This article first appeared in the Nordea Economic Outlook: Northern Lights, published on 21 January 2026.

Read more from the latest Economic OutlookGrowing demand for NOK

Kjetil Olsen

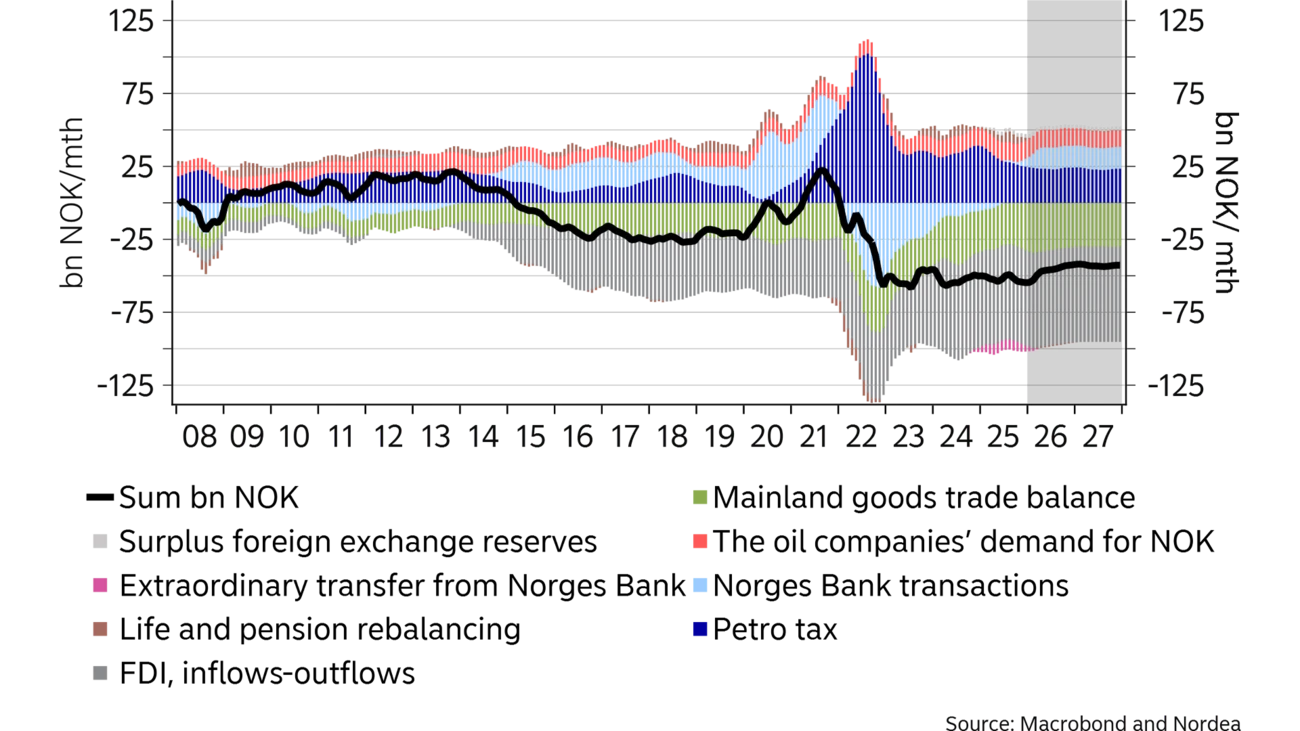

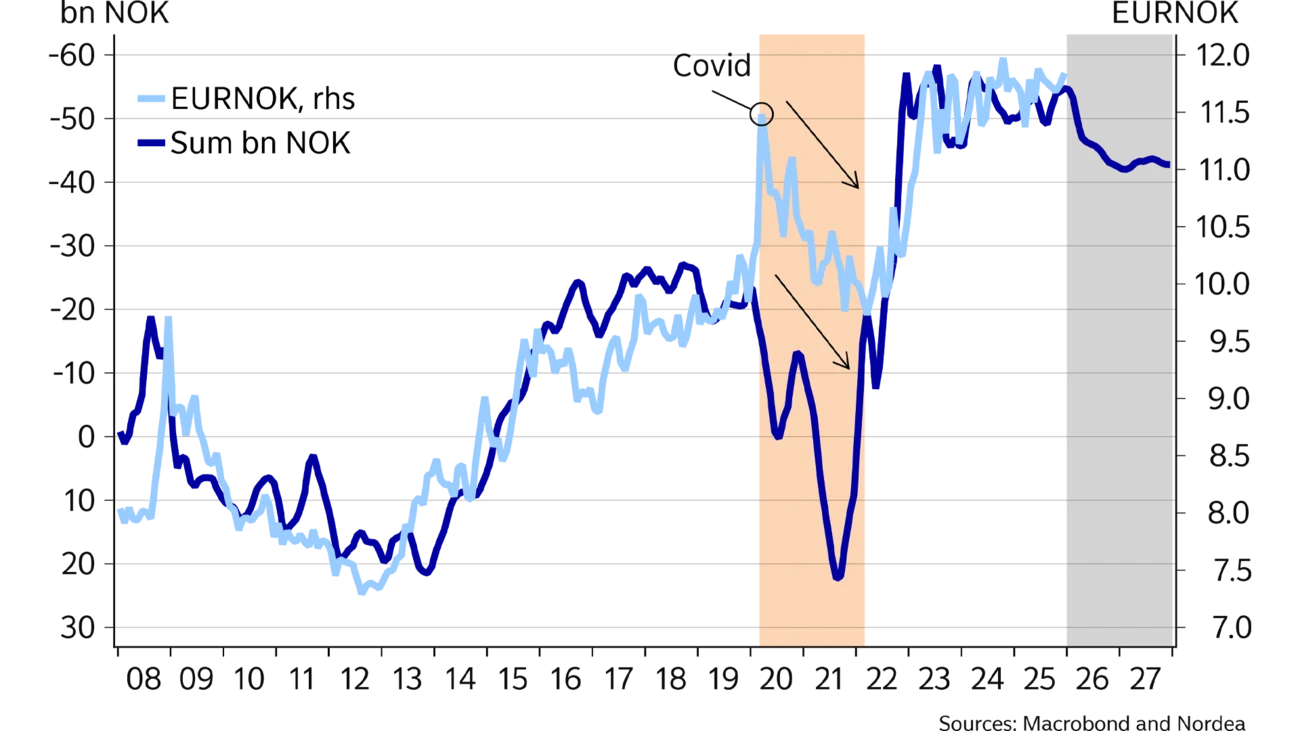

Movements in the NOK exchange rate are closely tied to structural net NOK transactions. After several years of persistent negative pressure, in which many market participants had an underlying need to sell NOK, we are now seeing signs of a shift in main flows, indicating a gradual strengthening of the NOK in 2026.