0.5%

Our forecast for GDP growth in 2025

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskJuho Kostiainen

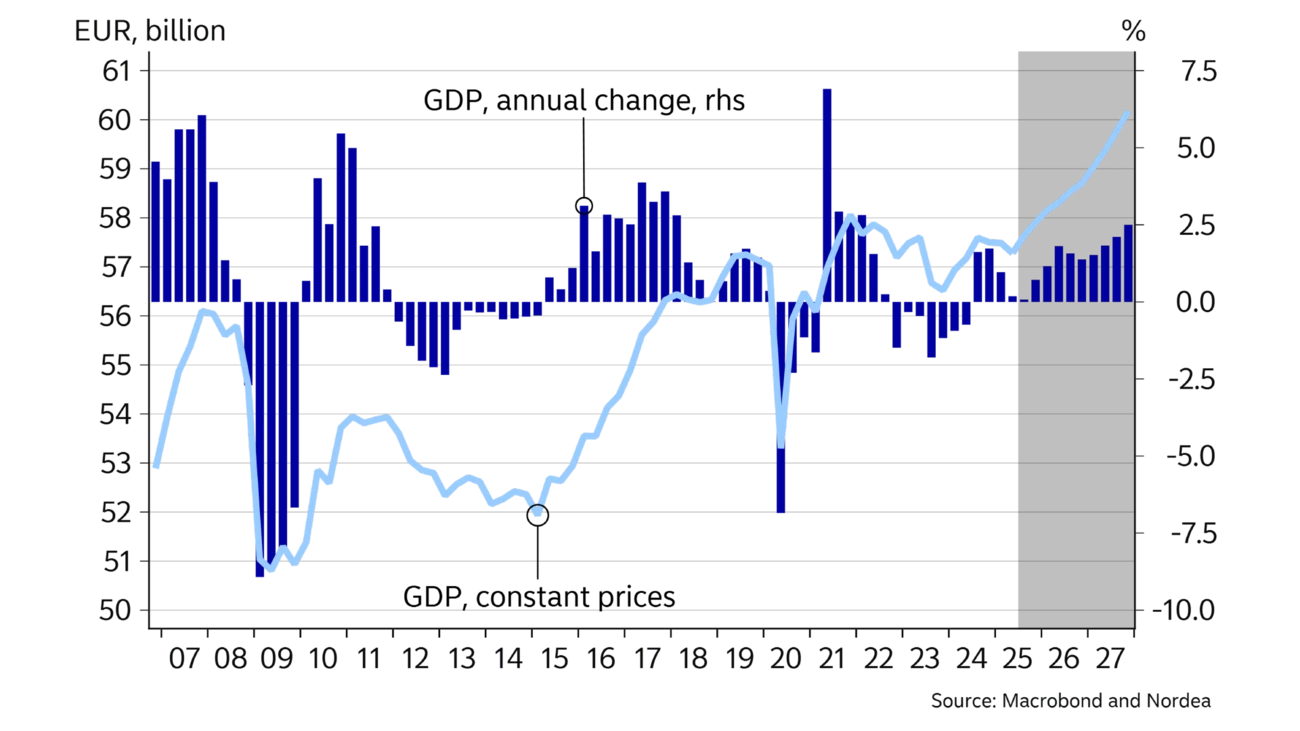

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment. There are signs of a turn for the better in manufacturing, but construction still looks weak.

The Finnish economy declined slightly in the first half of the year, and the expected growth still has not materialised. The fundamentals of economic growth have clearly improved, as the slowdown in inflation and the drop in interest rates increase households’ purchasing power. However, weak consumer and business confidence has so far kept the nascent economic growth in check. Households are now replenishing their financial buffers by increasing savings and paying down debt rather than spending, a typical situation when the economic outlook is uncertain.

