1.0%

Our forecast for GDP growth in 2025

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaJuho Kostiainen

The cautious growth seen in the Finnish economy is at risk of hitting a tariff wall. Lower inflation and interest rates are boosting purchasing power, but increased uncertainty threatens to put private consumption and investment on hold for a little longer. Housing market activity has increased, but prices are not rising yet. The oversupply in the rental market is still discouraging new construction.

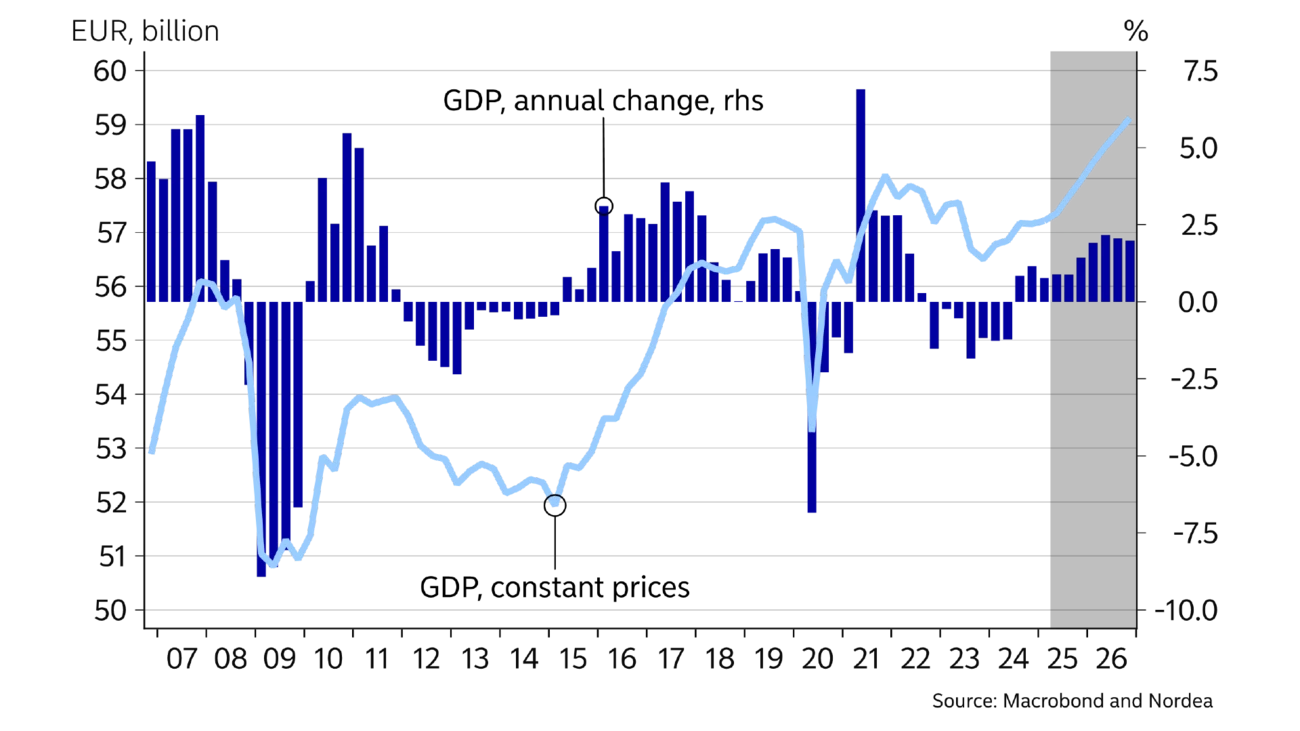

The Finnish economy grew by 1.2% year-on-year in the first months of this year. The fundamentals of economic growth have clearly improved, as the drop in inflation and interest rates has increased household purchasing power. Demand for corporate financing has also grown strongly this year, pointing towards more new investment.

However, the import tariffs imposed by the US, and the enormous uncertainty surrounding them, are likely to erase any budding economic growth, at least temporarily.

Because of this, economic forecasts are extremely difficult right now, as there are many very divergent paths the economy could take for the rest of the year. In our base scenario, we expect the tariffs imposed by the US on Europe to be around 10% and uncertainty over trade policy to clearly subside over the coming months. If these assumptions turn out to be too optimistic, the basis for our growth forecast for this year could collapse, and we may see the Finnish economy contract for the third year in a row.

