2.9%

Global GDP growth in 2025

Sivua ei ole saatavilla suomeksi

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivullePresident Trump’s policy actions have caused a lot of volatility in the financial markets and the economic outlook since our previous forecast. Uncertainty is high, and, given Trump’s tendency to cause chaos, this is expected to continue. Thus, there are still severe downside risks to our baseline forecast, which has only changed slightly in many aspects. The USD forecast is an exception – Trump’s actions have clearly weakened the attraction of US investments and the USD.

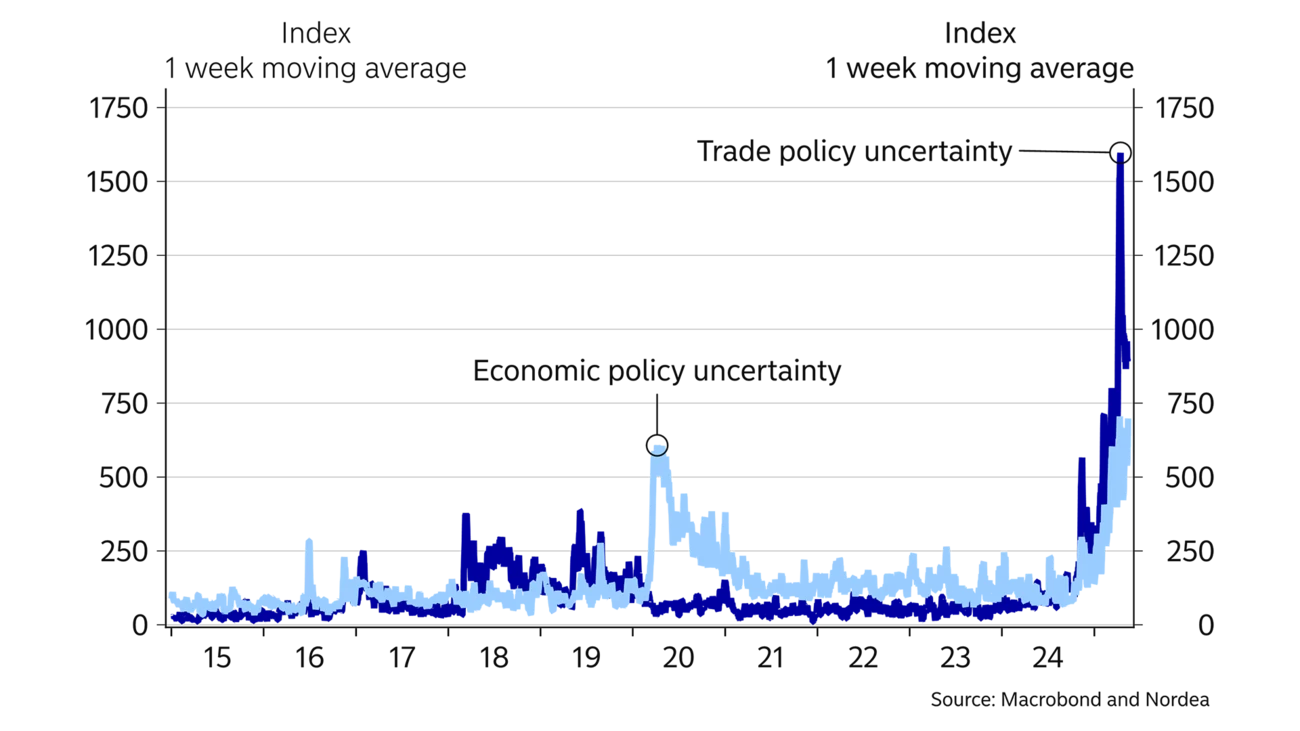

President Trump’s tendency to float radical ideas and create chaos was well known when our previous forecast was published in January. Still, the number of initiatives and the scale of radicalism have surprised us and many others in the financial markets. Uncertainty about US economic policies is at a record-high level, causing downside risks not only in the US but also to the global economic outlook.

In this forecast, we continue to expect Trump’s policies to not hurt the global economy as much as many may fear, but, at the same time, we would like to emphasise the high level of uncertainty around our baseline profile and the importance of making different scenarios about the future. In our baseline forecast, we assume Trump will back off from his most radical policy ideas domestically and the bilateral trade deals to limit the US tariff level on average at 10-15%. The downward revisions to most of our forecasts are limited, but the largest is to the US economy. As we illustrate later, these relative changes play an important role in the FX market and have significantly weakened the US dollar.

