3.2%

Global GDP growth in 2026

Tuuli Koivu, Jan von Gerich, Philip Maldia Madsen

Some of the downside risks in the global economy have vanished since our spring forecast due to President Trump’s trade deals and the fiscal agreement in the US. However, growth momentum in many countries continues to be rather weak and to some extent relying on loose fiscal policy as consumers and corporates are still cautious. While the central banks are almost done with their rate cuts, the FX segment is likely to see more volatility.

The global economic outlook has stabilised somewhat since our previous forecast due to the US fiscal agreement and Trump’s trade deals with multiple trading partners. However, global growth is projected to remain rather modest at around 3.0% this year and next as political and geopolitical uncertainties continue to make consumers and corporates cautious in many countries. In addition, Trump’s tariffs are expected to hurt growth in the US and global trade.

Financial markets have recently taken the political risks with a pinch of salt, and developments in that part of the economy have been surprisingly stable. However, we cannot rule out more surprises and stronger reactions in the coming weeks and months as Trump’s unpredictable policy proposals and decisions keep everyone on their toes.

In the geopolitical arena, Trump and European leaders have intensified their efforts to end the Russian assault in Ukraine. However, Russia’s stated objectives remain fundamentally at odds with those of Ukraine and Western Europe, potentially making resolution within our forecast horizon impossible. Thus, while positive spillover effects from peace in Ukraine are possible, we have not incorporated those in our baseline forecast.

The first signs of higher inflation due to the tariffs are already visible in the US and more is in the pipeline as consumers will ultimately bear most of the extra costs. However, the recent slowdown in US consumption growth may heighten competition and delay the pass-through of the tariffs to consumer prices.

Outside the US, price pressures look more or less contained. In the Euro area, HICP inflation has hovered around the targeted 2% for some months, and upward price pressures in the service sector are expected to remain moderate thanks to the slowdown in wage increases. Also price increases of commodities and energy are modest at the moment, and China continues to feed the global economy with its excess capacity – with resulting low or even negative price pressures. Food price inflation has recently surprised to the upside in many countries, causing some upside pressure on inflation forecasts.

After a few years of robust growth, the US outlook has weakened this year as expected. Consumption growth and labour market developments have slowed down, likely in part due to the elevated uncertainty caused by Trump’s policies. However, so far the slowdown in growth seems to have been a gradual process. It is important to keep in mind that the recent slowdown in job creation is probably partly due to limited labour supply and Trump’s restrictive immigration policy and not solely due to reduced demand for labour. Although there are large differences between confidence indicators, many soft indicators have weathered the storm well so far. In our baseline GDP growth in the US continues at around 2%.

