- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst

Sivua ei ole saatavilla suomeksi

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleThe Danish labour market has powered ahead in recent years. Job growth has been high and unemployment is approaching the lowest level since the early 1970s. But companies have had big recruitment problems and wage growth has been higher than abroad.

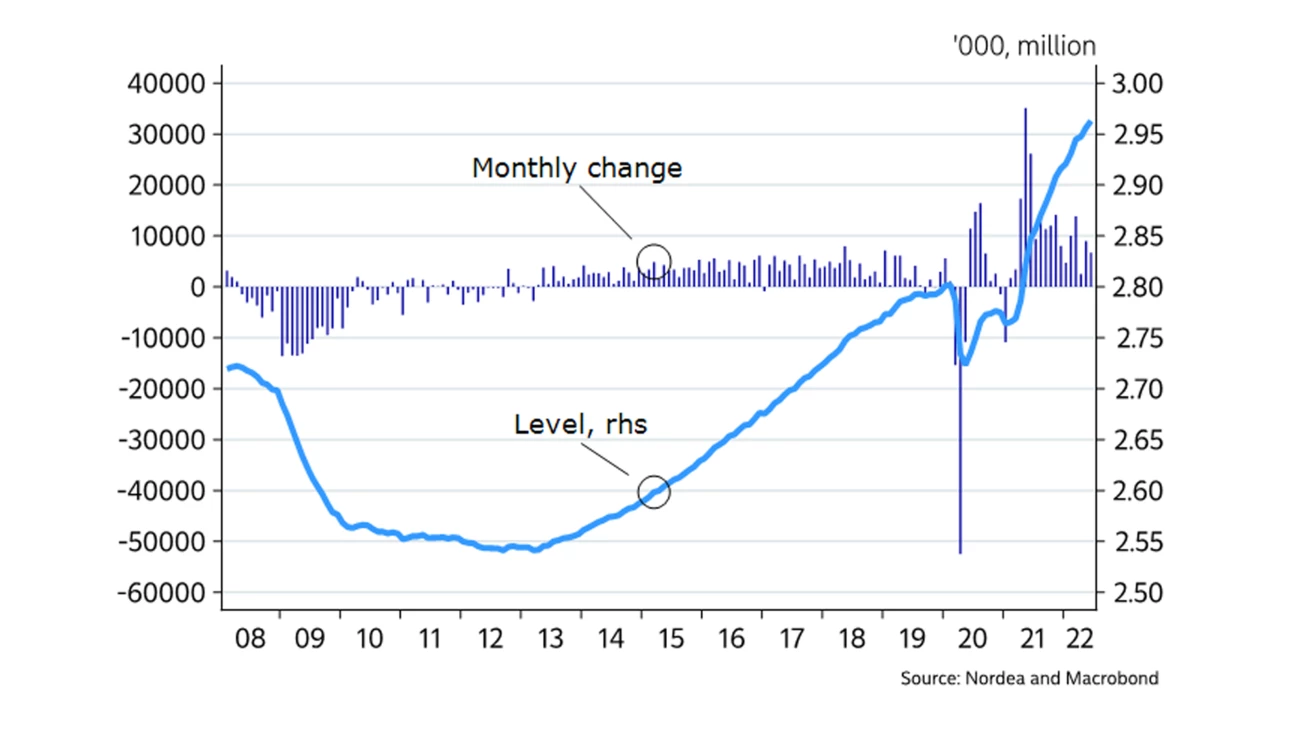

The number of wage earners in the Danish labour market has surged over the past few years. The increase has been broad-based across industries, so today there are 150,000 more people in jobs compared to the period up until the outbreak of the coronavirus pandemic in February 2020. This has contributed to lowering unemployment to 2.7% of the work force. The last time unemployment was this low was in the months ahead of the financial crisis; otherwise we have to go back to the early 1970s to find an equally low unemployment rate. The fall in unemployment has also contributed to a sharp decline in the number of long-term unemployed.

In contrast to many other countries, for example the US, there are no signs that the coronavirus pandemic has left a deep structural mark on the Danish labour market. The share of the working-age population that is active in the labour market is at a 15-year high. The labour force participation rate has especially risen noticeably for persons over the age of 60.

Another significant driver behind the growing labour market has been a huge influx of foreign labour. After a short dip during the lockdown at the beginning of 2020, the influx of foreigners has increased further, now accounting for more than 11% of total employment. This has thus played a key role in recent years’ strong economic upswing.

The strong rise in employment has made it increasingly difficult for companies to recruit the required labour. This has resulted in many unfilled positions and a lot of companies, especially in the services sector, indicate that labour shortages are constraining production. At the same time, there are signs of growing mismatch problems in the Danish labour market. One such sign is that that the number of vacancies at a given unemployment level has risen since the coronavirus pandemic.

The widespread labour shortages and increasing inflation expectations have added to wage pressures. This is the case seen in relation to previous years and when comparing wage trends in Denmark to those of our trading partners. The relatively high wage increases should be viewed against the backdrop of a very decentralised wage structure where economic changes feed through to wage formation quite quickly.

The red-hot labour market is set to cool moderately.

In the spring of 2023, the collective agreements for the private labour market are up for renegotiation. The renegotiation will need to take into account higher inflation expectations on the one hand and the risk of a sharp economic slowdown on the other. Despite the prospect of higher nominal wage increases next year, real wage growth is not expected to be positive until 2024.

A / Large increase in the number of wage earners

Wage earners, level and monthly change in number of persons

It is still difficult to see the current economic slowdown in hard labour market data. Unemployment has risen slightly over the past few months, but the main reason is an increased influx of Ukrainian citizens to the Danish labour market.

However, a more significant reversal of the labour market is expected over the coming months in response to the general economic slowdown. This is expected to trigger a fall in employment at the same time as unemployment slowly starts to climb. Some of the decline in labour demand may, however, be absorbed by the still large number of vacancies. Rising unemployment is expected to affect the most cyclical parts of the economy in particular, such as the building and construction sector.

This article originally appeared in the Nordea Economic Outlook: Feeling the squeeze, published on 7 September 2022. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more