast period. This is low from a historical perspective and significantly lower than in many other countries. Confidence in public finances thus remains intact, which strengthens the impact of fiscal policy on GDP growth.

2.9%

Goods exports to the US as a share of GDP

0.8%

The defence industry’s share of GDP according to NIER

10%

SEK appreciation, trade-weighted (KIX) September 2023 to April 2025

Expansionary fiscal policy is reflected in increased public investment during the forecast period, not least under the auspices of the central government. Housing construction has bottomed out, but any significant upturn will not materialise. Business sector investment has gone up and will increase in the forecast period, even though it may be a bumpy ride.

Sweden’s goods exports to the US account for 5.5% of total exports and nearly 3% of GDP. Some companies and regions may be affected by a decline in US deliveries, but it should be manageable at the national level. Consequently, the direct effect on the Swedish economy looks set to be limited.

The risks rather relate to the impact on key trading partners and developments in the global economy. Here, uncertainty is greater and demand for Swedish exports is expected to be subdued in the near term.

The direct effects on the Swedish economy of the trade war are limited.

There are glimmers of hope. As highlighted in this report, the Nordic economies, which account for 24% of Swedish goods exports, are doing relatively well. It should be noted that the US accounts for 15% of global GDP, while the remaining 85% of the world’s countries are not engaged in trade wars with each other. On the contrary, collaboration is strengthening globally in many aspects. One example is the deal signed between the EU and South American countries at the end of last year, which opens up a market with hundreds of millions of consumers. In addition, the EU is also expected to sign a free-trade agreement with India later this year. This presents new opportunities for Swedish exporters.

Moreover, fiscal policy is expansionary in Europe. Recently, the EU presented a package with ramped-up defence expenses to the tune of EUR 800bn over four years. In addition, Germany has eased its so-called debt brake and announced infrastructure investments of EUR 500bn over 12 years.

The effect of defence investments will be immediate, while other projects will affect the economies more gradually. The defence industry in Sweden accounts for just under 1% of GDP, but the civilian manufacturing sector will also benefit from this.

The situation in the Swedish manufacturing sector remains stable, according to the first surveys conducted after the trade war escalated in early April. Overall, the development in goods exports will remain weak near term, but a decline can be avoided. Later this year, goods exports will pick up again as global demand gains traction.

Services are not included in the trade war. However, some services are related to goods exports, causing a standstill in service exports in the near term as well. Many knowledge-intensive services stand on their own, though. In many cases, they are on a strongly rising trend that will have an impact during the forecast period.

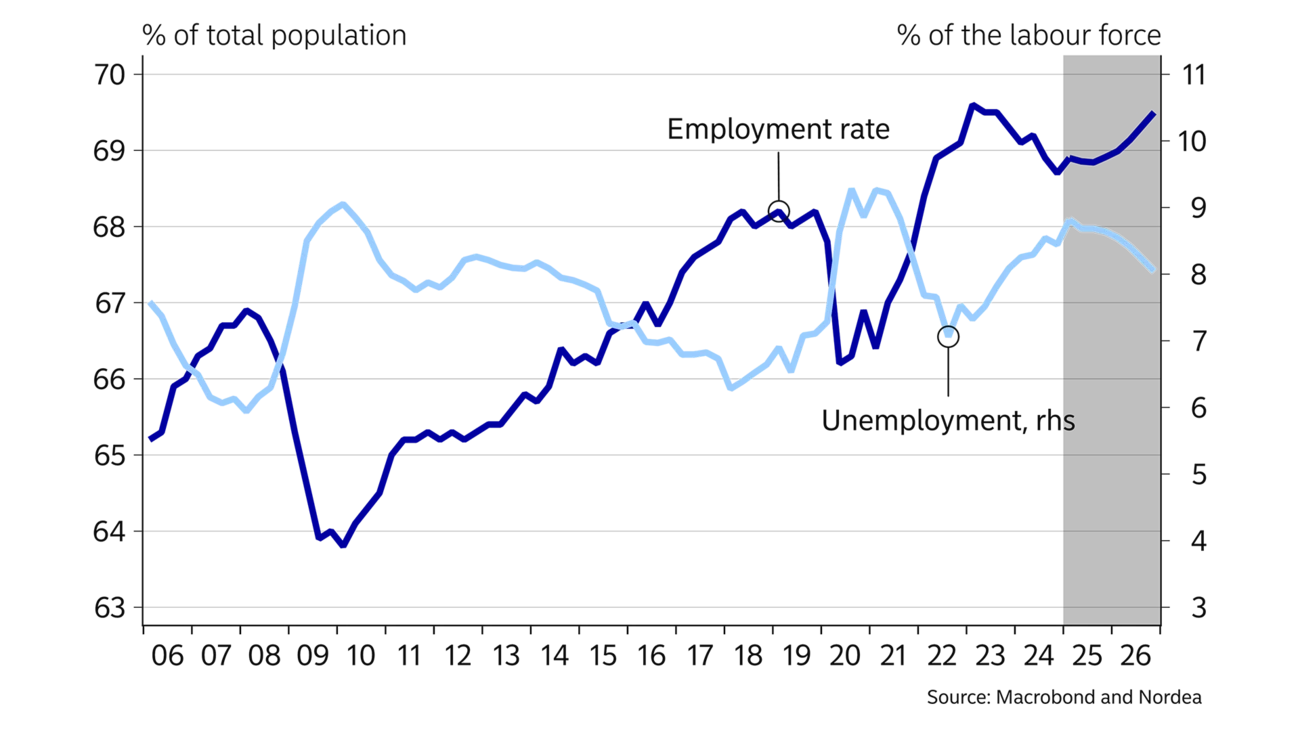

After nearly two years of declining employment, an uptick was recorded in Q1 2025. In other words, labour market developments follow the historical pattern insofar as GDP began to recover in Q3 2024, which affected employment with a typical lag. The economy will gradually recover and thus also the labour market. Employment will increase slightly during 2025.

