- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

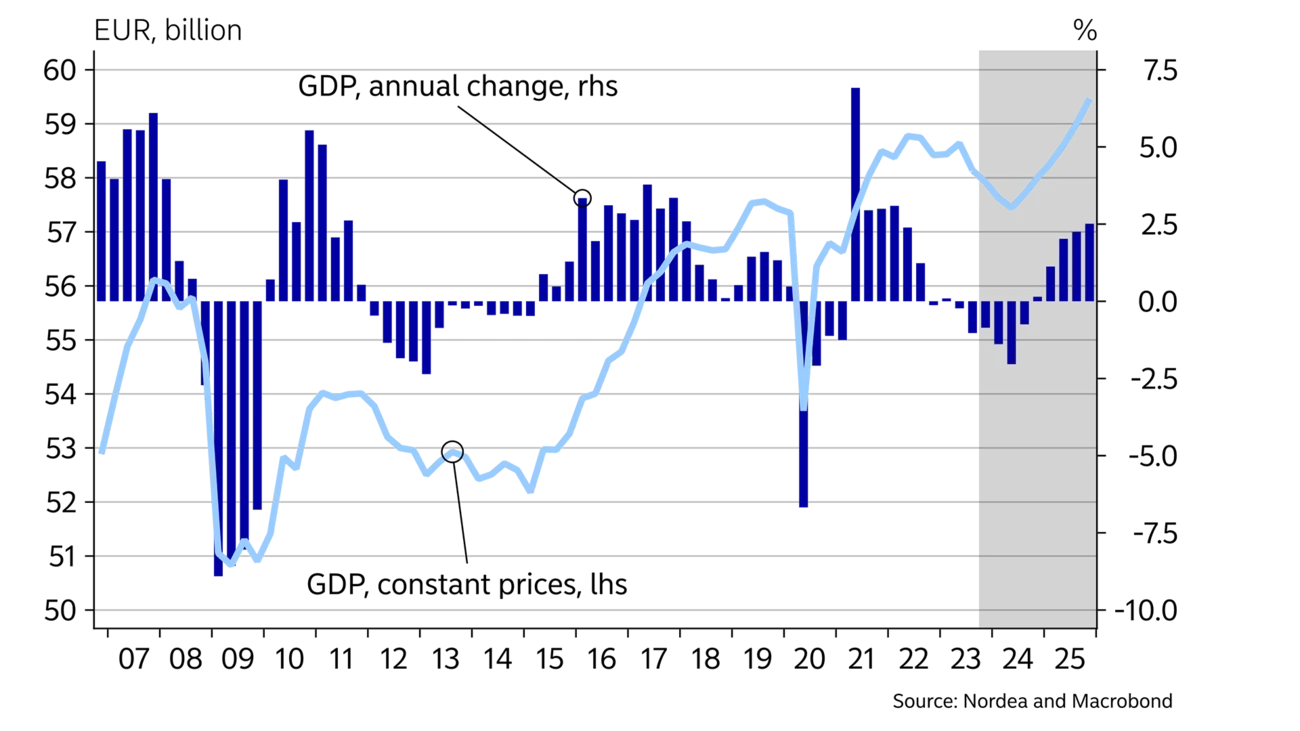

High interest rates have sent the Finnish economy into a recession. The outlook for the first half of the year is unfavourable for private consumption, construction and exports alike. However, the economy is expected to rebound in the second half of the year, as interest rates fall and consumer purchasing power improves. Public finances will require additional consolidation measures.

