Sign up for the Nordea Economic Outlook

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read moreKjetil Olsen

Housing investment has declined sharply in recent years, which continued towards end-2024, according to Statistics Norway. However, other indicators suggest housing construction has picked up. We question whether the official figures accurately reflect recent developments. Going forward, we expect increased housing investment will help boost economic growth in Norway.

National account figures indicate that housing investment has plunged by as much as 40% in the past two years, accelerating towards end-2024 and playing a significant role in the drop in mainland GDP in Q4, according to Statistics Norway. The fall in construction activity has undoubtedly been of historic proportions. However, we question whether the official figures accurately reflect recent developments.

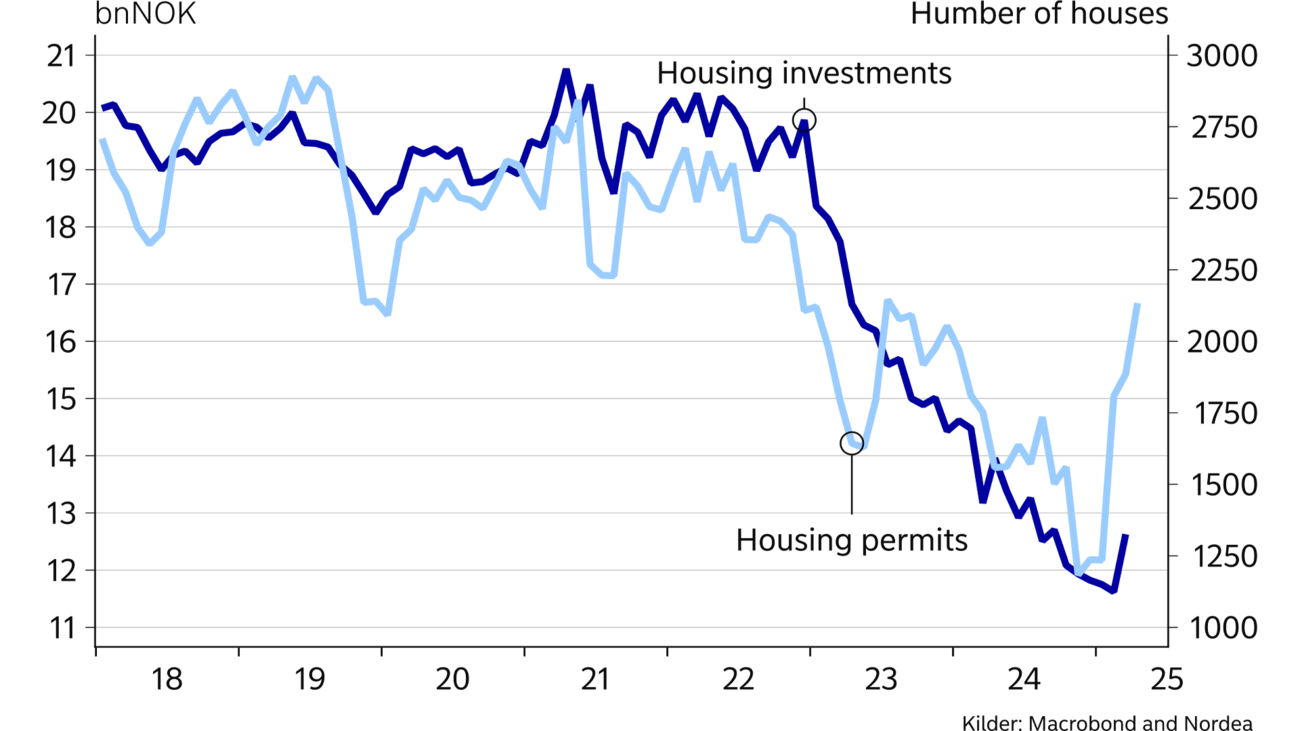

Measuring activity in the construction sector is challenging. Housing investment figures in the national accounts are based on tax reports. The challenge is that the final 2024 figures will not be out until November 2025. Meanwhile, Statistics Norway will calculate a housing investment estimate based on building permits. The number of building permits nosedived to-wards end-2024, and the housing investment figures thus show a similar decline (chart A).

Building permits are usually a good indicator for measuring construction activity, but not always. To break ground and begin construction, at least 50% of the housing units must typically have been sold. Sales of new homes declined noticeably in 2022 and 2023. Consequently, it became challenging to initiate construction projects that had already received permits. Additionally, construction costs rose steeply, making projects less profitable.

