- Name:

- Kjetil Olsen

- Title:

- Chief Economist, Norway

In the next couple of years, activity in the Norwegian economy will be less affected by petroleum price changes than previously. The tax package for the petroleum sector adopted in the summer of 2020 will boost petroleum investments significantly even if energy prices should nosedive. But large energy shocks will impact price growth and thus Norges Bank’s interest rate decisions. It is not a given that lower energy prices will lead to lower interest rates like in 2014.

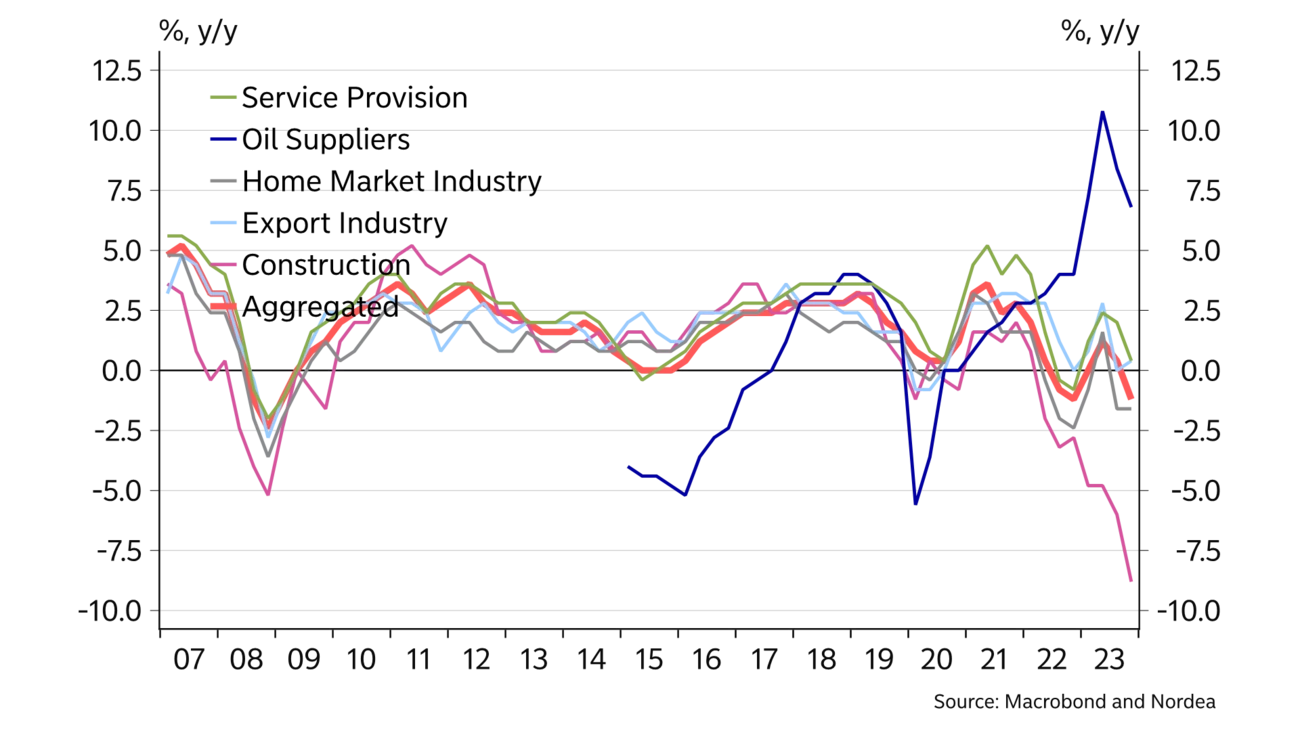

In the spring of 2020, petroleum prices fell sharply in the wake of the coronavirus pandemic and considerable economic uncertainty. Petroleum companies stated that investment projects could be postponed, and Norwegian jobs were at risk. In response, the Norwegian parliament adopted a favourable tax package to motivate companies to go through with investments despite lower energy prices. Thanks to the tax package, it became profitable to make new investments despite a very low oil price, and a record-high number of projects were registered with the authorities before the deadline in 2022. This year investments are expected to reach the highest level since before the oil crisis in 2014 (see chart A). No other sector in the Norwegian economy is more optimistic about the future than oil suppliers (see chart B).

A sharp increase in energy prices will not necessarily result in higher activity in Norwegian petroleum investments and for Norwegian oil suppliers, as activity is already at a very high level. Thus, even higher oil prices will not necessarily boost activity in the Norwegian economy. But higher energy prices may affect price growth via the wage level in the supplier industry and the NOK performance. The higher energy prices rise, the higher profitability and thus wage growth will be in the supplier industry and offshore companies. In a tight labour market, which we still expect in Norway, this may spill over to higher wage growth in other sectors. It is still uncertain how higher energy prices will affect the NOK. In the near term higher energy prices may strengthen the NOK. But if it also leads to price increases abroad, the expected rate cuts abroad may be cancelled or postponed. This could result in a weaker NOK, which would help underpin price growth in Norway. Thus, higher energy prices will not necessarily boost the Norwegian economy but may help underpin price growth and high interest rates for longer.

It is not a given that lower energy prices will lead to lower interest rates like in 2014.

What about a negative energy shock? The massive drop in oil prices in 2014 led to significantly lower activity in the petroleum sector and higher unemployment in Norway. The NOK weakened and inflation rose. Because inflation was low to begin with and the real economic consequences were high, Norges Bank was not afraid that inflation would take hold. Norges Bank thus cut interest rates to counter the negative economic consequences of the decline in energy prices. Today a new negative energy price shock would not have the same adverse impact on economic activity and unemployment. It will still be profitable to implement the planned petroleum investments thanks to the tax package. Thus, a negative energy price shock will not hit the Norwegian economy as hard as before. However, a negative energy shock could impact the NOK, which would likely weaken in such scenario. A weaker NOK will help to maintain imported inflation. The expected fall in inflation may then be more moderate than we and Norges Bank expect and postpone rate cuts. A negative energy shock will thus not necessarily lead to lower economic activity and higher unemployment, but could via a weak NOK result in continued high price growth and higher interest rates for longer.

This article first appeared in the Nordea Economic Outlook: Past the peak, published on 24 January 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more