- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

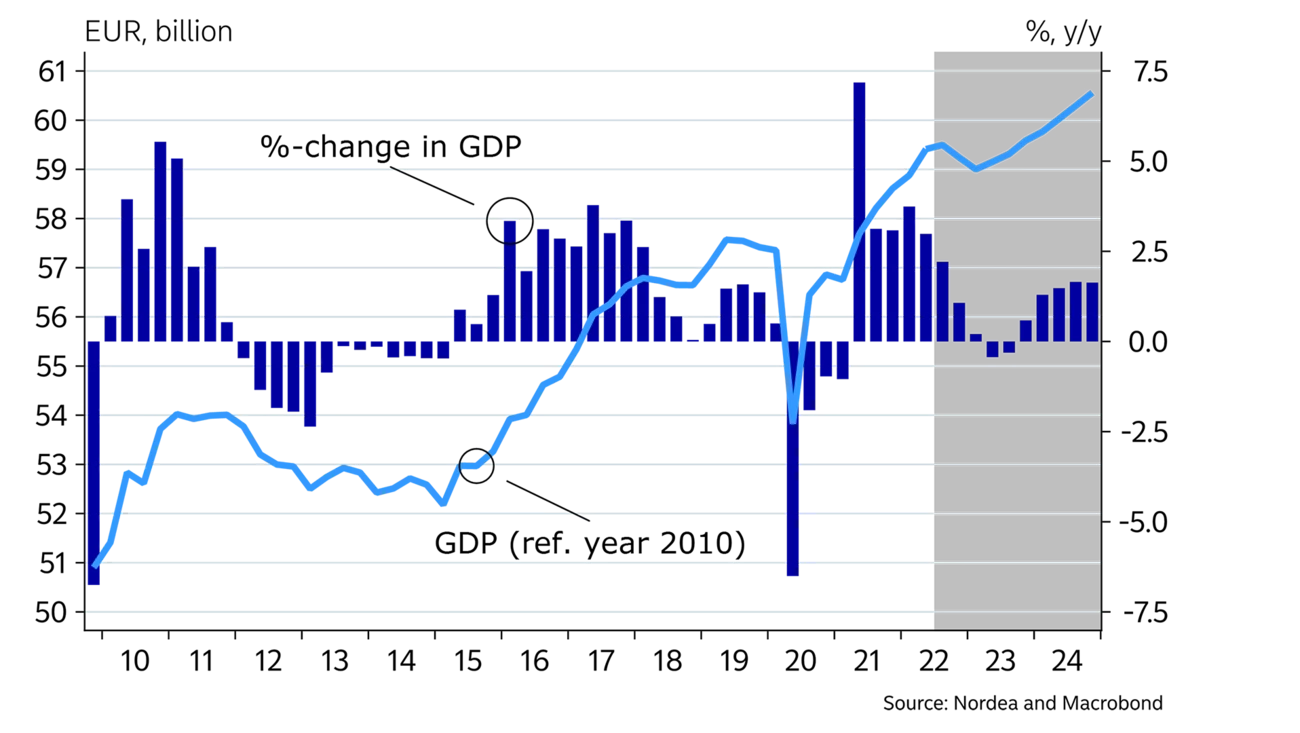

Economic growth was strong in the first half of the year but is showing signs of weakness towards the end of the year. High energy prices are sapping consumers’ purchasing power at the same time as the slowdown in global economic growth is hampering exports. Meanwhile, falling housing sales will slow down construction. The economy is supported by the good employment situation, even though the fastest period of recovery in the labour market appears to be behind us.

The Finnish economy fared well in the first half of the year despite Russia’s war of aggression and rising inflation. The manufacturing sector has been producing at full capacity, a strong housing market has boosted construction and the recovery from the pandemic has driven rapid growth in the services sector. The labour market has also been exceptionally strong as the economy has grown.

However, the economic outlook is deteriorating. Order books in the manufacturing sector are starting to thin out as the global economy stumbles due to slower growth in China and the energy crisis pressuring Europe. The rise in interest rates and slowdown in the housing market are hurting construction, while high inflation is limiting household consumption.

We expect Finland’s GDP to grow by 2.5% this year owing to the strong performance in the first half of the year, even though growth will clearly slow in the latter half. For next year, we have revised down our growth forecast to 0%. In 2024, we expect GDP to grow by 1.5%.