3.2%

Global GDP growth in 2026

2.7%

Consumer price inflation in the US in July 2025

$66

Expected oil price at the end of 2026 in the oil future market

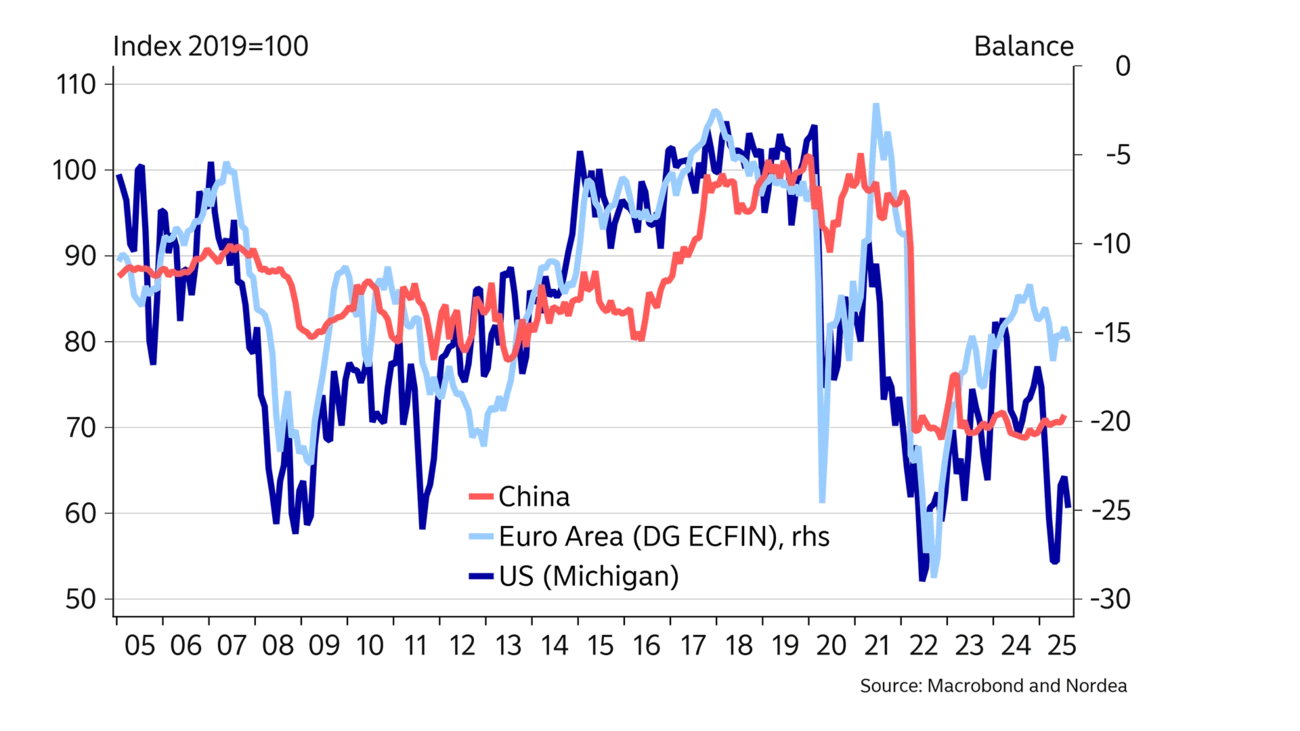

China continues to publish 5% growth numbers despite the fact that the housing sector is still in a downturn, labour market trends are weak and consumer confidence is low. Most China analysts think that the GDP numbers are politically too sensitive to truly reflect China’s weak business cycle and suggest that in reality, growth is considerably slower and sectoral differences are large. We expect this discrepancy between reality and official numbers to continue. The domestic reasons for weak growth are not going to be fixed any time soon and in addition, the geopolitical environment is also challenging from an economic growth perspective. While the tariffs between the US and China are expected to continue at around current levels, the intense power competition implies gradually weaker economic cooperation between the two super powers. In addition, China’s relationship with the EU continues to be challenging due to China’s continuous support to Russia and the conflicting views on China’s economic policies.

Financial markets have recently taken the political risks with a pinch of salt.

The Euro-area growth outlook has stabilised thanks to the trade deal with the US. Although the rather high 15% tariff rate will cover most of the bilateral trade, we expect the negative impact on EU exports to be limited and compensated by the reduced uncertainty. We expect growth to accelerate in 2026 due to the easier fiscal policy and rising consumer confidence. The pass-through from lower interest rates to the real economy is also expected to boost growth. The downward revision to our growth forecast in 2026 is due to slower-than-expected implementation of the German fiscal package.

The ECB stopped its rate cuts at 2%, a level the central bank finds neutral and suitable in the current environment, and the bar for further rate cuts has been raised. While the risk of further cuts has not disappeared, our baseline assumes that the focus will shift towards brisker growth and upside inflation risks, and we have added two 25bp rate hikes to our forecasts for 2027.