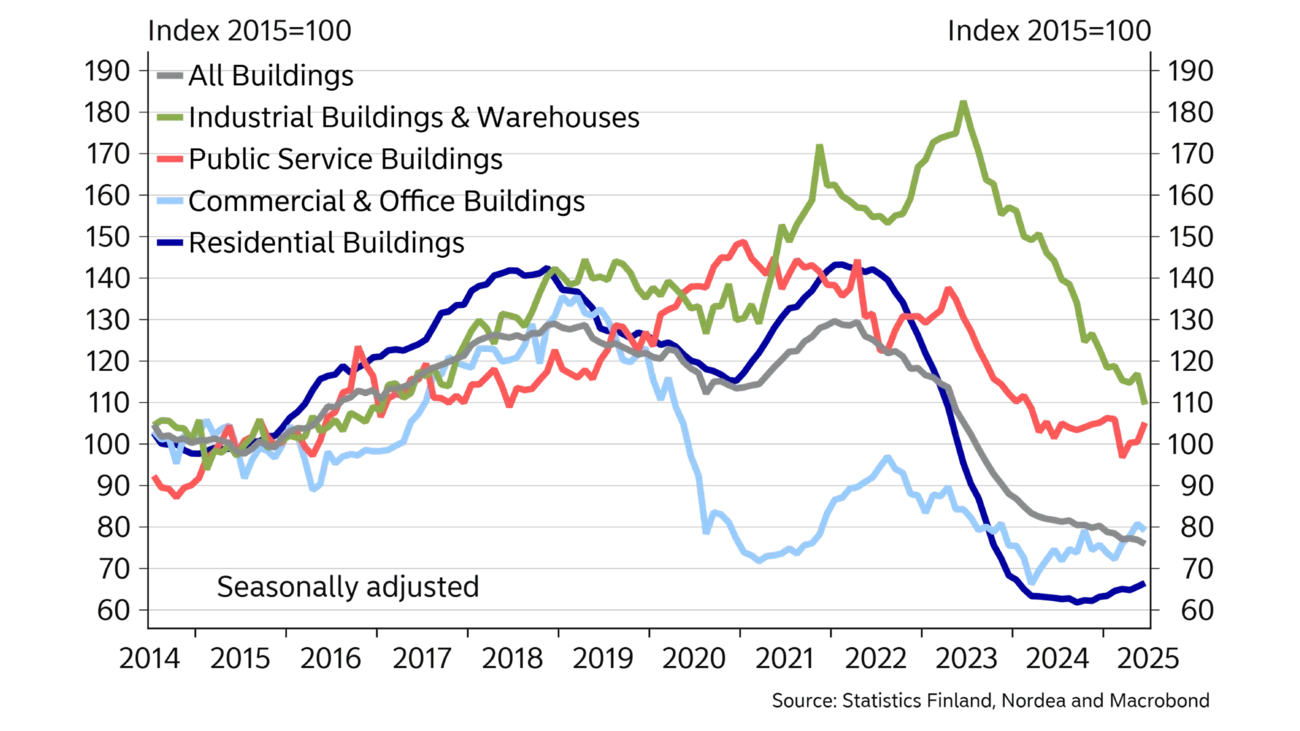

The stagnation in construction has continued in the early part of the year, and there are no clear signs of a turn for the better yet. The oversupply in the housing market will keep both home prices and construction sluggish this year and next.

The situation in the labour market remains challenging. Finland’s unemployment rate is the second highest in the EU, at more than 9%. The weak labour market is one of the major factors behind the weak consumer confidence.

But there is already light at the end of the tunnel, especially in manufacturing, where the order intake for the first half of the year was clearly better than in previous years.

The tariff agreement with the United States and the continued improvement in purchasing power are expected to improve business and household confidence this year and next, which is likely to mobilise investment and consumption. In the summer, there were already indications that consumption was starting to pick up, as card payments were clearly increasing.

We expect the Finnish economy to grow by 0.5% this year, and this growth is expected to accelerate to 1.5% next year. In 2027, we expect GDP to grow by 2% when construction gets back up and running.

0.5%

Our forecast for GDP growth in 2025

0.2%

Inflation in July 2025

88.7%

Our forecast for public sector debt relative to GDP in 2027

Domestic inflation (CPI) has fallen to 0.2%, lowered by the drop in interest rates. Meanwhile, the harmonised index of consumer prices (HICP) for Finland, which does not account for interest rates, was 2.0% in July. HICP at constant tax rates was 1%, as the VAT rate hike that took place late last year is estimated to have increased inflation by about one percentage point.

Inflation is reduced by cheap energy, as the prices of both fuels and electricity have been falling. Moreover, the prices of goods have only risen moderately. Food prices, however, have again increased by 3% this year. Service price inflation has slowed down over the past year, although it remains above 3%.

Since inflationary pressures are low as a whole, harmonised inflation is expected to remain around 2% this year. Domestic inflation (CPI) is expected to be a mere 0.4% this year, thanks to falling interest rates.