Forecasting a turning point is extremely difficult, and often the timing and extent of such a reversal come as a surprise. Currently, the outlook for the coming winter appears to be clearly weakening, but the rate at which the economy will fall depends on many factors. Should the European energy crisis become exacerbated, it would hurt the Finnish economy as well. Even if Finland manages to avert large-scale restrictions on energy consumption, the high price of electricity will further accelerate inflation, and a sharp increase in interest rates could make the situation even worse. We may see a positive surprise in domestic demand if employment remains high.

The rise in consumer prices has accelerated and become significantly more broad-based this year, reaching 7.6% in August. The drop in the price of oil and fuel-refining margins over the summer, combined with a reduction in the distribution obligation for renewable fuels, have resulted in cheaper fuel prices at the pump. The price of electricity, on the other hand, continues to rise, with no relief in sight in the near future. Food prices have increased by 12% over the past year and some price increases are still to be expected.

Inflation in the prices of goods has accelerated to 5%, although this pace is expected to slow down as demand decreases and global bottlenecks in transportation and the availability of materials are solved.

The rise in the prices of services has remained under control so far. The moderate increases in rents, in particular, have kept service inflation in check even though the increase in intermediate costs has partially been transferred to prices. The trend in service prices going forward is largely dependent on the outcome of wage negotiations this autumn, changes in energy prices and the availability of labour.

We expect inflation to amount to 7% this year and to fall to 4.5% next year before returning to 2% in 2024.

