- Name:

- Juho Kostiainen

- Title:

- Chief Analyst, Nordea

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskJuho Kostiainen

Households have been tested in recent years with higher inflation, interest rates and unemployment, as well as a stream of negative news from around the globe. However, now their fortunes have improved in many respects, as inflation and interest rates have fallen.

Domestic consumption has been stagnant for the past five years. Last year, private consumption was at the pre-Covid level of 2019 in real terms.

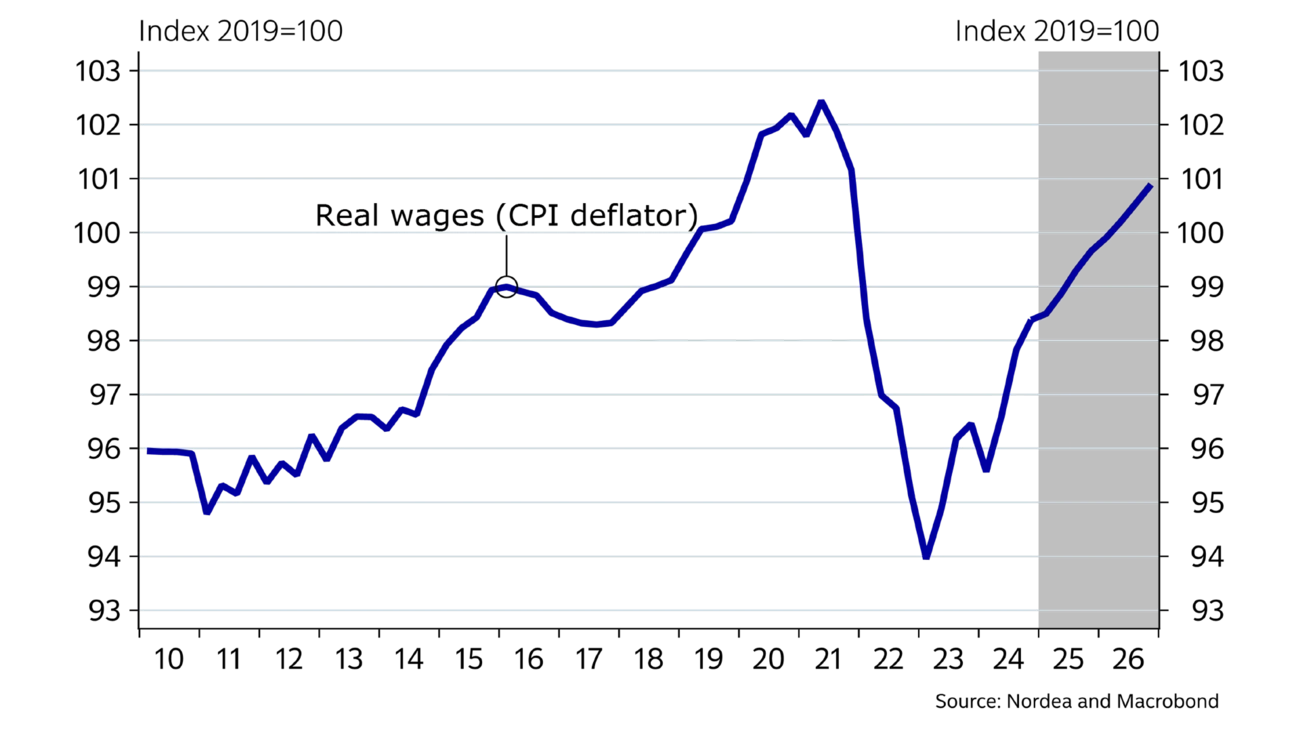

A lot of negative events for consumers have taken place since 2019. The Covid pandemic forced people to save, as restaurants were shut and travel abroad became unfeasible. Once restrictions were lifted, consumption in 2021 rebounded quickly to its previous level. At the same time, inflation began to rise, eroding consumer purchasing power. Then Russia’s invasion of Ukraine in 2022 sent consumer confidence crashing. Inflation continued to accelerate, forcing the ECB to rapidly hike its policy rate, which was quickly felt by Finnish mortgage holders as their loan-servicing costs rose. Over two years, the real income, or purchasing power, of wage-earners fell on average by as much as 8%, and even more in the case of those with large mortgages. At the same time, unemployment began to rise in Finland, driven by weak demand for construction. The deteriorated purchasing power and consumer confidence have also resulted in a decline in employment in the retail and service sectors.

