- Name:

- Joel Lundh

- Title:

- Analyst

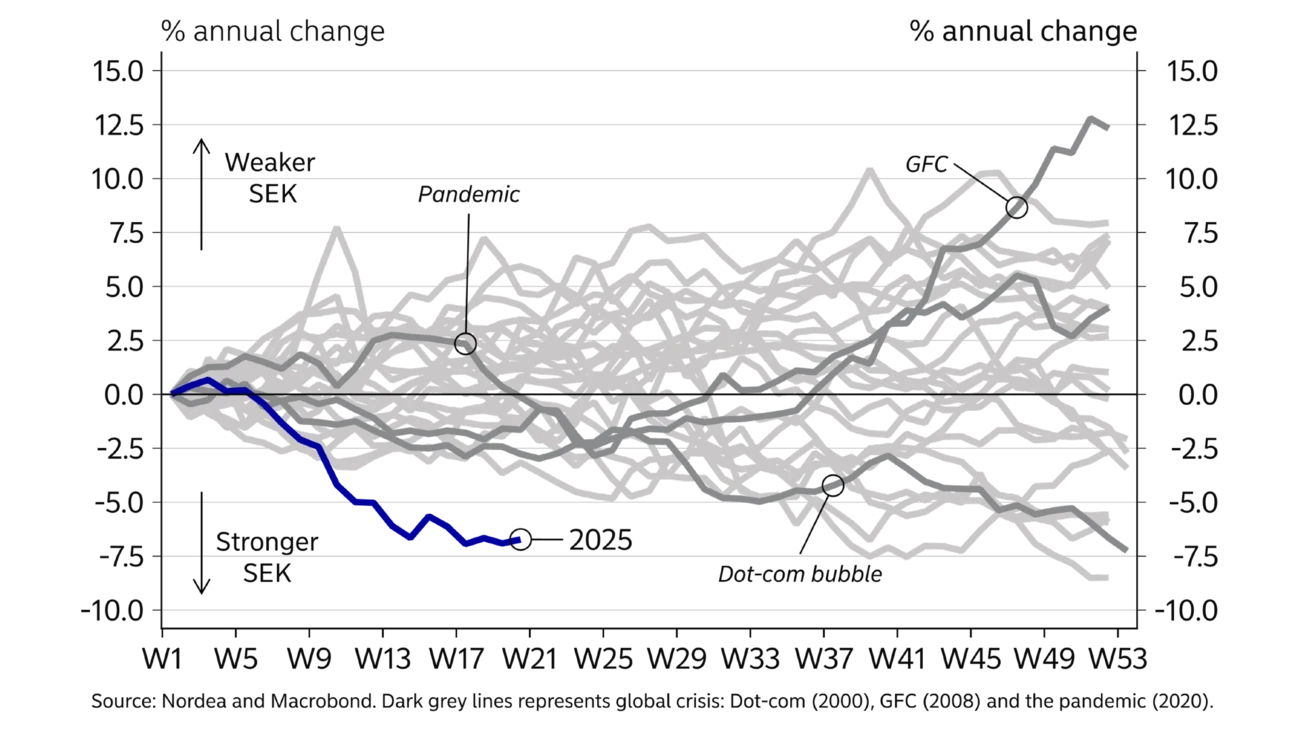

Since the start of 2025, the performance of the SEK has been historically strong. The trade-weighted exchange rate has appreciated by 7% – the most since 1993.

The past few months have been turbulent. The new US administration has changed the global geopolitical and trade policy landscape – triggering sharp fluctuations in financial markets and much higher uncertainty about economic conditions and inflation both in Sweden and worldwide. The SEK often weakens in such an environment, but this time has been different.

Since 1 January, the Swedish krona has (in nominal terms) appreciated 5% and 12% against the EUR and USD, respectively – or SEK 0.50 and SEK 1.25. In trade-weighted terms (KIX), it has strengthened 7%.

The main reason is the US policy actions in both domestic and global matters, which have led to a reassessment of the US economy. Confidence has been eroded and demand for the USD – the world’s reserve currency – has declined, causing the USD to weaken significantly.

Global capital has thus been reallocated from USD-based securities to other markets. The EUR has been one of the winners – gaining around 8% against the USD since early 2025. This has benefitted the SEK exchange rate, which generally co-varies with the EUR against other currencies, often with large fluctuations.

The SEK often weakens in such an environment, but this time has been different.

One factor to consider in both the short and long term is the interest rate differential between countries. Between Sweden and the US, it has narrowed by around 10bp since the turn of the year. For the US, the market is reassessing the impact of Trump’s economic policy on the outlook for growth and inflation. This situation requires the Fed to walk a difficult tightrope in its monetary policy considerations. Europe and Sweden, however, have agreed to boost defence investments, increasing the countries’ borrowing requirements. Germany has eased its debt brake and presented an infrastructure investment package.

The current pause in Trump’s so-called “reciprocal” tariffs ends in July. The outcome of the trade negotiations may play a key role for the USD and, in turn, the SEK performance. It is difficult to estimate the magnitude and duration of the impact on the SEK. Several scenarios are possible, but many will likely point to the USD continuing to lose ground.

According to the International Monetary Fund’s latest report from 2024, the SEK real exchange rate, with the labour cost index as deflator, is underestimated by 17% – more than any other currency at the time of publication. This assessment should be taken with a grain of salt, but it indicates nevertheless that the SEK is underestimated – as also pointed out by the Riksbank.

Exchange rate forecasts, especially for small currencies, are challenging. Nordea expects a gradual strengthening during the forecast period, to 10.50 against the EUR by end-2026. In the long term, Sweden's growth prospects seem better than those of other European countries. Sweden’s robust public finances are also a strength. This indicates a somewhat higher policy rate in Sweden than in the euro area, contributing to the steady and gradual strengthening of the SEK.

SEK will strengthen gradually and steadily during the forecast period.

Exchange rate fluctuations often have a major impact on inflation. The general rule of thumb is that if the SEK appreciates by 1%, inflation will, over time, decline by 0.1%. The impact occurs with a certain lag, with the greatest effect after six to nine months. Given the SEK appreciation since last autumn, inflation should ease by almost 1% point. Inflation is still expected to remain above target in the near term, but the SEK performance is a key reason why we expect inflation to fall later this year.

It is difficult to assess the impact of exchange rate changes on the real economy. Recent decades’ trend of SEK depreciation has likely benefitted Swedish export companies’ profits, but a fundamentally competitive business sector is probably even more important for Sweden's relatively good growth trend. A stronger SEK is expected to have a dampening effect on GDP via lower net exports and worsened net tourism balance.

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more