- Name:

- Torbjörn Isaksson

- Title:

- Nordea Chief Analyst

The Swedish economy is showing some resilience. Especially the labour market has been stable. But there are still major challenges. Not least, households are struggling with high inflation and increasing interest rates with reduced spending as a result. Also exports will fall. Consequently, GDP will be weak for longer and unemployment will rise. The Riksbank will tighten further near term, but cut interest rates next year when inflation has normalised and economic conditions are weak.

The Swedish economy quickly bounced back after the pandemic. Already during Q1 2021 GDP had recovered and by the end of the year GDP was 5% higher than before the pandemic. Global trade developed similarly and exporters’ order books were booming.

During the pandemic Swedish households accumulated large financial buffers, leading to a boost in spending when restrictions were lifted. Add to this a very expansionary economic policy, which contributed to overheating the economy. The share of employed persons was higher than in several decades and labour shortage was at a record-high.

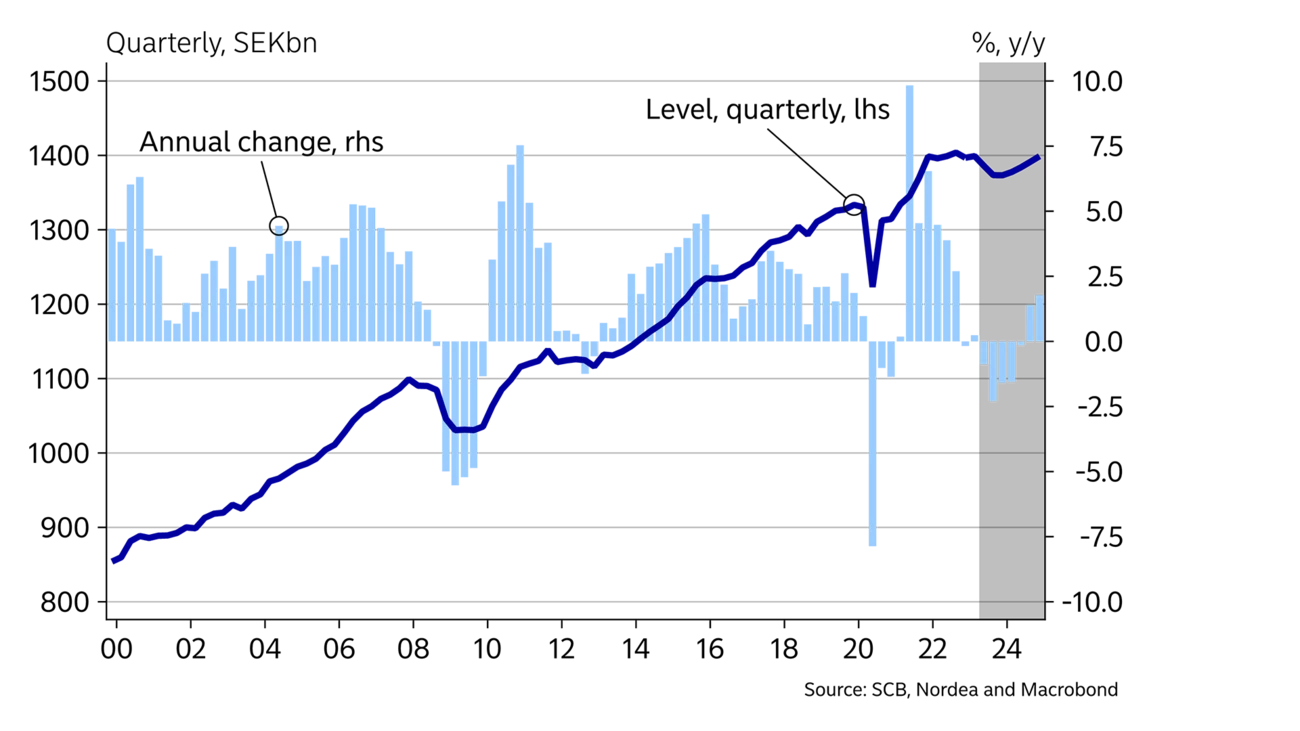

Households and companies were thus financially very strong ahead of 2022. A sign of this was the exceptional growth in money supply. The unusually strong basis and excessive financial balance sheets are important reasons why some areas of the economy have been more resilient than expected. During 2022, growth certainly came to a halt and GDP fell during Q4. But in early 2023, production and especially the labour market proved to be more resilient than expected.

