- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

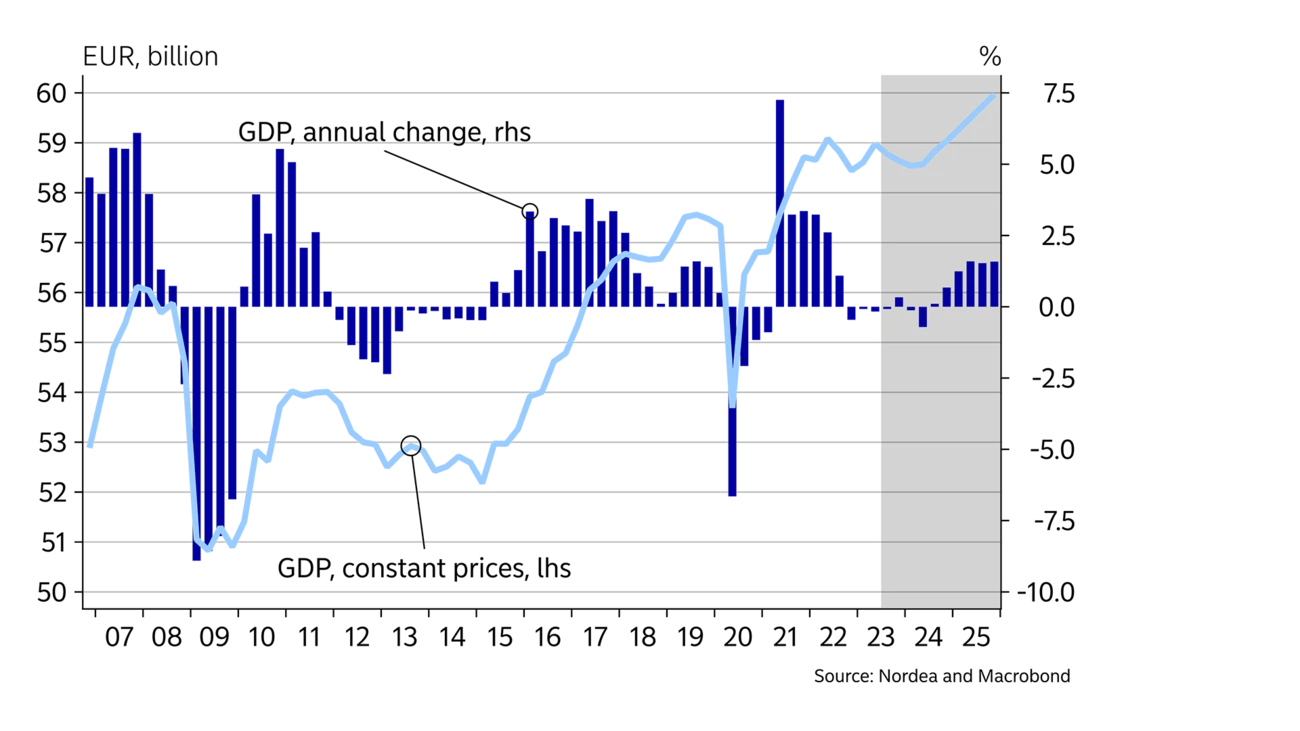

Economic growth was healthy in the first half of the year, but the outlook going forward is clearly weaker. Higher interest rates will continue to put pressure on consumers, and residential construction. Demand for exports has also deteriorated as global economic growth has slowed down. However, investments in the green transition act as drivers of future growth.

The Finnish economy grew during the first half of the year on the back of growth in service demand. Meanwhile, the net exports figure improved because imports slowed down even more than exports. This was due to lower consumption of goods and a decreased need for imported electricity thanks to growth in domestic output. Meanwhile, the slowdown in construction has already begun to curb investment.

The employment situation remained good in the first half of the year, wages were raised over the summer and inflation fell thanks to lower energy prices. All of these factors have gradually begun to improve consumer purchasing power, which is nonetheless still weak. In fact, households have continued to spend their savings to maintain their lifestyle. The recovery in household real income is expected to continue, but at the same time an uptick in unemployment will limit growth.