In our base scenario, private consumption and corporate investment will drive economic growth this year. We expect export growth to remain positive, driven by service exports, as the tariffs will not affect them.

We expect the Finnish economy to grow by 1% this year, accelerating to 2% next year, as construction also begins to contribute positively to the economy.

In a negative scenario, economic growth may easily dip into the red for the full year if uncertainty keeps investment and consumption on hold while the export sector suffers from tariffs and, more broadly, from slower global economic growth. Positive scenarios are also possible if, in addition to a deal on tariffs, the German investment package and potential peace in Ukraine were to spur demand and boost confidence in Europe.

1.0%

Our forecast for GDP growth in 2025

0.5%

Consumer price inflation in April 2025

82.1%

Public sector debt-to-GDP ratio in 2024

Domestic inflation (CPI) has fallen to 0.5%, lowered by the drop in interest rates. Meanwhile, the harmonised index of consumer prices (HICP) for Finland, which does not account for interest rates, was 1.9% in April. The HICP at constant tax rates was 0.9% in April, as the VAT rate hike that took place late last year is estimated to have increased inflation by about one %-point.

Food and goods inflation has remained low, while energy prices have continued to fall. The annual average price of electricity has fallen to pre-energy crisis levels, and even the price of fuel has declined steadily for more than two years. Inflation has been sustained mainly by the rise in service prices, which have gone up more than 3% year-on-year.

However, since inflationary pressures are low on the whole, we expect harmonised inflation to remain below 2% this year. We expect domestic inflation to remain below 1%, thanks to falling interest rates.