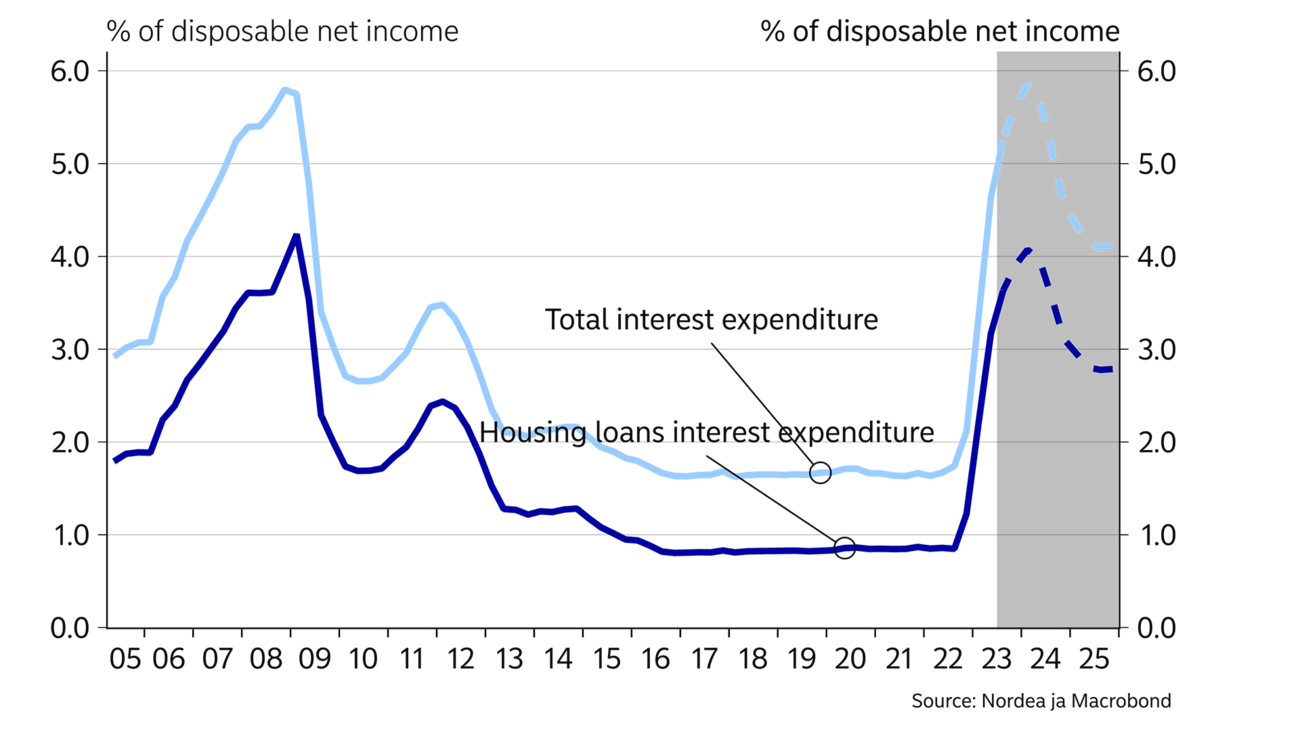

The autumn ushered in a recession in the Finnish economy. Higher interest rates have had a strong impact on the economy through variable-rate mortgages taken out by homeowners. This has further weakened purchasing power, which has been hurt by high inflation in recent years. The increase in interest rates has also weighed on housing sales and, consequently, residential construction. We expect the slump in construction to continue this year. At the same time, the post-cyclical export sector is declining because high interest rates are holding back investment across the globe.

However, the drop in inflation, rising wages and lighter taxation will improve consumer purchasing power this year. Nonetheless, the deteriorating employment situation and the uncertain economic outlook will keep domestic consumption sluggish for the first half of the year.

Economic conditions are expected to improve towards the end of the year. The recovery is expected to be driven by the global economy, once interest rates head lower. The decline in interest rates is also expected to boost household consumption, as well as the housing market.

Public finances will deteriorate further this year as the economy contracts. As a result, the current government will have to come up with more consolidation measures if it aims to balance public sector spending and halt the growth in government debt.

We revise our economic growth forecast down to -1% for 2024. We expect the economy to turn to growth during the latter half of this year, and we anticipate that GDP growth will accelerate to 2% in 2025.

