- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

Juho Kostiainen

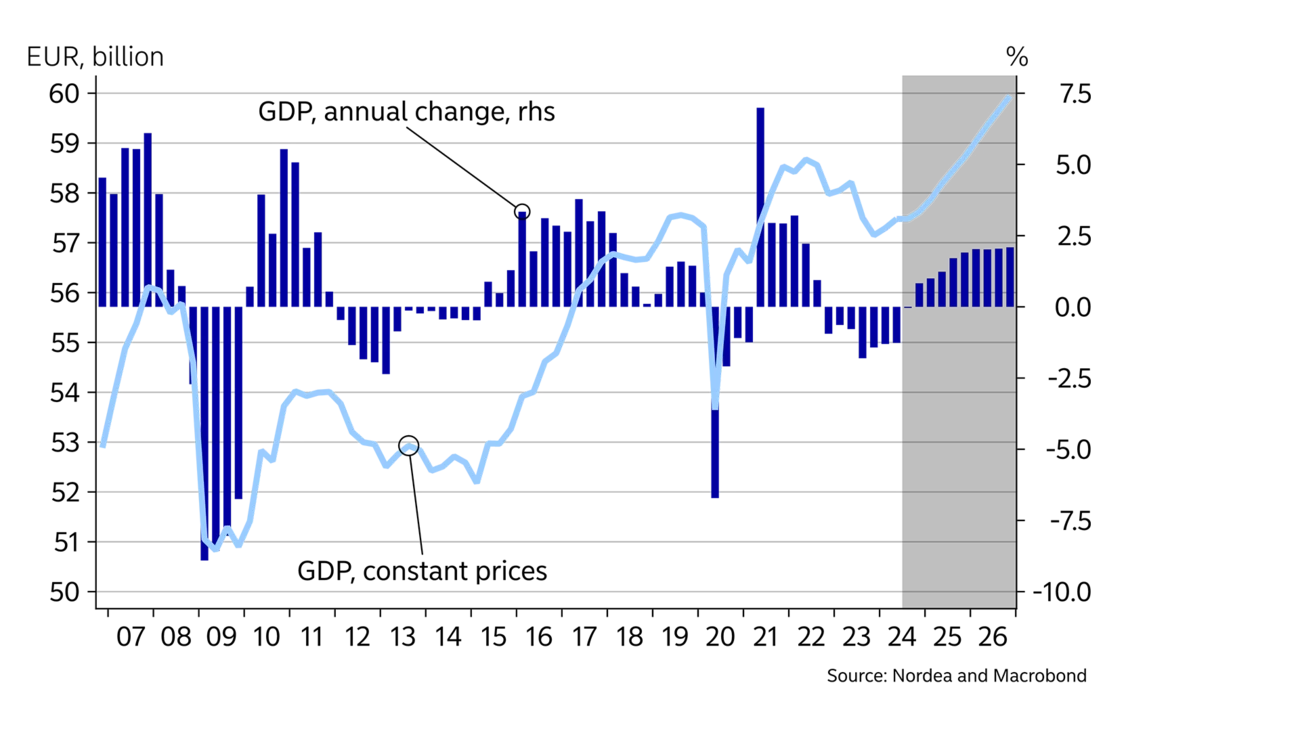

We saw the first positive signs for the Finnish economy in the first half of the year. The gradual recovery in consumer purchasing power and lower interest rates are expected to send the Finnish economy back on a growth track. The government’s spending cuts will likely slow down economic recovery to some extent, but they are essential to halting growth in public debt.

In the first half of this year, the Finnish economy showed some positive signs for the first time in two years. GDP grew moderately in the first two quarters of the year, and it appears that the economic slide is coming to an end.

Lower inflation and interest rates have improved consumer purchasing power, lifting consumer confidence at the same time. However, consumer purchasing power and confidence are still relatively weak, so private consumption is expected to remain stagnant this year.