The economic outlook for the rest of the year and 2024 is still challenging, despite the good first half of the year. The slump in the housing market is causing a clear slowdown in residential construction. Similarly, order backlogs in the manufacturing sector have begun to dwindle and export prices are falling due to sluggish global demand, which is also weighing on the growth outlook for next year.

We reiterate our zero economic growth outlook for this year, and are lowering our growth forecast for next year to 0% due to a deteriorated outlook for manufacturing and construction. For 2025, we forecast economic growth of 1.5%.

The growth in domestic energy generation, the new investment opportunities offered by clean energy and a recovery in consumer purchasing power will brighten the long-term outlook for the economy.

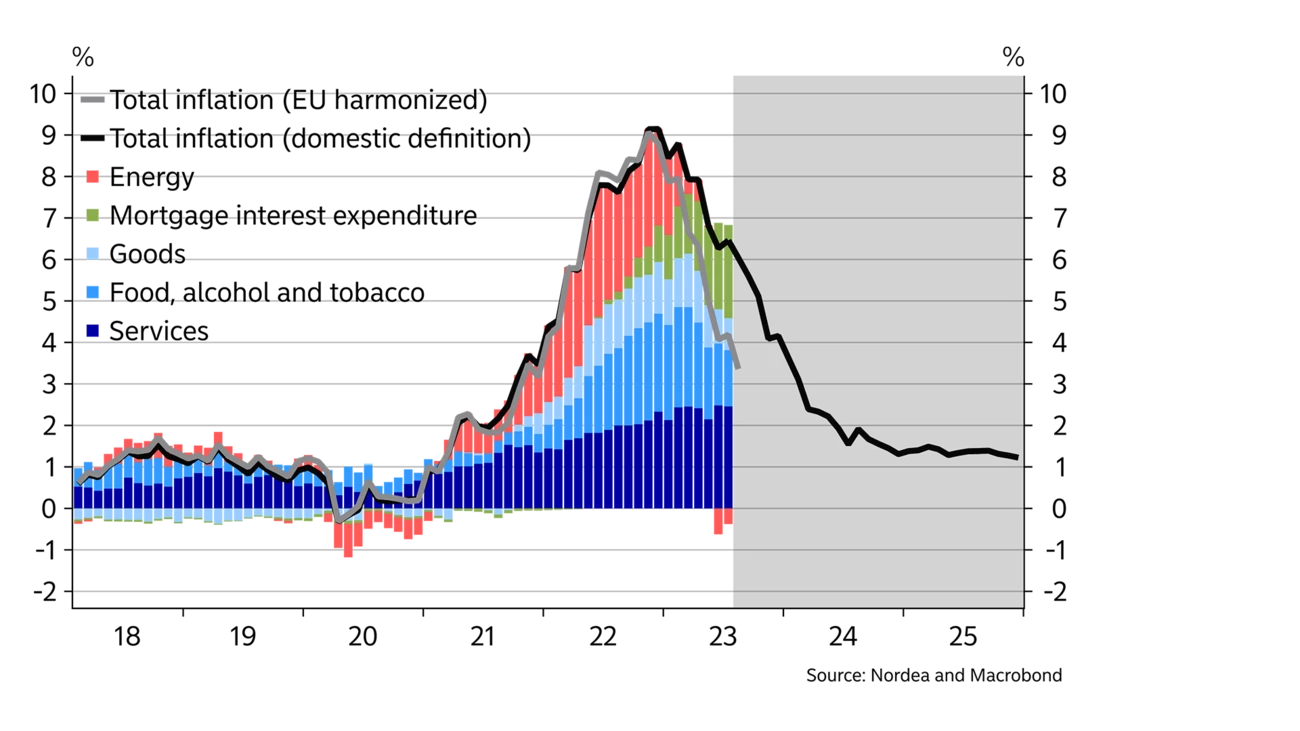

The rise in consumer prices slowed down considerably in the first half of the year, thanks to a drop in energy prices. In July, the annual change in the consumer price index was 6.5%, compared to more than 9% at the end of last year. Using the EU’s Harmonised Index of Consumer Prices, inflation in Finland was 3.4% in August, but this figure doesn’t include the effect of loan interest on prices.

Inflation is expected to continue to decline for the rest of the year, and in 2024 full-year inflation is forecast to be as little as approximately 2%. The decrease in the cost of transportation, industrial products and energy, combined with weakening demand, will curb the rise in the prices of goods and food.

