- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

Russia’s attack against Ukraine will slow down economic growth in Finland this year. The collapse of exports to Russia, the deterioration of consumer purchasing power due to rising inflation and the general uncertainty are weighing on economic activity. However, strong order books and a rise in export prices will keep the manufacturing cogs turning. A strong labour market, the lifting of restrictions and the savings accumulated by households during the Covid pandemic will underpin growth in the service sector.

Finland’s economic growth is expected to slow down this year as a result of the war started by Russia. Although exports from Finland to its eastern neighbour have decreased in the past decades, the total collapse of exports to Russia has still had a profound effect. Meanwhile, higher energy prices are eroding consumer purchasing power, and shortages in materials are hampering many companies. Moreover, the uncertainty is postponing investments.

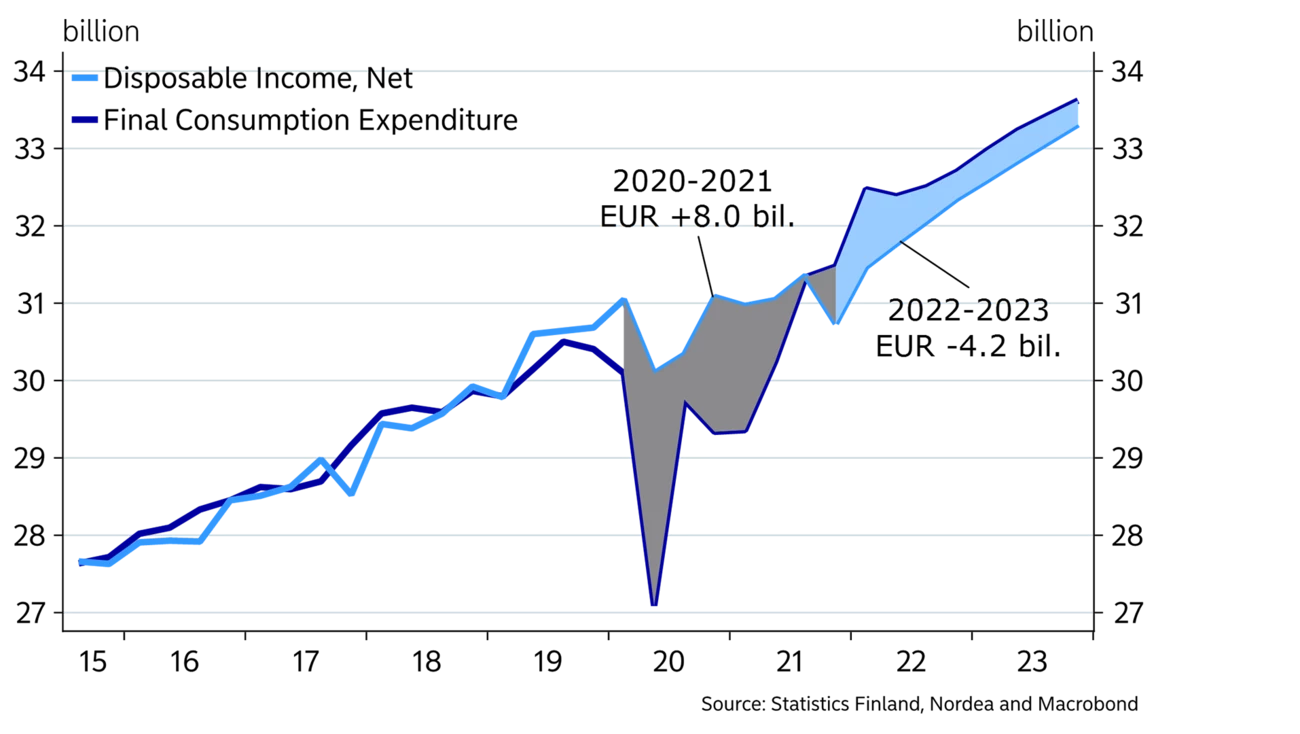

The Finnish economy was performing well at the start of the war, and demand has remained at a good level. Order books in the manufacturing sector are full, the number of construction projects is record high and the service sector is still recovering. The more than 8 billion euros in savings accumulated by households during the pandemic will help sustain private consumption despite real incomes falling this year due to rising inflation.

The Finnish economy as a whole will not suffer from a rise in the global prices of commodities and materials in the same way as many other countries in Europe. The prices of imports and exports in Finland have actually risen in tandem.