Uncertainty about the economic outlook is high due to Trump’s volatile actions

The shift in the German fiscal policy is one of the developments that has surprised us positively since the winter forecast and allows the Euro area to compensate for part of the negative effects caused by the global uncertainty. It remains to be seen whether Trump will be able to stabilise the European geopolitical landscape and whether consumer confidence can finally start to recover. The NATO summit at the end of June is important in this respect. In our view, the chances of seeing strong positive growth and a confidence shock from a possible peace agreement in Ukraine have declined, as the profound contradictions between Russia and the EU have become even more evident.

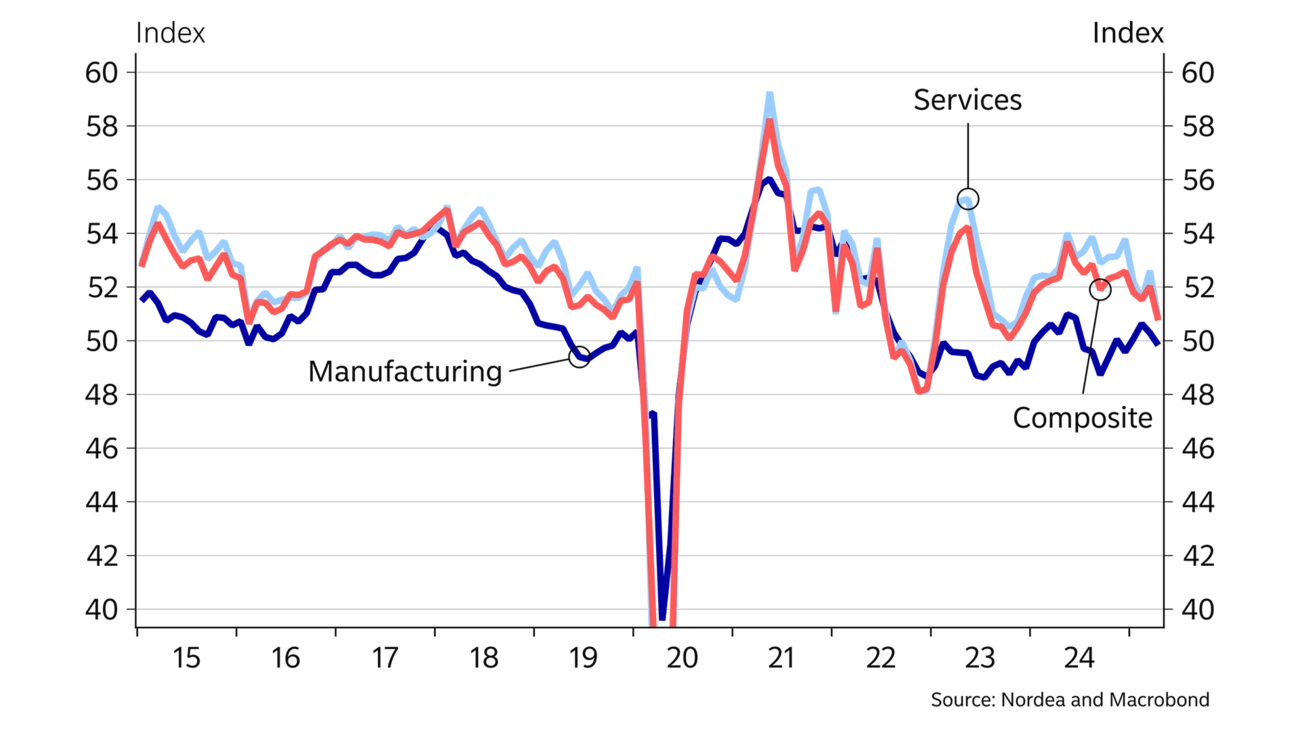

Broad measures of inflation have been hovering slightly above the central banks’ targets in the US and the Euro area. In the coming months, developments are expected to diverge more, as weak economic growth and lower wage increases are expected to further slow core inflation in the Euro area; meanwhile, in the US, Trump’s tariffs point to another round of upside risks to inflation. Global price pressures are expected to remain under control, mainly owing to China’s overcapacity and expected modest energy price increases.