The VAT rate hikes instituted last year will cease to have an inflationary effect next year, but the effect of lower interest rates will also subside. We expect inflation to accelerate slightly next year as economic growth picks up, but to remain at a moderate level of slightly more than 1%.

| 2024 | 2025E | 2026E | 2027E | |

| Real GDP, % y/y | 0.4 | 0.5 | 1.5 | 2.0 |

| Consumer prices, % y/y | 1.6 | 0.4 | 1.2 | 1.4 |

| Unemployment rate, % | 8.4 | 9.4 | 9.0 | 8.2 |

| Wages, % y/y | 3.1 | 2.7 | 2.8 | 2.2 |

| Public sector surplus, % of GDP | -4.4 | -4.0 | -3.5 | -3.0 |

| Public sector debt, % of GDP | 82.1 | 86.4 | 88.0 | 88.7 |

| ECB deposit interest rate (at year-end) | 3.00 | 2.00 | 2.00 | 2.50 |

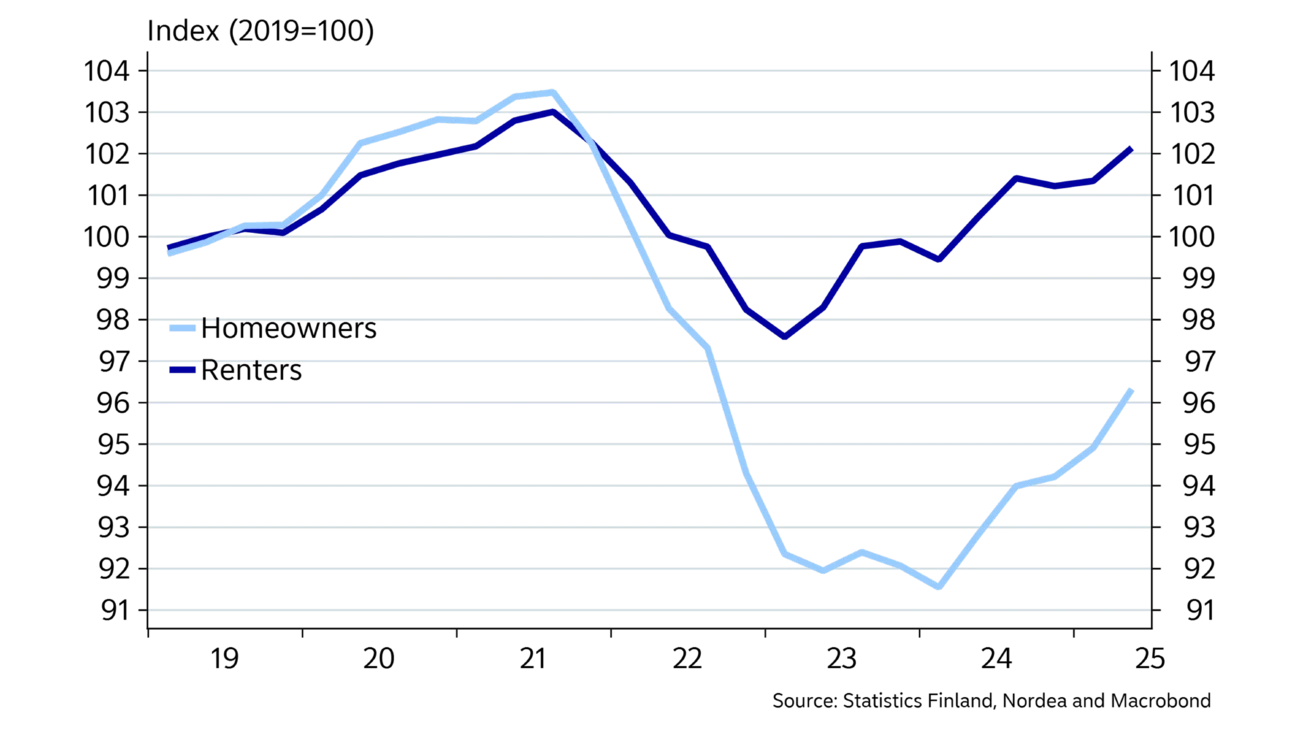

Consumers remained cautious in the first half of the year. Falling interest rates and slow price rises have enhanced consumers’ purchasing power, as wage increases have been around 3%. The purchasing power of households with mortgages is still 5% weaker than at the beginning of this decade, despite the recent drop in interest rates. The purchasing power of wage earners living in rented accommodation has developed better, although cuts to housing allowances have reduced the income of many renters. The gradual improvement in purchasing power has not yet been reflected as an increase in consumption, as the household savings ratio is still high. The theme text describes in more detail the slow effects of monetary policy on economic growth.

