- Name:

- Marco Kisic

- Title:

- Head of ESG Research, Nordea Equities

Marco Kisic

Two decades ago, China saw in the energy transition the opportunity to leapfrog into a new technology era. It delivered on a strategy to gain global leadership in clean technologies through highs and lows, boosted by large-scale state intervention. In today’s new geopolitical reality, this poses multiple challenges to Europe. We examine the scale of China's efforts, and explore what policies the EU could adopt in a scenario of increased trade assertiveness.

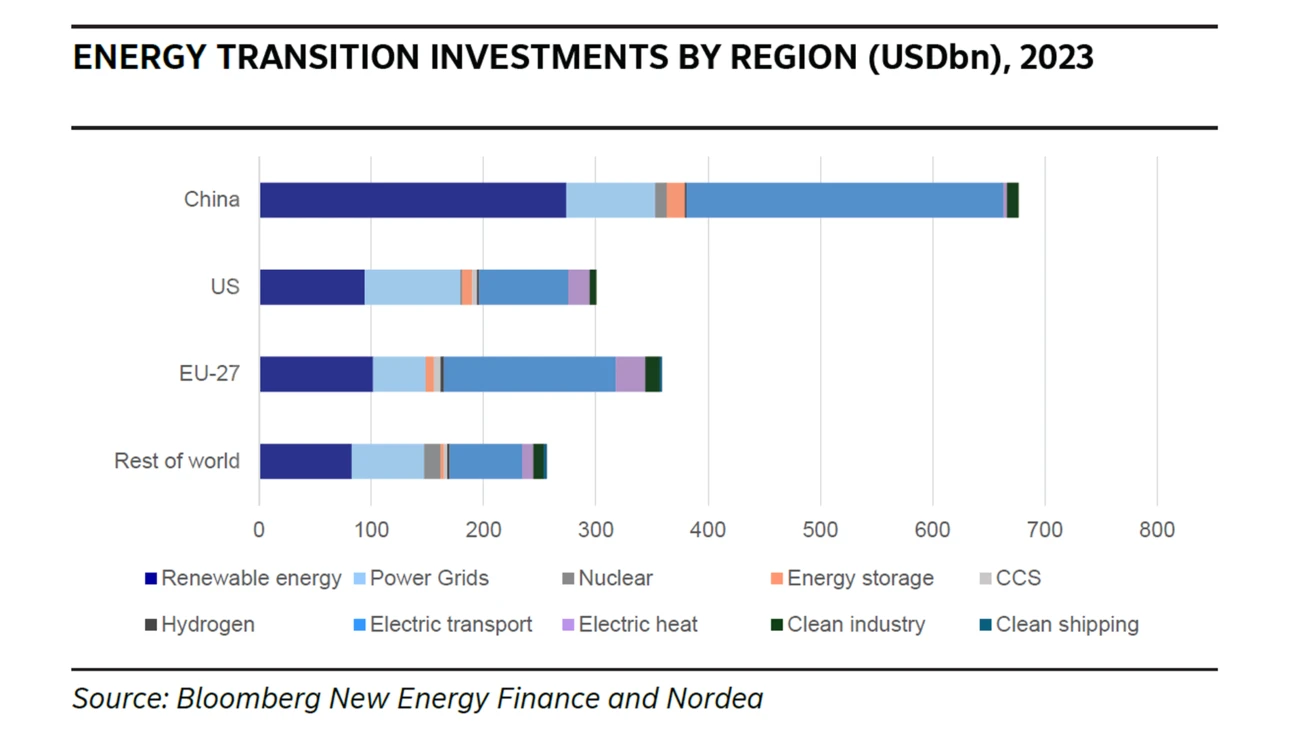

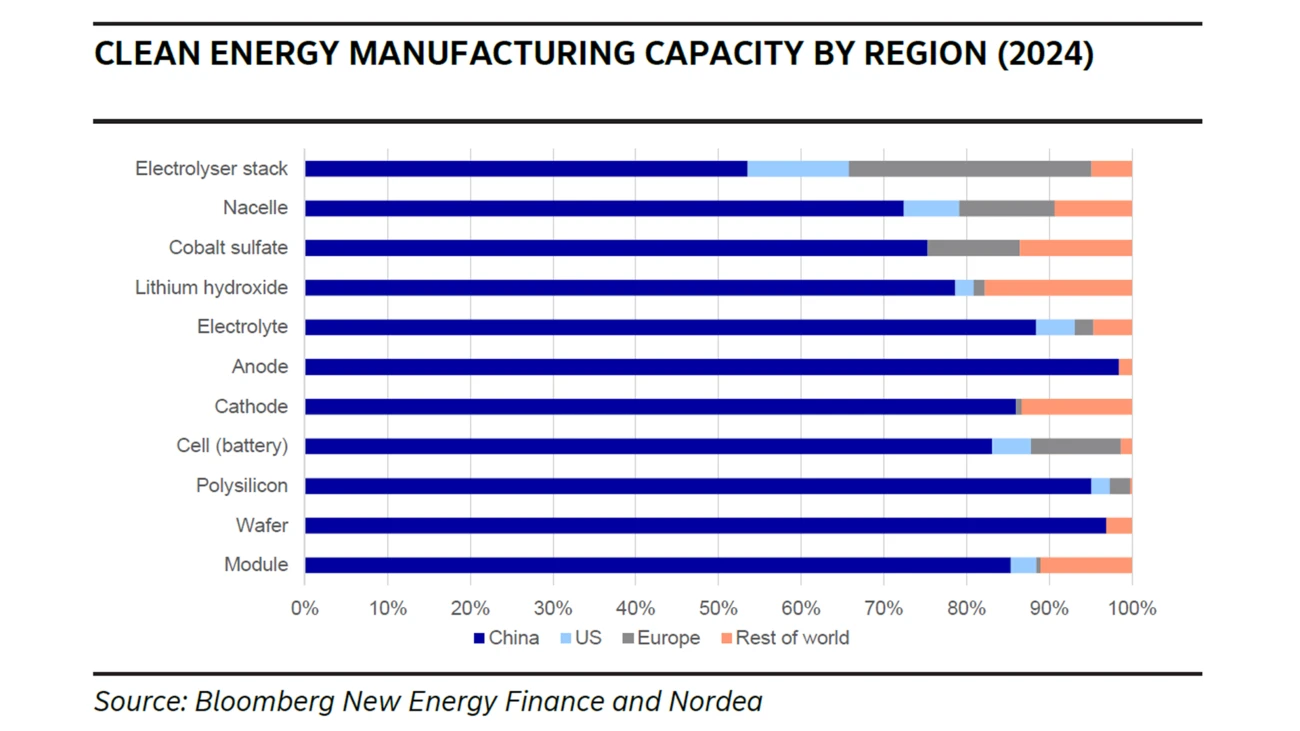

Despite the political noise around climate action, China has remained focused on developing a world-class clean technology sector. The country saw in the transition a unique opportunity, and has pursued it through a heavily subsidised strategy. Today, China invests more in cleantech than the EU and the US combined, it controls 70% of global cleantech manufacturing capacity and 80-90% of critical materials processing, and accounts for half of the global installation pipeline for multiple clean technologies. This has driven innovation, cost declines and global decarbonisation, but has also contributed to creating large global imbalances, partly fuelled by uneven subsidy systems.

