Investor demand inspires testing (once again) for green premiums

The increased interest from investors for green bonds during the last couple of years sparks the question: How do green bonds fare compared to non-green bonds? The dramatic growth in the green bond market has provided a critical mass of data points, with multiple examples of issuers with both green and non-green bonds outstanding.

Andreas Zsiga, Chief Analyst for Industrials and Utilities in Nordea Credit Research recently tackled the question of pricing in the green market versus the non-green market.

“We have seen indications that green bonds tend to have tighter spreads but have not previously seen a study on this. With the increased number of green bonds in the market from issuers with ordinary bonds issued as well, we saw an opportunity to examine this,” Zsiga says.

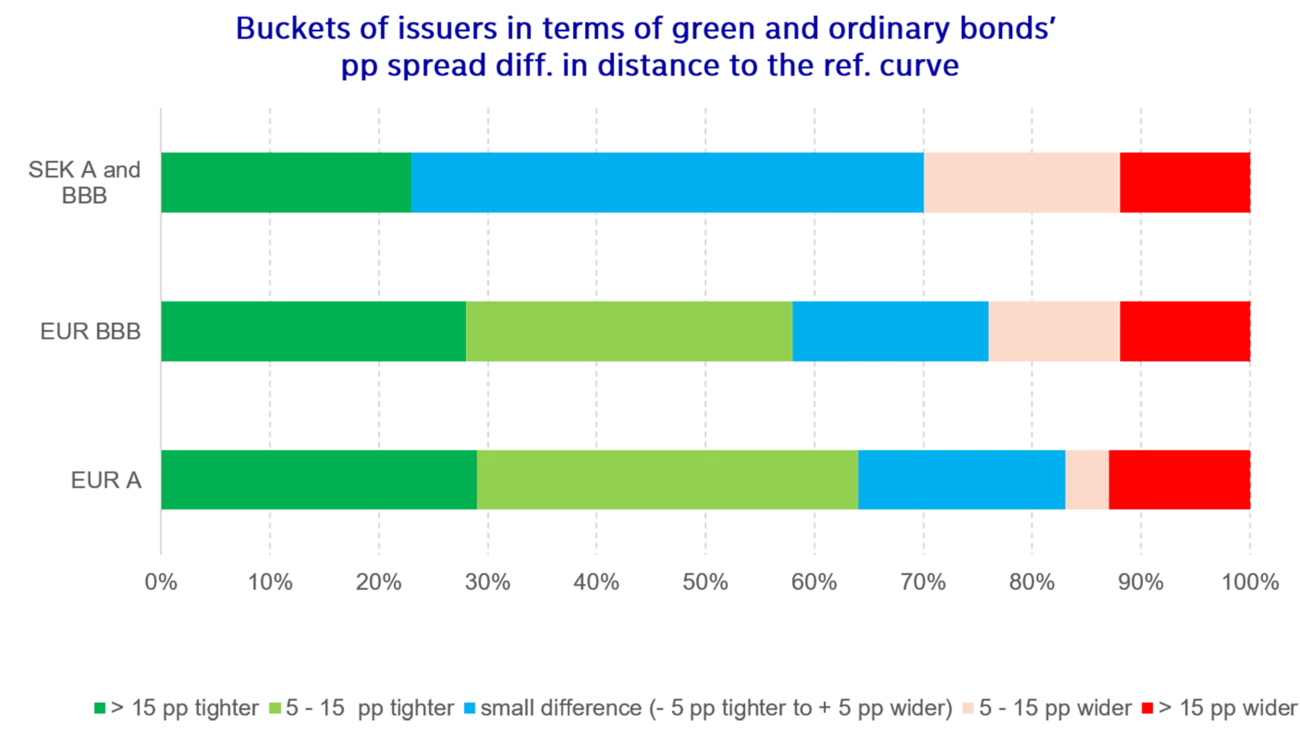

The report looks at secondary market spreads for corporate investment grade issuers with both green and non-green bonds outstanding, with comparable bond tenors. The study compares the existence of green bond premiums in three different groups: EUR bond issuers with a credit A rating, EUR bond issuers with a BBB credit rating and a sample of SEK issuers with an investment grade rating.