Sustainable finance developments on the horizon for real estate

When it comes to future developments within sustainable finance and real estate, Ramel highlights the following five hot topics:

1. Reporting under the EU Taxonomy

The EU’s new classification system for green investments, the EU Taxonomy, is top-of-mind for many real estate companies, according to Ramel. 2022 is the first year companies will need to report on their eligibility, or whether they are covered by the Taxonomy, while next year they will need to report on their Taxonomy alignment.

“We have seen the first companies reporting now, some on eligibility, some also on alignment,” says Ramel.

She notes that one challenge is that the Taxonomy requires existing buildings to be in the top 15% of most energy-efficient buildings to be green. The question is: What is the top 15%? That varies by country, Ramel notes.

“That’s a challenge many companies are dealing with – finding the definition to be able to say they’re aligned with the Taxonomy,” she says.

2. Updates to frameworks

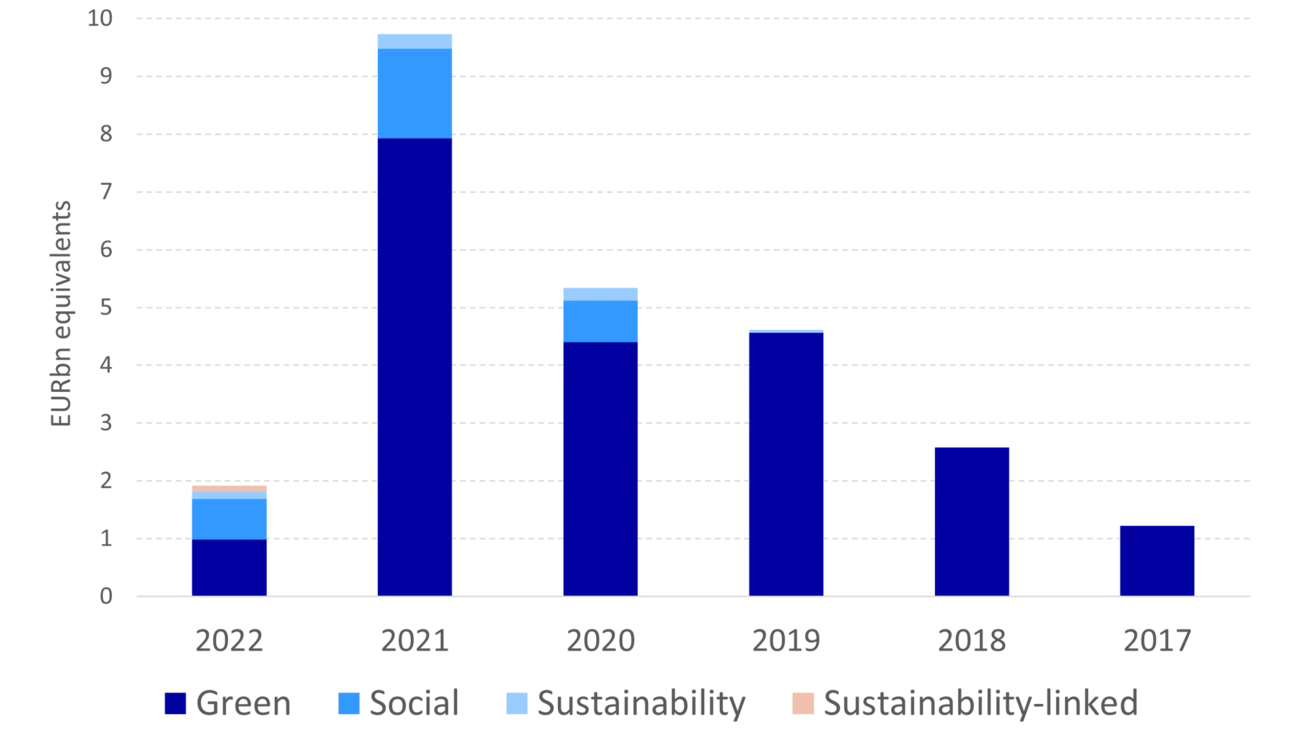

Many real estate companies produced their green bond frameworks around three years ago. That means it’s time for an update, given that many of the Nordic real estate companies have a second party opinion with a three-year expiration date.