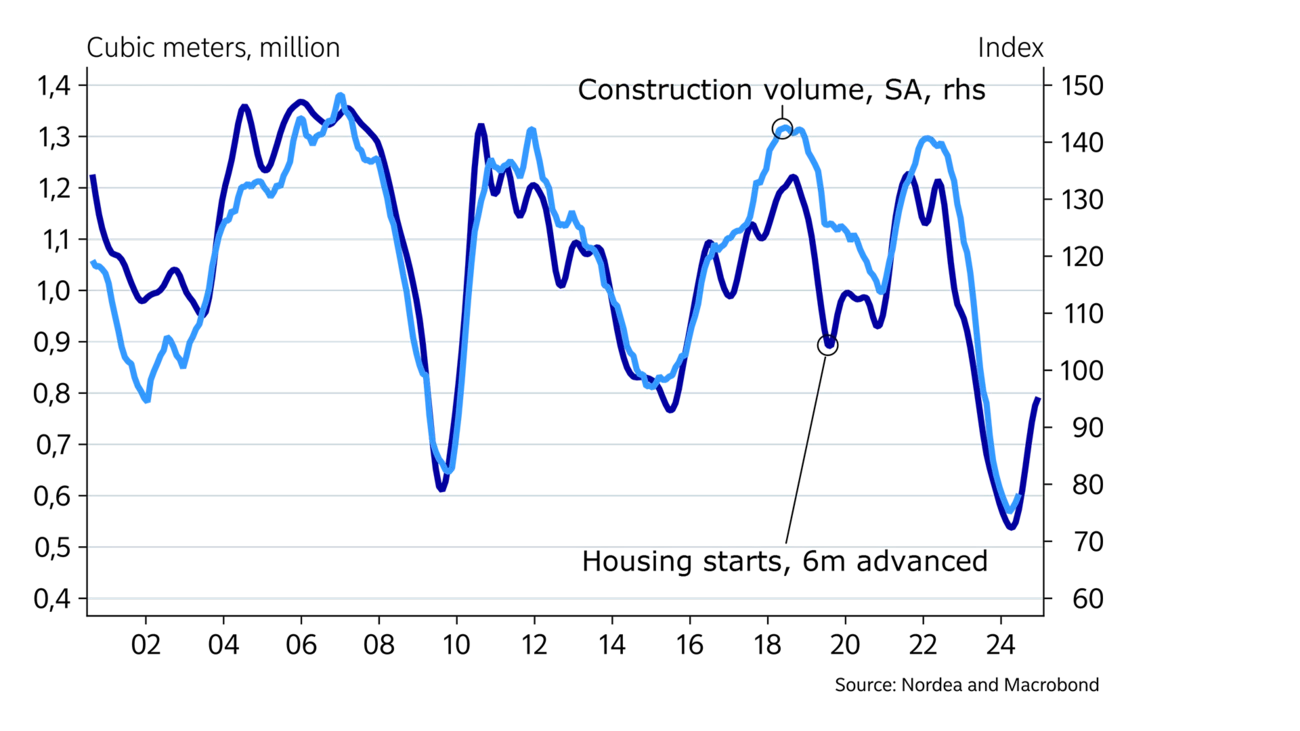

Lower interest rates have also gradually stimulated housing sales, and the slide in house prices appears to have ended The construction cycle is still weak, although it seems to have reached a trough. There were more new housing starts in the first half of the year than in the same period in 2023.

The labour market continued to deteriorate in the first half of the year, but we expect a turn for the better next year as economic growth picks up.

The public sector deficit is still sizable despite the government’s large-scale cost-cutting measures. While these measures will slow down the economy’s recovery from the recession, they are necessary for halting the growth in public debt.

Due to the positive economic performance in the first half of the year, we upgrade our economic growth forecast for this year to -0.5%. We expect economic growth to accelerate next year to 1.5% on the back of higher consumer spending. For 2026, we forecast growth of 2% as the construction sector moves into full gear and other investments pick up once interest rates fall to around 2%.