Production has been maintained as businesses have executed the previously booming order books and households have spent their financial wealth to maintain consumption. At the same time, some sectors continuously need to hire manpower after two red-hot years with recruitment difficulties.

Some parts of the economy began to slow during last year. We fear that more industries will be affected and that unemployment will rise during 2023. The Riksbank and other central banks have hiked rates rapidly during the past year, with a lagged effect on the economy. Moreover, the Riksbank’s hiking cycle is not over yet. The timing is difficult to assess, but after a stable Q1, GDP will decrease again during coming quarters.

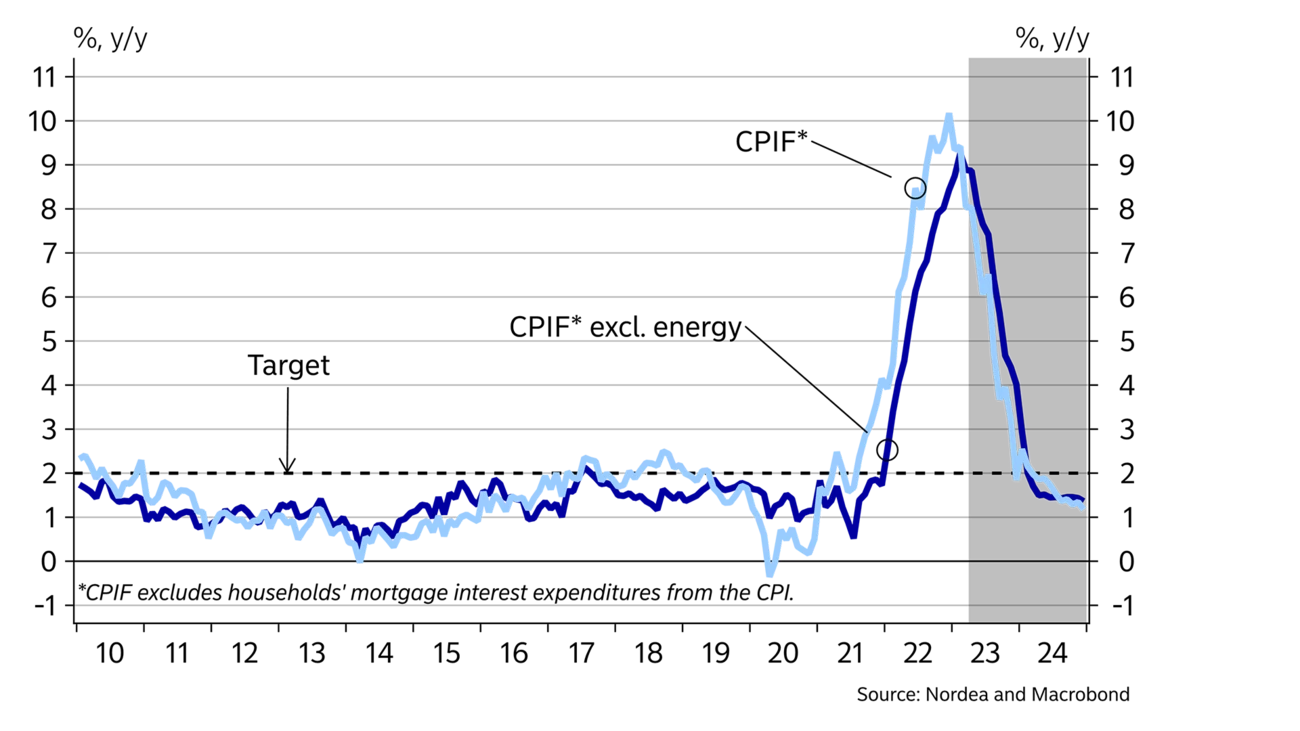

Inflation is expected to fall and land below the 2% target next year. Coupled with the weak economy, this will lead the Riksbank to lower interest rates in 2024. In spite of this, interest rates will still be significantly higher than before the pandemic. It will be a difficult and long process for households and businesses to get used to the higher interest rate level. The recovery will therefore be weak during 2024 and unemployment will continue to rise.