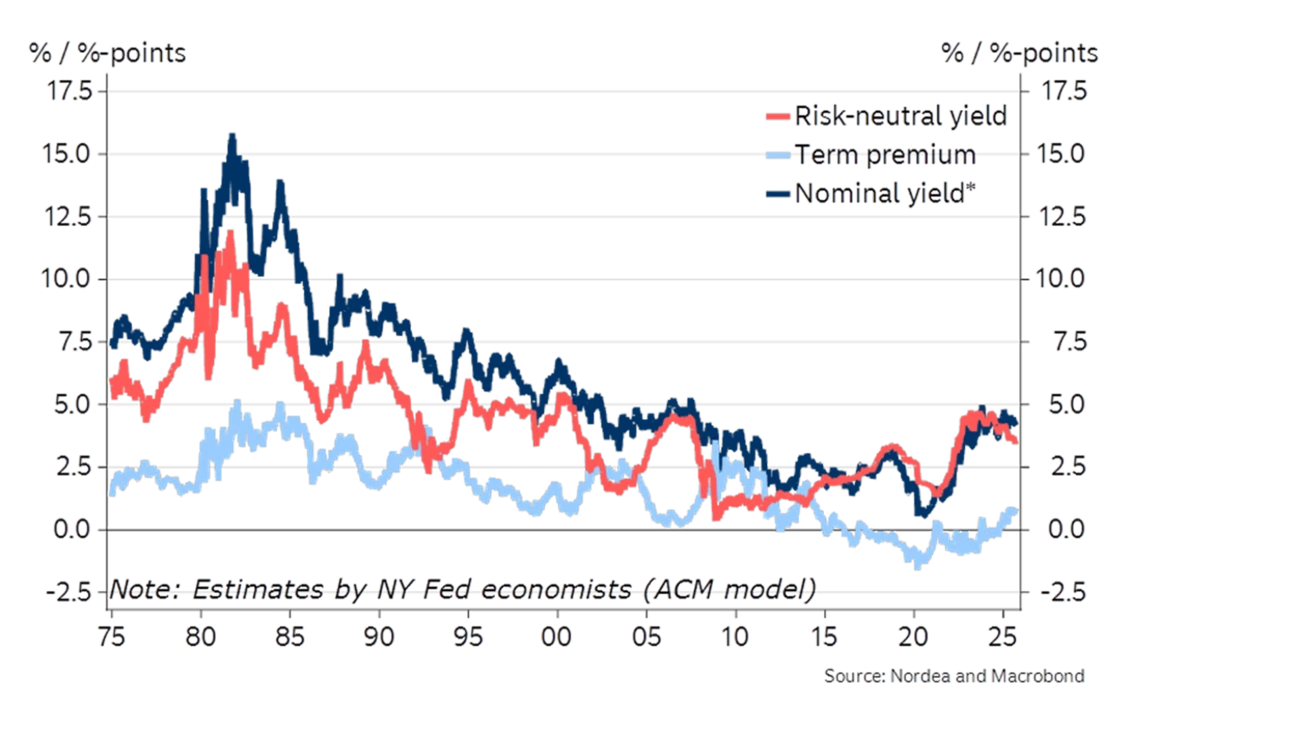

The Fed, in turn, has persistently kept rates high at above 4%, and while we now consider a near-term rate cut likely on the back of weaker employment growth, we continue to see only limited room for lower rates and expect rates to remain clearly higher compared to current financial market pricing. Despite weaker growth, the measures from the US administration are already noticeably impacting labour supply growth, and the unemployment rate should thus remain low even with rather modest employment growth. Further, the inflationary impact of the tariffs imposed on US imports has only started to be reflected in the inflation data.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

|---|---|---|---|---|---|---|---|---|

| 2024 | 3.3 | 3.3 | 2.8 | 2.8 | 0.7 | 0.8 | 5.0 | 5.0 |

| 2025E | 3.1 | 2.9 | 1.9 | 1.8 | 1.2 | 1.0 | 5.0 | 4.5 |

| 2026E | 3.2 | 3.1 | 2.0 | 1.7 | 1.5 | 2.0 | 4.5 | 4.0 |

| 2027E | 3.2 | 2.0 | 2.0 | 4.0 |

| Year | EUR/USD | EUR/GBP | EUR/NOK | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