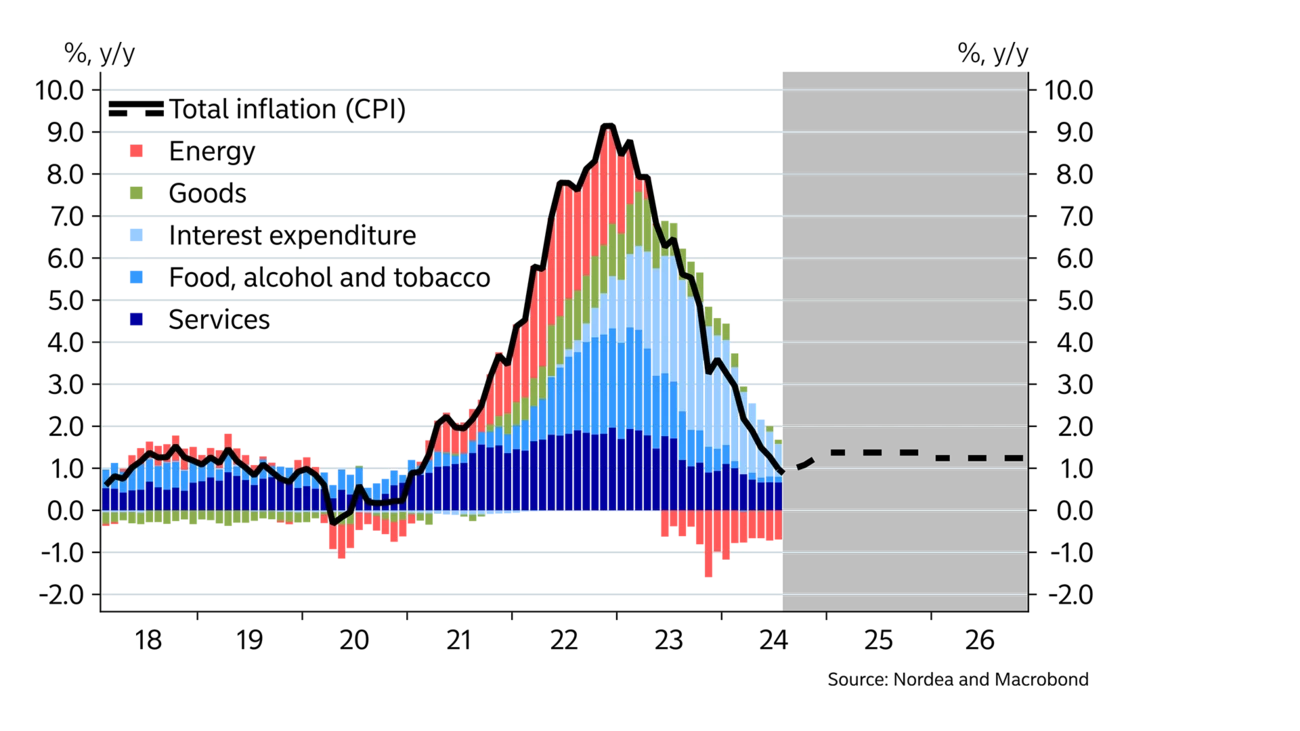

Inflation in Finland has been the lowest in the eurozone this year. The harmonised inflation (HICP) for Finland was 0.7% on average from January to July. Domestic consumer price inflation (CPI), which accounts for interest on loans, also fell to 1% in July.

Annual inflation on goods and food has fallen to nearly zero. Only service prices have increased clearly this year, although their annual change also fell to 2.6% in July. The price of electricity has fallen throughout the year, and due to a statistical error, the actual inflation in energy prices over the past year is lower than what the data indicates. The statistical error in the price of electricity will no longer affect inflation in August, due to which total inflation will increase by about 0.7 percentage points.

In September, we will also see price hikes as the higher value added tax rate takes effect. The tax rate will be raised from 24% to 25.5%, which is predicted to increase total inflation be approximately 0.7 percentage points. As a result, inflation is Finland is expected to increase to nearly 2% in September.

However, since inflationary pressures are low, inflation is expected to remain below 2% next year, despite the price increase resulting from the VAT hike. In 2026, domestic inflation is expected to fall, driven by lower interest rates.

