- Name:

- Jan von Gerich

- Title:

- Nordea Chief Analyst

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskJan von Gerich

Trump’s newest round of tariffs hit financial markets and added to downside risks to the economy. Plenty of uncertainties remain, and the USD sentiment has taken a beating. The ECB will likely cut again, while the Fed may find the outlook trickier, writes Nordea Chief Analyst Jan von Gerich.

President Trump this week delivered his much-vaunted decision on reciprocal tariffs, and, judging by reactions in financial markets, the outcome was stricter than expected. The US will start to apply a baseline 10% tariff on imports from all countries starting on 5 April, while an individual reciprocal tariff will be added on a country-by-country basis, which will kick in on 9 April. The EU will face a 20% tariff and, for example, China an additional 34% tariff, which will come on top of the 20% Trump already imposed earlier this year.

Mexico and Canada were exempted from the reciprocal tariff for now, while sectors such as cars, which already had a levy of 25% imposed on them, would not be hit by an extra reciprocal tariff.

Deals are still possible, and the Executive Order implementing the tariff explicitly mentions that the tariffs may be modified in scope or size in response to the lowering of trade barriers on the part of the trading partner or aligning with the US economic and national security interests. On the other hand, if a trading partner retaliated with counter tariffs or if the situation in the US manufacturing sector worsened, the tariffs could also be increased.

