Johan Trocmé

Director of Nordea Thematics

Sivua ei ole saatavilla suomeksi

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleNordea’s annual treasury survey of Nordic and international companies finds that treasury departments have been quick to adapt to the challenging circumstances of the COVID-19 crisis. However, they are spending too much time on the wrong things. Automation is the answer, says Nordea’s Johan Trocmé.

Treasury departments have weathered the COVID-19 pandemic remarkably well, but there remains a large gap between how they are spending their time and how they want to be spending their time.

That was one of the key takeaways from Nordea’s annual treasury survey, which this year focused on the state of the treasury function before and after COVID-19.

“Treasuries have shown a quick and impressive ability to adapt, but they still face a long journey to get to where they want to be,” says Johan Trocmé, director of Nordea Thematics, who spearheads the annual survey. He adds that automation will play a key role in closing the gap.

The study is Nordea’s sixth consecutive survey and this year drew a record response from around 200 Nordic and international large corporates across a range of industries.

While the majority of respondents reported little to no reduction in working hours due to the pandemic, they also described a shift from minimal to a moderate amount of remote work going forward. Around 64% expect to work an average of one to two days per week remotely.

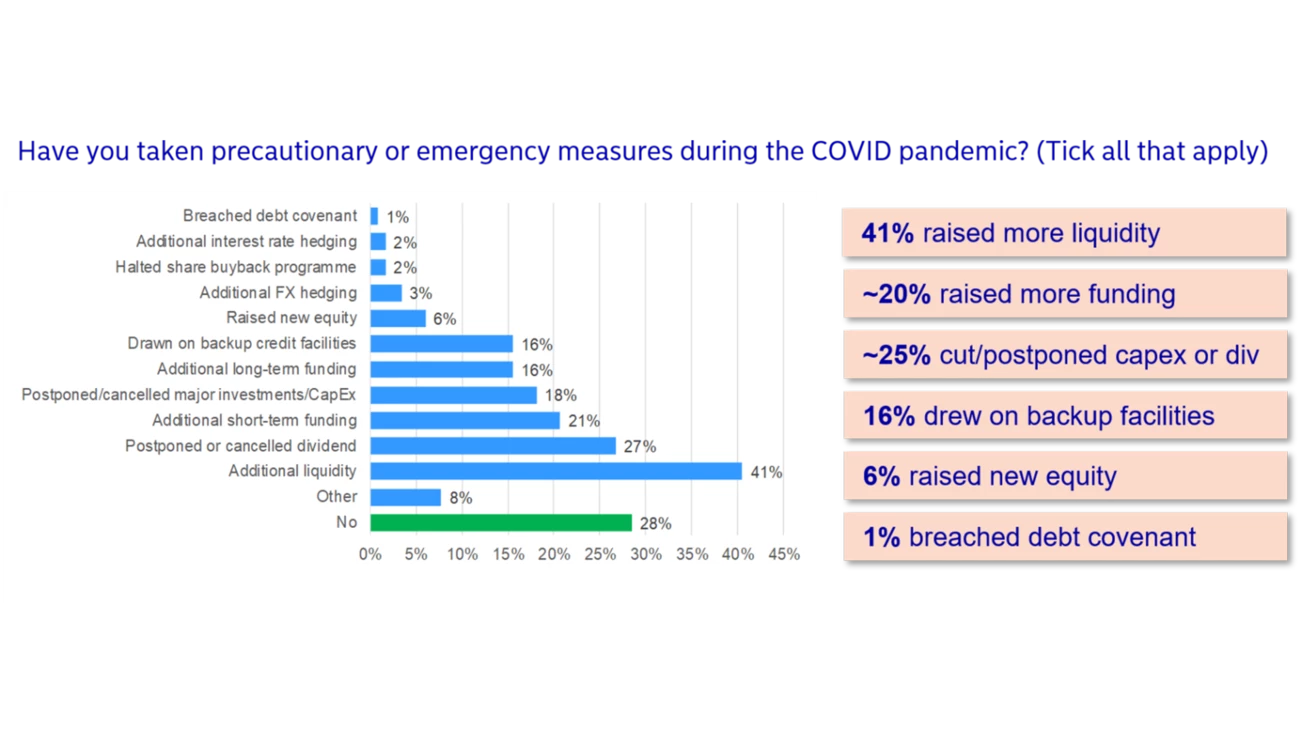

The survey also examined the pandemic’s impact on financial performance, asking companies about any precautionary or emergency measures taken. The results show that COVID-19 financial emergencies could have been much worse. Just over 40% of companies raised more liquidity; 20% raised more funding. A quarter (25%) either cut or postponed their capital expenditure or dividend, while 16% drew on backup facilities. Only 6% raised new equity, and a modest 1% breached a debt covenant.

