- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

Denne siden findes ikke på norsk

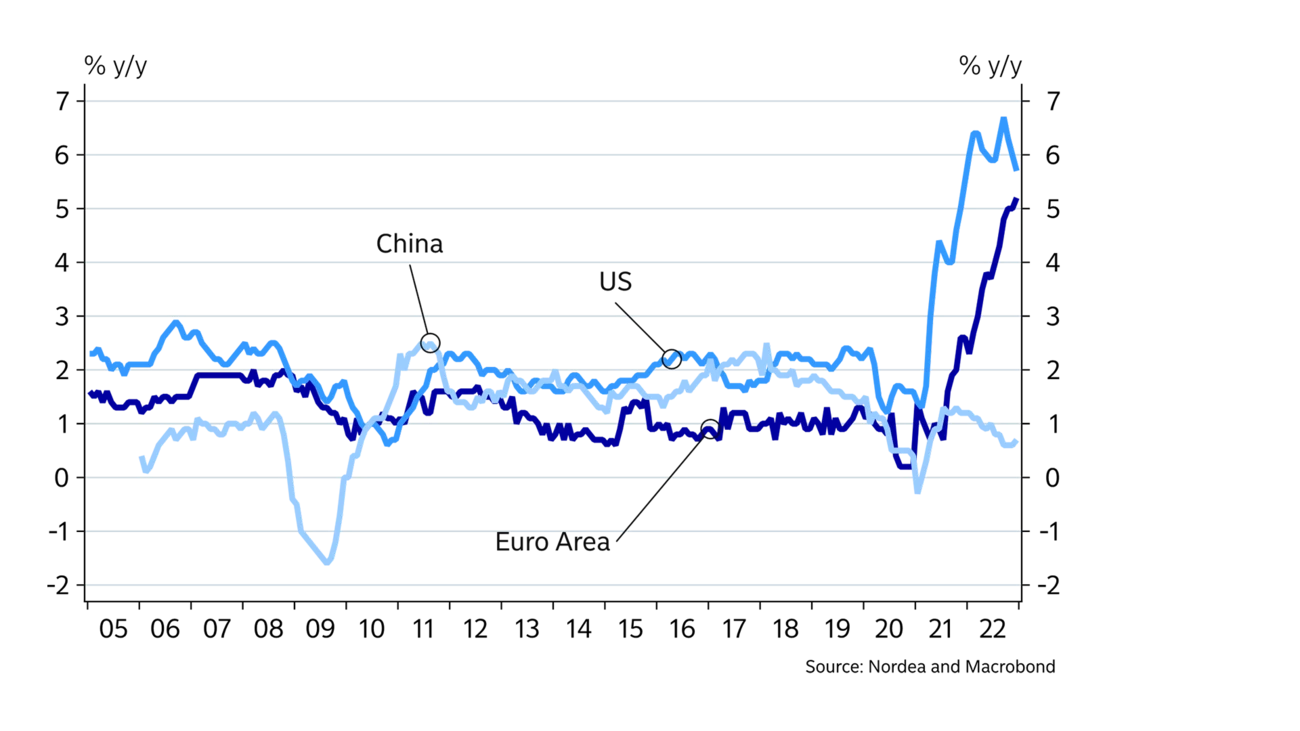

Bli værende på denne siden | Fortsett til en lignende side på norskGlobal growth is weak at the moment. However, there are signs that 2023 could uncork positive surprises, as mild weather has eased the energy crisis in Europe and China is set to rebound after ending its zero-COVID policy. From the financial markets’ perspective, one of the key questions is how easily inflation will come down in 2023.

Global growth slowed towards the end of 2022, and many countries may experience negative growth numbers during the winter. The main reason for the sluggish growth momentum is high inflation, which has resulted in weak household purchasing power and tighter financial conditions. However, there are signs that we could be approaching a turning point, where the global outlook could start to look brighter. In particular, inflationary pressures have started to decline, China’s outlook has improved due to the end of its zero-COVID policy, and the euro area has benefited from a mild winter, which has softened the negative impact of the energy crisis.

At the same time, the downside risks are also still elevated. Inflation continues to be clearly above central banks’ targets and a considerably tighter monetary policy could finally tip countries into a recession. The worst effect may be felt in the housing sector.

2022 was an extreme year for energy markets, especially in Europe where prices of natural gas and electricity reached unprecedented levels during the summer. However, mild weather and several measures taken by governments have shielded households and companies from the worst blow.

Europe’s energy situation will remain uncertain, but we expect overall energy prices to be lower in 2023 than the year before. The mild winter, high gas storage levels at the onset of 2023, improved efficiency in energy consumption, more LNG infrastructure and alternative power sources should mitigate the worst for gas and electricity prices ahead. Yet, China’s reopening complicates matters as it means Europe has to compete with Asia for LNG supplies. However, we believe there is somewhat more upside than downside for oil prices from today’s USD 85/barrel, in particular due to China’s reopening and OPEC’s desire for higher oil prices.

