- Name:

- Ebba Ramel

- Title:

- Lead ESG Analyst at Nordea

Nordic real estate is advancing in developing energy-efficient and environmentally-friendly buildings, benefitting from green loans and “greeniums” in the green bond market. At the same time, challenges and opportunities arise in transforming the existing buildings into greener assets. Ebba Ramel and Mons Lunde, part of the ESG Sector Analysis Team at Nordea, outline how developing credible transition plans is not only reducing buildings’ environmental impact but also making them more attractive for investors and banks.

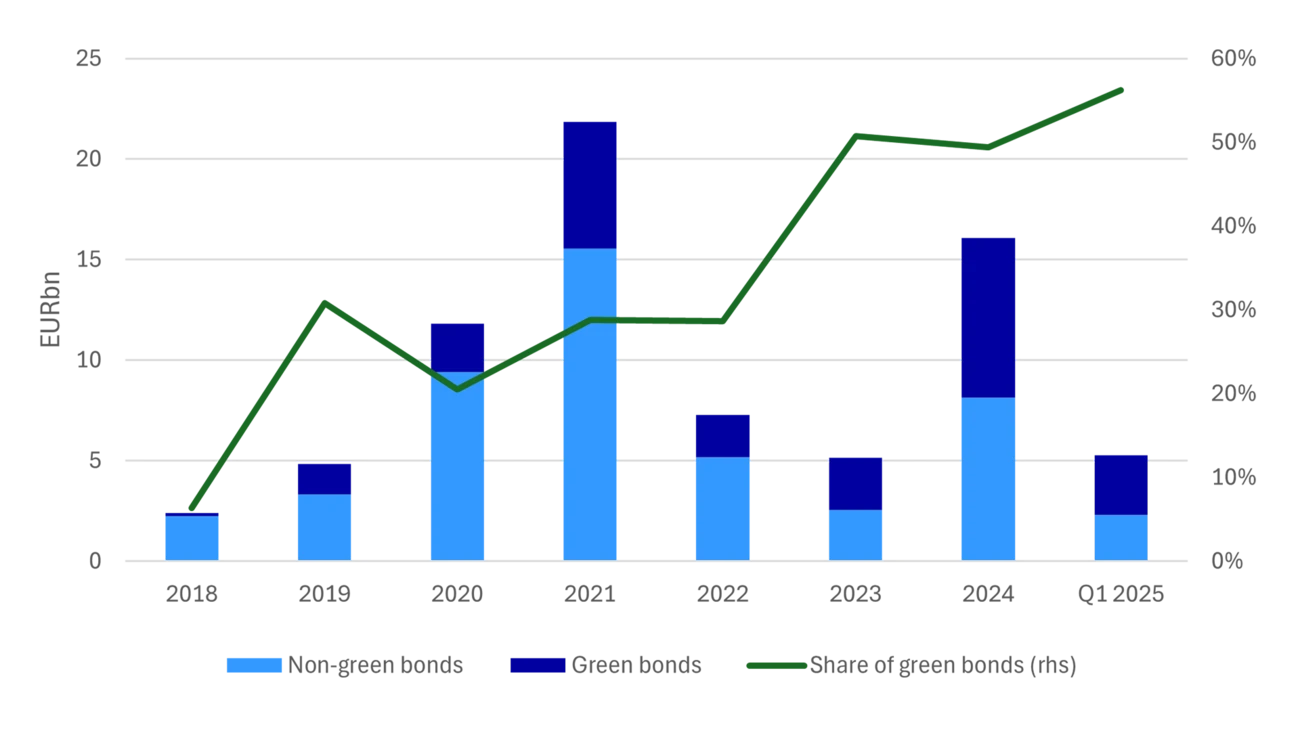

Throughout the sustainable finance market’s lifespan, the real estate sector has led in green finance. Green bonds are used to finance top-performing buildings and projects, primarily measured by energy use and environmental certification schemes. The introduction of green bonds has motivated improved reporting and contributed to increased data collection on environmental metrics, especially energy performance and carbon emissions from energy sources. In Q1 2025, the share of green bonds compared to non-green bonds from Nordic real estate companies was 56%, signaling continued trust in the green bond market as a tool for shifting capital towards green real estate.