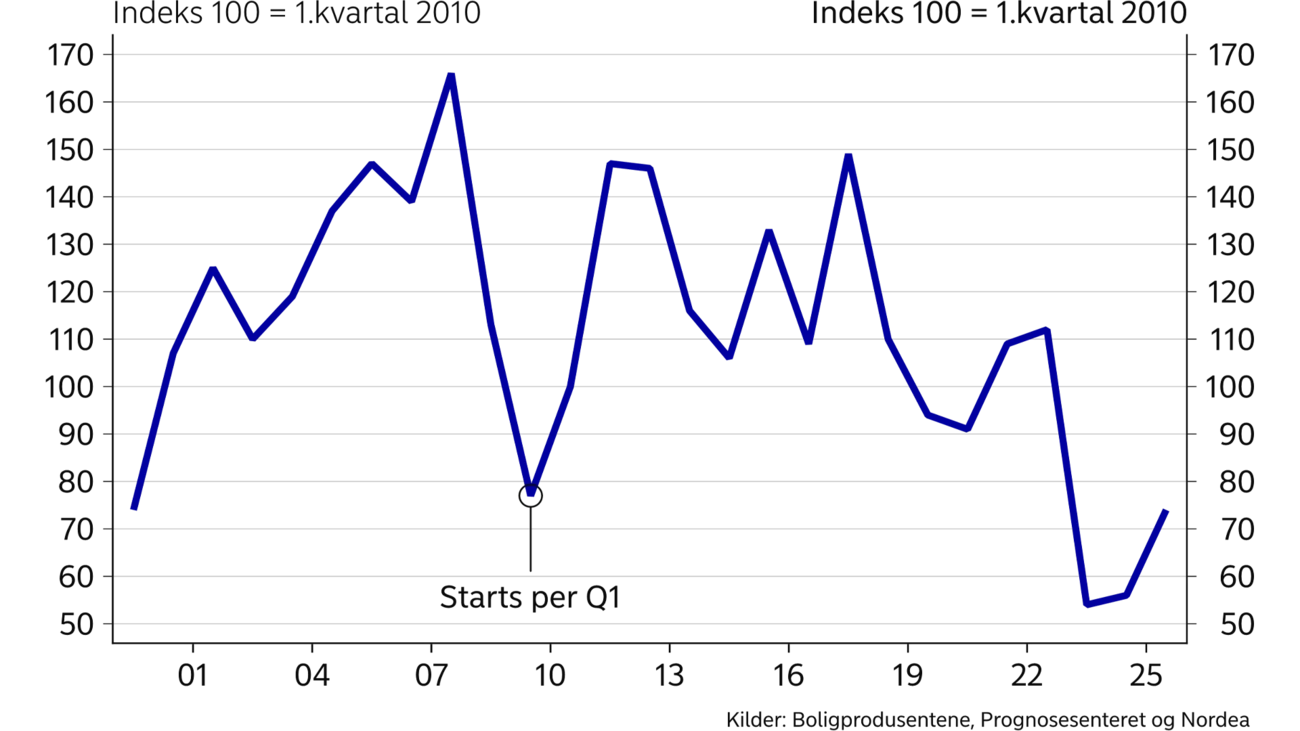

Building permits continued to plummet towards end-2024, but this does not necessarily mean construction activity fell correspondingly. Other housing construction measures paint a different picture. Prognosesenteret and Boligprodusentene conduct a survey that shows “shovel in the ground” starts. This survey shows construction activity picked up last summer and housing starts have risen significantly (chart B). In addition, unemployment in the construction sector has fallen over the past six months, while employment has risen.

Developers might have used old building permits they were unable to use in 2022 and 2023, as these are valid for three years. If so, there would have been no need to apply for new building permits to start construction. Consequently, the building permits and thus the housing investment figures towards the end of 2024 may not necessarily reflect actual construction activity.

We question whether the official figures for housing investments accurately reflect recent developments.

We now see clear signs of increasing housing construction. Sales of new homes have risen by over 20% in the past year. The strong growth in house prices over the past year has made more people consider buying brand new homes rather than existing ones. Construction projects are thus more likely to reach their sales targets required for housing starts. This has also led to a clear uptick in building permits in the first months of 2025. Consequently, we can expect that housing investment will also increase, as estimated by Statistics Norway.

Going forward, we expect increased housing investment will help boost economic growth in Norway. If strong wage growth continues, household borrowing capacity should improve. Even if rates are not cut, growth in housing prices will likely remain strong in 2025, supporting further increases in housing construction. At the same time, it will take a long time before the supply of new homes matches the demographic housing need, which will also help to underpin growth in house prices. Although construction activity will not reach past peaks for quite some time, the sector is undoubtedly recovering.

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Housing investment tracks building permits

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more