1.0 %

Our forecast for GDP growth in 2026

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskJuho Kostiainen

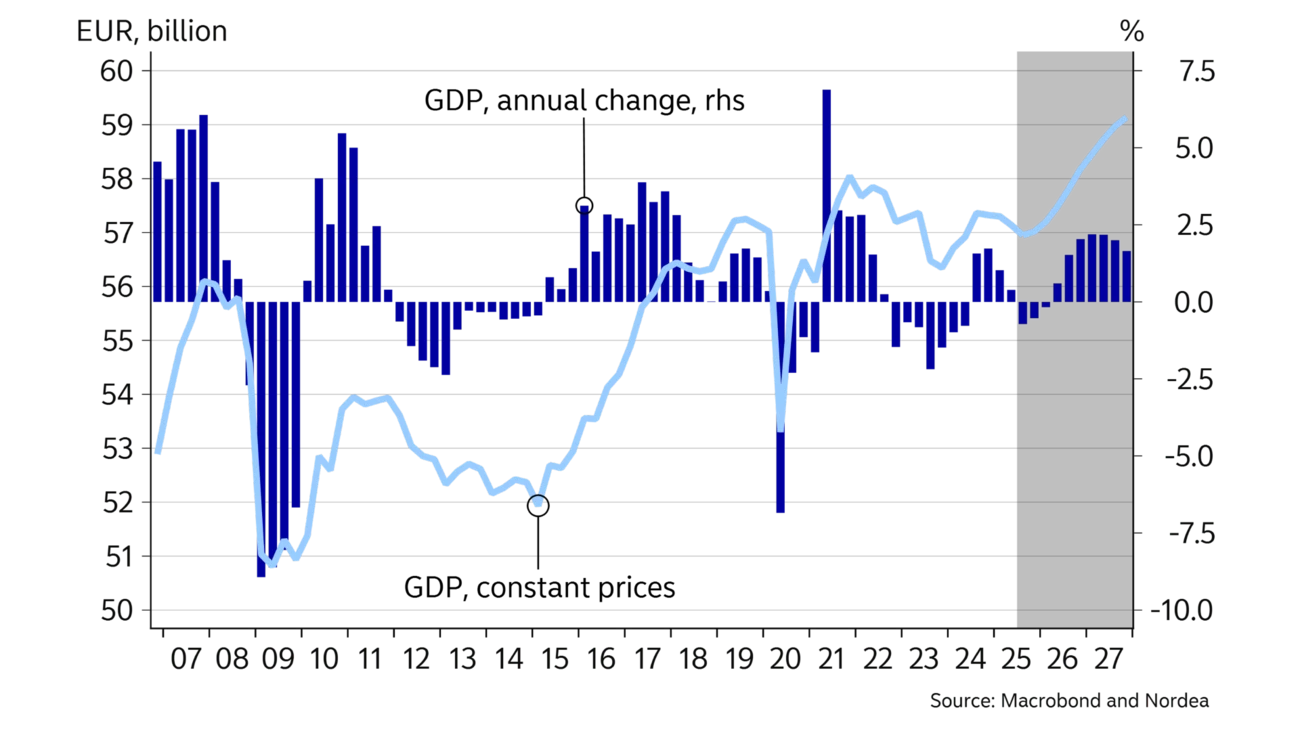

Finland’s economic growth has been slow to materialise. Weak consumer confidence and falling housing prices continue to hold back private consumption and construction investments. However, the fundamentals of the economy have improved, so the conditions for recovery are present. There are already signs of improvement in the manufacturing sector.

Finland’s economy stagnated last year, and the expected turnaround has not yet taken place. Construction remained in a slump, with no quick recovery in sight as the housing market is still sluggish, prices are falling and the rental market has ample supply.

Falling interest rates and improved purchasing power for wage earners have not yet spurred private consumption. Increased income is still being channelled into savings, as persistently high unemployment has kept consumer confidence low. Households have been building up buffers and reducing debt for two years, so their balance sheets have strengthened, providing better conditions for growth in consumption.

Despite global uncertainty, the export sector seems to have come out of its trough and production investments are holding up. Growing defence investments in Europe are also starting to show up in Finnish companies’ order books. Strong competitiveness and affordable electricity support both investments and exports.

We expect the Finnish economy to grow by 1% this year, driven by private consumption and exports. Next year, growth is forecast to accelerate to 2%.