Chart 1: Green bond and non-green bonds in volumes issued - Nordic real estate

Nordic real estate entities welcomed the introduction of the EU Taxonomy as a means to define and showcase the green share of their portfolios, further highlighting the important role of top energy performing buildings in mitigating climate change. In 2022, real estate was already the second-largest sector, after energy, reporting on Taxonomy-alignment (30% aligned turnover and 26% aligned capital expenditures).

With increasing pressure from regulators and other stakeholders to report sustainability data, the real estate sector will need to be even more specific about how it mitigates climate and energy-related risks, substantiating claims with underlying data. Despite recent delays and rollbacks in sustainability regulatory developments, the EU Taxonomy and certain concepts from the European Sustainability Reporting Standards (ESRS) will remain essential for the real estate sector. These frameworks will help showcase how impacts, risks and opportunities are managed while transitioning towards a low-carbon economy.

The real estate sector will need to be even more specific about how it mitigates climate and energy-related risks, substantiating claims with underlying data.

The Nordic real estate sector, a major energy consumer, benefits from access to relatively low-carbon energy grids, which can limit its climate footprint. However, with increased electrification and decarbonisation efforts in other sectors, competition for low-carbon electricity will intensify, making efficiency investments in existing buildings in the Nordics necessary.

The utility of the EU Taxonomy has faced scepticism for not providing clearer guidance on how buildings should transition towards being “greener” despite not fully meeting the strict “green” definition. Looking ahead to 2026, the revised Energy Performance of Buildings Directive’s implementation in member states will further emphasise the need for brown-to-green strategies within the sector. National building renovation plans will be presented with requirements on transforming the national stock of residential and non-residential buildings, both public and private, into highly energy-efficient and decarbonised building stock by 2050.

While some larger Nordic real estate companies have focused on transitioning their building stock for years, most real estate companies will need to develop transition plans, complementing their current green building focus, to reduce future financial risks from energy-inefficient buildings. Companies with credible, well-financed energy renovation transition plans will be more attractive to investors and banks, as they mitigate the risks of high operating costs and declining property market values.

Beyond energy performance, upstream emissions are expected to gain importance for Nordic real estate companies. This includes climate impact from building materials and construction activities. Currently, upstream greenhouse gas emissions are difficult to estimate due to data limitations. However, this is expected to change with the introduction of Zero Emissions standards in the revised Energy Performance of Buildings Directive, requiring all new buildings to comply by 2030.

Recent recommendations from the Platform on Sustainable Finance suggested adding a life cycle greenhouse gas threshold requirement and decarbonisation pathways for EU Taxonomy alignment. This further ensures that green buildings consider embodied emissions.