| 2023 | 2024E | 2025E | 2026E | |

|---|---|---|---|---|

| Real GDP, % y/y | -0.9 | -0.1 | 1.0 | 2.0 |

| Consumer prices, % y/y | 6.3 | 1.6 | 0.8 | 1.3 |

| Unemployment rate, % | 7.2 | 8.4 | 9.0 | 8.2 |

| Hourly earnings, % y/y | 4.2 | 3.1 | 3.0 | 2.8 |

| General gov. budget balance, % of GDP | -3.0 | -4.4 | -3.9 | -2.8 |

| General gov. gross debt, % of GDP | 77.5 | 82.1 | 85.5 | 86.2 |

| Monetary policy rate (end of period) | 4.00 | 3.00 | 2.00 | 2.00 |

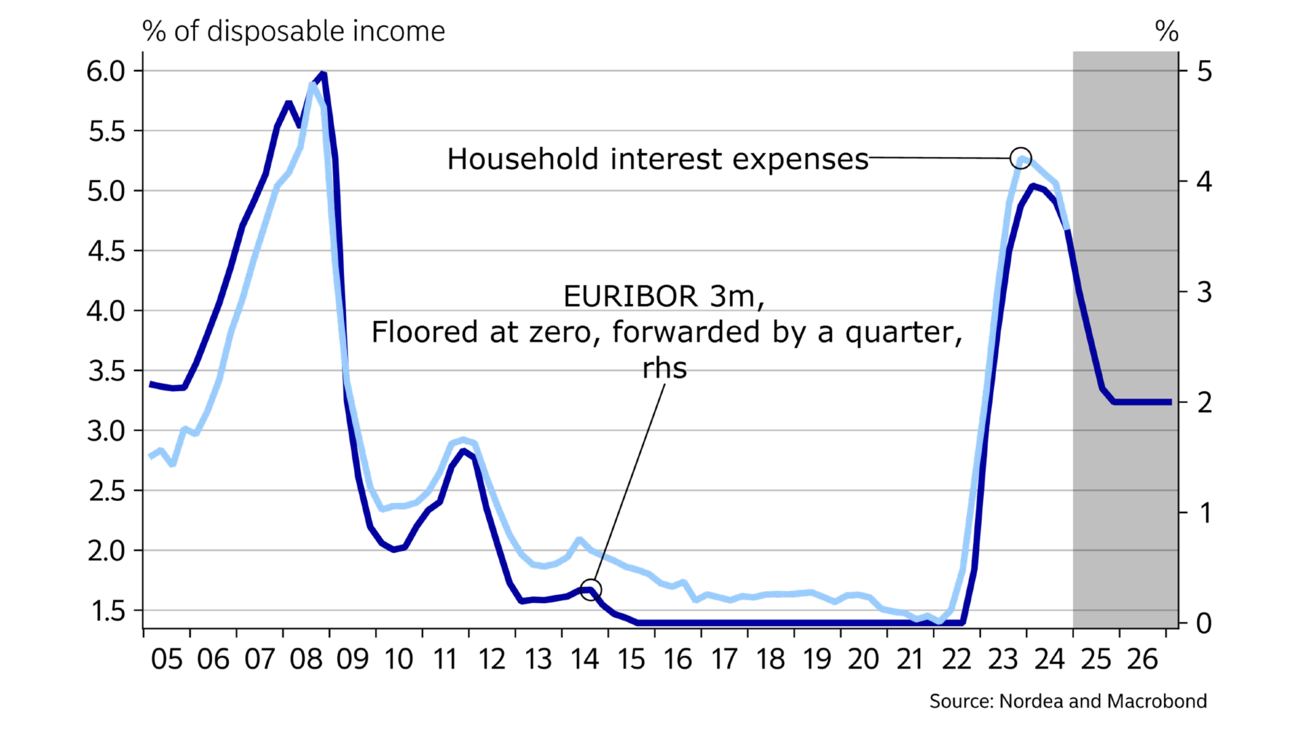

With inflation remaining moderate, wage increases are now genuinely improving wage-earners’ purchasing power. Additionally, the drop in interest rates will substantially free up more money for households to spend this year. Some leading indicators showed a recovery in April, as both card payments and retailers’ sales expectations were up.

We expect private consumption to start growing again this year after two years of zero growth. So far, consumers have mostly used rises in their real wages to increase their savings and repay their debt. A more detailed analysis of the Finnish consumer can be found in our theme article on page 19.

The employment situation continued to deteriorate throughout last year, and the unemployment rate was as high as 9.3% in March. The number of job vacancies also fell clearly, indicating weak demand for labour. Private-sector employment has no longer contracted in recent months, and the drop in overall employment comes from cuts in the public sector, though.

We expect employment to gradually recover this year, as improved purchasing power accelerates consumption. Growth in the working-age population, driven by immigration and the government’s measures to expand the labour supply, are also expected to boost employment as the economic situation improves.