In July, card payments increased clearly from the previous year, but it is still too early to say whether this is due to a genuine upturn in the consumption trend or a consumption peak caused by the hot weather.

After three years without growth, we expect private consumption to start growing properly next year, spurred by a recovery in purchasing power and confidence.

The employment situation has remained weak. The trend in the unemployment rate was 9.6% in July. The decline in overall employment comes mostly from cuts in the public sector. The number of job vacancies also decreased in the first half of the year.

Working hours have decreased even more than employment. The decrease in working hours has led to an increase in productivity, as GDP remained stagnant in the first half of the year. Productivity has increased especially in manufacturing, but the productivity growth in the economy as a whole is partly explained by the decline in the weight of the construction and service sectors, which have lower productivity.

Employment is expected to recover gradually next year as improved purchasing power accelerates consumption and the manufacturing sector gains momentum. The government measures to enhance the labour supply are also expected to stimulate employment as the economy improves.

The purchasing power of households with mortgages is still 5% weaker than it was at the beginning of this decade.

The year-long decline in market interest rates has boosted the sale of previously owned dwellings, but selling times are still long and there is a clear oversupply in the market, which has resulted in weak price performance. In April–June 2025, the prices of old apartments fell by 1.3% year-on-year. Due to the weaker-than-expected economic performance in the first half of the year, we are downgrading our forecast for home prices to -0.5%. Next year, we expect home prices to increase by 2%.

Oversupply also persists in the rental market, which is reflected in weak rent increases and low occupancy rates. Cuts made to housing allowances are now encouraging renters to share apartments or to downsize, which limits growth in rental demand. Population growth in growth centres has slowed down from last year, but has remained at a good level.

Subsidised rental construction is maintaining house building, but otherwise residential construction is still quite weak. The construction cycle does not seem to be taking a turn for the better this year yet, and the outlook for next year is moderate as the loan authorisations for interest-subsidised housing are reduced. There have been some starts in developer-contracted construction of owner-occupied housing, but their number is still small as sales of new properties are sluggish.

In industrial and warehouse construction, volumes are still declining, and the construction of office and commercial premises is not yet expected to pick up. Construction as a whole will continue to decline this year. For next year, we expect a cautious turn for the better, but we will have to wait until 2027 for a stronger recovery.

Other investments held up better than construction in the first half of the year. The tariff deal with the US is likely to remove uncertainty and thereby boost investment. Drawdowns of corporate debt were on the rise in the first half of the year, indicating that lower interest rates have gradually begun to stimulate investment demand.

Cheap and clean electricity is attracting unusually large investments in data centres in Finland at the moment, boosting other industries as well. The procurement of fighter aircraft for the air force and other defence investments will increase public investment beginning from this year.