“With many real estate companies now updating their frameworks, that leaves room to expand them to include new formats, such as social and sustainability-linked bonds,” says Ramel.

Nordic companies with a social use-of-proceeds format include SBB, Studentbostäder i Norden, Hemsö Fastigheter, Y-Foundation and Trianon.

3. Opportunities with sustainability-linked bonds

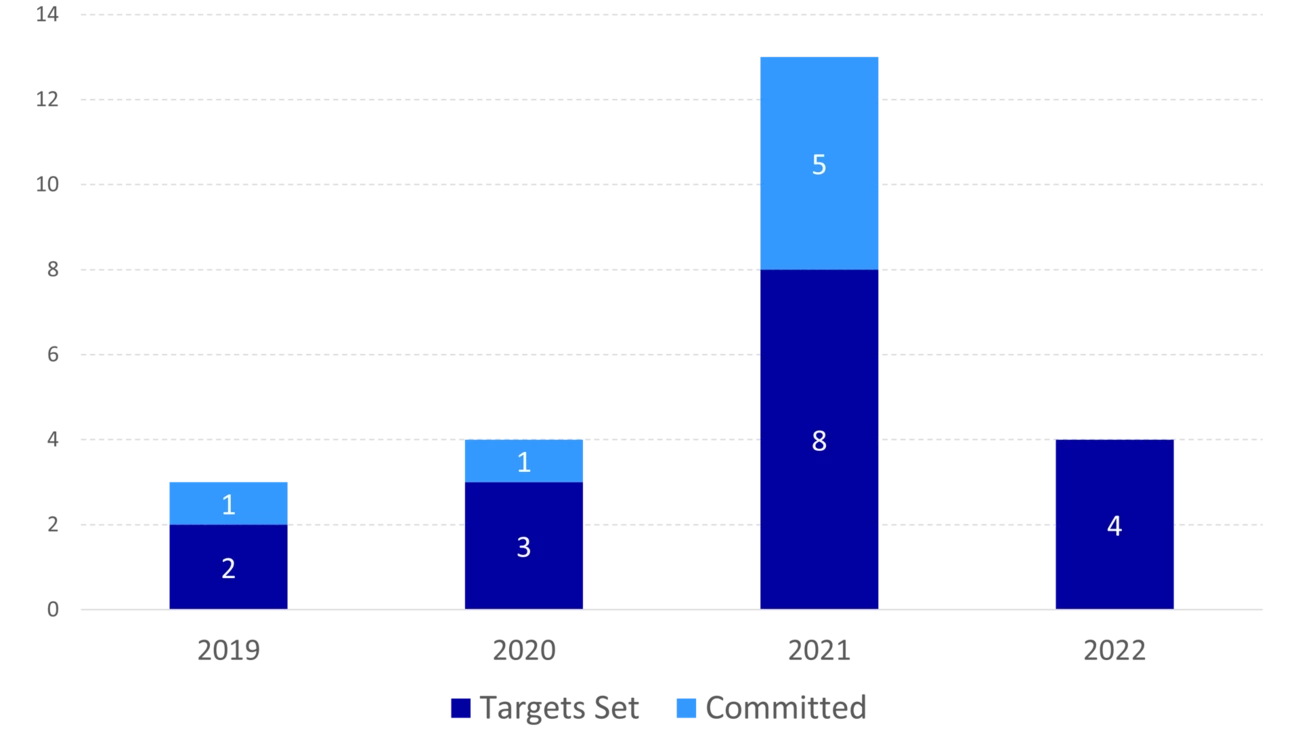

Real estate companies are often already working with climate targets, such as energy performance and emissions reduction goals. Those targets can work well with sustainability-linked bonds, in which the bond characteristics, such as the coupon rate, vary depending on whether the issuer meets set ESG targets.

“The sustainability-linked format can be a good format for companies to show investors their climate ambition, together with setting Science Based Targets,” says Ramel.

Atrium Ljungberg, for example, recently launched its framework for issuing sustainability-linked bonds.

4. Climate adaptation bonds

Given that companies are more focused on adapting to and becoming more resilient to climate change, we could see more climate adaptation bonds from real estate companies, according to Ramel.

“With costs related to climate adaptation likely to increase, we expect the bond category will be included in frameworks going forward,” she says.