GDP growth slowed in the US last year as the strong post-pandemic rebound in consumption was over and tighter financial conditions sent construction activity into a steep decline. Growth is expected to continue to be slow in the coming quarters but recession fears may not materialise as the labour market continues to be strong, inflation is coming down and consumers are likely to further consume the excess savings that they accumulated during the pandemic. Moreover, companies hold a lot of cash and that together with Biden’s policy packages, the turnaround in globalisation, lack of skilled labour and increasing wages are expected to encourage fixed asset investments despite the tighter financial conditions.

China’s economic outlook improved significantly when the country decided to give up its tight zero-COVID policy. We expect economic activity and especially service consumption to pick up significantly in the coming weeks and months. Chinese households have accumulated significant excess savings during the lockdowns and we expect those to be partly consumed. Part of the savings could help to stabilise the downturn in the real estate sector where we expect the worst to be over soon, and another part will be spent outside the country as Chinese tourists resume travel to other countries.

In the longer run, however, political risks still loom over the Chinese business environment. There is a lot of uncertainty concerning China’s decision-making and President Xi’s role at the moment. While the October Party Congress continued to concentrate power in Xi’s hands, the sudden turnaround in the zero-COVID poli-cy illustrates just how quickly decisions can be made – in one direction or another.

Wage pressures have remained strong in the US and accelerated in the euro area.

One major obstacle for economic growth last year in the euro area was the energy crisis, which also contributed substantially to high inflation. Luckily, the winter has been exceptionally mild in Europe so far. Together with voluntary cuts in energy consumption both among households and corporates, this implies that gas storages are still full, and energy prices have been much lower than feared. As a result, the likelihood of the downside scenarios for the euro area has clearly declined.

In any case, growth momentum is weak at the moment. PMI readings were below 50 in the last quarter of 2022, indicating that many euro area countries are currently experiencing very low or even negative growth. We expect growth to return to positive territory rather quickly due to high wage increases, which together with fiscal stimulus and slower inflation will improve households’ situation. However, the uncertainty of the euro area outlook remains high. The challenges in the energy sector may continue next winter, which coupled with tight financial conditions implies that the investment environment is going to be difficult.

Inflation will slow down in the euro area and in the US in the first half of 2023. The main reason is energy, as the contribution of the oil price to annual inflation numbers is likely to turn negative. Also, broader global price pressures have continued to abate as supply chain problems have eased. In addition, many freight, food and raw material prices have normalised and the post-pandemic price pressures are over in certain sectors.

On the other hand, wage pressures have remained strong in the US and accelerated in the euro area. Those could keep broad inflationary pressures elevated, but it is good to keep in mind that the relationship between wages and inflation is often complex and the strength of demand will also define whether higher costs are passed on to final prices. There is thus a lot of uncertainty around future inflation paths and the magnitude of further monetary policy tightening required in many western economies. In China, price pressures remained weak throughout the pandemic, but we expect slightly more pressure now that the service sector development is anticipated to be strong.