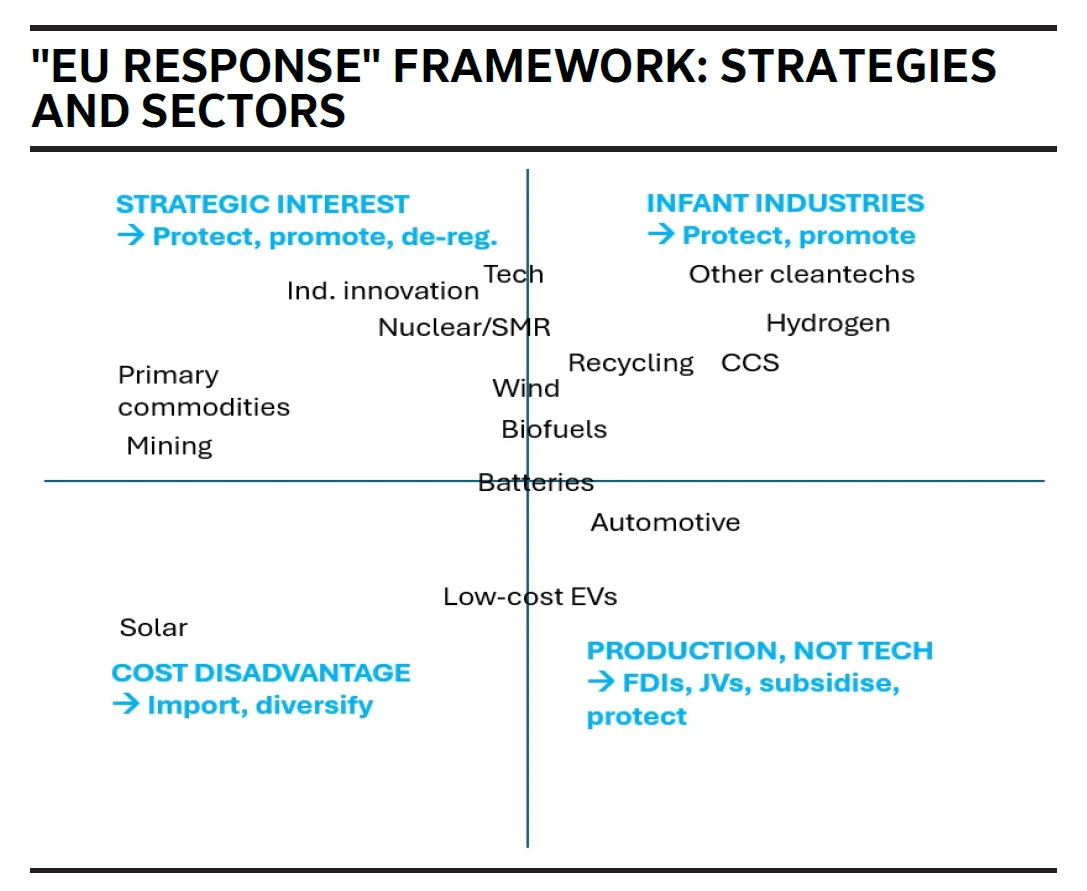

As trade tensions intensify, so do the challenges to European cleantech sectors, with a widening trade gap, strategic overdependencies and de-industrialisation. Calls to action are growing, and recently the EU's stance has become increasingly assertive. A large investment plan backing strategic industries and lowering energy prices should be the foundation of the EU's response, in our view, but is unlikely in the near term. Instead, a combination of targeted barriers, climate policy changes and selective incentives is a more likely scenario, we believe. Based on a framework we have developed, freely inspired by Mario Draghi's EU competitive analysis, we highlight what we view as the most likely policy changes in such a scenario.

| Area | Measure | Safeguards |

|---|---|---|

| Ferrosilicon | Safeguards | High |

| Steel, aluminium, cement, fertilizers | CBAM | High |

| Steel | Safeguards | High |

| Aluminium | Scrap exports restrictions | High |

| Critical materials, recycling, mining equipment | RESource EU Plan | High |

| Cars | Tech neutrality in 2035 CO2 target and soften trajectory | Medium-high |

| Clean technologies | Industrial Decarb Bank | Medium-high |

| Wind | Faster permitting | Medium-high |

| Trucks | Soften CO2 target trajectory / penalties | Medium-high |

| Cars | Local content for cars | Medium |

| Wind | Investigations/tariffs | Medium |

| Consumer goods, capital goods | CBAM extension | Medium-low |

| EU cleantech and innovation | Local content requirements | Medium-low |

| Electricity generation / infra / consumers | Lower energy price package | Low |

| Steel, aluminium, cement | Delay free ETS allowances phase-out | Low |

| EU cleantech and innovation | Subsidies | Low |

Source: Nordea

Calls to action are growing, and recently the EU's stance has become increasingly assertive.

We identify four areas that would benefit from increased EU assertiveness:

Business growth

Verda, formerly known as DataCrunch, is a fast-growing AI-focused cloud provider from the Nordics. In the rapidly evolving cloud industry, Verda is addressing the growing demand for specialised infrastructure tailored to AI workloads.

Read more

Business growth

Nordea has partnered with the European Investment Fund (EIF) for several years to strengthen the growth and competitiveness of small and medium-sized businesses in the Nordic region. The EIF guarantee helped UpCloud access financing for projects that promote sustainability and innovation.

Read more

Economic Outlook

Despite trade tensions and geopolitical turmoil, Danish exports have surged in recent years. Much of this growth stems from exports of goods produced outside Denmark’s borders.

Read more