SWEDEN: MACROECONOMIC INDICATORS

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP (calendar adjusted), % y/y |

-2.4 |

5.3 |

2.7 |

-1.2 |

0.4 |

|

Underlying prices (CPIF), % y/y |

0.5 |

2.4 |

7.7 |

5.9 |

1.7 |

|

Unemployment (SPES), % |

8.5 |

8.8 |

7.5 |

7.5 |

8.4 |

|

Current account balance, % of GDP |

6.0 |

6.5 |

4.4 |

5.6 |

6.3 |

|

General gov. budget balance, % of GDP |

-2.8 |

0.0 |

0.7 |

0.1 |

-1.1 |

|

General gov. gross debt, % of GDP |

39.8 |

36.5 |

33.0 |

31.1 |

32.4 |

|

Monetary policy rate (end of period) |

0.00 |

0.00 |

2.50 |

3.75 |

2.00 |

|

EUR/SEK (end of period) |

10.04 |

10.30 |

11.12 |

11.30 |

10.80 |

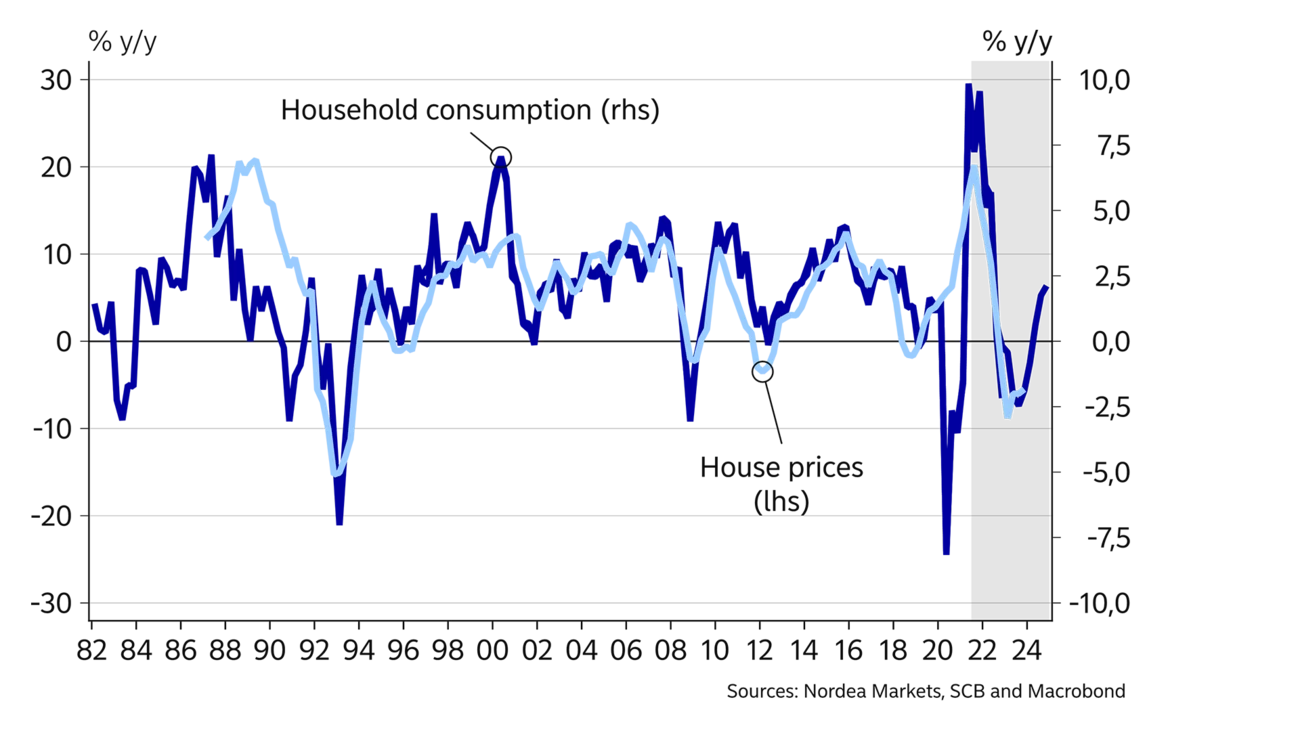

The most interest-sensitive parts of the economy reacted early to the Riksbank’s tightening moves. Housing prices went south and households tightened the purse strings.