| 2023 | 2024E | 2025E | 2026E | |

| Real GDP, % y/y | -1.2 | -0.5 | 1.5 | 2.0 |

| Consumer prices, % y/y | 6.3 | 1.6 | 1.4 | 1.2 |

| Unemployment rate, % | 7.2 | 8.2 | 8.0 | 7.4 |

| Hourly earnings, % y/y | 4.2 | 2.9 | 3.1 | 3.0 |

| General gov. budget balance, % of GDP | -2.7 | -3.7 | -2.9 | -2.2 |

| General gov. gross debt, % of GDP | 76.6 | 80.4 | 82.4 | 83.3 |

| Monetary policy rate (end of period) | 4.00 | 3.25 | 2.25 | 2.25 |

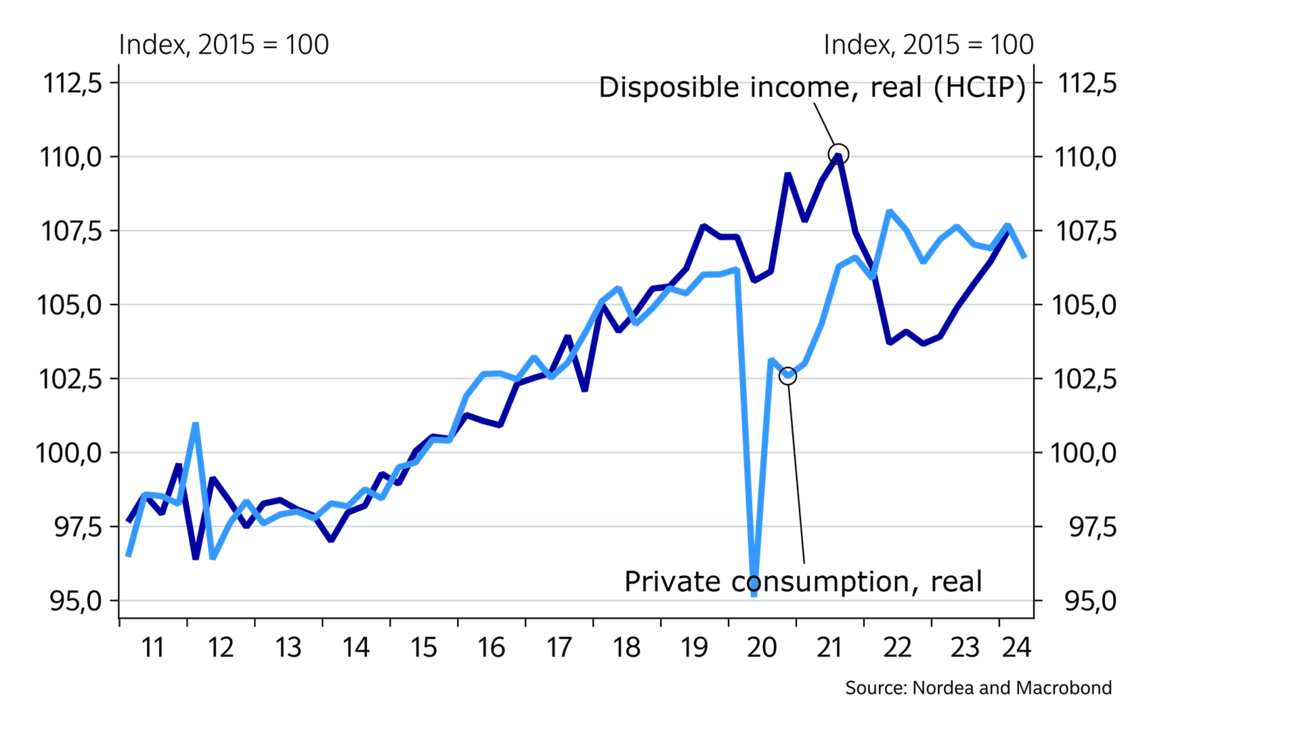

Households’ disposable income in real terms, or purchasing power, has improved for a year but is still below the peak reached in 2021. The growth in real income has been helped by lower inflation, higher wages and, in particular, index-linked increases to pensions. Taxation has also been lighter this year thanks to a lower unemployment insurance contribution.

Better purchasing power, however, has not yet improved the consumption of many categories of goods or services. Demand for restaurants continued to fall in the first half of the year and the trade for new cars is in a slump, as consumer confidence remains low despite a small improvement. The increased threat of unemployment and higher interest rates are keeping consumers tight-fisted.

Higher interest expenses continue to explain the weakness in consumption. Changes in interest rates are reflected in disposable income through an increase in interest expenses and income. An increase in interest income is typically not enough to offset the decrease in consumption caused by higher interest expenses, as interest income is usually earned by wealthier households whose marginal propensity to consume is lower than for those with debt. The sharp decline in interest rates seen in recent months will bolster private consumption, even though its impact on the disposable income of all households is small.

The increase to the value added tax will accelerate inflation for the rest of this year and thus hamper the recovery in purchasing power. However, it won’t stop the recovery altogether. Purchasing power is expected to continue to improve next year and the year after, boosting consumption.

The employment situation has continued to deteriorate this year. The trend in the unemployment rate rose to 8.3% in July. The number of job vacancies also fell clearly, indicating weak demand for labour. In addition to the construction sector, the service and retail sectors have seen their employment decline clearly.