Increases in the prices of services, on the other hand, continue to be high at about 5%. Wage growth and strong demand for services are maintaining the rise in service prices.

The increase in the average mortgage interest rate will also have a large effect on the Finnish inflation indicator this year. Next year, the impact of interest rises on inflation will decrease considerably. Meanwhile, the drop in house prices has reduced living expenses.

| 2022 | 2023E | 2024E | 2025E | |

| Real GDP, % y/y | 1.6 | 0.0 | 0.0 | 1.5 |

| Consumer prices, % y/y | 7.1 | 6.4 | 2.1 | 1.4 |

| Unemployment rate, % | 6.8 | 7.2 | 8.0 | 7.4 |

| Wages, % y/y | 2.4 | 4.0 | 3.5 | 3.0 |

| Public sector surplus, % of GDP | -0.9 | -1.2 | -2.2 | -1.8 |

| Public sector debt, % of GDP | 73.0 | 73.4 | 75.9 | 76.9 |

| ECB deposit interest rate (at year-end) | 2.00 | 3.75 | 3.00 | 2.00 |

Household spending has been lacklustre since last autumn, as inflation and the rise in interest rates have eroded consumer purchasing power. However, the consumption of services has continued to grow while the goods trade has contracted. The strong performance of the service sector has kept up economic growth. The value added in Finland for every euro spent on services is higher than that spent on goods consumption because a smaller percentage of the value goes abroad through imports.

The weak purchasing power of households is gradually turning to slow growth due to falling inflation and the wage increases that took place in the summer. Wages will rise by about 3% on average this year, in addition to which workers were paid various one-off bonuses depending on the sector that amounted to around 1% of the total salaries and wages. Thanks to these increases, total salaries and wages grew rapidly over the summer.

Despite a slight improvement in purchasing power, households will still be forced to spend their savings to maintain their consumption. Mortgage holders in particular have seen their expenses rise more than the rest, because the interest on their loans has increased in line with reference rates.

The employment situation remained robust in the first half of the year, partly boosted by high consumption of services. The latest observations from the labour market, however, indicate that the unemployment rate has exceeded 7% and that the employment rate has declined. The number of job vacancies has also begun to decrease markedly.

We expect unemployment to continue rising slowly for the remainder of this year. The slowdown in construction and manufacturing, in particular, will begin to increase temporary layoffs and unemployment.

The uptick in unemployment is expected to be moderate, however, and the unemployment rate is forecast to rise to 8%.

Consumer purchasing power has begun to recover.