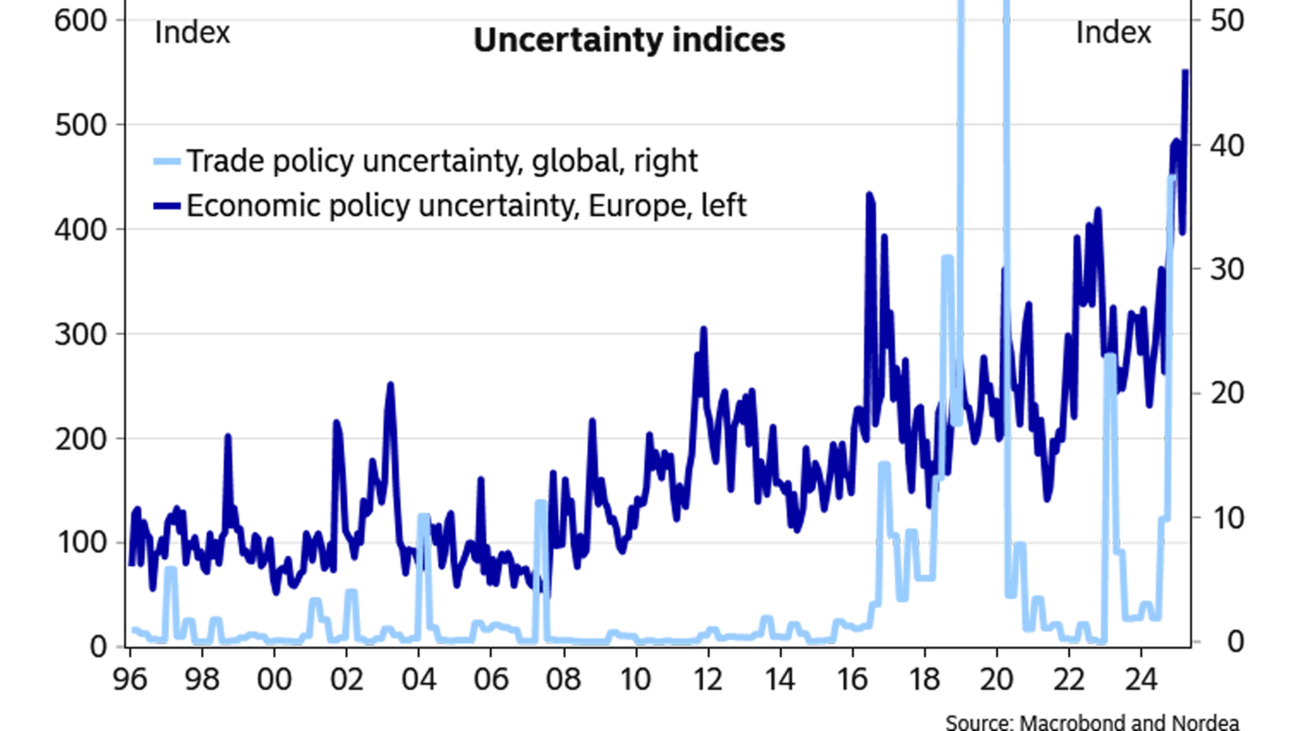

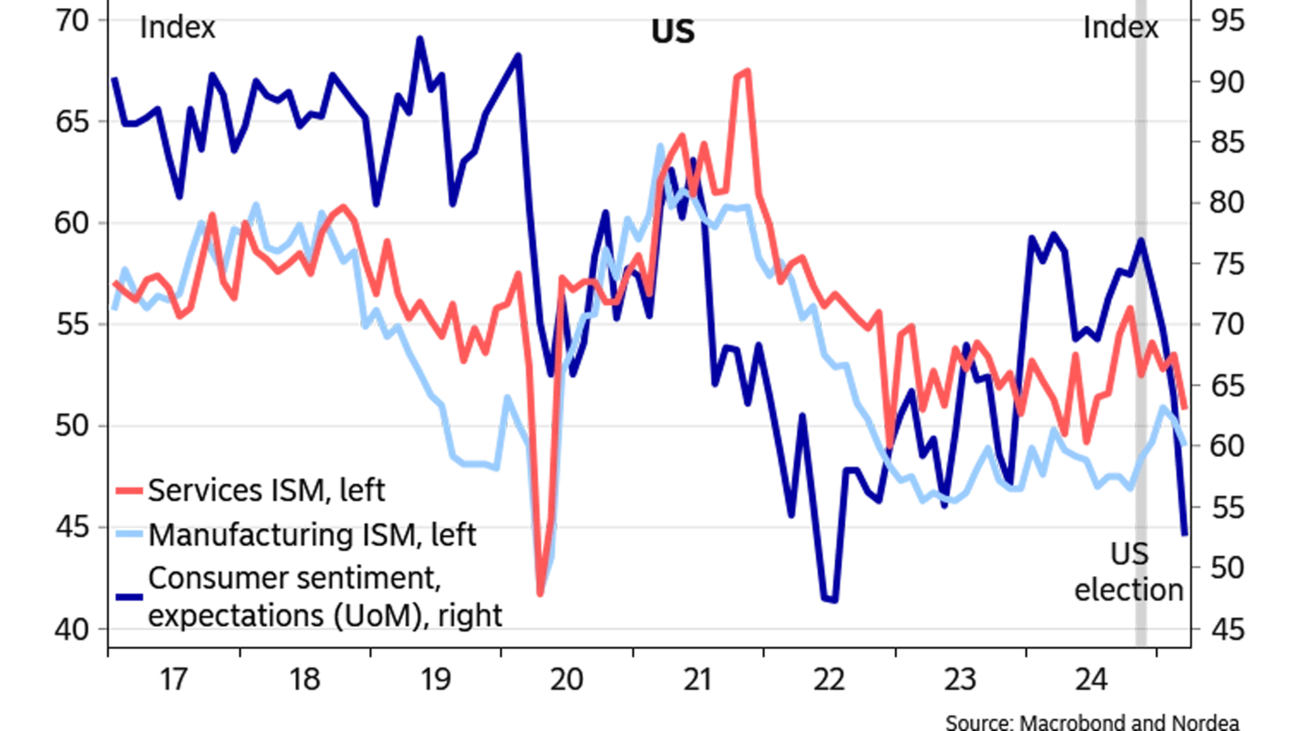

The economic consequences of the new tariffs are uncertain and depend on what else will be in store: how long the tariffs will be in place, whether there will be further modifications, and how the revenue from the tariffs will be used, especially in the case of the US. Foremost, the near-term impact will depend on how confidence evolves. We have already seen worrying signs in various uncertainty indices, and lately also several US sentiment indicators have started to suffer. Further, if the tariffs come into force as planned and companies expect at least part of them to be short-lived, activity in the near term could take a more sizable hit, while companies wait for more certainty on what is ahead.

Various models give different results on the magnitude of the economic impact. The Peterson Institute for International Economics, for example, recently modelled how a 25% tariff on the EU would affect GDP and inflation. Even with retaliation, growth in Germany would take a hit of around 0.4 percentage points at most vs the baseline, while France and Italy would suffer less. According to this model, the US economy would suffer clearly as well, and given that only tariffs against the EU were modelled here, the hit to the US economy should be much bigger, when tariffs on all countries are taken into account.

In terms of inflation, the model suggests an upward move of around 0.5 percentage points at the point of peak impact, depending on the country, enough to cause some further headaches for central banks, but probably not enough to set the course for monetary policy on its own.

The tariff news adds to downside risks to our baseline forecasts. For the ECB, another 25bp rate cut in April now looks even likelier, and while the recent EU and German spending plans have added upside risks to our baseline further out in the forecast horizon, we think risks are tilted towards further ECB rate cuts at the coming meetings.

For the Fed, we still think that the upward inflation impact of the tariffs will keep the Fed on hold, but if the deterioration in confidence worsens and growth takes a more notable hit, rate cuts could rather quickly come back into play. After all, the Fed still considers current policy to be clearly in restrictive territory. Market pricing of Fed rate cuts has increased rapidly, and a 25bp cut is currently fully in prices by the June meeting, while a total of around 100bp of cuts are in prices by the end of the year.

For the EUR/USD, the dollar did not gain on the tariff announcement, and EUR/USD actually subsequently surged higher, further suggesting a weakened USD sentiment. While our call of a lower EUR/USD to a large extent is based on interest rate differentials starting to favour the USD again more, risks to this view towards higher EUR/USD have increased clearly.

See the full article on Nordea Corporate, Macro & Markets: The day after liberation day.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more