A weak labour market will keep the increase in total wages low this year. In 2025, however, employment is expected to improve as the economy picks up, boosting wages and confidence. The government measures to enhance the labour supply and growth in the working-age population, driven by immigration, are also expected to stimulate employment as the economy improves.

High interest rates will keep consumers cautious, despite the increase in purchasing power.

The first rate cut by the ECB and the rapid decline in market interest rates over the summer have brought long-awaited relief to the housing market. The housing transaction volume has cautiously begun to rise during the summer, so now it appears that the bottom may have been reached in the housing market.

However, in terms of housing transaction volumes, we’re still far from a normal level, with sales of new dwellings lagging, in particular. The increase in house prices and rents is expected to be moderate this year, as there is still an ample supply of housing both in the rental and owner-occupied markets.

Residential construction perked up somewhat during the first half of the year. Although sales of new dwellings and private rental construction are still weak, growth in interest-subsidised construction starts is helping the residential construction sector turn the corner.

Residential construction is expected to recover gradually, as the accelerating population growth in growth centres removes oversupply from the housing market. Residential construction has been the biggest drag on the economy over the past two years. The sector’s difficulties are now slowly easing.

Investments in machinery and equipment have held up better than construction, but higher interest rates and weak demand have caused companies to postpone investments in production capacity. In the longer term, the investment environment in Finland is attractive due to, for example, clean and relatively inexpensive electricity. Additionally, the government’s incentives to increase investments in the green transition, coupled with lower interest rates, are expected to launch new investment projects in the coming years.

Finland’s goods exports rose during the summer after a decline caused in the first months of the year by labour strikes that took place in the spring. However, exports in June saw a bump due to an individual delivery of a cruise liner, so as a whole, goods exports remain lacklustre.

New manufacturing orders have picked up slightly since the beginning of the year, and manufacturing output managed to reach last year’s level in June.

Service exports have grown this year following a weak trend in 2023. In particular, IT service exports and the value of patent income have developed favourably. The trade balance of services has improved significantly in the first half of the year, even though the tourism balance remains clearly more negative than normally.

Imports fell more sharply than exports last year, which brought growth contributions to the economy. Now exports and imports are more balanced, so going forward the contribution of net exports to the economy will be more modest, despite the fact that exports are expected to grow next year.

The government’s cost-cutting measures will curb the growth in the deficit, but they won’t fully halt the increase in public debt.

The debt ratio of the Finnish public sector has continued to grow in recent years, driven by a structural public sector deficit as well as a weak economy.

The rapid increase in public spending is due to the constant cost pressure caused by the ageing population, particularly for the health care and social services sector, as well as by an increase in defence spending, large wage increases in the public sector and growth in the volume of purchased services. Large index-linked raises to social benefits and growth in interest expenses have also increased expenses dramatically. On the other hand, a weak economy has hampered growth in tax revenue.

The government’s cost-cutting measures for next year will curb growth in the deficit but they won’t reduce it by much. The general value added tax rate increased from 24% to 25.5% at the beginning of September, and beginning from 2025, a 14% value added tax rate will be applied to most services currently subject to a lower rate of 10%. Cost savings will be achieved next year from, among other things, the introduction of graduated unemployment benefits and personnel cuts in the government administration.

The government’s many adaptation measures aim for long-term savings and increases in revenue. For example, the economies of scale promised by the health care and social services reform have not materialised yet, which means the new structure will have to be re-adjusted and the social services offering critically re-evaluated to control rising costs. The effects of the government’s measures to increase jobs will not be reflected in tax revenue until the labour market begins to recover, when low demand for labour will no longer limit the growth in employment.

The public debt ratio has increased to 77.5% and it is expected to continue to grow this year and next. In 2026, economic growth and the government’s adaptation measures are expected to reduce the public sector deficit and slow down the growth in debt.

This article first appeared in the Nordea Economic Outlook: Precision play, published on 4 September 2024. Read more from the latest Nordea Economic Outlook.

Markets and investment

As the European regulatory environment for cryptocurrencies has matured and the demand for virtual currencies and cryptocurrencies is growing across the Nordics, Nordea has decided to allow customers to trade in a crypto-linked product on its platforms.

Read more

Markets and investment

Our analysis of the main public infrastructure programmes in Europe points to a substantial step-up in investment due in 2026, which contrasts with the capital drain we’re seeing for US cleantech. This is driving investors’ sentiment for infrastructure, which, for the first time in years in Q2 2025, was higher in Europe than in the US, topped by the Nordics.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more