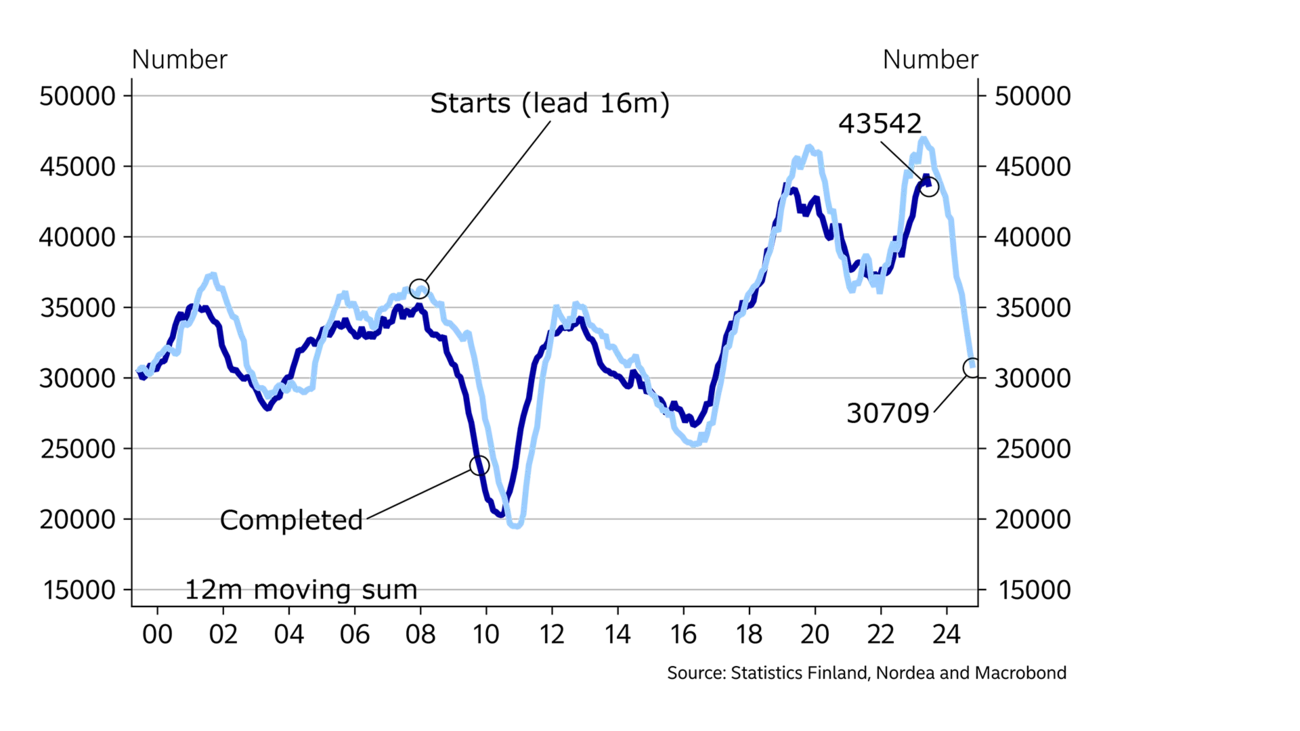

House sales have been subdued since the second half of last year. Higher interest rates, the drop in house prices and the increase in other living costs have made home buyers consider their purchasing decisions for longer than before. Property investors have also stopped buying apartments.

The slump in house sales has lengthened selling times especially in growth centres. The increase in selling times can be attributed to weaker demand as well as to an increase in supply, as plenty of new apartments are still being completed. The high number of rental apartments built in recent years and the decreased interest of property investors has weakened demand for small apartments in particular.

Housing prices have decreased across Finland by 8% year-on-year. However, we believe that most of the decline in housing prices has already occurred. In the Greater Helsinki Area, the housing supply currently outstrips demand, which is why we expect prices there to drop by a few more per cent.

Housing sales are expected to pick up in the second half of this year as the rise in interest rates slows down and housing prices stop declining. That said, the oversupply in housing is expected to continue next year until the stock of unsold new homes is off the market.

With house sales still very sluggish, the number of new residential construction starts has fallen by 25% year-on-year, signalling that construction will contract sharply this year and next as ongoing projects are completed. The number of apartments to be completed next year will be as much as a third lower than this year.

The stock of unsold new homes has grown considerably, and new construction starts are not expected to begin growing again until late 2024. The slowdown has been more moderate in non-residential construction. Renovation has picked up as new construction has sagged, and this is maintaining activity in the sector.

Investments in machinery and equipment have held up better than construction, but dwindling manufacturing demand will decrease these investments, too. Over the longer term, the investment environment in Finland has become more attractive due to clean power being readily available, which will provide opportunities for many green investments. We discuss the outlook for investments in the green transition in our theme article ''Investing in the green transition in Finland''.

