The goal: predictability

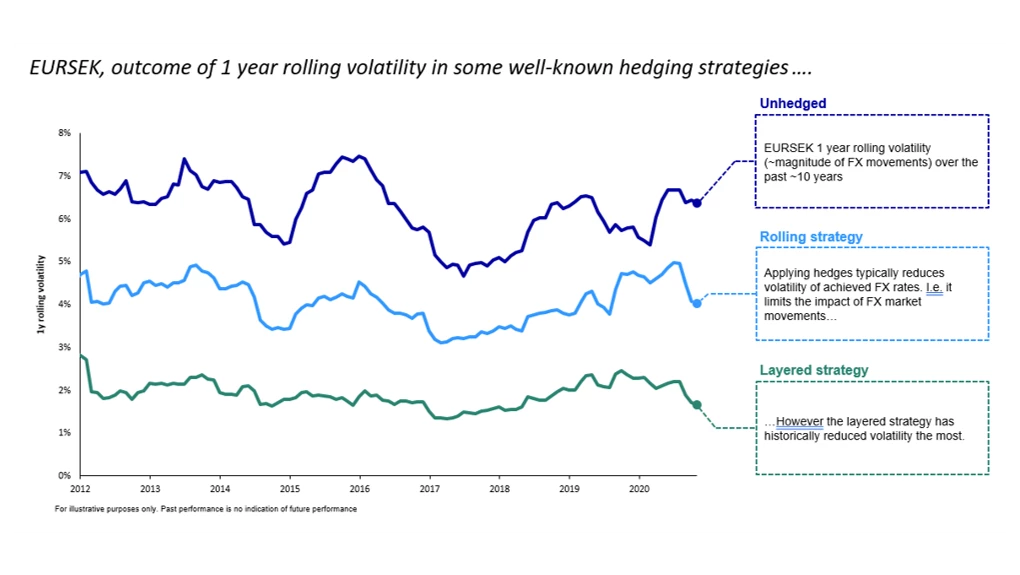

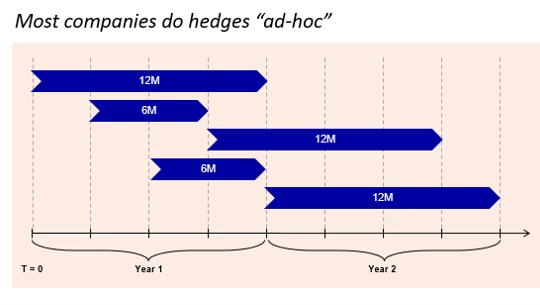

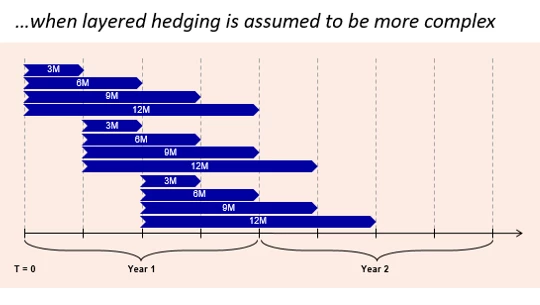

Soon after joining Newgen in 2019, Hunyadi engaged Nordea’s FX team to conduct an FX risk analysis on the company, which showed that the company was highly sensitive to FX fluctuations. Nordea recommended implementing a so-called “layered” hedging program, where hedge ratios are built up over time.

Under the strategy, Newgen calculates the amount of each currency it will likely need in the future. For the three months to come, it hedges 75% of those payments; for three to six months out, 50%; and for six to nine months out, 25%. As the months pass, new hedging contracts are continuously added.

“With Nordea’s help, we managed to achieve our purpose of having a more predictable and smooth level of exchange rate through hedging contracts. We were lucky to enter the period of high FX volatility in the spring with our hedges in place,” says Hunyadi.

Not all small to mid-size companies in the Nordics have been so lucky, according to a recent study by Nordea, which found that around almost half of such companies take no measures to reduce their currency risk. What’s more, roughly over half report having taken hits from currency fluctuations during this volatile year.

Asked what advice he would give to other companies trying to navigate these volatile times, Hunyadi says it’s undoubtedly to implement a similar hedging strategy to Newgen’s: “Not to earn more money, but to control the risks,” he says.