Predicting economic turning points typically involves a lot of uncertainty. In particular, forecasting consumer saving behaviour has proven challenging in recent years. Household balance sheets are now clearly in better shape, but this does not guarantee a pick-up in consumption. In the recent Economic Outlook, we present alternative calculations for the economic growth outlook under different saving scenarios.

1.0 %

Our forecast for GDP growth in 2026

0.2 %

Inflation in December 2025

91.4 %

Our forecast for public sector debt relative to GDP in 2027

Price increases in Finland have remained very moderate. Harmonised consumer prices rose by 1.8% year-on-year in 2025. Inflation in Finland is clearly slower than the eurozone average (2.2%), even though VAT increases raised Finland’s inflation by almost one percentage point last year.

The domestic consumer price index which accounts for mortgage interest fell by 0.2% in December year-on-year. The index is mainly weighed down by lower interest expenses. The impact of falling interest rates on consumer prices will gradually fade this year, so different inflation measures will converge again.

The annual change in goods and energy prices is down to zero, so only the rising prices of services and food are driving inflation. In December, the prices of services and food rose by 2.5% year-on-year.

Finland’s inflation is expected to be 0.8% this year and is forecast to stay low, at 1.0% next year as well, since there are no acute price pressures in sight.

| ‘24 | ‘25E | ‘26E | ‘27E | |

|---|---|---|---|---|

| Real GDP, % y/y | 0.4 | 0.0 | 1.0 | 2.0 |

| Consumer prices, % y/y | 1.6 | 0.3 | 0.8 | 1.0 |

| Unemployment rate, % | 8.4 | 9.7 | 9.9 | 8.6 |

| Wages, % y/y | 3.1 | 2.9 | 3.0 | 2.2 |

| Public sector surplus, % of GDP | -4.4 | -3.4 | -3.0 | -2.5 |

| Public sector debt, % of GDP | 82.5 | 88.1 | 90.3 | 91.4 |

| ECB deposit interest rate (at year-end) | 3.00 | 2.00 | 2.00 | 2.50 |

Private consumption has been subdued for three years, even though household purchasing power has almost recovered from the inflation shock. The rise in the savings rate has kept consumption in check. There are several reasons for increased saving. Inflation eroded many households’ financial buffers, which are now being rebuilt. The rise in interest rates from zero to the current 2% level has reduced households’ willingness to take on new loans, as they are focused on paying down their debts because of higher interest expenses. Although household indebtedness relative to income has fallen, indebtedness relative to house values has increased due to falling house prices. The weak economy, rising unemployment, public sector savings and global uncertainties have also contributed to increased precautionary saving. Saving typically increases in a weak economic environment.

Households’ real income will continue to grow this year, and it is expected that a larger share of this growth will be used for consumption. Private consumption is expected to grow by 1.4% this year and 2% next year.

However, it is challenging to estimate when households will shift from saving because of balance sheet adjustment and uncertainty and start spending again. Our theme text explores alternative economic scenarios if the savings rate remains at its current high level or falls faster than expected.

