Sustainable finance in action

Industry: Energy and technology

Headquarter location: Hamar, Norway

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskNordea supported Norwegian energy and technology company Eidsiva with its green financing framework and green bond issuance in 2025. How will the company put the bond proceeds to use?

Industry: Energy and technology

Headquarter location: Hamar, Norway

In our series, “Sustainable finance in action,” we ask our clients how they are putting sustainable funding to work to drive change. We have this time talked with Jørn Gunnar Kleven, Head of Finance and Business Control, about Eidsiva’s sustainability-related efforts.

Can you briefly describe the company and its business?

Jørn Gunnar Kleven: Eidsiva is one of Norway’s largest energy and technology groups, with a rich history dating back to 1894. Eidsiva operates in three main business areas: power distribution, digitalisation and bioenergy. We also hold a significant stake in Hafslund Kraft, Norway’s second-largest power producer. As a leading energy and technology group, we’re committed to ensuring reliable energy supply for more than 2 million people daily, while also driving renewable energy production, building digital infrastructure and expanding our power network capacity. Our vision of being a driver of new opportunities guides us as we invest in new infrastructure and digitalisation.

Eidsiva published its new green financing framework in January 2025. With a long tradition of issuing green bonds, Eidsiva has approximately NOK 12 billion outstanding in green bonds out of a total bond portfolio of NOK 15.2 billion. The first issue under the new framework took place on 11 June 2025, with a NOK 1,250 million 5-year bond and a NOK 500 million 10-year bond.

Eidsiva published its new green financing framework in January 2025.

Eidsiva has approximately NOK 12 billion outstanding in green bonds out of a total bond portfolio of NOK 15.2 billion.

What will the money go towards?

JGK: Over the three years following issuance, Eidsiva expects to allocate approximately 90% of the proceeds to the energy efficiency project category, mainly investments in the electricity grid. The remaining 10% will go towards the renewable energy project category, mainly solar and wind. Eidsiva expects 30% to 50% of the proceeds will be used to refinance existing projects, while the rest will fund new initiatives.

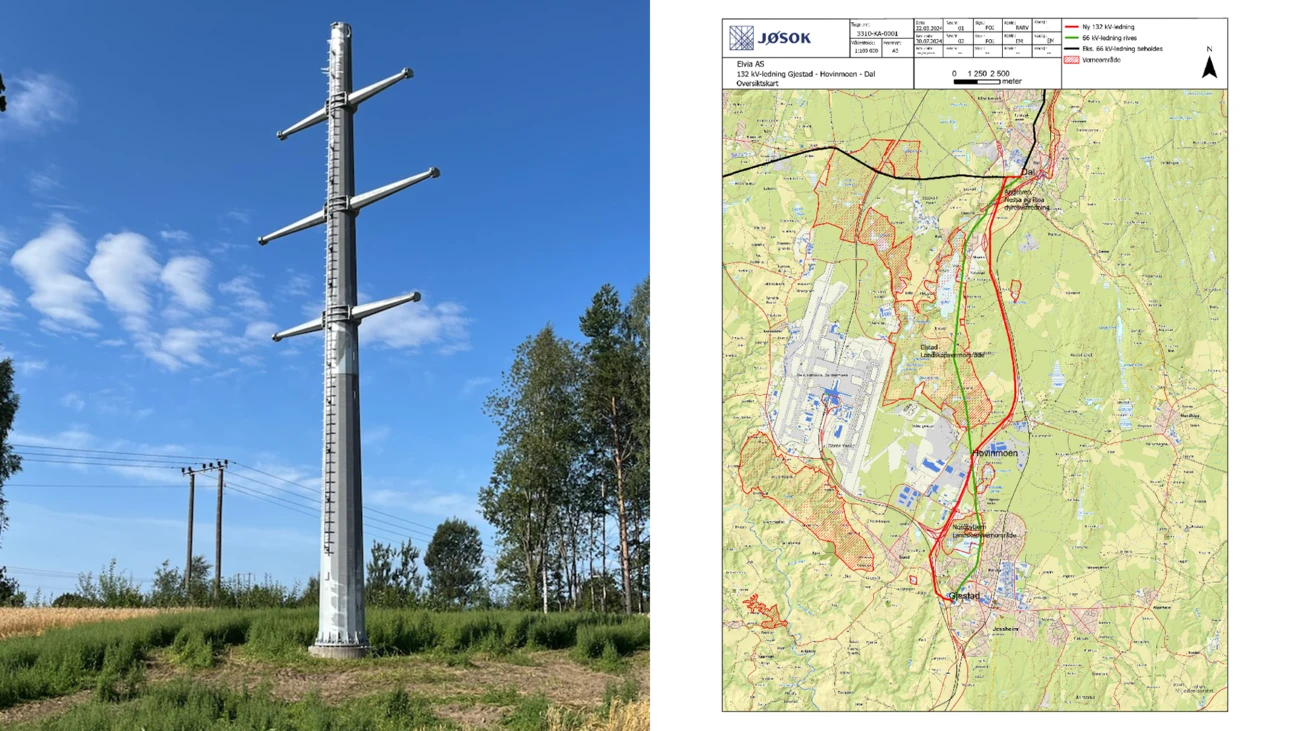

For example, a key initiative to strengthen the power supply in upper Romerike in the Oslo region (the Gardermoen area) involves rebuilding several power lines. One such project is the Hovinmoen – Gjestad section, which entails establishing a new line route and removing the old one.

The old route runs through forest and protected areas, while the new one will run through more developed areas, reducing impact on nature and avoiding protected zones. This project will integrate railway, road and power grid infrastructure. Some agricultural land will be released, and where we need to take agricultural land, special masts will be used to allow farming right up to the base.

Throughout the reconstruction period, power supply has been maintained using parallel lines.

What was it like to work with Nordea in setting up the framework and issuing the green bonds?

JGK: Eidsiva has been issuing green bonds since establishing our first green framework in 2017. We’ve updated this framework in 2019, 2021 and most recently in 2025, collaborating with Nordea. As experienced green bond issuers, we’re well-versed in both pre-issuance and post-issuance processes.

There is no doubt that a lot has changed since 2017. Working on green financing in 2025 requires contributions from far more people internally at Eidsiva than just a few years ago. The formalities surrounding second party opinions have also changed a lot in recent years.

When selecting a sole green structuring advisor, we wanted a partner who not only knew the Eidsiva Group well but also understood the challenges our businesses within power grids, bioenergy and new business have in relation to the Green Bond Principles and not least investors' expectations for a green framework in 2025.

In collaboration with Nordea, we decided to reduce the number of eligible categories compared to the 2021 framework by not including telecommunications (beyond data centers) in the new framework. The process with Nordea was efficient and value-creating for Eidsiva, and we successfully issued two new green bonds before the summer of 2025.

The process with Nordea was efficient and value-creating for Eidsiva, and we successfully issued two new green bonds before the summer of 2025.

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more