Risk Solutions – Exploring hedge accounting to mitigate risks

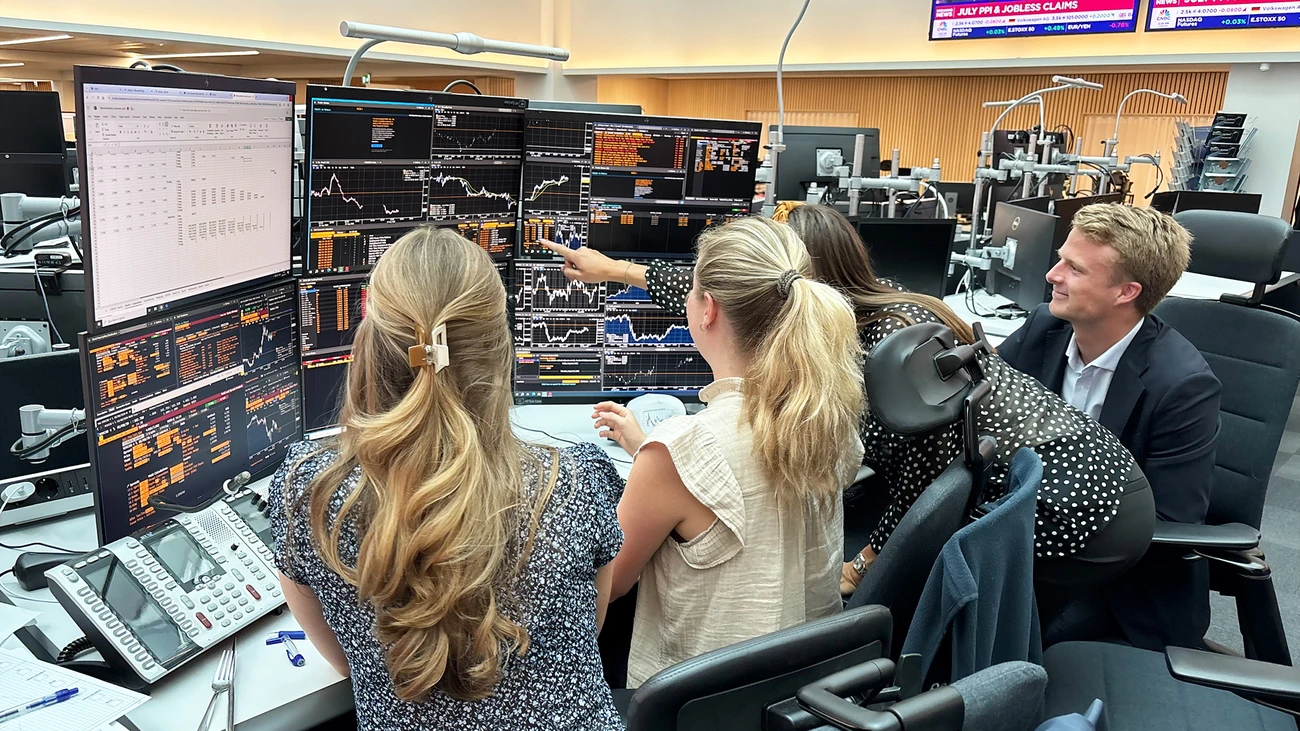

Sadly, we reached the final week of our internship. We spent the week with Risk Solutions, which was a great opportunity to apply everything we had learned over the past seven weeks about FX and derivatives.

We learned to view risks from a balance sheet perspective, explored hedge accounting, and understood how it can be used to mitigate risks while impacting the company’s financial results. The main case of the week was highly technical: “Analysing a company’s FX and interest rate risk from a balance sheet angle”.

We also had two mini cases during the week, where each of us presented a news event and how it could be relevant for the desk – for example, a cross-border acquisition or a company with large foreign currency revenues.

Huge thank you

With only one day to go, we ended Thursday with a squash tournament. It was the first time for all of us, and it was both intense and fun. On Friday, we enjoyed a farewell lunch with the team, followed by a nice after-work gathering.

It has been bittersweet to wrap up the internship after such a steep learning curve – we’re sad to leave. A huge thank you to everyone at Nordea Markets for an incredibly educational and inspiring summer.

/Isabelle Byman, Fanny Strandberg, Wilmer Samuelsson and Wilhelmina Stenbeck