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP, % y/y |

-2,2 |

3,0 |

2,5 |

0,0 |

1,5 |

|

Consumer prices, % y/y |

0,3 |

2,2 |

7,0 |

4,5 |

2,0 |

|

Unemployment rate, % |

7,8 |

7,6 |

6,7 |

7,2 |

7,5 |

|

Wages, % y/y |

2,0 |

2,4 |

2,3 |

3,1 |

2,8 |

|

Public sector surplus, % of GDP |

-5,5 |

-2,7 |

-0,8 |

-1,4 |

-1,4 |

|

Public sector debt, % of GDP |

74,8 |

72,3 |

68,4 |

67,6 |

65,8 |

|

ECB deposit interest rate (at year-end) |

-0,50 |

-0,50 |

2,00 |

2,25 |

1,75 |

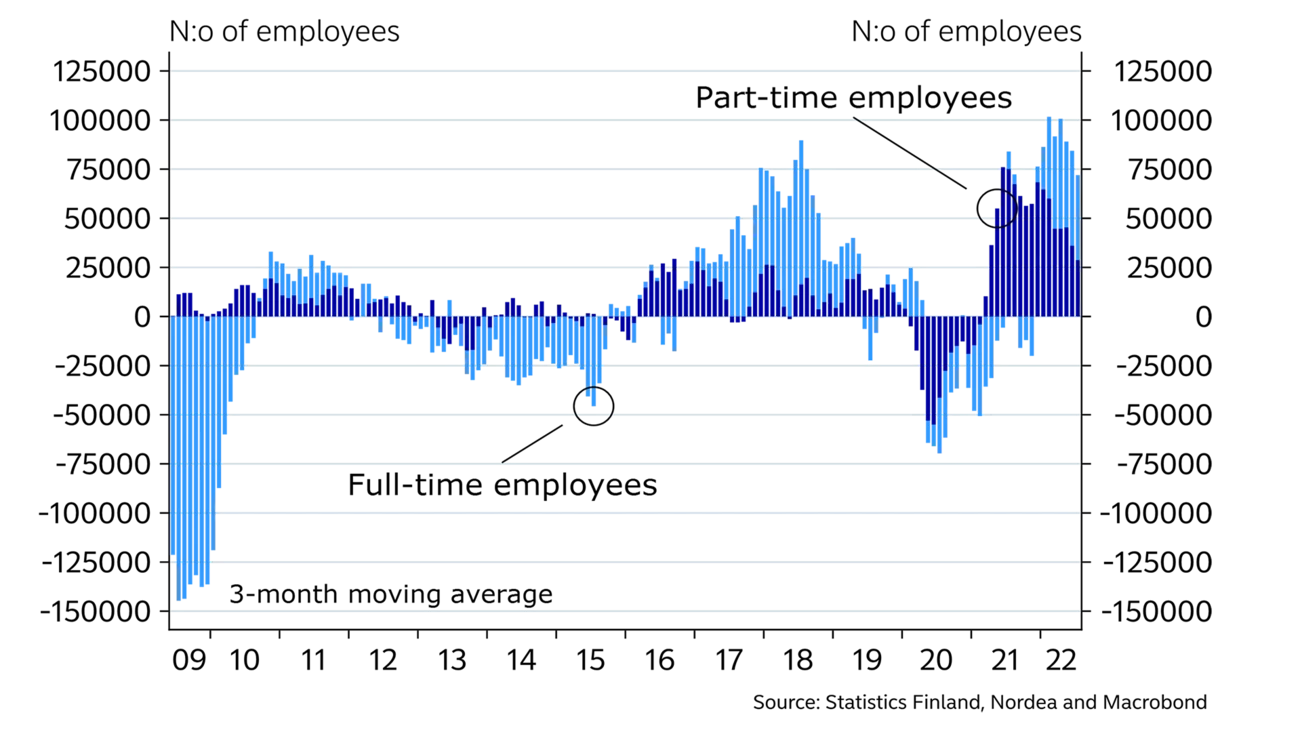

The labour market has performed exceptionally well this year. In July, there were 150,000 more people employed than two years ago. This year, the growth in employment has been divided equally among full-time and part-time employees. Growth in the total wages in the economy was around 6% in the first half of the year. The growth in employment is boosting domestic demand as more and more people are receiving earned income.

There are still more than 100,000 job vacancies available, although this number has not grown over the summer. Nearly all sectors are still reporting a shortage of skilled labour.

The clear slowdown in economic growth starting from the second half of the year will bring headwinds for the labour market as well. Indeed, employment growth is expected to stop, while unemployment is forecast to begin increasing slightly next year.