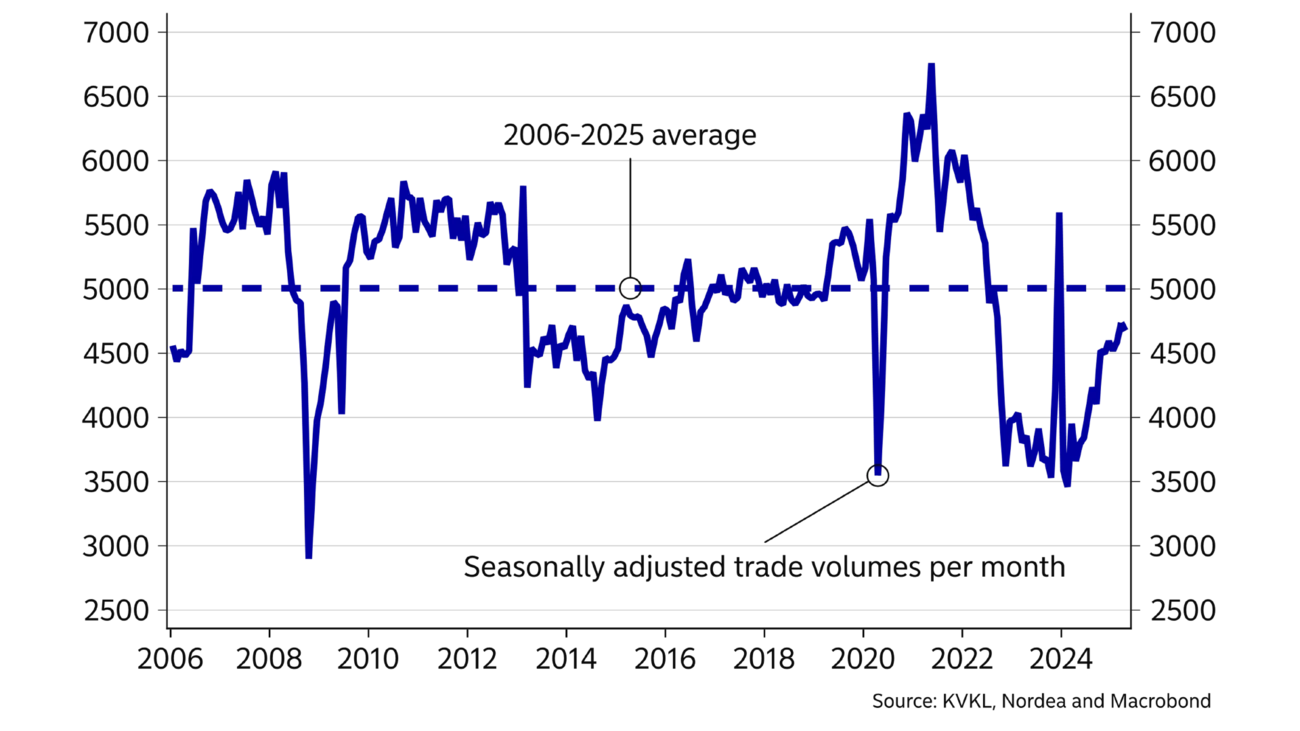

The rapid decline in market interest rates since last summer has brought a long-awaited boost to home sales. The number of transactions is already close to normal levels, but selling times are still long and there is a clear oversupply in the market, which has resulted in weak price performance. In January-March 2025, the prices of old apartments fell by 1.3% year-on-year. Home prices have now fallen by 12% from the peak seen in 2022. We expect home prices to level off this year, as lower interest rates, diminished construction volumes and growth in consumer purchasing power and confidence should balance out supply and demand in the market.

Oversupply persists in the rental market, evidenced by lower-than-normal occupancy rates, high numbers of rental ads and slow increases in rents. In the Greater Helsinki Area, the rental market has been stagnant for three years, indicating a bigger oversupply than in the other large cities.

The number of completed dwellings last year, at 20,900, was half of the figure for 2023, and this year, barely the same number of dwellings will be completed, with around half of them interest-subsidised rental homes. At the same time, populations in the large cities have continued to grow exceptionally rapidly. On the other hand, cuts to housing subsidies are now incentivising people to live in smaller homes, which limits the growth in demand for rental housing.

We expect housing construction to gradually get back on track, as the stock of unsold and unrented dwellings unwinds in a slowly recovering market.

We expect renovation construction to pick up this year after a few weaker years, as housing companies will begin to address their accumulated renovation needs once their finances improve on the back of lower interest rates and energy prices.

The large number of new business loans indicates a pick-up in investment.

Businesses have drawn down an exceptionally large number of new loans since the start of the year, which indicates a pick-up in investment. The uncertainty caused by the trade war may result in some projects being postponed, but on the whole, we expect investments in machinery and equipment to begin growing this year. Cheap and clean electricity is attracting an unusually high amount of investments in data centres in Finland at the moment. The procurement of fighter aircraft for the air force and the government’s investment programme should increase public investment this year and next.