Hard data on the US has indicated that the economy has so far weathered the shocks from Trump’s policies surprisingly well. However, soft data already indicates that consumers and corporates are becoming more aware of the downside risks, and we expect growth numbers on domestic demand to weaken in the coming quarters, as high uncertainty, financial market volatility and import tariffs affect consumption and investment negatively. Part of the negative effect is expected to be compensated by a loose fiscal policy. Although the focus has recently been on Trump’s trade policy and the negative effects in the short term, we think it is important to also follow the long-term implications of Trump’s policies for the US society and economy. For example, the rattling institutions can be a challenge for the US business environment.

2.9%

Global GDP growth in 2025

2.2%

Consumer price inflation in the Euro area in April 2025

$62

Expected oil price at the end of 2025 in the oil future market

China has suffered from low consumer confidence and the housing market downturn for many years, and real growth has most likely been significantly lower than in the official data. However, rapid technological development, increased stimulus and a slightly higher propensity to consume seemed to have stabilised the outlook early this year. More recently, the uncertainty around the outlook has increased, driven by the trade war with the US. If the fresh deal between the countries holds and the level of limits is around or below Trump’s campaign promise of 60%, China can achieve 4.5% growth in 2025. However, if the trade war intensifies again, Chinese leaders need to decide whether they will increase stimulus or accept significantly lower-than-targeted growth in 2025 and blame the US for the problems.

Euro-area growth remained resilient in the first quarter of 2025 but partly due to temporary reasons. The short-term growth outlook continues to be hurt by the uncertainty about the trade policy and weak consumer and business confidence. On the other hand, the labour market is still strong, real wage increases are positive and the ECB’s loose monetary policy continues to pass through to the real economy. Regarding 2026, the upside risks increased considerably a couple of months ago when the outgoing German parliament voted for a large investment package and looser fiscal rules for the country. We expect the package to raise Euro-area GDP growth by around 0.5% in 2026 and 2027.

We expect the German fiscal package to raise Euro-area GDP growth by around 0.5% in both 2026 and 2027.

Despite the increased downside risks around the economic outlook, one should not expect central banks to swiftly intervene with steeply lower rates, as they have done many times before. The Fed especially is concerned about the inflationary impact of Trump’s policies and stays firmly on hold for now. We still do not have any Fed cuts in our baseline.

The ECB is more worried about the downside risks and will likely continue cutting rates.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

|---|---|---|---|---|---|---|---|---|

| 2023 | 3.3 | 3.2 | 2.5 | 2.5 | 0.5 | 0.5 | 5.2 | 5.2 |

| 2024E | 3.3 | 3.2 | 2.8 | 2.7 | 0.8 | 0.7 | 5.0 | 5.0 |

| 2025E | 2.9 | 3.3 | 1.8 | 2.5 | 1.0 | 1.0 | 4.5 | 4.5 |

| 2026E | 3.1 | 3.2 | 1.7 | 2.0 | 2.0 | 1.5 | 4.0 | 4.0 |

| Year | EUR/USD | EUR/GBP | EUR/NOK | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

|---|---|---|---|---|---|---|---|---|

| 2023 | 1.10 | 0.86 | 10.53 | 11.10 | 4.00 | 5.50 | 3.88 | 2.02 |

| 2024 | 1.04 | 0.83 | 11.24 | 11.48 | 3.00 | 4.50 | 4.58 | 2.36 |

| 2025E | 1.14 | 0.87 | 11.75 | 10.70 | 2.00 | 4.50 | 5.00 | 2.90 |

| 2026E | 1.20 | 0.88 | 11.50 | 10.50 | 2.00 | 4.50 | 5.00 | 3.10 |

However, the central bank is far from convinced that an accommodative monetary policy is needed at this moment, and there are also upside risks on the horizon in the form of forthcoming German infrastructure investments, higher EU defence spending and elevated household savings. When balancing these risks, we think the ECB will cut rates only one more time, which would leave that deposit rate at 2%.

We see further upside potential for longer yields, especially owing to the need for higher term premia. Given huge bond issuance volumes at a time of central banks reducing their bond holdings, inflation uncertainties especially in the US, questions towards the attractiveness of US assets going forward and even possible doubts towards the independence of the Fed and still relatively low levels of term premia historically, we argue that higher risk premia abound.