We project GDP to grow by 2% this year. Next year, growth is expected to slow down to 1.5%. In light of this, the Finnish economy looks poised to survive the war relatively unscathed.

Due to the unpredictable nature of the war, our economic forecast includes a considerable amount of uncertainty. However, it is clear that Finnish exports to Russia will remain low for a long time, while the price of oil will remain permanently at a higher level. On the other hand, the price of electricity will drop in the coming years.

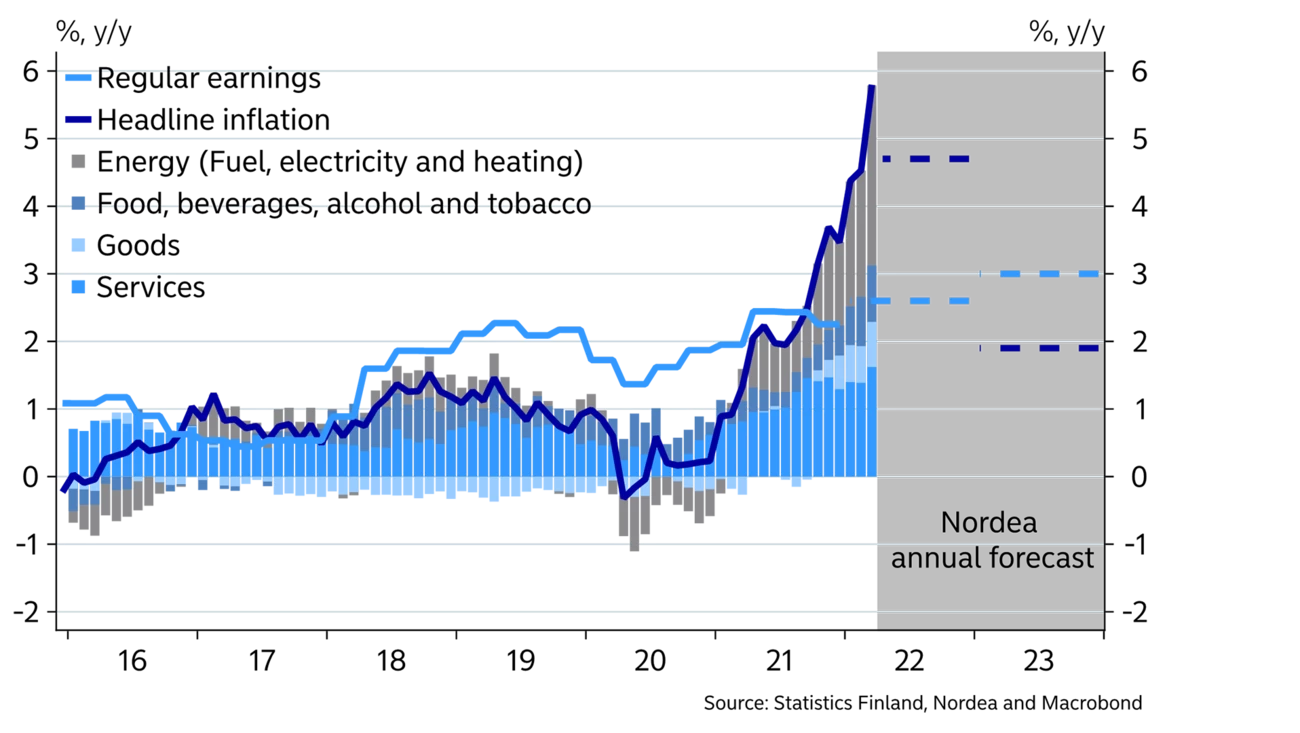

The increase in consumer prices accelerated to 5.8% in March. Half of this increase can be explained by rising energy prices. Costs of housing are increased by the higher electricity prices as well as the increase in maintenance and renovation expenses. In Finland, district heating expenses have risen moderately compared to the higher gas heating expenses in many European countries, which has kept inflation among the lowest in the EU.

Fuel prices are going up primarily due to the rise in price of oil, as well as a shortage of refining capacity. The price of electricity is already falling, which will be felt in consumer prices with a delay. The inflationary pressure caused by energy is expected to ease over the rest of this year.

The price of food is expected to rise considerably this year on the back of higher prices for fertilisers and fuel used for agricultural machinery. Disruptions in imports from Russia and Ukraine are also raising global grain prices. Meanwhile, a new surge in global logistics problems and a shortage of components continue to push the prices of goods up.