“The overall conclusion from this is that financial policies work pretty well. They seem to have been well-configured to allow companies to stay on top of the very challenging circumstances faced during the pandemic,” Trocmé says.

One place some companies did make modifications was in the area of liquidity, with roughly one in 10 treasuries strengthening their liquidity provisions in the wake of the pandemic.

One common theme in Nordea’s annual survey has been treasuries’ desire to be a strategic partner to the business, specifically by playing a role in their company’s digital transformation.

While COVID-19 has accelerated the digitalisation of business models, treasuries are still not as involved in the digital transformation as they would like to be, the survey found. Only one in four reports being regularly involved in the digitalisation of the business, while nearly one-third remains on the sidelines.

The study’s authors conclude that one major contributing factor is treasury’s lack of visibility within the organisation.

“Treasury could benefit from raising its profile internally,” says Trocmé. While a minority (30%) are visible on the corporate intranet or present at kick-offs and conferences, a “shocking 16%” never promote themselves internally in any way, he notes.

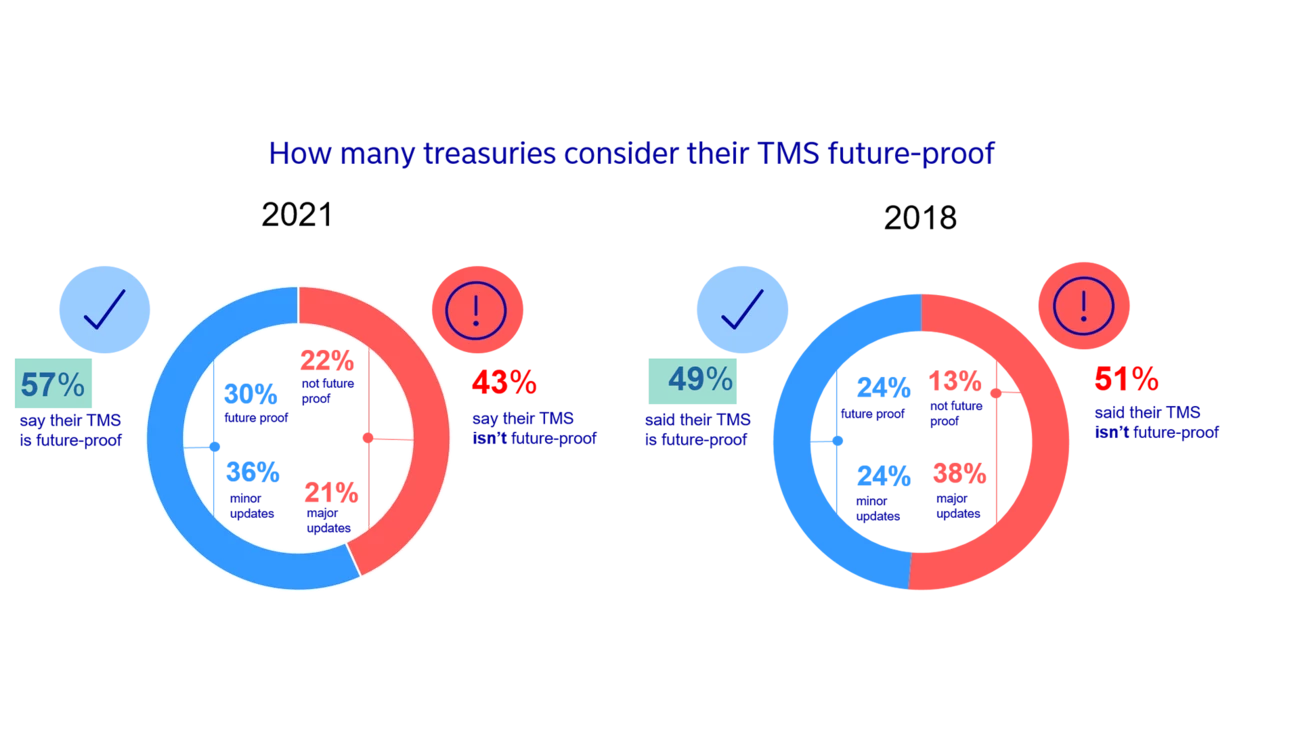

The wide-ranging survey also asked respondents about their use of treasury management systems (TMS). Around 57% of companies described their TMS as “future-proof,” compared to only 49% in Nordea’s 2018 survey, but a majority (62%) plan to upgrade or replace their TMS in the coming years.