The pressure on consumers has eased over the past year. Inflation has fallen below 1%, while wages are rising at a rate of 3%. This means that wage increases are actually boosting purchasing power, which is expected to rebound to its 2021 level next year for wage-earners. Meanwhile, interest rates have fallen from 4% to 2%, leaving more money for consumption for households with mortgages.

Consumer confidence hasn’t shown a similarly clear uptick yet, as it is mostly weighed down by global events, unemployment and weak purchasing power at the moment. Private-sector employment is no longer shrinking, as the economy has picked up since last autumn, but personnel cuts in the public sector continue to depress total employment. The war in Ukraine and the recent trade war launched by the US are keeping sentiment low, prompting consumers to postpone large purchases, in particular. Home and car sales are still subdued.

The pressure on consumers has eased over the past year.

Private consumption was expected to recover last year, but consumers didn’t begin spending in full force despite growth in real income and a drop in loan costs. Weak confidence in the economy has encouraged consumers to save their increased income for a rainy day. As a result, the savings ratio has increased considerably.

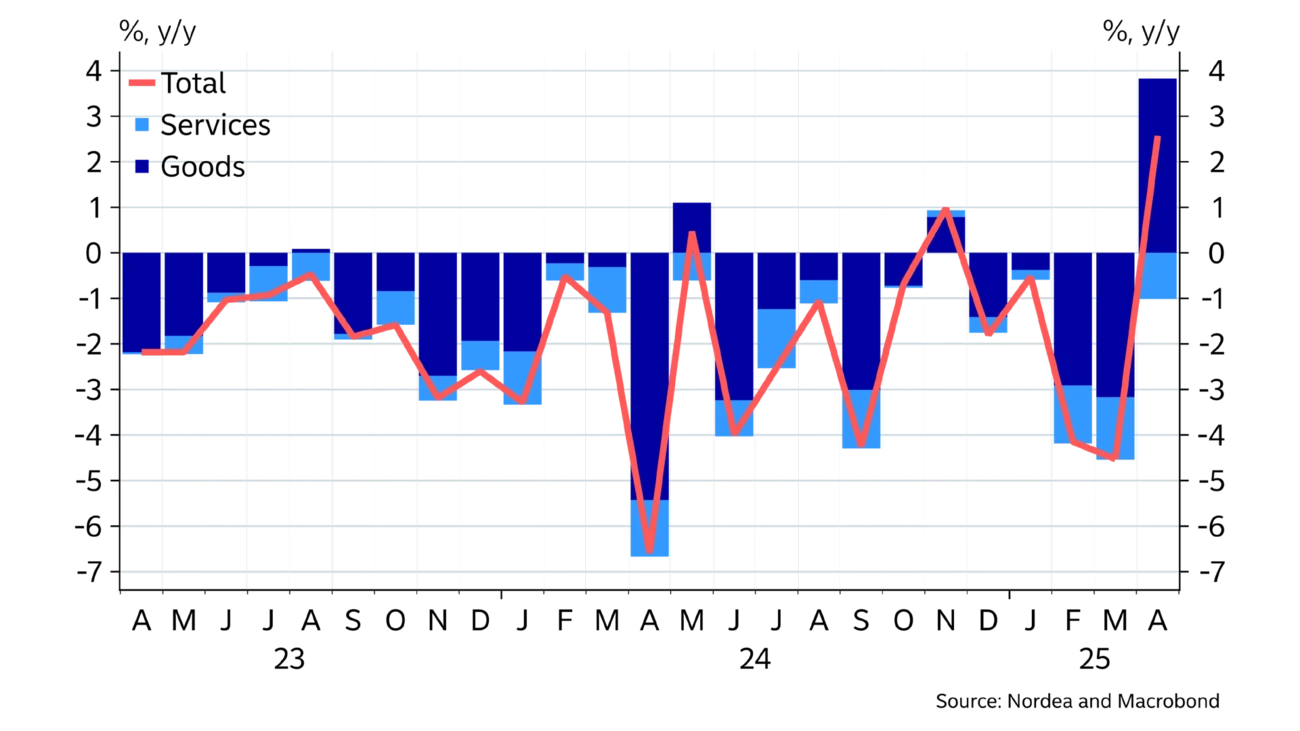

However, card payment data for April indicates a shift in consumer behaviour. Goods sales, in particular, grew clearly year-on-year, although some of this growth could be attributed to the timing of Easter. The same story is told by the confidence of the retail sector, which rose to notably positive figures in April for the first time in three years.

As for the sales of services, the card payment data doesn’t signal clear growth yet, as the consumption of hotel and restaurant services continues to decline. Statistics Finland reports that the volume of services provided grew in total by 1.7% in March compared to a year ago, and it has been growing steadily for nearly two years already.

This article originally appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more