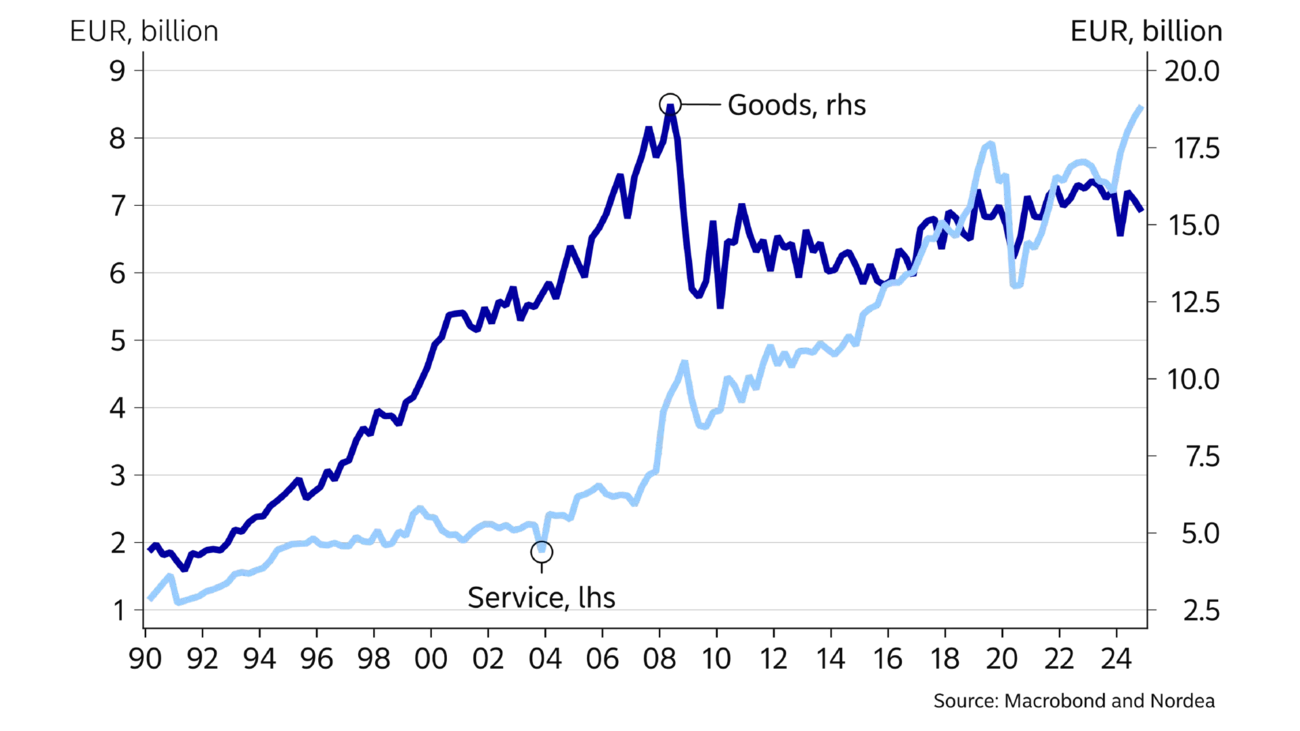

Last year, 11.2% of Finland’s goods exports went to the US, which, alongside Sweden, was the most important export market for Finland. About 2% of Finland’s GDP comes from goods exports to the US, so future decisions about tariffs will have a great impact on the Finnish economy.

If US tariffs are left at the current level of 10%, they would reduce Finland’s exports to the US, but would not send the Finnish economy back into a recession on their own. On the other hand, any reciprocal tariffs imposed by the EU, as well as tariffs between other countries and the US, could have an effect on Finland’s exports.

Finland mostly exports investment goods to the US (EUR 2.8bn in 2024). Exports of industrial goods amounted to EUR 2.2bn that same year, half of which came from the forestry sector and the metal industry. Pharmaceutical exports amounted to around EUR 1bn and fuels to EUR 0.7bn.

Finland’s exports are expected to grow this year after two years of zero growth. This growth is expected to be driven by service exports, which already expanded strongly last year. Goods exports are also forecast to grow slightly, partly because of the delivery of a large cruise ship, which should result in a spike in goods exports this summer and improve the goods exports figure for the full year. Otherwise, goods exports are expected to remain fairly sluggish due to the tariffs, although we may see an increase in goods exports to the US in the spring as companies aim to lock in their prices at the current levels for fear of higher tariffs to come. In addition to the tariffs, a stronger EUR relative to the USD could slightly curb exports to the US.

On the other hand, there are positive signs for exports to countries in which tariffs do not apply. Germany’s investment package will likely increase demand for exports by Finnish companies. Additionally, the SEK has appreciated considerably versus the EUR, improving Finland’s competitiveness against Swedish companies.

If tariffs are left at 10%, they would not send the economy back into a recession on their own.

The situation with public finances is expected to begin to improve this year. Index increases will likely remain low this year as inflation has slowed. Wage growth should also be more moderate than in previous years, even though the expensive wage settlement in the public sector looks set to have an impact for several years to come. Additionally, growth in interest expenses will level off this year. At the same time, central government adjustment measures aim to curb expenditure growth while increasing tax revenues along with the slowly recovering economic cycle. The Finnish Defence Forces’ fighter aircraft procurement will begin to burden public finances this year, slowing down the reduction of the public sector deficit. The deficit is not expected to fall below 3% of GDP until 2026.

The government’s bold cuts to income and corporate taxes for 2026 and 2027 should improve consumer purchasing power as well as incentives for working and investing. On the other hand, these tax cuts will increase the public sector deficit by about EUR 1bn per year in the short term.

The public sector deficit was 4.4% of GDP last year. This deficit is expected to decrease somewhat this year, provided that economic growth picks up. Growth in public sector debt will also slow down this year. Next year, the government plans to transfer funds from the state pension fund, which will curtail growth in gross debt but decrease the state’s assets. Public sector debt is expected to increase from 82.1% last year to 86.3% by the end of 2026.

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more