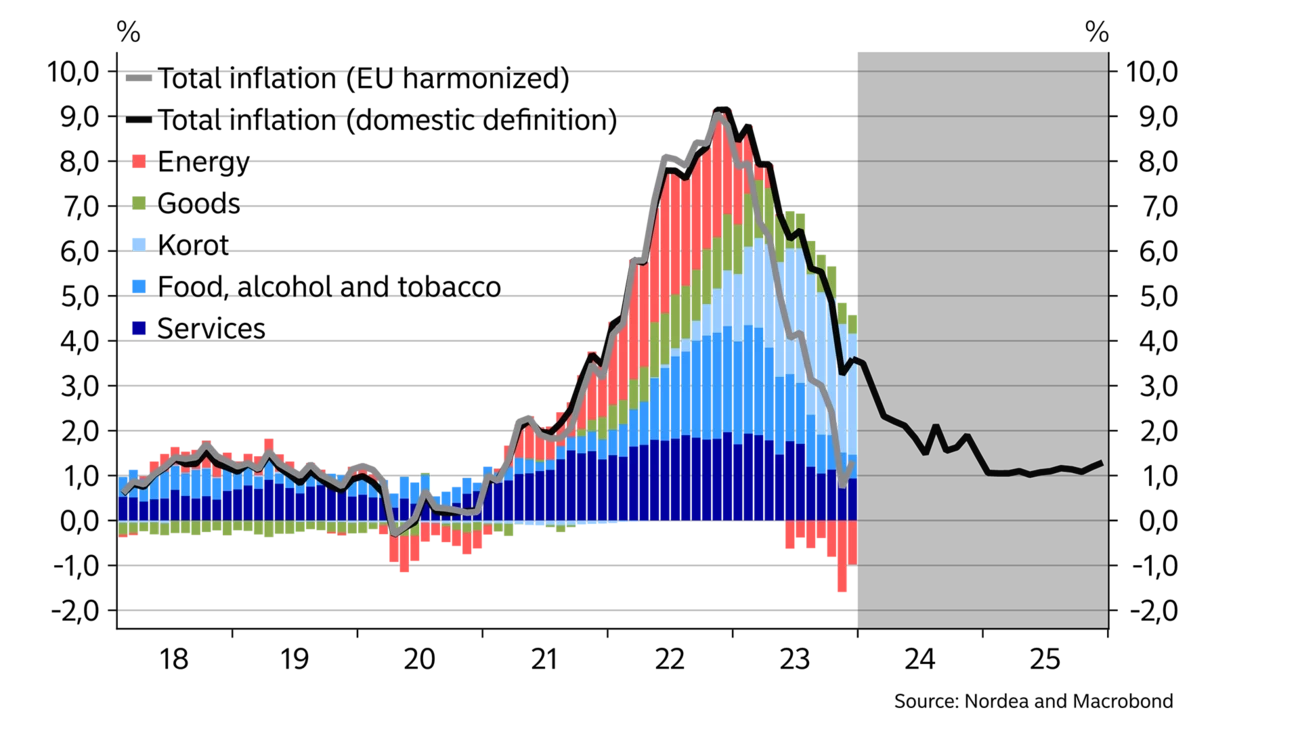

The rise in consumer prices slowed across the board last year. Consumer price inflation (CPI) in Finland was 3.6% in December, compared to an average of 6.2% last year. The EU’s harmonised index of consumer prices (HICP) for Finland was 1.3% in December. The HICP does not include the effect of loan interest.

The drop in energy prices since last year has greatly contributed to lowering inflation, although price pressures eased more broadly in 2023. Inflation in the price of goods is now under 2%, while food prices have nearly stopped increasing since the first half of 2023. Service prices have still risen by more than 3% year-on-year, which reflects the fairly high wage increases implemented last year.

We expect inflation to continue easing this year, with inflation in Finland falling to around 2%, as the rise in service prices slows down and interest rates begin to have a smaller impact on the domestic inflation indicator. In Finland’s case, inflation is no longer considered a problem.

Shipping problems in the Red Sea, if they are prolonged, could raise the prices of goods and pose a risk of inflation remaining higher than we forecast.

| 2022 | 2023E | 2024E | 2025E | |

| Real GDP, % y/y | 1.6 | -0.5 | -1.0 | 2.0 |

| Consumer prices, % y/y | 7.1 | 6.2 | 2.1 | 1.1 |

| Unemployment rate, % | 6.8 | 7.3 | 8.2 | 7.8 |

| Wages, % y/y | 2.4 | 4.4 | 3.7 | 2.4 |

| Public sector surplus, % of GDP | -0.8 | -2.0 | -2.7 | -2.3 |

| Public sector debt, % of GDP | 73.3 | 74.9 | 77.4 | 77.8 |

| ECB deposit interest rate (at year-end) | 2.00 | 4.00 | 3.25 | 2.25 |

Private consumption began to shrink in the autumn, despite the gradual improvement in consumer purchasing power, due to lower inflation and higher wages. However, the purchasing power of wage-earners is still weak. The household savings ratio has increased because economic uncertainty has kept consumer confidence low, and rising interest rates have prompted many to repay their loans instead of consuming.