|

Year |

World New |

World Old |

US New |

US Old |

Euro area New |

Euro area Old |

China New |

China Old |

|

2021 |

6.0 |

6.0 |

5.7 |

5.7 |

5.3 |

5.3 |

8.1 |

8.1 |

|

2022E |

3.4 |

3.1 |

1.9 |

2.0 |

3.3 |

3.0 |

3.0 |

3.0 |

|

2023E |

3.2 |

2.3 |

0.8 |

1.0 |

1.0 |

0.0 |

6.0 |

4.0 |

|

2024E |

2.7 |

2.6 |

1.3 |

1.5 |

1.0 |

1.0 |

4.0 |

4.0 |

|

Year |

EUR/USD |

EUR/GBP |

USD/JPY |

EUR/SEK |

ECB: Deposit rate |

Fed: Fed funds target rate |

US: 10Y benchmark yield |

Germany: 10Y benchmark yield |

|

2021 |

1.13 |

0.84 |

115.10 |

10.29 |

-0.50 |

0.25 |

1.52 |

-0.18 |

|

2022 |

1.07 |

0.89 |

131.93 |

11.11 |

2.00 |

4.50 |

3.93 |

2.54 |

|

2023E |

1.15 |

0.90 |

118.00 |

10.90 |

3.25 |

5.25 |

4.00 |

2.40 |

|

2024E |

1.17 |

0.88 |

115.00 |

10.50 |

2.50 |

4.25 |

4.00 |

2.15 |

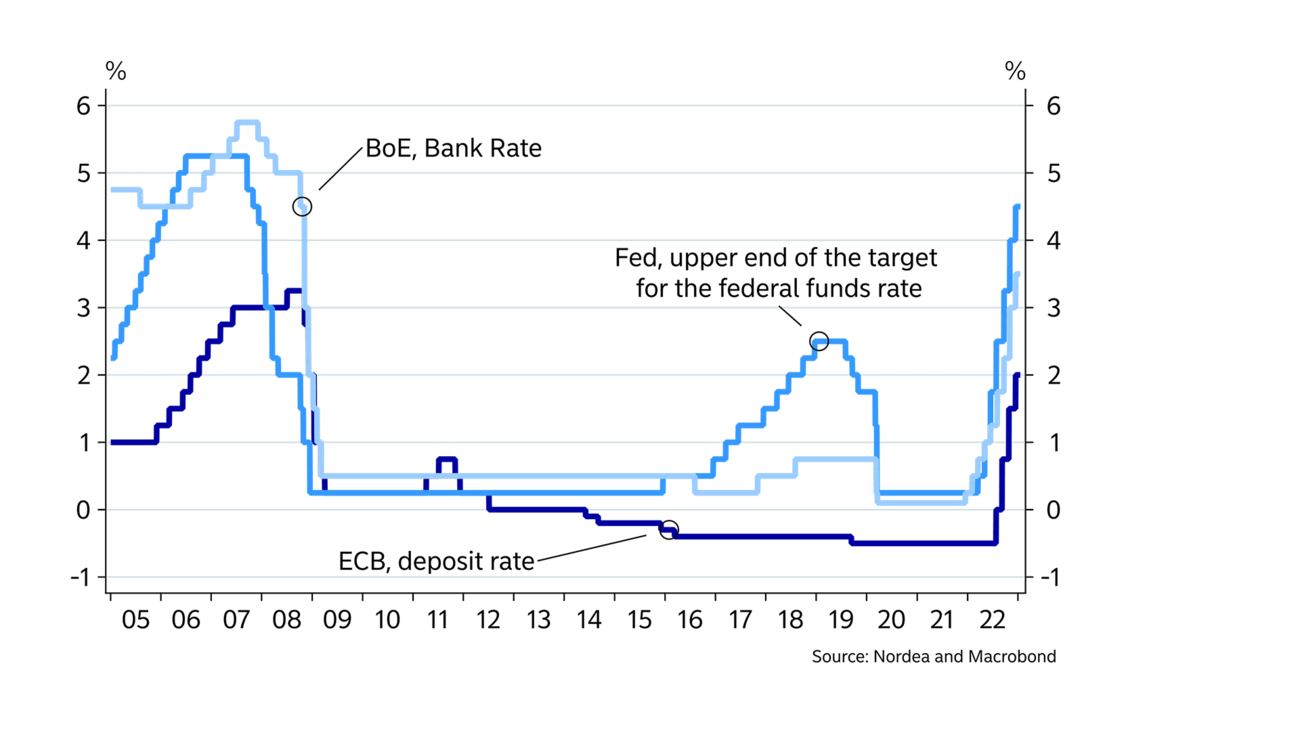

Even though major central banks have slowed down the pace of rate hikes, more work remains. In fact, the ECB signalled that even after 2.5 percentage points of rate hikes, rates still need to rise significantly. The Fed is probably already closer to its terminal rate, but we think it will raise rates to above 5% in the first half of this year and keep them there at least well into 2024.

Peaks in headline inflation may be behind us, but the tight labour markets and elevated core inflation readings will keep central banks on a tightening path. In fact, in the euro area, core inflation has continued to rise, hitting a new euro area record of over 5% in December. The ECB has emphasised that it has more work to do compared to the Fed and it is too early to say how high rates will need to go. So far, the euro area economy has weathered the high energy prices and tightening financing conditions rather well, which also means the ECB needs to tighten its policy further if it wants to cool down the hot labour markets.

Longer US yields peaked last October, and even though we see some upside from current levels, those peaks may not be revisited. The direction of global yields is important for euro area yields as well. However, since the ECB is behind the Fed in the tightening cycle, net bond issuance will balloon again this year, and the ECB will start to reduce its bond holdings in March, euro area yields may well peak much later than US equivalents.

Uncertainty remains elevated. More clarity on the peak for short rates will likely accelerate the pricing of rate cuts further out and push longer yields lower. However, for now, central banks remain in a hawkish mode and there are clear risks that rate hikes will continue for longer, with rates reaching higher levels than currently estimated.

The USD strengthened strongly against G10 currencies during 2022. Looking ahead, we see a weaker USD. The reopening of China should underpin global economic activity and thus support risk sentiment, providing less tailwind for safe-haven currencies such as the USD.

Moreover, we expect USD-G10 rate differentials to move broadly sideways and even diminish (in particular vs the JPY), which argues for a weaker USD ahead. The wild card for the dollar will be the likelihood of a global recession over the next couple of years. A recession will lead to risk-off mood, which will favour the USD. Moreover, while Europe will avoid an energy recession this winter, the situation is not yet fully in the clear for upcoming winters. Still, we believe global factors are in favour of a weaker USD against the EUR and see EURUSD at 1.15 by year-end 2023.

Looking at the other G10 currencies, China’s reopening and other governments’ investments will support commodity prices ahead, which should favour commodity-exposed, risk-sensitive currencies such as the CAD, AUD, NZD and NOK. These currencies should do especially well if the calls for a global recession do not materialise. However, economic activity will likely be dampened due to higher rates, and in turn that means downside risks are high for the global economy. That would not only favour the USD, but also safe-haven currencies such as the CHF and in particular the JPY, which we expect will also benefit from a normalisation of BoJ monetary policy this year. The latter could make the JPY the best performing G10 currency this year.

This article first appeared in the Nordea Economic Outlook: The Balancing Act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more