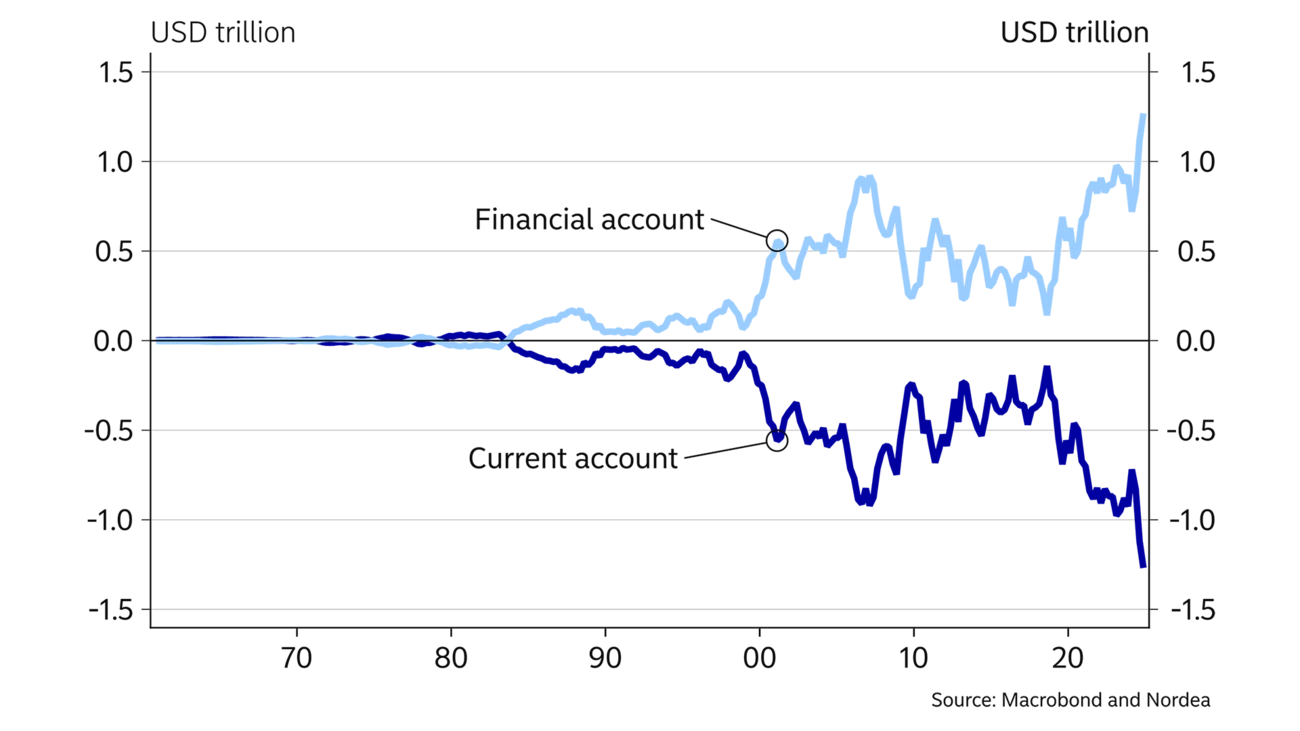

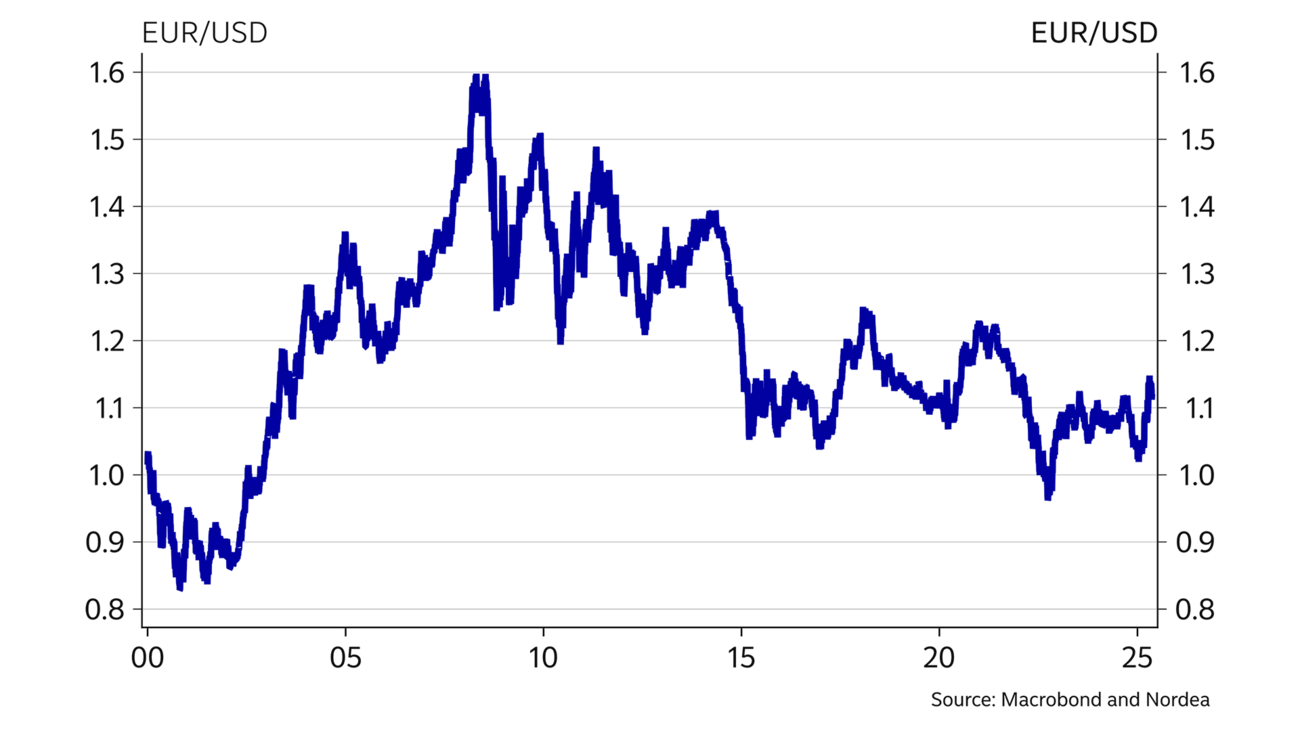

The US dollar started 2025 at record-strong levels, as a robust economic and investment outlook had boosted capital flows and USD demand. Since then, the US dollar has surprisingly weakened by almost 10% versus the euro, and the trade-weighted USD indices are down by almost the same amount. Although the depreciation has already been rather massive in such a short-time horizon, we tend to think that the balance of risks points towards further deprecation in the coming years.

The main driver of such depreciation is the shrinking economic gap between the US and the rest of the world as a result of Trump’s chaotic policies. The US economy will be hit by tariffs and increased uncertainty, and we now revise down our forecast for the US more than for the rest of the world, for example for the Euro area, where the negative effects from the trade war will be partly compensated by the increased fiscal spending. As mentioned above, Trump’s policies may weaken US growth prospects also in the long run.

The attraction of the USD has weakened.

In addition to the downside risks to the US growth outlook, more investors are now questioning the credibility of US institutions and even the independence of the Fed in the FX market due to Trump’s policy attacks. Investors have already begun reacting to the elevated uncertainty by gradually reducing their exposure to US assets and the US dollar, and we expect this type of asset and currency diversification to take several years. The slow process is partly explained by the fact that, given that the US offers by far the deepest and most liquid financial markets in the world, there is no viable alternative to USD assets at least in the short term.

In our view, this transition will create a multi-year USD depreciation against most currencies. In Scandinavia, capital flows are likely to benefit Sweden’s open economy and its currency but only have a limited impact on the smaller and more closed Norwegian economy and its currency.

Overall, the recent volatility in the FX market may continue, and the risks are exceptionally high. Foreign sector funding and large global capital accumulating in US assets are based on trust and confidence. If foreign investors begin to fear political interference in monetary policy, the forces underpinning the large global demand for US assets and the US dollar could begin to erode more rapidly.

3.1%

We expect German 10-year yields to rise gradually towards the end of 2026

1.20

The level we expect EUR/USD to hit by the end of 2026

2.0%

The level we expect the ECB to stop its rate cuts at

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Be the first to get the latest news releases Subscribe to our news service and you'll be the first to get the latest news from the bank.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more