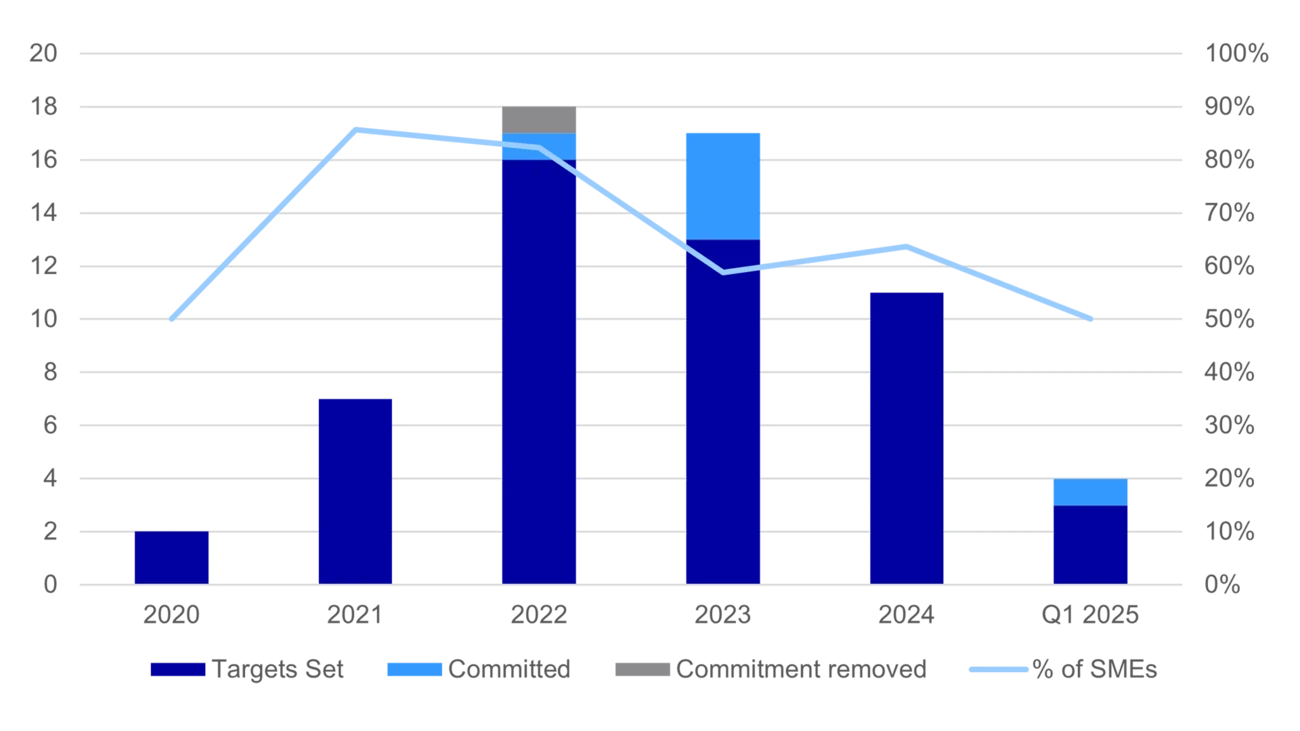

An increasing number of Nordic real estate companies are addressing their life cycle climate impact, as evidenced by the increased number of Science Based Targets that cover reporting and/or target setting for buildings’ life-cycle emissions. Ongoing initiatives to reduce emissions from the value chain include:

Chart 2: Science-based targets, commitments and removed targets from Nordic real estate

In conclusion, real estate owners that complement their green energy efficiency focus with energy transition and life cycle climate impact strategies are likely to be better positioned. These comprehensive approaches will help mitigate future risks while capitalising on opportunities that arise from responsible transition plans.

Nordea supports the climate transition of the real estate sector by offering a range of solutions and products to our large as well as small- and medium-sized corporate customers.

The revised EPBD entered into force in all EU countries on 28 May 2024 and includes rules that will play a part in achieving the objectives to reduce greenhouse gas emissions from the building sector by at least 60 percent by 2030 (compared to 2015) and decarbonising the sector to reach a zero-emission building stock by 2050. The aim is to increase the rate of renovation in the EU, particularly for the worst-performing buildings in each country.

The directive, which will be transposed into national law by 2026, poses requirements for member states including, but not limited to, the following areas:

Sector insights

The Nordic forestry sector plays a significant role in Europe’s green transition, but potentially faces complex sustainability challenges. Senior ESG Analyst Samuel Pendergraph explains how regulatory pressures within forestry are creating supply tensions for companies navigating within the EU and abroad.

Read more

Sector insights

The global shipping industry is navigating significant change, driven by environmental regulations, technological advancements and geopolitical challenges. This article lays out the key trends shaping the future of the sector and its sustainable transition.

Read more

Sector insights

As oceans warm and marine ecosystems face unprecedented threats, the aquaculture and fishing industries navigate a complex landscape of environmental challenges and evolving regulations. This article lays out the key factors shaping the sector’s sustainable transition.

Read more