Due to large swings in labour supply, unemployment is highly volatile. When including those who are latently unemployed, which is a broader measure of unemployment, the trend was more stable at the end of last year and early this year. Unemployment will fall slowly during the forecast period.

The recently concluded pay deals extend over two years and include wage increases of 3.4% during the coming year and 3.0% during 2026. With a certain wage drift, total wage increases will be nearly 4% this year and 3.5% next year.

Pay deals at that level are welcomed by the Riksbank. Wages are higher than before the pandemic when inflation was too low, but will hardly drive up inflation too much during the coming years.

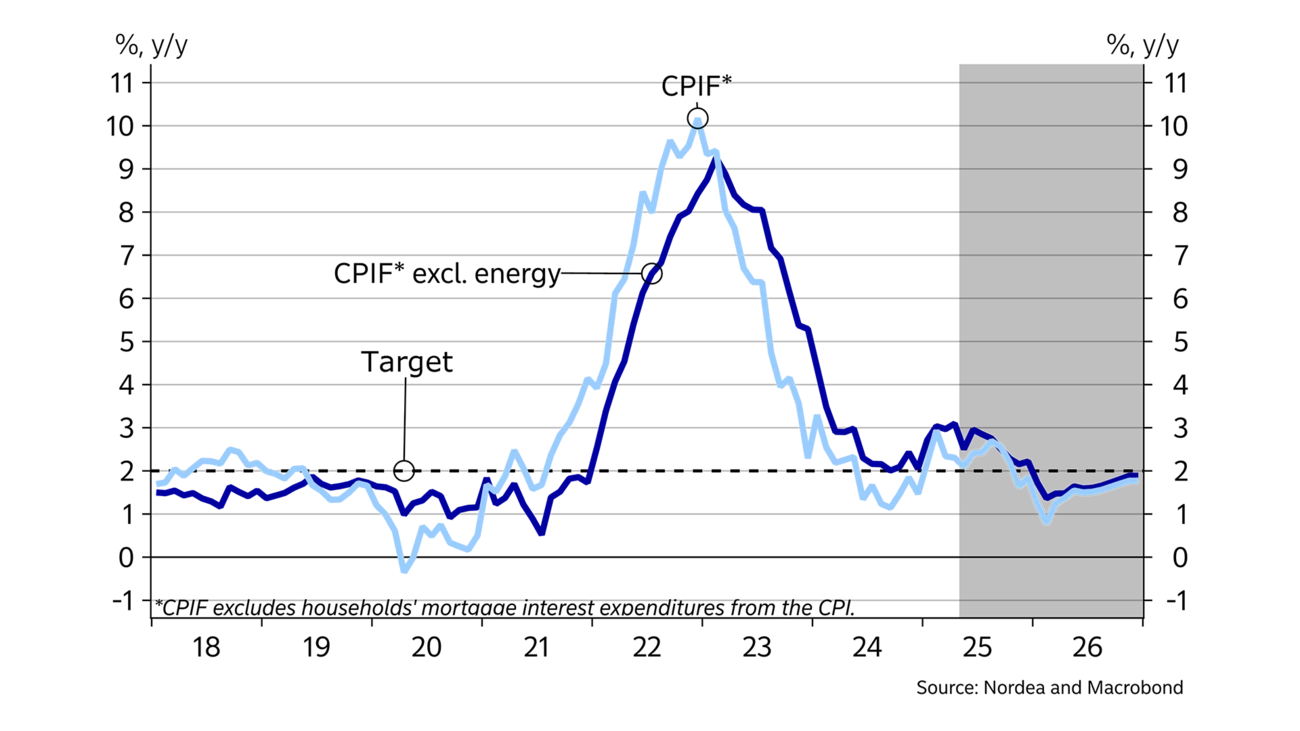

The unexpected uptick in inflation this year can mainly be explained by rising food prices, which in turn are caused by supply shocks for certain food products. Prices of other goods have also risen, which is likely a result of last year’s high global freight costs. It cannot be ruled out that companies’ haste to dispatch deliveries to avoid higher tariffs may also have contributed to higher prices.

Freight costs have fallen and the EU is not assumed to raise tariffs against any countries. Goods inflation are thus expected to fall this year and food prices to stabilise. Meanwhile, the important services inflation is already at modest levels, indicating that inflation will decline later this year. The Riksbank will nevertheless be cautious about lowering the policy rate as the economy is recovering.

An important reason why inflation is expected to decline later this year is the strengthening of the SEK exchange rate that has mainly taken place this year. The outlook for exchange rates is uncertain. The USD may continue to weaken, which would benefit the SEK. However, our baseline scenario is a slight strengthening of the SEK during the forecast period. Read more about the SEK in our Swedish theme article: The return of the SEK.

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more