|---|---|---|---|---|---|---|---|---|

| 2024 | 1.04 | 0.83 | 11.24 | 11.48 | 3.00 | 4.50 | 4.58 | 2.36 |

| 2025E | 1.20 | 0.86 | 11.75 | 10.90 | 2.00 | 4.25 | 4.50 | 2.80 |

| 2026E | 1.24 | 0.87 | 11.50 | 10.60 | 2.00 | 4.25 | 5.00 | 3.15 |

| 2027E | 1.26 | 0.87 | 11.50 | 10.50 | 2.50 | 4.25 | 5.00 | 3.30 |

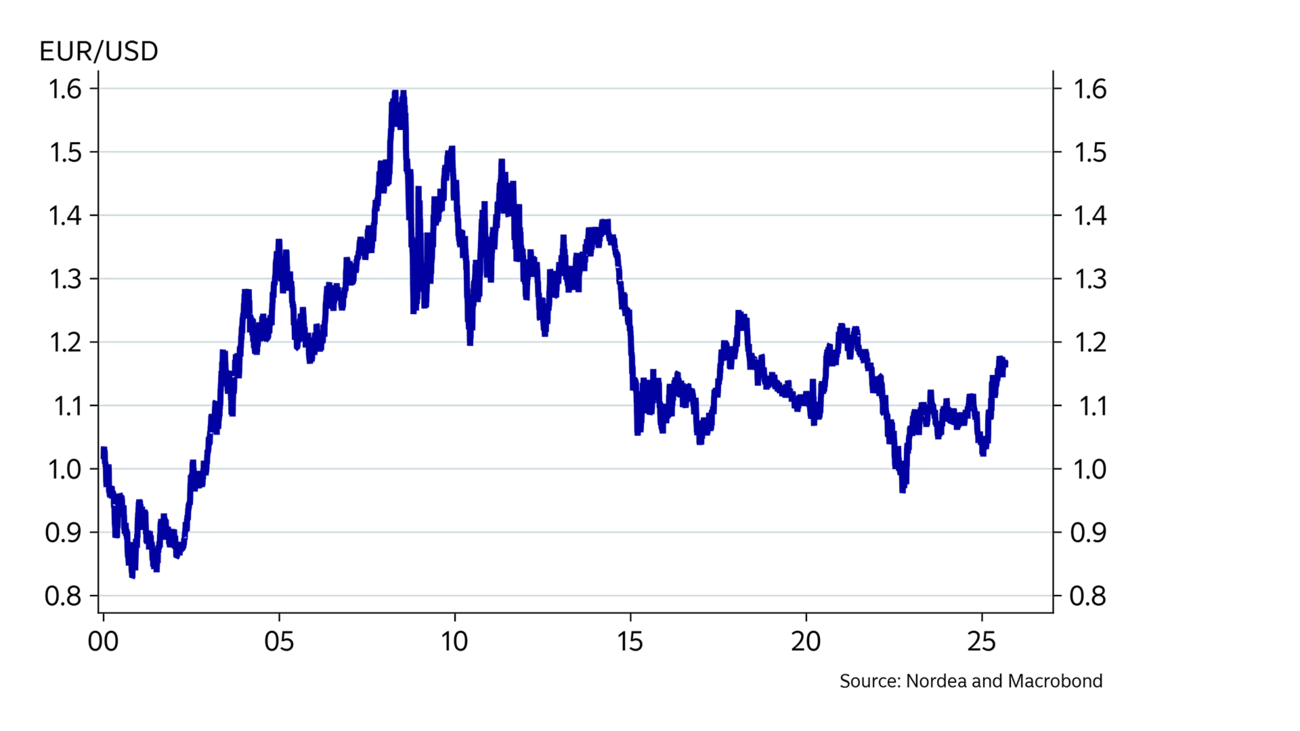

The dollar has weakened by about 13% versus the euro this year, which is a historically large drop in such a short time. We and most other forecasters have been surprised by the speed and magnitude of the depreciation, but we tend to think the balance of risks points toward even more dollar weakness over the next year, although there could be some larger reversals compared to the one-way trend we have seen so far.

An important driver remains the somewhat weaker economic outlook in the US and the improving outlook in the Euro area. Concerns about the politicisation of the Fed and economic data as well as questions about government debt have also contributed to weakening the dollar by raising the risk premium that investors demand to hold the dollar. While some of those drivers have already been priced into the currency market, we think they could potentially run even further.

A new rapid 10% dollar depreciation would probably require a new catalyst. This could be an economic downturn triggering significant interest rate cuts by the Fed. That is a risk scenario, but not our base case. Our expectation of a one-off cut could put temporary pressure on the dollar, but if we are right that it will only be one cut, financial markets will be wrong about their current expectation of about five cuts. Interest rates might actually be a source of strength for the dollar in the short term if we are right about the Fed outlook. This could offset some of the current downward pressure and potentially strengthen the dollar, especially if it convinces investors that the Fed has not become political. It is, however, not certain that the currency market will focus a lot on nominal rate differentials, especially if inflation starts to pick up because of the tariffs. The dollar comeback could be strong, but we tend to think it would be temporary. A ceasefire between Russia and Ukraine could also be a game-changing catalyst, which could strengthen the euro versus the dollar by improving economic activity in the Euro area through lower energy prices and higher consumer and business confidence. Again, that is a risk scenario, but not part of our base case either.

Overall, we maintain our view that the dollar will weaken further over the next years, but expect a more modest and gradual depreciation accompanied by larger fluctuations, especially if one of our risk scenarios materialises.

3.15%

We expect German 10-year yields to rise gradually towards the end of 2026

1.26

The level we expect EUR/USD to hit by the end of 2027

50bp

We believe the ECB will hike rates again in 2027.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more