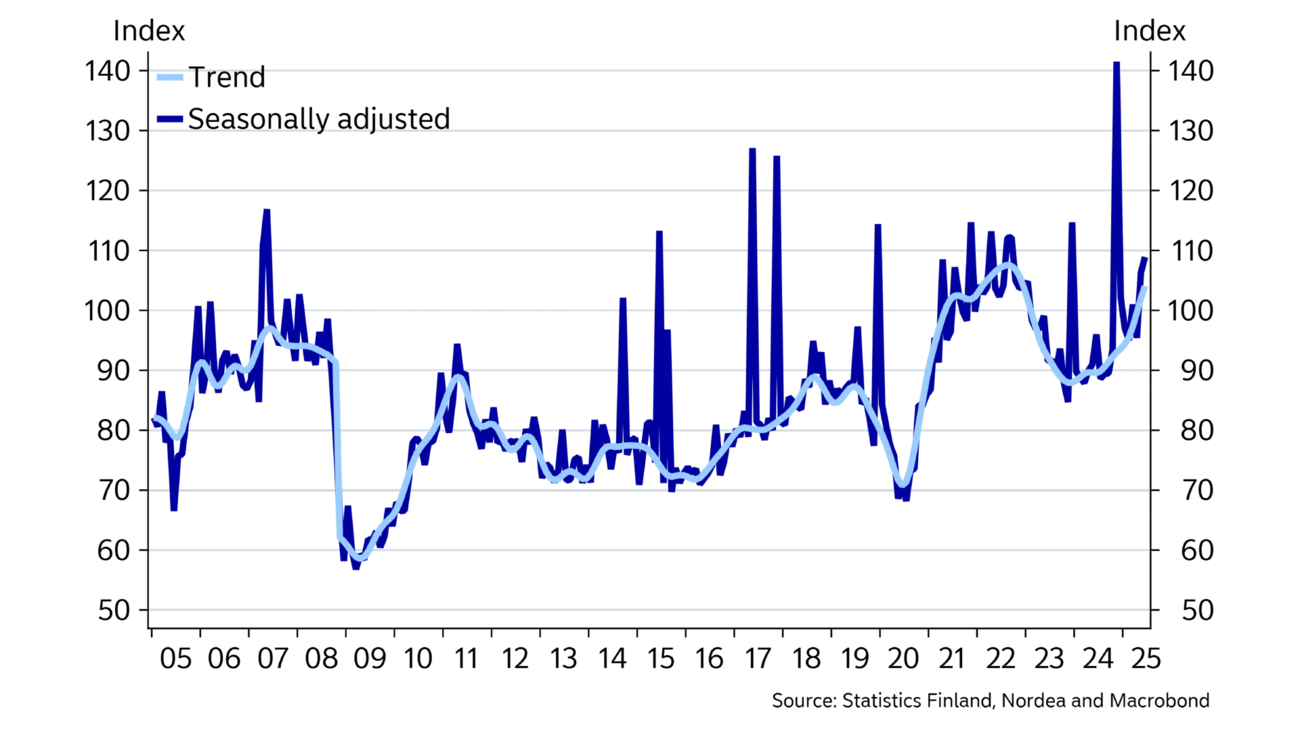

There was a clear increase in new orders in manufacturing during the first half of the year. The metal and chemical industries, in particular, had a clearly higher order intake than a year ago, while the economic cycle in the forest industry is still subdued. The growing order books will be reflected with a delay in industrial production and goods exports.

Growth in demand will be driven by the gradual pick-up in investment in Europe, especially in the defence industry. Various investments related to the electrification of industry are also still growing. The aversion of the US towards Chinese-made machinery and equipment is likely to improve demand for some Finnish products, despite US tariffs.

The competitiveness of Finnish industry is at a good level, as the price of electricity and wage increases have remained moderate in Finland. This is reflected in the strengthening of the trade balance. Over the past year, the balance on goods has been more than EUR 7bn in surplus. The trade balance has improved as imports have contracted more than exports.

This growth is expected to be driven by service exports, which already expanded strongly last year. Goods exports are also forecast to grow slightly, partly because of the delivery of a large cruise ship in July, which will result in a spike in goods exports this summer and improve the goods exports figure for the full year. It is still difficult to estimate the impact of US tariffs on exports, but it seems it will only be moderate at least in the short term. On the other hand, the strengthening of the euro against the dollar has weakened the competitiveness of European products in the US, in addition to the tariffs.

The order intake in manufacturing has been clearly stronger than in previous years.

Public finances are expected to begin to improve next year. Index increases in social benefits will remain low because inflation has fallen. Wage growth will also be more moderate than in previous years, even though the expensive wage settlement in the public sector will have an impact for several years to come. In addition, the growth in interest expenses is coming to an end. At the same time, central government adjustment measures will curb the pressure from public spending while increasing tax revenues together with the slowly recovering economic cycle. The Finnish Defence Forces’ fighter aircraft procurement will begin to burden public finances this year, slowing down the reduction of the public sector deficit.

This deficit was 4.4% of GDP last year, and it is expected to decline slightly in 2026 and 2027, thanks to adjustment measures and economic growth. The public sector debt to GDP ratio is expected to increase from 82.1% last year to 88.7% by the end of 2027.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook .

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more

Economic Outlook

The previously high-flying Danish economy has had its wings clipped as historical growth figures have been revised lower and industrial production has declined, particularly in the pharmaceutical sector. Despite reduced altitude, the Danish economy is still very strong.

Read more