“That’s likely due to a necessity for companies to be able to automate to the extent they need to,” says Trocmé.

While the pandemic made life extremely busy for treasury professionals, particularly in its early phases, it did not put a brake on treasury departments’ efforts to automate. A majority of treasuries expect their automation efforts to ramp up going forward, compared to pre-COVID-19.

“We can clearly see that automation efforts are increasing,” says Trocmé.

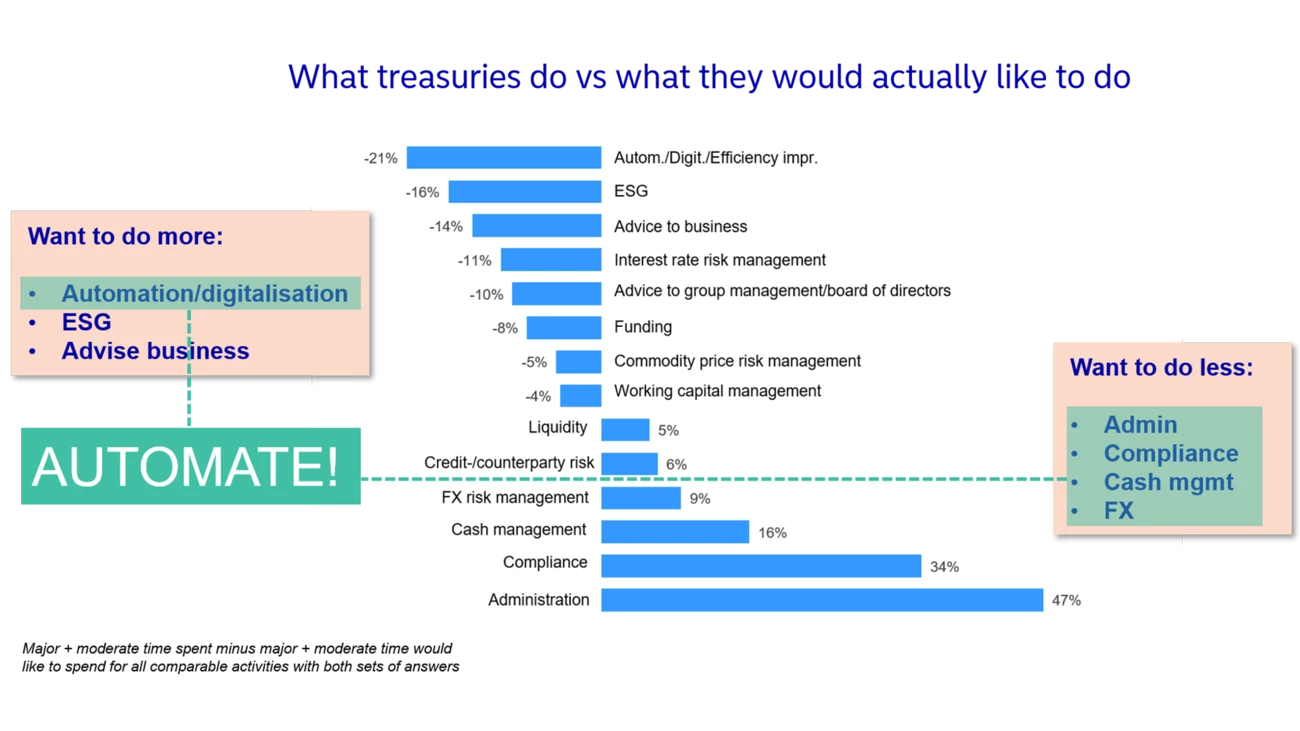

The study also examined how treasuries are spending their time – specifically what they would like to do more and less of. The top three areas they currently spend their time on come as no surprise: cash management; liquidity; and funding. Areas they want to spend their time on are: advising business; advising management; and automation.

What’s more, if you look at the biggest gaps between what they currently spend time on and what they want to spend time on, the survey reveals a desire to do less: administrative work, compliance, cash management and FX risk management. On the other hand, they want to do more: automation/digitalisation, ESG and advising the business.

Director of Nordea Thematics

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more