Household interest expenses will remain at last year’s level in 2024, despite the expected drop in interest rates. However, falling interest rates during the year will gradually take some pressure off indebted households.

This year, consumer purchasing power will improve, due to inflation remaining low and cuts to income taxes and employees’ social security contributions. The 5.7% index-based increase to pensions that took effect at the beginning of this year will improve pensioners’ purchasing power, but on the other hand, the cuts introduced by the government to some social benefits will reduce disposable income in some households.

Private consumption is expected to pick up towards the end of the year, thanks to lower interest rates and improved purchasing power. Next year, we expect consumption to grow fairly rapidly as the economic outlook and purchasing power continue to improve.

The employment situation took a turn for the worse in the autumn. The number of people employed by the private sector has fallen by more than 60,000 since last year, but at the same time, the public sector workforce has grown by 40,000, which has mitigated the drop in employment. The employment rate has fallen to around 73%, which is nonetheless a relatively high figure. We expect employment to continue to weaken in the first half of 2024.

The unemployment rate was 7.6% in November, an increase of one percentage point year-on-year. We expect the unemployment rate to top 8% during the first half of this year. While the continued decline in activity in, particularly, the construction sector will increase unemployment, employment is expected to also weaken in manufacturing and private services.

However, the unemployment situation is expected to rebound again next year as economic growth picks up. The government’s actions to bolster employment will also contribute to a higher employment rate next year should the economy improve.

Consumers are cautious, despite the increase in purchasing power.

Housing sales picked up late last year as first-time homebuyers rushed to the market before the end of the year, when their exemption from the transfer tax was set to expire. In early 2024, we expect housing sales to be more moderate again, despite the drop in interest rates.

Market interest rates began to fall in late 2023, with the most widely used reference rate, the 12-month Euribor, declining by more than 0.5 percentage points from the 4.2% peak seen in the autumn. This was caused by higher expectations of rate cuts by the ECB, because inflation has slowed down in the eurozone. The lower interest rates are expected to boost housing sales this year, and house prices are predicted to begin to rise mildly in the second half of the year.