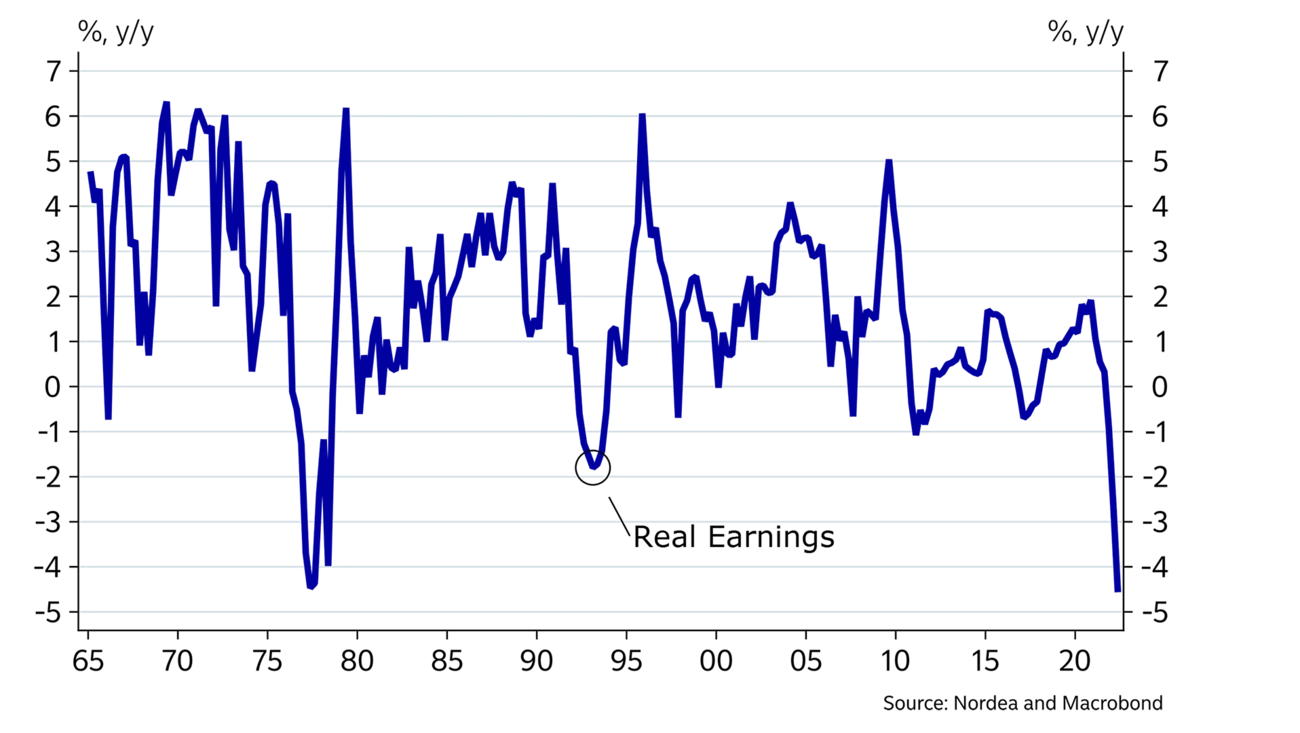

Wage growth has remained moderate despite the tightening labour market. Wages have increased by only 2% this year. The wage negotiations this autumn are expected to result in somewhat higher raises for next year. Therefore, we expect wages to rise by 3% in 2023.

Household consumption has normalised over the past year as COVID restrictions have been lifted. The consumption of services has markedly picked up, while the consumption of goods has slightly declined. Growth in consumption has been boosted by a better employment situation and a decrease in the savings rate.

As a result of inflation, real wages will decline by about 5% this year, which will begin to rein in consumption. Costlier food and energy will take up an increasingly larger share of household income, leaving less money to be spent on other forms of consumption.

Pensioners and recipients of other benefits will maintain their purchasing power since benefits were increased by 3.5% in August, and the next similar index raise will be applied in January.

Growth in private consumption is expected to stop during the second half of this year, as demand for services levels off after the summer and retail sales continue to decline as a result of dwindling purchasing power. Next year, consumption is expected to grow moderately as inflation slows down, albeit still remaining higher than wage growth.

The price of electricity continues to rise, with no relief in sight in the near future.

Manufactured goods have enjoyed plenty of demand this year, at high prices no less, as global prices for commodities and materials spiked following the start of the war in Ukraine. Now manufacturing demand has begun to slightly wane due to worries over global economic growth. Meanwhile, commodity prices have begun to drop, especially those of metals and timber, as the housing market’s slowdown starts to hurt the construction sector across the globe, especially in China.

Since the volume of goods exports from Finland decreased in the first half of the year, growth in the value of exports has relied on an increase in prices. The cessation of trade with Russia has also weakened exports. The outlook for goods exports is still moderate for the rest of the year, but order books are becoming thinner.

The energy crisis in Europe is also indirectly felt in Finnish manufacturing. Half of Finland’s exports are sold to EU countries, so a slowdown in the European economy will quickly have an impact on demand for Finnish exports. Although energy is more readily available in Finland than in many European countries due to its low reliance on natural gas, the high price of electricity could make some manufacturing operations unprofitable.

The outlook for service exports is significantly better, as the biggest destination for these, the US economy, continues to perform well. As for tourism exports, the lack of Russian and Asian tourists is having a negative impact. As a result, the tourism balance deficit has grown.

