- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

The Russian assault on Ukraine, very high inflation and China’s lockdowns imply a high degree of uncertainty in the global economy and take the growth forecasts somewhat lower for 2022. Despite the downside risks to the growth outlook, high inflation dominates the outlook in the short term and will force central banks to tighten monetary policy at a faster pace than previously expected.

The global outlook has been hit by two major shocks this year. The Russian assault and China’s Covid lockdowns take our growth forecasts lower. Although the direct impact of these two shocks on economic growth in the Western countries has so far been limited, it will further intensify price pressures and challenges in the global supply chains. We thus expect inflation to continue at high levels for all of 2022, and the Western central banks will tighten monetary policy faster than we expected in our winter forecast. In China, of course, the policy stance is the opposite as its leaders want to stabilise the weakened growth outlook leading up to the important Party Meeting in the autumn.

The outcome of the war, reactions to monetary policy tightening and China’s exit from Covid are all highly uncertain. Risks to our baseline forecasts are large and biased to the downside. One possible risk is that the EU bans energy imports from Russia as a whole. That would not only take inflation even higher but would also lead to restrictions on energy consumption in the EU and thus a decline in economic activity. Regarding China, the possibility of a nationwide lockdown cannot be excluded given how easily Omicron spreads. In the US, the biggest risks continue to be linked to the strong inflation cycle and the capability of the Fed to bring that under control in a balanced way.

Oil prices have risen above USD 100 per barrel during the first quarter of the year due to a tighter balance between supply and demand and the war in Ukraine. We expect prices to move sideways around USD 100 per barrel going forward. Global oil investments are on the rise, however, demand for oil will likely also continue to rise as global travel resumes. There are many risks for the oil price ahead. Tight labour markets, high cost inflation and supply chain issues are curbing growth in oil production. There is no quick fix to these issues, and oil prices could remain elevated. However, there are also risks on the demand side stemming not least from the coronavirus-related lockdowns in China.