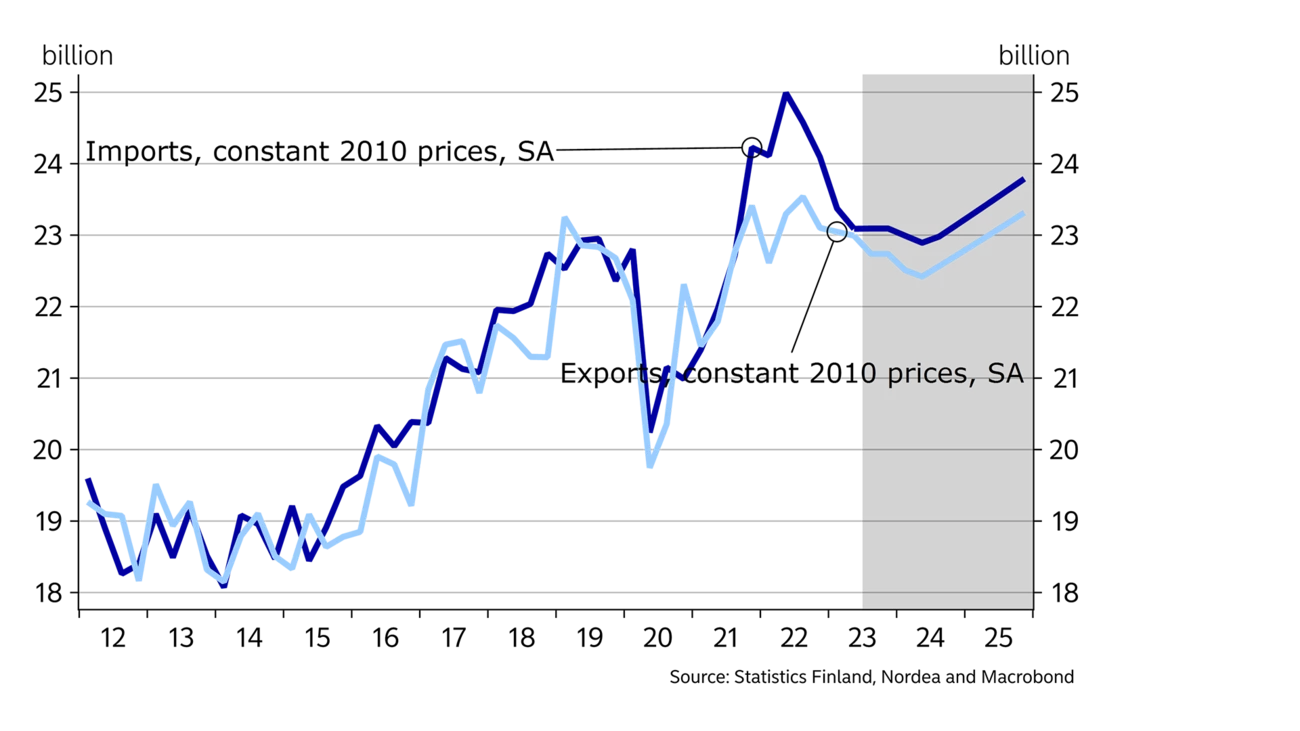

The flow of new orders in the manufacturing sector has begun to dry up and the order backlog has shrunk, presaging a contraction in goods exports and, consequently, manufacturing output. The economic woes of Finland’s key export partners, namely Sweden and Germany, are hurting Finland’s exports. Moreover, export prices have begun to fall, which will be reflected in the profitability of export companies.

In the foreign trade for services, imports have outgrown exports. One of the factors behind this is a weaker tourism balance, as Finns travelled abroad after the COVID pandemic while at the same time the number of Russian and Asian visitors to Finland has remained at a low level.

Domestic power generation has grown thanks to the new nuclear power plant in Olkiluoto and the construction of additional wind power, which has improved the trade balance. In fact, imports will decrease even more than exports this year, and the contribution of net exports to economic growth will be positive as the trade balance improves.

The moderate wage increases in Finland compared to many competitor countries, coupled with the drop in the price of electricity, will maintain the competitiveness of manufacturing.

Weak housing demand will plunge the construction sector into a recession.

Finland’s public sector deficit was only 0.9% of GDP last year. The rapid growth in tax revenue continued in the first months of this year, but at the same time a growing need for services and rising costs have increased spending. The forecast increase in unemployment and temporary layoffs will also push expenses up towards the end of the year.

The new government programme includes major cost-cutting measures aimed at balancing public finances. In particular, the government plans various labour market reforms that would set stricter conditions for unemployment benefits. More detailed information on the reforms and their timetable will be made available in the government’s budget negotiations on 19 and 20 September.

The public sector deficit is expected to increase to 1.2% this year. The deficit next year will largely depend on economic development and the government’s budget decisions. However, without any cost-cutting measures, the deficit is expected to grow next year as well.

Public debt increased to 73% of GDP last year. The debt-to-GDP ratio is expected to continue to increase this year and next as deficits grow and nominal GDP growth slows down due to falling inflation.

This article first appeared in the Nordea Economic Outlook: Not there yet, published on 6 September 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more