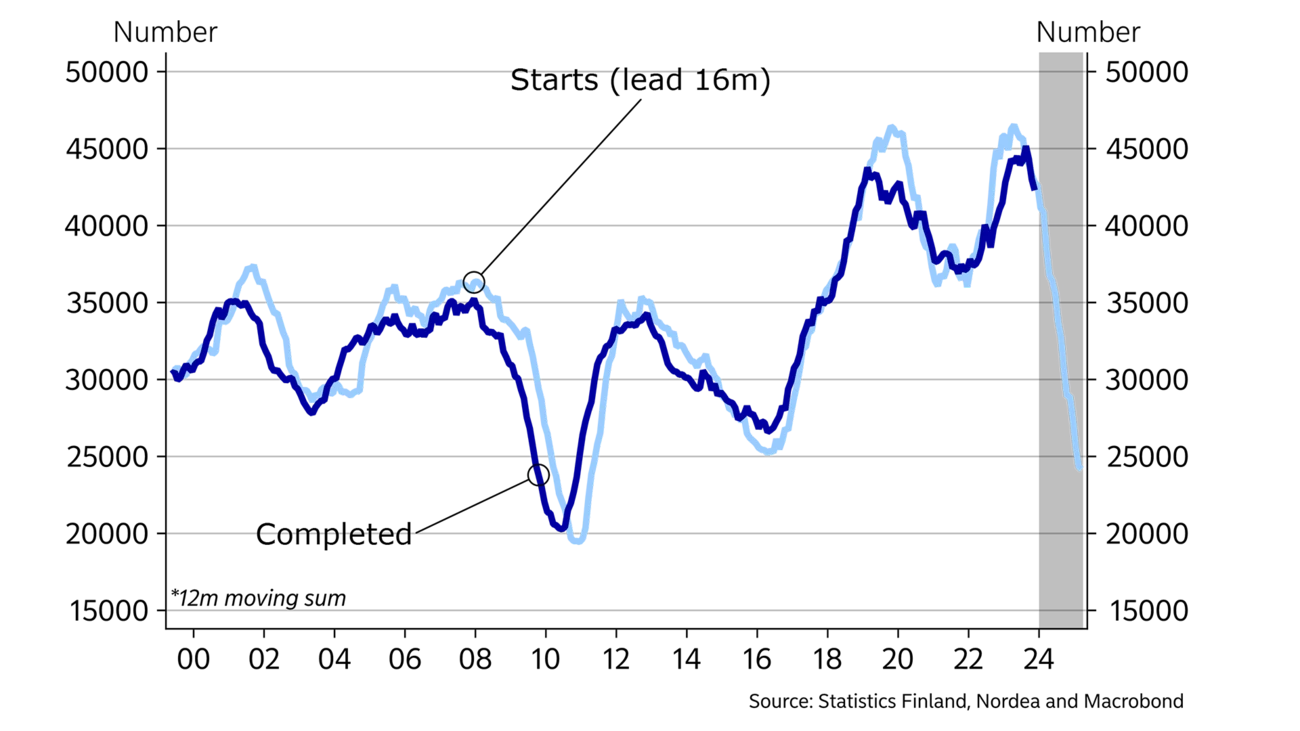

Sales of new homes have continued to be sluggish, so many construction companies have not yet started to build apartments that they marketed in advance.

Housing production is plagued by oversupply and weak demand in the market, but also by increased costs. The costs of construction, financing and plots have remained high, while the prices of old apartments have fallen by about 10%. Newbuilds are now too expensive relative to old apartments. There is also a persistent oversupply in the rental market, following rapid construction in recent years, which is keeping rental construction moderate.

Due to these factors, residential construction will continue to contract strongly this year, slowing economic growth. Markedly fewer apartments will be completed in 2024 than last year, while population growth in the growth centres has accelerated. As a result, the oversupply in the housing market will ease gradually.

So far, investments in machinery and equipment have held up better than in construction, but higher interest rates and weak demand have caused companies to postpone investments in production capacity. In the longer term, the investment environment in Finland is attractive, due to, for example, clean and relatively inexpensive electricity. However, the policy of subsidising domestic production pursued by large EU countries weakens Finland’s chances for green investments, which should still pick up in 2025.

The value of new export orders for the manufacturing sector is down by as much as 20% year-on-year. Despite this, industrial production has so far held its own, but the outlook for the first half of 2024 is bleak.

Without a rapid turnaround in global economic growth, and especially in the economies of Finland’s key export countries, industrial output will begin to decline this year. Finnish industry is often post-cyclical, due to the large share of capital goods with long order times. Investment appetite is low globally due to the high level of interest rates, which will have a negative impact on Finnish exports this year.

The strong inventories in the manufacturing sector have also dampened demand, as companies have focused on reducing their inventories. However, the decline in the level of inventories is expected to end during this year, which may partially stimulate industrial demand.

The balance of foreign trade in services has weakened over the past two years, as growth in service imports has outpaced exports. The balance on goods, in turn, has turned positive, as imports have slowed down more than exports, due to growth in domestic electricity production, among other factors.

More consolidation measures are needed in public finances.

Finland’s public sector deficit grew markedly last year, rising above 2% of GDP. Government expenditure continued to grow rapidly, driven by high index increases in social benefits, public sector employment and wages, and higher interest expenses.

This year, expenditures will continue to grow, but more moderately than last year, as wage raises, index increases and growth in interest expenses will be smaller than last year. On the other hand, rising unemployment will increase income transfers. However, the government’s spending cuts will contribute to reducing public expenditures.

Taxes will be lighter this year, especially as income taxes are cut and unemployment insurance contributions are reduced. This, coupled with a slowdown in economic growth, will decrease tax revenues this year. Next year, increases to value-added taxes and a pick-up in economic growth will increase tax revenues.

The government budget deficit is expected to grow to just under 3% this year, but to decline slightly in 2025, as the economic situation improves. However, even an improvement in the economic situation will not completely resolve the deficit, which is structural. The fiscal adjustments must continue, and the consolidation measures proposed by the government are unlikely to be sufficient to bring the debt ratio down. The government debt ratio rose to around 74% last year. The debt ratio is set to continue to grow this year and next.

This article first appeared in the Nordea Economic Outlook: Past the peak, published on 24 January 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more