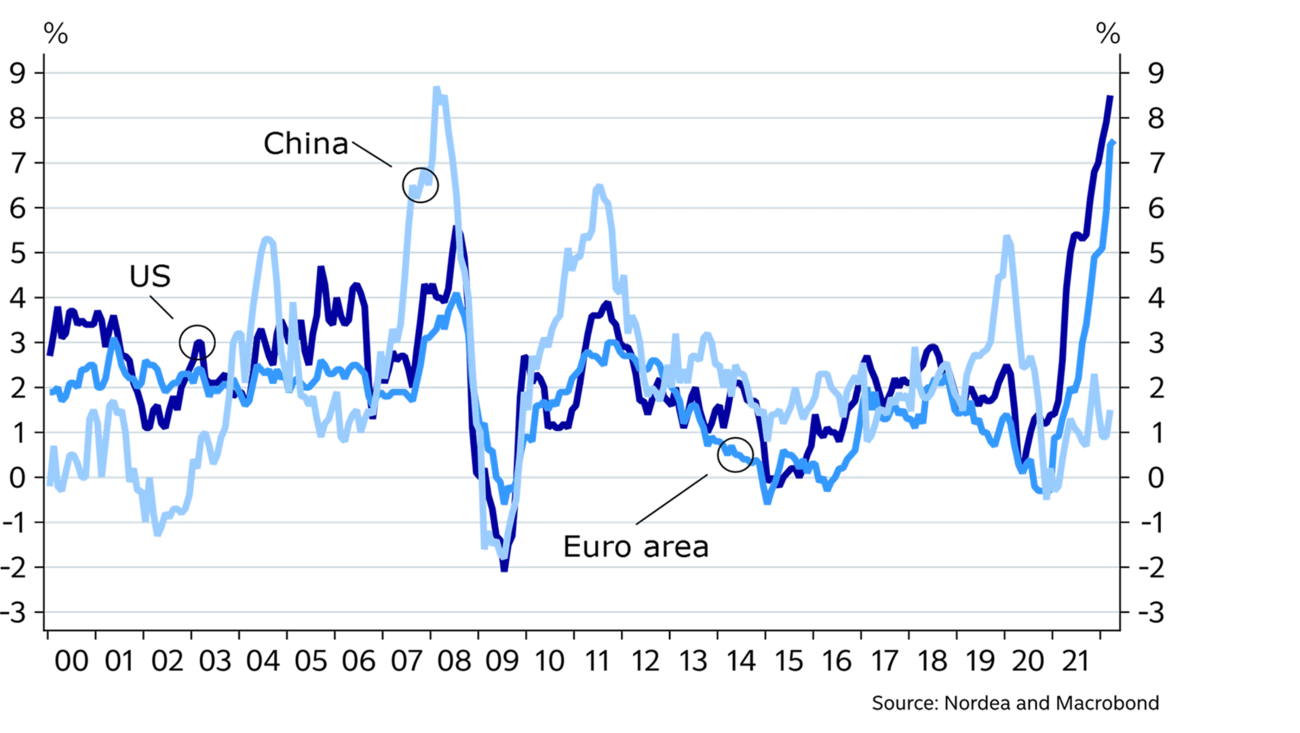

Inflation has recently accelerated even further as the war has increased price pressures on energy, raw materials and food. We expect those pressures to continue, and goods price inflation to be boosted also by the lockdowns in China and the resulting challenges in global supply chains. Thus, the short-term outlook speaks for very high inflation.

From the central banks’ point of view, it is of course important to understand the inflation outlook longer out. In this regard, wage and price pressures in the US continue to be extremely strong, and the signals of overheating are even stronger than in our previous forecast. In the Euro area, recovery from the pandemic has continued, but households are in a relatively weak position as nominal income growth is still modest. Together with fast inflation, this implies that real income development will be negative in 2022. However, as long as the economic outlook remains robust enough despite the elevated uncertainty, wage increases will accelerate later this year, which will imply that core inflation is likely to continue at levels around the ECB target in 2023.