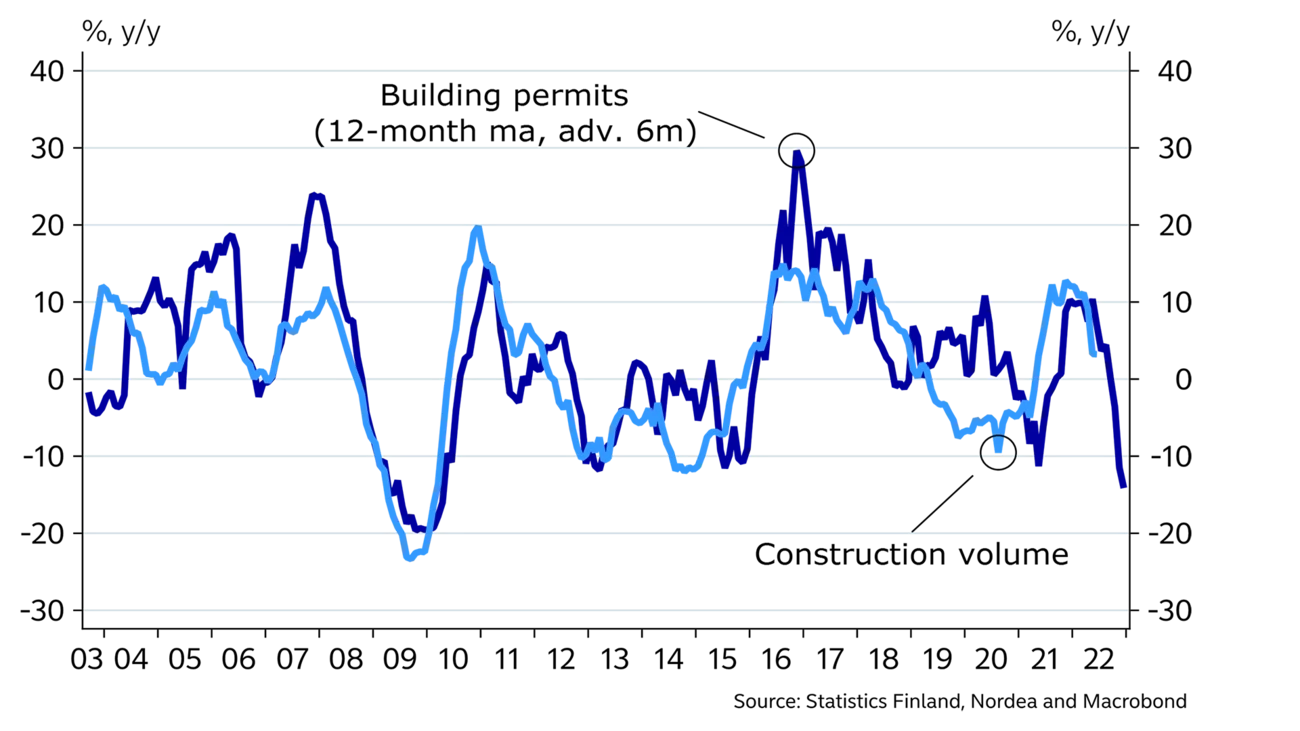

Investments have picked up again this year on the back of good economic development. Construction, in particular, performed strongly in the first half of the year thanks mainly to a solid housing market, although the construction of office and commercial premises also perked up.

However, the slowdown in housing sales since the spring is starting to be reflected in a decrease in the number of building permit applications. Construction is expected to slow down towards the end of the year, and next year, the construction volume will be clearly lower than this year. The drop in the prices of building materials could help relaunch some of the construction projects that were put on hold due to high costs.

The amount of industrial investments has grown this year due to a high capacity utilisation rate. It is unlikely that we will see a similar shortage in capacity next year as demand decreases. Investments will mostly be concentrated in the energy sector and on improving energy efficiency, where the incentives are currently great due to the high price of energy. We provide more insight into the manufacturing outlook in our theme article on page 27.

The number of housing sales dropped sharply from the record numbers seen in 2021. Housing sales have been dragged down by higher interest rates, the decline in consumer purchasing power and the increase in spending on services following the lifting of COVID restrictions.

The rise in housing prices has slowed down this year and it is expected to remain subdued through the end of the year and into next year as well, as rising interest rates and falling real wages constrain the amount of money people spend on housing. On the other hand, the employment rate has remained excellent, and therefore the growth in total wages will be the biggest driver of the housing market in the medium- to long term.

There is currently a glut of small apartments on the market because the rental market is underperforming. Meanwhile, housing charges and interest rates have gone up. Housing benefits will see a hefty increase at the beginning of next year due to inflation, which will channel more money into the rental market and possibly lead to an increase in rents, which have performed anaemically this year.

The government finances were balanced in the first half of the year. The public finances have improved significantly this year, as tax revenues have grown thanks to higher employment and increased consumption. Income tax revenues, in particular, have developed favourably. Meanwhile, the growth in public expenses has stopped as COVID subsidies have been discontinued and unemployment expenses have decreased significantly. Inflation-linked increases to social benefits and support given to energy bills will increase expenses this year and next.

The transfer of health care and social services to the wellbeing services counties at the start of next year will herald a big change for municipalities, where income and expenses will fall by more than half of their current level. Subsequently, the central government’s income and expenses will see a similar increase because the funding for the wellbeing services counties will be included in its budget. This will add a new constant expense to the government’s finances – one that will grow rapidly throughout the decade as the number of people aged 70 and over increases considerably.

This article first appeared in the Nordea Economic Outlook: Feeling the Squeeze, published on 7 September 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more