Inflation is expected to amount to 4.7% on average this year and to fall to 1.9% next year as the impact of energy prices levels off.

Contractual wage increases will amount to about 2% this year, but due to wage drift, we forecast wages to rise by 2.6%. Next year, wages are projected to rise by 3%.

|

|

2019 |

2020 |

2021 |

2022E |

2023E |

|

Real GDP, % y/y |

1.2 |

-2.3 |

3.5 |

2.0 |

1.5 |

|

Consumer prices, % y/y |

1.0 |

0.3 |

2.2 |

4.7 |

1.9 |

|

Unemployment rate, % |

6.7 |

7.8 |

7.6 |

6.6 |

6.3 |

|

Wages, % y/y |

2.1 |

2.0 |

2.3 |

2.6 |

3.0 |

|

Public sector surplus, % of GDP |

-0.9 |

-5.5 |

-2.6 |

-2.1 |

-1.9 |

|

Public sector debt, % of GDP |

59.6 |

69.0 |

65.8 |

65.7 |

66.1 |

|

ECB deposit interest rate (at year-end) |

-0.50 |

-0.50 |

-0.50 |

0.25 |

1.25 |

The inflation rate will outpace the growth of disposable income this year, which means consumers will have to turn to their savings to maintain their spending at last year’s level. In 2020–2021, households accumulated 8 billion euros in savings when consumption opportunities were limited due to the Covid-19 pandemic.

As a result, households are expected to consume more than their income this year and next. Private consumption is expected to grow by 1.4% this year and 0.7% next year. This assumes that households will unwind around 4 billion euros of their accumulated savings.

Consumption will continue to shift from goods to services this year. Additionally, the consumption of goods is expected to increasingly shift towards staples as purchasing power weakens.

The return of travel will send household income abroad in the form of service imports. On the other hand, tourism income will begin flowing to Finland as well, even though the number of Russian tourists is expected to be moderate in the coming years.