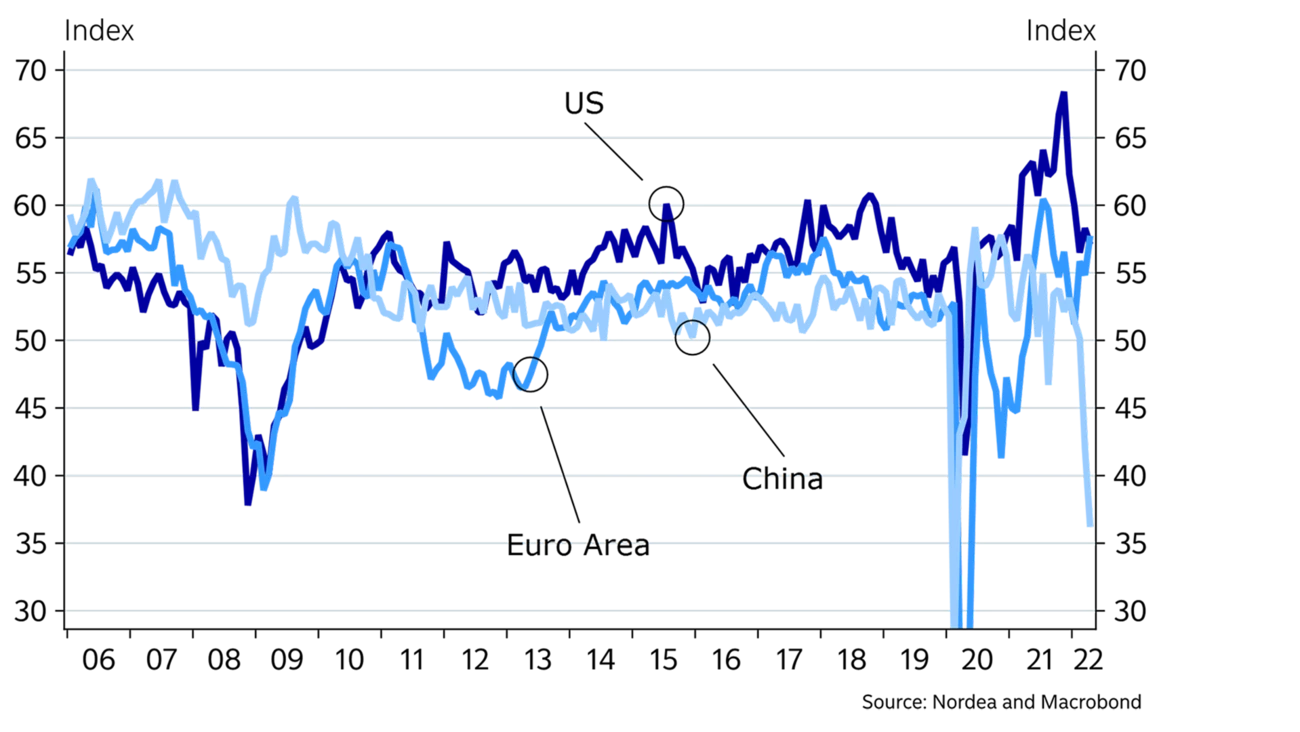

Economic activity remains at a high level in the US. Consumer spending has continued to grow despite the very high inflation, not least supported by normalising services consumption. The labour market is tight, and wage growth is at its highest level in 38 years. However, rapidly rising prices are weighing on real incomes, and consumer sentiment has plummeted. Financial conditions are set to tighten further as the Fed tightens monetary policy aggressively, which dampens growth prospects.

China announced a growth target of “about 5.5%” in March, but since then the outlook has been severely hurt by the spread of Omicron. At the beginning of May, strict lockdowns were in place in areas contributing around a third of China’s GDP. As a result, indicators especially on the service sector have collapsed, and even if Q1 growth was reported at 4.8% y/y, the growth target for the whole of 2022 seems nearly impossible without a new wave of strong stimulus policies. The rapid rise in unemployment to 5.8% may encourage leaders to stabilise the outlook more actively towards the approaching Party Meeting, but that obviously increases China’s long-term risks.

|

|

World |

US |

Euro area |

China |

||||

|

|

New |

Old |

New |

Old |

New |

Old |

New |

Old |

|

2020 |

-3.2 |

-3.3 |

-3.5 |

-3.5 |

-6.5 |

-6.5 |

2.3 |

2.3 |

|

2021E |

5.9 |

5.5 |

5.5 |

5,5 |

5.0 |

5.0 |

8.1 |

8.1 |

|

2022E |

3.3 |

4.1 |

3.2 |

3,9 |

3.0 |

4.0 |

4.0 |

5.0 |

|

2023E |

3.2 |

4.2 |

2.1 |

2.5 |

1.5 |

2.5 |

5.0 |

5.0 |

Increased supply chain challenges and the rise in energy prices will hurt growth in the Euro area.

The direct negative impact of the Russian assault on Ukraine on the Euro-area growth outlook via exports and financial links is limited. However, increased uncertainty, challenges in supply chains and the rise in energy prices take the growth forecast lower. Consumption will be hurt by negative real income development and it remains to be seen to what extent companies will delay their investment plans. On the other hand, investments are boosted by the NGEU package and policies aiming to reduce the dependency on Russian energy. Growth will also be supported by fiscal expenditure on, for example, defence and refugees. Thus, in our baseline, the labour market continues to tighten, resulting in higher wage increases from the autumn onwards and supporting the inflation outlook.