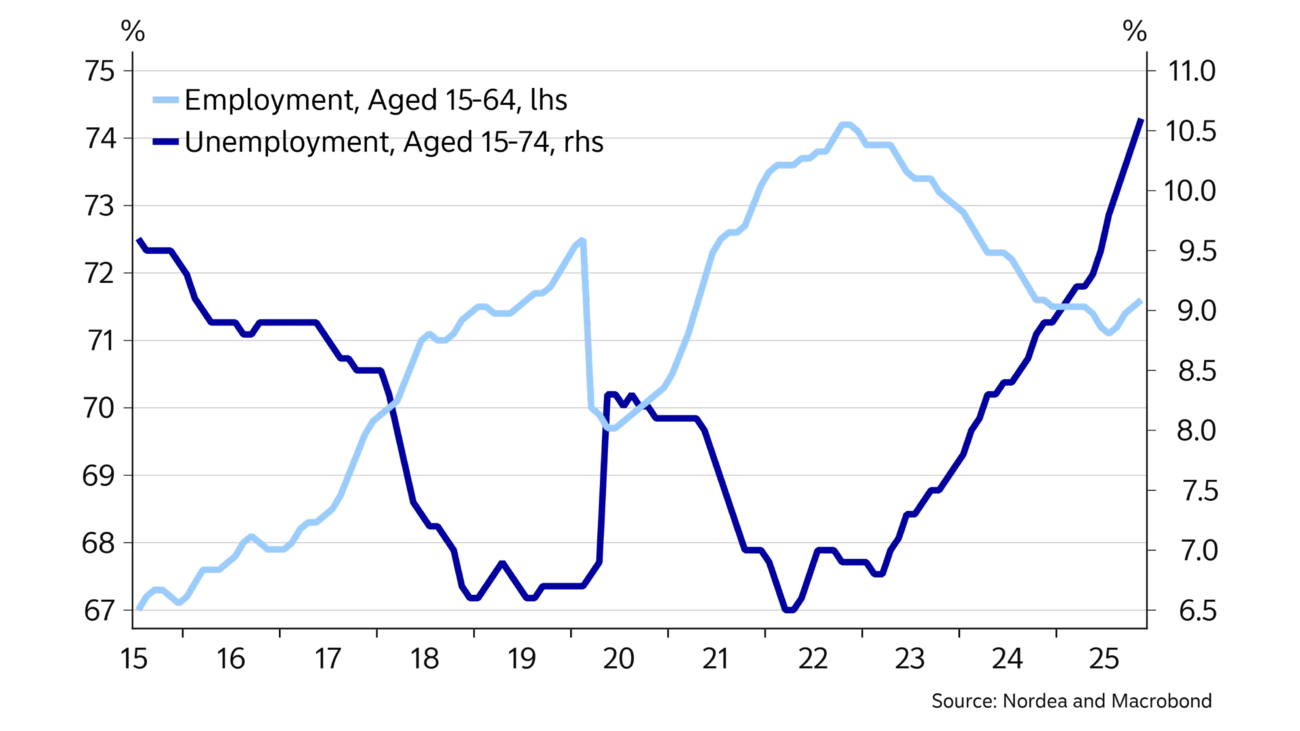

The unemployment rate rose to 10.6% at the end of last year, the highest in Europe. At the same time, the employment rate has remained at the previous year’s level. Private sector employment has begun growing slightly, while public sector cost-cutting measures are reflected in declining public employment. Employment has grown in the manufacturing, transport and tourism and restaurant sectors, but continues to fall in other private services and retail, in addition to the public sector.

The number of unemployed has increased by 50,000 in a year, while the number of employed has remained at last year’s level. Typically, these numbers move in opposite directions. Several factors are behind this phenomenon. The working-age population has grown by about 10,000 over the past year, mainly due to immigration. The number of people in subsidised employment due to labour market measures has decreased by 6,500 per year, which may have increased the number of unemployed. In addition, the labour market policies of the current and previous governments may have prompted more people to seek work. The so-called job search obligation, which is a condition for receiving unemployment benefits, requires the unemployed to remain active job seekers. Similarly, the staggering of unemployment benefits, the removal of income the unemployed are allowed to earn without affecting their unemployment benefits, and reductions to the government housing allowance have increased incentives to seek work. The labour force participation rate, i.e. the ratio of employed and unemployed to the working-age population, has risen to a historically high level.

The unemployment rate is expected to start falling this year as the economy grows. A good labour supply creates room for longer-term economic growth, as overall labour availability is not a barrier to growth.

The unemployment rate is increasing, while employment has remained at last year’s level.