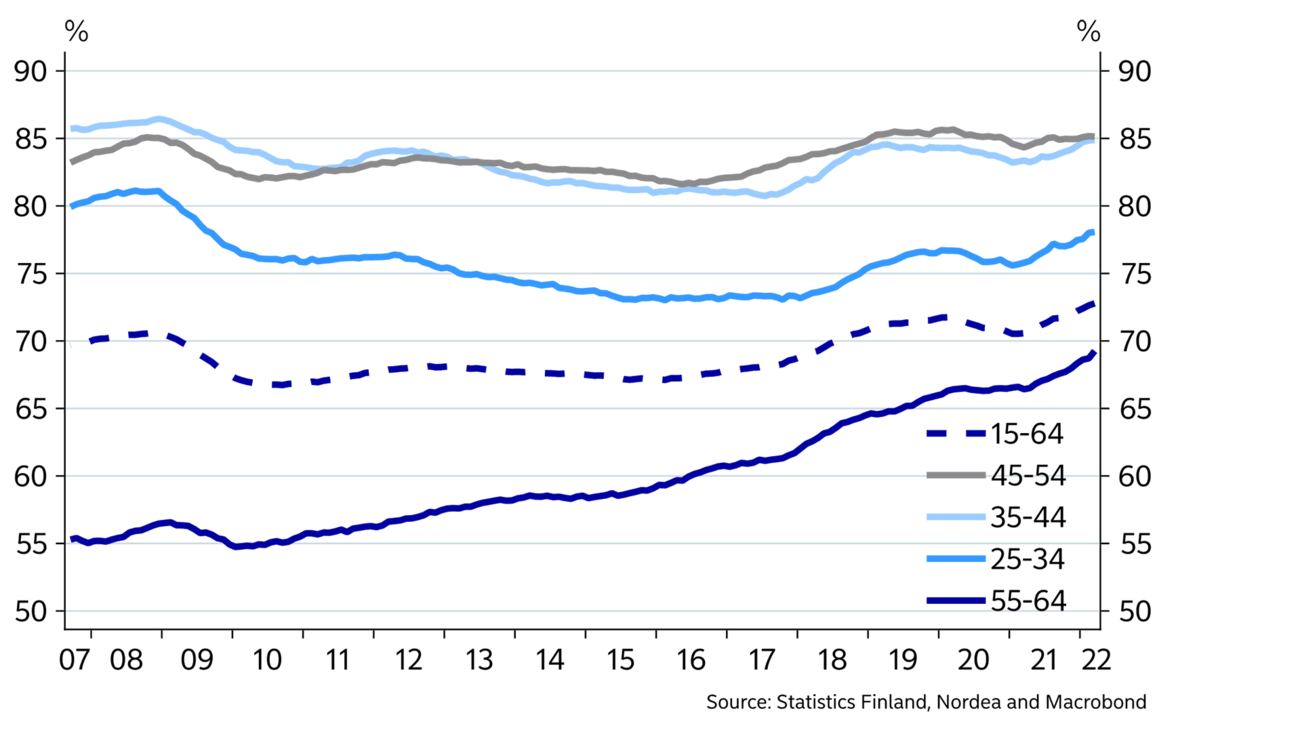

The employment rate hit a new all-time high early this year, and the unemployment rate has fallen below 7%. The rapid improvement in the employment rate is primarily due to a sharp recovery in demand for labour in manufacturing, construction and services alike. Additionally, the labour supply has grown especially among those aged over 55, who are participating in the labour market at a growing rate as a result of a higher retirement age and a shorter period of extended unemployment benefits leading up to retirement.

As a result of the war in Ukraine, the growth in employment will slow down, although demand for labour will remain stable. There are still plenty of job vacancies, and businesses continue to face recruitment problems. The pick-up in the service sector will further boost employment, whereas the outlook in construction will slightly cool off.

The Finnish economy looks poised to survive the war in Ukraine relatively unscathed.

Trade sanctions imposed on Russia and voluntary boycotts by companies are set to bring exports to and imports from Russia almost to a standstill. In March, exports to Russia fell by 42%, and imports increased by 63% year-on-year. Last year, Russia accounted for 4.5% of Finland’s exports and 8.3% of the country’s imports. Russia’s importance in Finland’s foreign trade has clearly declined in the past decades, with Finnish companies systematically cutting down their operations in Russia in recent years.

Russian demand for exports can largely be supplanted by demand from elsewhere across the globe. The Finnish export market is expected to grow by only 4% this year and next, as economic growth slows down across Europe.

Despite the war, demand for the manufacturing sector has remained at a good level. The capacity utilisation rate in the manufacturing sector was still above 90% in April, and businesses boasted long order backlogs, which will help them adapt to the loss of the Russian export market.

About half of the imports from Russia have been energy, mostly consisting of oil, but also natural gas and electricity. Finland is not dependent on Russian energy, and these imports are set to be replaced over the summer with energy imports from other countries.

As for commodities and materials, imports from Russia can mostly be replaced with imports from other countries or Finnish production, for example in the case of woodchips. The import restrictions on raw materials and commodities could cause stoppages in manufacturing and construction.

As a result of the war, the export prices of raw materials and commodities produced in Finland have shot up, keeping Finland’s terms of trade unchanged and improving the earnings of many export businesses. Rising prices are treating companies very unequally at the moment, with some seeing a swift rise in expenses while others are enjoying higher global market prices for their products. Learn more about the price competitiveness of the Finnish economy in this theme article.

Investments are suffering from increasing economic uncertainty, with surveys indicating that investment projects have been postponed as the economic outlook has become fuzzier.

However, there are plenty of investment needs in the manufacturing sector since capacity is restricting production and the green transition is taking place faster than expected. Wind power, for example, is one of the areas where a great deal of investment is taking place.

The number of permits for residential construction has begun to decrease at the same time as growth in the number of new building starts has dwindled. The construction sector is expected to slow down as the increase in construction costs and housing demand level off. Construction will continue to remain at a high level this year because a record number of projects were started last year.

Housing transactions reached a record number last year, resulting in price rises across the country. Newly built apartments have sold well this year, too. Demand for housing will calm down this year as consumption shifts back to services, real purchasing power weakens and interest rates rise. As a result, the increase in housing prices is expected to be modest this year.

There is oversupply in some places in the rental market, causing rents to fall, especially in the Greater Helsinki area. However, demand for rental housing is expected to recover by the autumn, when students return to the lecture halls, employment in the service sector improves and demand for short-term accommodation grows on the back of reinvigorated tourism.

The public sector deficit was 2.6% of GDP last year, which was less than half of the deficit in 2020. Economic growth has boosted tax revenues, while the lower unemployment rate and the lifting of Covid-19 restrictions have alleviated expenses.

The government added around 2 billion euros to its budget for this year and next to fund defence spending and general readiness. In addition, a rise in interest rates will increase the public sector’s interest expenses. Due to the additional expenditure, the public sector deficit will not significantly decrease during the forecast period.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more