|

|

|

|

|

|

ECB |

Fed |

US |

Germany |

|

|

EUR/USD |

EUR/GBP |

USD/JPY |

EUR/SEK |

Deposit rate |

Fed funds target rate (upper end) |

10Y benchmark yield |

10Y benchmark yield |

|

2020 |

1.22 |

0.90 |

103.20 |

10.04 |

-0.50 |

0.25 |

0.93 |

-0.56 |

|

2021 |

1.13 |

0.84 |

115.10 |

10.29 |

-0.50 |

0.25 |

1.52 |

-0.18 |

|

2022E |

1.00 |

0.86 |

135.00 |

10.40 |

0.25 |

2.75 |

3.50 |

1.60 |

|

2023E |

1.10 |

0.85 |

120.00 |

10.20 |

1.25 |

3.50 |

3.50 |

2.00 |

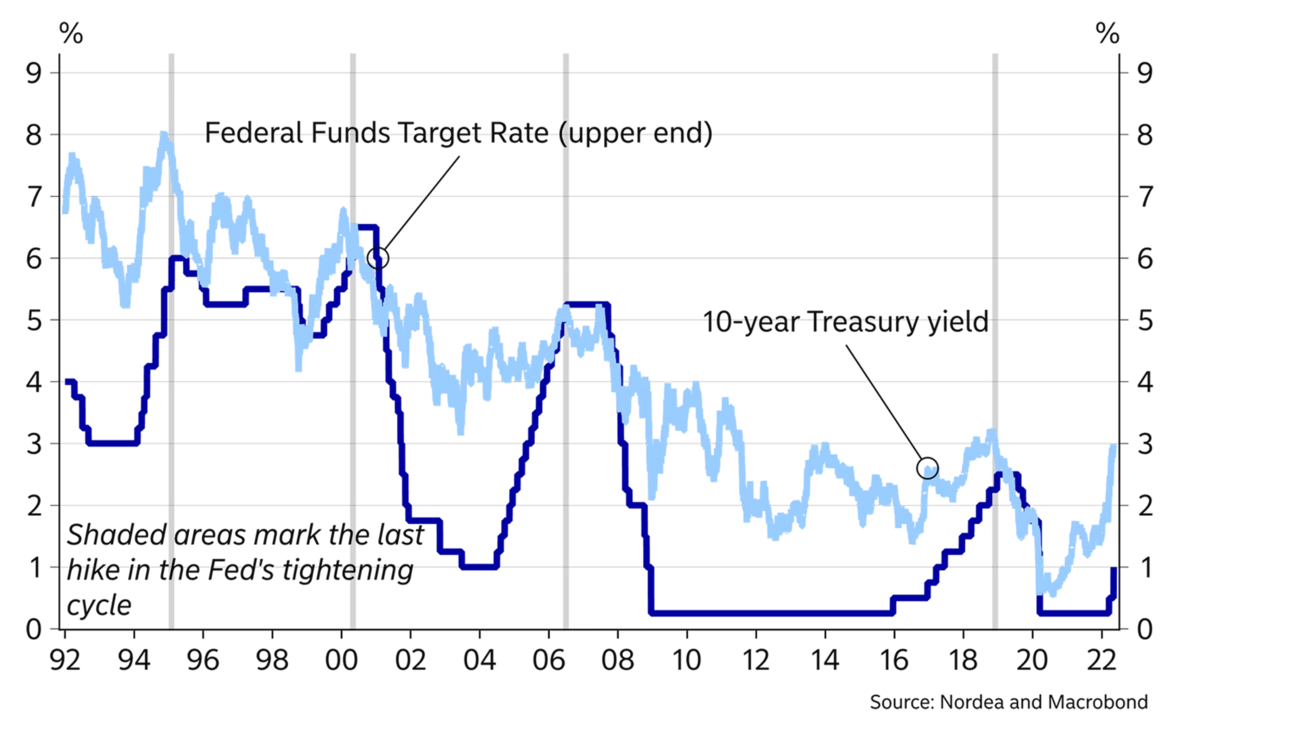

Central banks have become genuinely worried about the inflation outlook, and the monetary policy outlook has changed rapidly. The Fed has openly admitted that it is behind the curve and now needs to catch up. This means rates will be raised quickly to neutral later this year, which will likely mean several 50bp rate hikes and a rather rapid increase in rates also in a historical context. We think the Fed will continue its rate hiking cycle until the middle of next year, when the benchmark rate reaches 3.5%, clearly above the Fed’s neutral rate estimate of 2.4%.

In the Euro area, the bulk of the high inflation is still explained by energy and food prices, while realised wage developments have been more modest. Nevertheless, the ECB’s signals have also turned significantly more hawkish, pointing to a first hike in July. Financial markets price in a much faster increase in rates compared to the ECB’s assurances that any rate hikes will take place gradually, and we expect Euro-area economic growth to slow sufficiently to favour a gradual policy tightening course. Nevertheless, risks are tilted to the upside, especially for this year’s central bank action.

The US yield curve was sending recession signals in early April, but longer yields have also joined the rising rates party since. We read the rise in especially longer real yields as implying less growth worries in financial markets and thus more room for also longer yields to climb. Long US yields often peak around the time the Fed ends its rate hiking cycle, and as a result, we see long US yields peaking around the middle of 2023. The ECB is behind the Fed in this cycle as well, which means EUR yields are likely to peak later than US ones. Longer out on the forecast horizon, risks start to tilt downwards, as the Euro-area economy could suffer more from higher energy prices, and the rapid rise in rates could hurt the US economy.