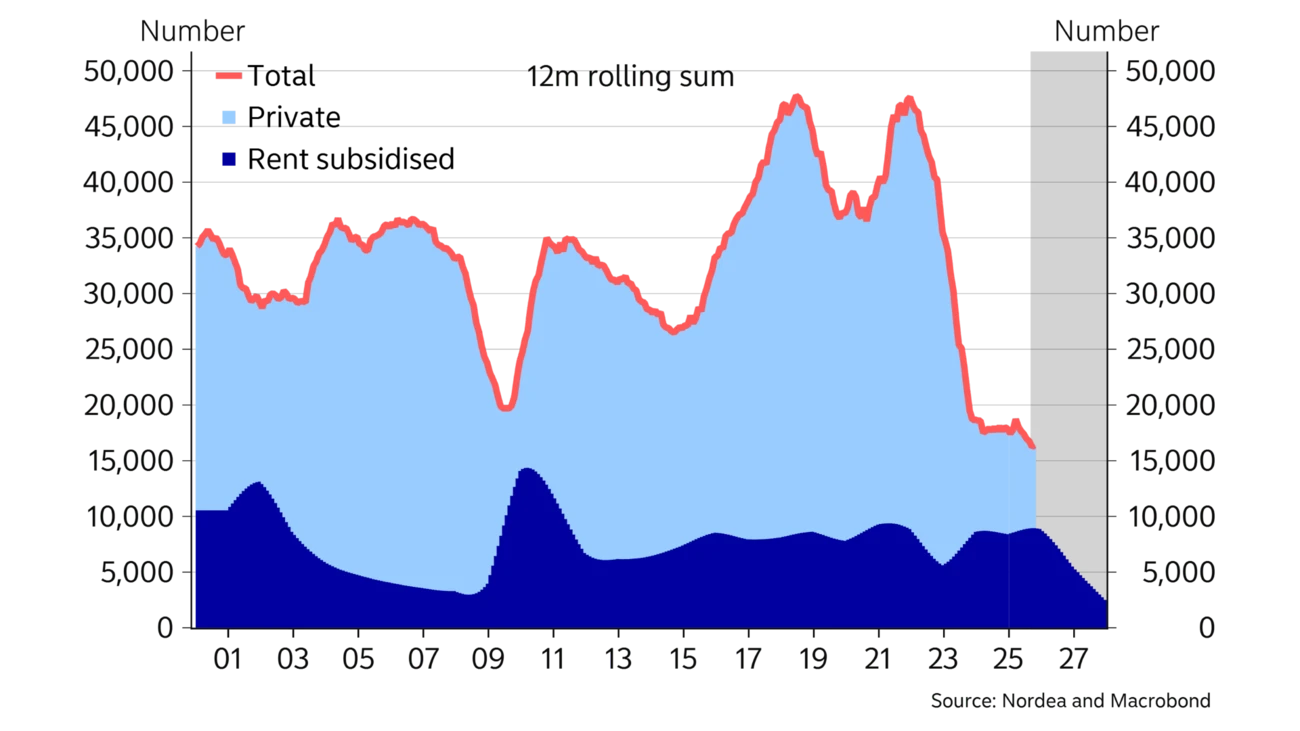

The housing market remains subdued, even though the sales of previously owned dwellings increased significantly last year. Selling times are still long and house prices continue to fall. In November, the prices of old apartments fell by 2% year-on-year.

The rental market still has ample supply, which is keeping rent increases very low. In some areas, rents are even falling.

The housing market situation is not favourable for private construction and, in addition, state-subsidised housing production authorisations will decrease by about a third this year, meaning significantly fewer subsidised housing starts.

Residential construction is expected to continue to contract this year. A turnaround in residential construction requires further increases in occupancy rates and a recovery in consumer confidence so that homeowners are again willing to invest in new homes.

Demand for commercial and office construction is sluggish due to an oversupply of offices and weak economic conditions in retail.

Renovation and industrial and warehouse construction are the only sectors where growth is expected this year.

Other investments besides construction held up last year, and the reduction in global uncertainty is likely to support investments this year as well. In investment surveys, companies report investing more in product development and the use of AI, while the share of construction has decreased.

Cheap and clean electricity is attracting unusually large investments in data centres in Finland at the moment, boosting other industries as well. The procurement of fighter jets for the air force and other defence investments will increase public investment beginning from this year.