Housing prices peaked in February 2022 and dropped by 14% up to and including March this year. We expect housing prices to decrease further. According to our forecast, housing prices will bottom out during H2 2023 and fall by a total of 20% since the peak in early 2022.

Fluctuations in housing prices often impact households’ spending and savings behaviour. The historical pattern is intact so far, as spending has decreased in line with housing prices. Household spending fell by nearly 2% in Q3 2022 and has continued to fall. The next step is that precautionary savings will go up, which is likely to happen later this year when households’ financial reserves and the labour market move into a weaker phase. We thus expect spending to decline further this year.

The high inflation is also a burden for households and a strong contributory reason why consumption volumes have gone down. However, in current prices spending has continued to increase over the past year. Here we see several risks as it is uncertain how long households can keep up with the high and persistently rising price level. Should inflation fall more than expected, the scope for spending should improve. Another possibility for a softer decline is that the previously very strong financial wealth lasts longer than expected.

The cooling housing market has led to a sharp decline in residential housing construction. We expect the downward trend in investments to continue this year. Our forecast for the number of housing starts will drop to 22,500 homes this year; a third of the level in 2021.

The direct effect on GDP of falling housing construction is nearly 1% point this year. Other investments are also expected to fall. After the spiralling trend in recent years, there is room for a sizeable drop. That goes for investments both in the industrial sector and the private services sector.

Households are expected to save up more this year.

Global trade slowed down significantly around the turn of the year. At the same time, Swedish exports have been stable. Goods exports, which were previously hampered by capacity restrictions and shortage of certain input goods, thus seem to have moved into sync with global demand. The previously full order books are thinning out as the order inflow is diminishing. Consequently, goods exports will fall later this year. Also the increasingly important services exports, which recorded incredible growth throughout last year, will flatten in the wake of lower global demand.

Public sector spending and investment are not cyclical buffers this year. Local authorities struggle with high costs and further ahead also lower income. The situation will improve somewhat in 2024. The pressure is mounting on economic and political decision-makers to support the economy. First and foremost the local authorities should be allocated public funds next year, according to our forecast. Public defence spending will also go up and stimulate growth in some areas. But for GDP and public finances the effects are small. High nominal economic growth and high energy prices will contribute to the state coffers. The budget is close to balancing in the forecast years and public debt (Maastricht) is still below 40% of GDP.

So far the labour market has been extremely resilient. The number of vacancies reached a new record in March, the number of redundancies is stable at low levels and employment has continued to rise.

However, later this year weaker domestic demand will have a more clear impact on the labour market. Employment will fall and unemployment rise to around 8.5% next year due to the combination of lower employment and population growth.

The benchmark, which is set by the parties within the industry, ended with a wage settlement of 7.4% over 24 months until March 2025. Much suggests that other sectors will follow the benchmark. The high inflation has eroded 10 years’ real wage increases. Falling real wages are likely a contributing factor to why employment has been surprisingly high as labour costs have fallen in relative terms. According to our forecast for wages and inflation, real wages will only recover slightly during the forecast period, which among other things will soften the fall in employment, but at the same time limit the scope for households to increase spending.

Low demand makes it more difficult to pass on increased costs to the consumers.

Inflation peaked at the end of 2022 and has since declined. But it is still far too high. Excluding energy, price increases have also been higher than expected. Prices for services, which are considered to reflect domestic cost pressures, have for example risen sharply. The Riksbank will thus continue to hike its key policy rate near term.

The inflation outlook is uncertain. But there is growing hope that the far too high inflation will fall. Thanks to lower energy prices, inflation has fallen over the past months. Lower energy prices also reduce the risk of second-round effects via production and transportation. In addition, global transport costs and commodity prices have fallen across the board, which curbs price increases of food and other goods. Moreover, wage increases are not a threat for the 2% target.

The SEK exchange rate has had a tough year. Recurring turbulence in the financial markets, soaring inflation and an uncertain outlook for both the economy and monetary policy have created an environment which has not favoured the SEK exchange rate. Some of these elements of uncertainty will stay put this year. The Swedish krona is thus still trading at weak levels against the euro, while some strengthening is expected against the US dollar, according to our forecast.

This article first appeared in the Nordea Economic Outlook: The Inflation Standoff, published on 9 May 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more