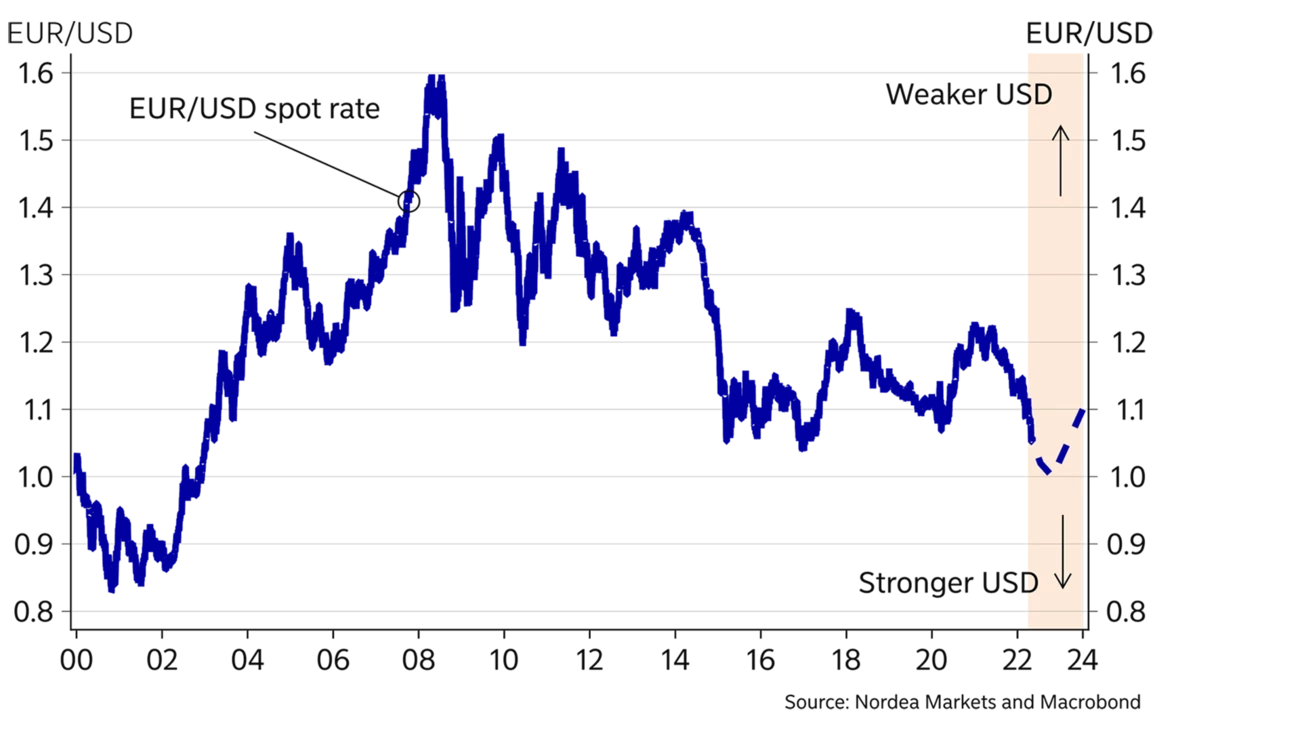

The US dollar remains strong across the board. Geopolitical tension and very aggressive rate hike expectations support the greenback. EUR/USD fell from 1.15 to 1.05 from February to the end of April, and the Fed is unlikely to be too concerned about a stronger dollar as it puts a damper on inflationary pressures in the US.

In Europe the growth outlook is very uncertain with the ongoing war in Ukraine. This leaves the euro on the defensive. Lately, the ECB has sharpened its rhetoric by signalling earlier rate hikes. This potentially offers some relief for the euro. However, we believe the USD will continue to have the upper hand in the current environment due to higher rates and its status as a safe heaven. We therefore see EUR/USD falling down towards parity (1.00) towards the end of 2022 – levels not seen since late 2002. At some point next year however, US rates will peak and economic momentum should slow. Softer data out of the US should weigh on the dollar. Hence, the dollar should give up some the recent gains in the long term.

A key driver in the FX space is divergence in the monetary outlook. Some central banks do not see an urgent need for monetary tightening, leaving their currencies very vulnerable. Bank of Japan and People’s Bank of China both continue a very accommodative monetary policy. The yen has weakened by more than 10% in March and April, and lately, the yuan has suddenly weakened. Both will continue to face headwinds due to the loose monetary policy.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more