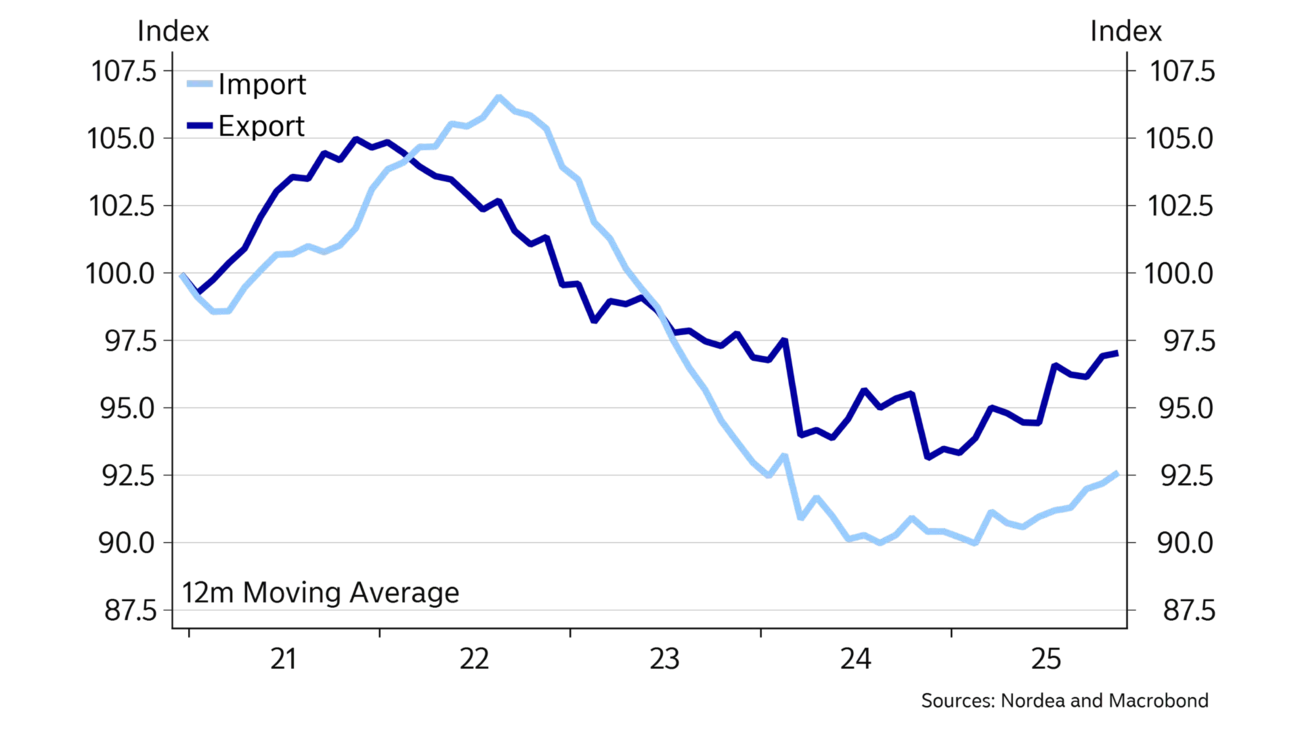

There was growth in new manufacturing orders last year, especially in the metal industry, while the forest industry remains sluggish. Growing order volumes will be reflected with a delay in industrial production and goods exports.

Growth in demand is being driven by the gradual pick-up in investment in Europe, especially in the defence industry. Various investments related to the electrification of industry are also still growing. The aversion of the US towards Chinese-made machinery and equipment is likely to improve demand for some Finnish products, despite US tariffs. It is still difficult to estimate the impact of US tariffs on exports, but it seems it will only be moderate at least in the short term.

The competitiveness of Finnish industry is at a good level, as the price of electricity and wage increases have remained moderate in Finland. This is reflected in the strengthening of the trade balance.

The public sector deficit shrank last year, but debt continued to grow rapidly. The deficit is expected to fall to 3% of GDP this year, as index increases in social benefits will be low and wage increases will be more moderate than in previous years, although the expensive public sector wage agreement will still be felt for several years to come. In addition, the growth in interest expenses has slowed, and government adjustment measures are easing spending pressure while gradually increasing tax revenues as the economy recovers. The Finnish Defence Forces’ fighter jet procurement will begin to burden public finances this year, slowing down the reduction of the public sector deficit.

The public sector debt to GDP ratio is expected to increase from the current 86.6% to 91.4% by the end of 2027.

This article first appeared in the Nordea Economic Outlook: Northern lights, published on 21 January 2026. Read more from the latest Nordea Economic Outlook .

Economic Outlook

The global economy was characterised by a high degree of resilience in a tumultuous 2025, with the prospect of renewed growth in 2026. However, there are significant risks are associated with the unpredictable geopolitical situation.

Read more

Economic Outlook

In a world of political uncertainty, the Danish economy is well positioned to handle future challenges. The foundation lies in the labour market, where record-high employment helps ensure robust public finances.

Read more

Economic Outlook

Movements in the NOK exchange rate are closely tied to structural net NOK transactions. After several years of persistent negative pressure, in which many market participants had an underlying need to sell NOK, we are now seeing signs of a shift in main flows, indicating a gradual strengthening of the NOK in 2026.

Read more